It’s no secret that big tech companies are leveraging their technical expertise to pursue traditionally non-tech industries. These include companies such as Apple, Amazon, Alphabet, and Facebook’s headline grabbing efforts in financial services, healthcare, and transportation, as well as tech companies’ multitude of projects in other domains. While much emphasis is placed on the type of industries tech companies are targeting, it is also important for incumbents to look at the actual strategies tech companies are employing.

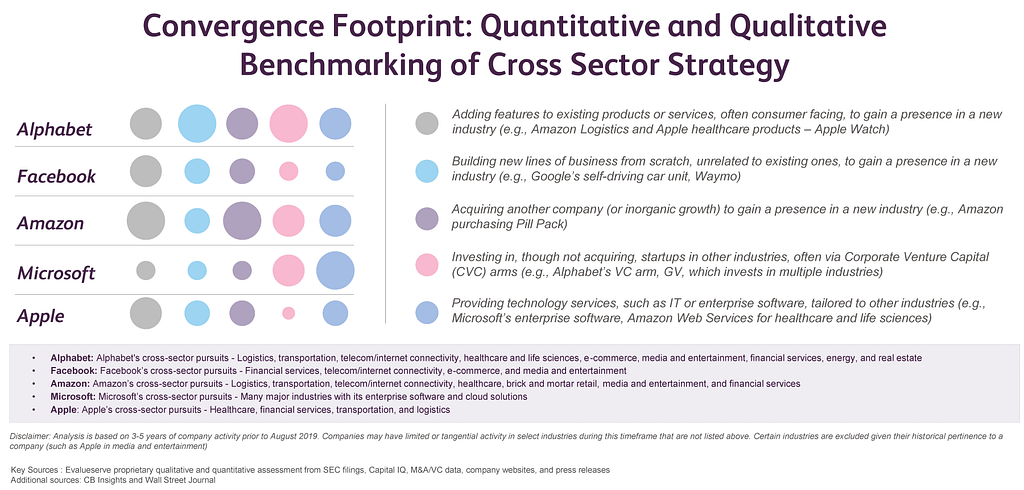

Our team conducted a thorough audit of such strategies to provide better guidance on the subject. While there are many ways to define “cross sector” strategies, our analysis looked at commonly identified methods such as platform/product expansion, internally created divisions separate from traditional lines of service, acquisitions, non-acquiring venture capital, and industry tailored IT/tech operational solutions. Analyzing these strategies can help incumbents separate actual threat levels from hype, and it can help incumbents identify strategies to ward off these new entrants and even potential threats from less immediately apparent encroachers.

Stakeholders across industries can benefit from this cross-sector strategy analysis

Healthcare & Life Sciences

Healthcare and life sciences are prominent industries where this approach can help paint a clearer picture of threats from big tech.

Amazon, for instance, has generated a lot of press for its efforts in health care. Many of these moves fall into the categories above, including acquisitions, such as Pillpack and Health Navigator, internal initiatives, such as Amazon Care, and platform expansion, such as OTC medications on Amazon’s website and voice assisted care. With this diverse strategic approach, Amazon could be positioned to expand across many areas of the health value chain, especially as many of these strategies have synergies.

However, Amazon had many large cross sector acquisitions prior to 2019, but in 2019 shifted to a venture capital heavy approach, possibly to preserve capital. This could signal a shift in Amazon’s health efforts, be it a slow down or saving up for larger plays. Moreover, by having a greater focus on platform expansion, Amazon may have been slightly restrained to efforts that focus on supporting its core business units, such as digital platforms and distribution.

Turning to a different company’s health moves, Alphabet, like Amazon, has a diverse strategic approach, though with a greater emphasis on internal initiatives (having launched Verily in 2015). This has likely given Alphabet greater freedom to pursue its vision of proactive healthcare. Since its inception, Verily has had research partnerships with a wide variety of health and life science organizations and has built so much momentum that they recently received a $1 Billion investment for activities beyond research.

Alphabet has also had acquisitions, including Stenosis and Fitbit, and a very active VC arm in health and life sciences, having backed up to 57 companies up to Q4 2019, according to CB Insights. Combining Alphabet’s VC and acquisition capabilities, with Verily’s diverse and growing project portfolio, and even Google’s consumer health tech, the parent company could likely expand into multiple different areas within health and life sciences and could likely offer unique value propositions in doing so.

Automotive

In automotive, assessing these strategies shows how incumbents can play defense. Companies such as Alphabet, Uber, Tesla, Amazon, and Apple have all been investing in autonomous vehicles, and many have launched their own business units dedicated to developing this technology. Legacy automotive manufacturers have naturally also begun investing in self driving cars. However, because tech companies had launched their own initiatives in house they had a leg up, in terms of technical capabilities, over traditional automakers. Some, legacy automotive players, such as Ford and GM, likely recognized their disadvantage and purchased self-driving technology companies to acquire in-house capabilities.

Some legacy companies, such as GM, have continued to vertically integrate, i.e. bring many aspects of the supply chain in house. Given GM’s auto-manufacturing capabilities, they could even start to have an advantage over tech companies, many of which do not plan to manufacture their own vehicles.

Financial Services

Many banks have launched their own apps and digital banking platforms to ward off encroaching tech companies such as Apple, Google, and Amazon, all of whom have launched digital banking solutions. However, banks have also noticed an opportunity in tech companies’ expansion efforts. Since many of these tech companies’ digital banking solutions are built off their existing platforms, they have certain limitations, namely that they lack a proper banking apparatus. As such banks have stepped in through partnerships to fulfill this need (though these partnerships could also have their downsides for banks).

Key points

-

There isn’t necessarily a single cross sector approach that is most advantageous for tech companies. However, observing how large tech companies deploy these strategies can illuminate the strategic gaps and advantages tech companies face in new sectors, especially by looking at how these strategies complement each other.

-

This type of strategic assessment is therefore useful for tech companies, incumbents, and professional services firms advising clients in either category. Tech companies can better hone their overall cross sector initiatives, incumbents can identify threats and opportunities, and professional services firms can help both clients in their respective efforts.

Additional References

- httrs://www.beckershospitalreview.com/healthcare-information-technology/15-things-to-know-about-amazon-s-healthcare-strategy-heading-into-2020.html

- https://techcrunch.com/2019/09/24/amazon-care-healthcare-service/

- https://verily.com/newsroom/

- https://www.cbinsights.com/research/tech-giants-digital-healthcare-investments/

- https://www.theverge.com/2017/8/15/16148212/google-acquires-start-up-senosis-health-patel-shwetak

- https://www.mobihealthnews.com/news/look-back-alphabets-moves-2019

- https://seekingalpha.com/article/4101942-self-driving-companies-will-win-and-lose

- https://fortune.com/2019/11/18/big-tech-banking-regulation-apple-goldman-sachs-google-citigroup/