As more and more investors prioritize sustainability, investment managers need a viable strategy for seeking out and analyzing ESG (environmental, social and governance) data. However, existing data sources are patchy and inconsistent. The best way forward combines new tech and human expertise to generate the insights that managers need.

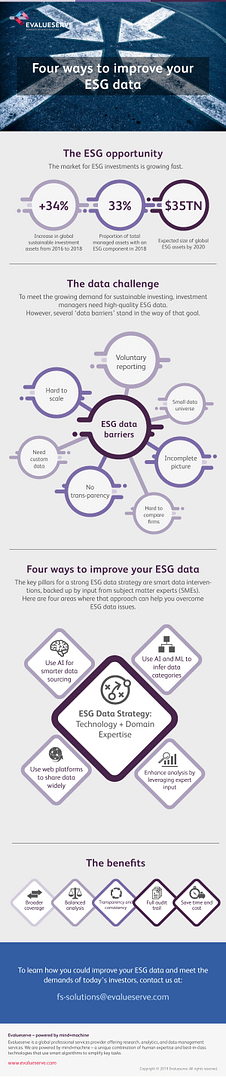

Once a specialist niche, sustainability has moved center-stage and become big business in the investment world. The global market for ESG investments touched $30.7 trillion in 2018, representing a growth of 34% over 2016, and this is expected to reach as much as $35 trillion by 2020.

Sustainably invested assets also accounted for 33% of professionally managed assets around the world in 2018. Institutional investors are playing a big part in this, accounting for 75% of ESG investments in 2018, and more and more institutions are casting an eye over their portfolios with a view to making them more sustainable.

In 2019, BNP Paribas’ ESG Global Survey found that the proportion of asset owners with 25% or more of their investments in funds that incorporate ESG has risen by 27% since 2017. The proportion of asset managers doing the same has also risen by 9%.

Several investment managers have already made important steps in their ESG journey. For example, Blackrock, in collaboration with JP Morgan, has introduced ‘ESG-compliant’ emerging market debt benchmarks. On the flip side, they also aim to provide disclosure of each ETF’s exposure to ‘sin’ stocks such as those related to alcohol, tobacco, gambling, weapons and so on.

ESG is good for brand image, but there’s much more to it than that. ESG criteria are increasingly recognized as a factor in long-term financial performance. Identifying and pricing ESG factors can help to boost returns and reduce risks.

ESG demands data

As ESG investing becomes more popular with institutional investors, investment managers need a data strategy that is up to the job. They need to meet the challenge of developing relevant ESG products, incorporating ESG analysis into the investment decision process and providing transparent, customized reporting on the ESG parameters of individual investments, as well as a view of the overall sustainability of client portfolios. And all these things depend on data.

Any investment manager who wants to make a success of targeting the sustainable investing marketplace needs a cost-effective, process-efficient and scalable ESG data strategy. However, it’s not always as simple as it sounds. Sourcing, storing, reviewing and processing ESG data in line with the custom investment strategy of a product or investment manager is one challenge. Moreover, capturing and reporting data on investments and client portfolios can be a tough job too.

Understanding the data challenge

To meet the growing demand for sustainable investing, investment managers need to find a way to source high-quality ESG data and handle it in an effective way.

Without recent, consistent and high-quality ESG data, there’s no way to carry out a sound investment analysis. However, there are several ‘data barriers’ that stand in the way of that goal:

- Small data universe. Few governments around the world have mandated the reporting of ESG data so far. Therefore it’s up to individual companies to choose whether they will report ESG data or not – and many don’t.

- Incomplete picture. With reporting left to companies’ own discretion, there’s a risk of ‘greenwashing’ and only partial information being made available.

- Companies can’t be compared. Different companies report different ESG metrics, resulting in inconsistent data that doesn’t support like-for-like comparisons between them.

- No transparency. Third-party paid-for ESG datasets are now available. However, there’s a real lack of transparency over the methodology they use for capturing, analyzing and reporting ESG information. So even if portfolio managers can access data, they still can’t necessarily carry out a consistent evaluation.

- Need for customization: Investment managers are looking for custom data sets tuned to their investment strategy. So they need to build a bespoke, cost-effective and scalable process and infrastructure to handle ESG data sets the way they want.

- Scaling up is tough. All the factors listed above restrict investment managers’ ability to scale up their ESG coverage in three ways: cost, the complexity of expanding coverage and ongoing maintenance

How tech can help

In our experience, the key pillars for a strong ESG data strategy are smart data interventions, backed up by input from subject matter experts (SMEs).

Here are four areas where that approach can help you overcome ESG data issues:

- Data sourcing. Instead of sticking with a traditional manual sourcing process to look at company-reported information only, get into AI-powered data sourcing. With AI, you can dramatically expand your coverage, both in terms of the data sources you use and the companies you evaluate. Make sure you use input auto-tagging to automatically create an audit trail to enable smart access to the data you generate and make it easy to reuse.

- Data processing. Use AI and machine learning techniques to infer categories for qualitative and quantitative data and organize it under relevant headings.

- Data analysis. Leverage a powerful combination of technology and SME input to quantify impact and generate predictive indicators for each relevant methodology (customized for investor preferences, accounting standards, etc.).

- Data distribution. Explore the use of web-based platforms to enable smart access to information, and develop automations to support easy reporting, data visualization and re-use.

With this approach, you can easily expand your coverage universe and tap into multiple new data sources. That will give you quicker turnaround; a comprehensive, well-rounded analysis with full transparency; control over the underlying methodologies; and consistent, comparable information within a structured framework. And that, in turn, will mean your ESG strategy is truly fit for the demands of investors today.

The infographic below sums up the key pillars around building a smarter ESG strategy.

Download as .pdf Four-ways-to-improve-your-ESG-data

If you need expert help with creating a smarter, tech-driven ESG strategy, click HERE to send a query.