July 15, 2021

Biden has made the global minimum tax a cornerstone of his Made in America tax plan1, as the proposed corporate income tax hike comes under scrutiny back home.

This is our second blog that aims to look into potential alternatives for funding President Biden’s multi-trillion-dollar infrastructure spending proposed in March earlier this year. The first blog mainly focused on securing the infrastructure funding through proposed tax hikes and its implications on the markets and businesses (refer to our previous blog titled Generosity Has Its Price: Decoding Biden’s Infrastructure Push published on April 29). Most of our underlying analysis in the April blog has held firm up till now – such as the Treasury coupon auction sizes remaining steady since January this year, the US inflation rate hitting a 13-year high in May2, and President Biden agreeing to a scaled-down $1.2tn infrastructure deal with the bipartisan group of senators3.

Interestingly, an alternative to fund Biden’s ‘Build Back Better’4 plan has emerged in the form of a global minimum tax on the companies that move their earnings to more favorable low-tax destinations abroad. In a bid to win global support, the US, along with its DM counterparts, endorsed a minimum global corporate tax of 15% in a recently concluded meeting of G7 countries. The agreement received a further boost on June 30 when 130 out of 139 countries, including tax havens like Switzerland, Bermuda and Cayman Islands, agreed to join OECD’s framework that calls for a 15% minimum global corporate tax rate. However, Ireland and Hungary were opposed to the proposed minimum global tax commitment. Over the weekend, the proposals won the backing of finance minister of G20 members in a summit held on July 10, and this is seen as a major win for the proponents of the global tax overhaul. The technical framework for new tax regime is expected to be ironed out by October and the deal is likely to be implemented by 2023. The new tax system will raise about $150bn5 annually in global tax revenues and shift taxing rights of over $100bn in profits to other countries, according to OECD estimates.

Back home, the Biden administration has been pushing to increase the US corporate tax rate to 28% from 21% currently, but the plans have come under criticism from the Republican lawmakers, calling the proposal a ‘red line6’ that must not be crossed to fund the massive infrastructure spending. The proposal also calls for doubling the global intangible low-taxed (GILT) income7 rate to 21%8. Amidst growing criticism, the Biden administration has signaled to drop its plan to raise the US corporate tax to as high as 28% if a deal on a global minimum corporate tax is reached.

What is a 15% global minimum tax rate?

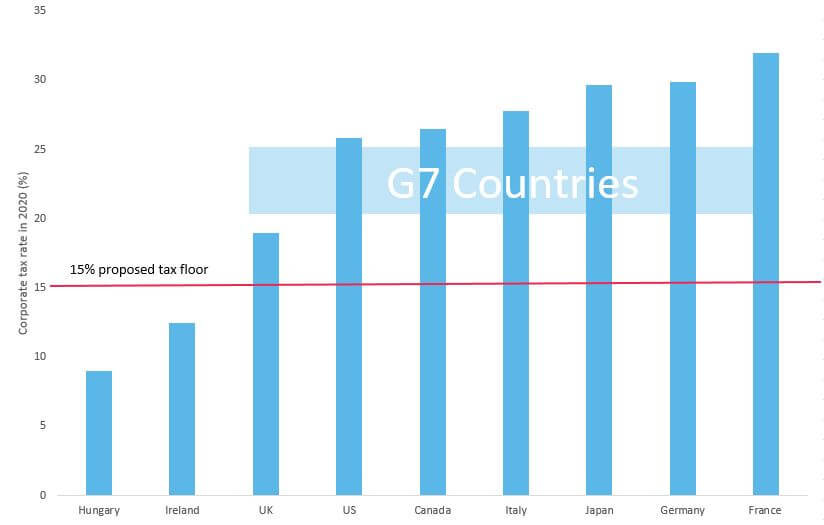

The global minimum plan aims to tax the overseas earnings of the companies. Therefore, if the governments agree on a 15% minimum rate, they would still be allowed to set their own corporate tax rates. So, if a company relocates some of its profits to a low-rate tax jurisdiction, the home country would be entitled to compensate for the lost revenues by topping up its taxes to the agreed global minimum rate. For example, if a company in a country with a global minimum rate of 15% earned overseas profits that were taxed in Hungary, where corporate income tax is 9% (see figure 1), the home country would be entitled to charge the company an additional 6%, thus aligning it with the global minimum rate.

Figure 1: Corporate income tax rate in G7 countries and the proposed 15% global tax floor

Source: Organization for Economic Co-operation and Development.

Description: The chart shows corporate tax rates in G7 countries. Ireland and Hungary where the benchmark corporate tax rate is below the proposed 15% tax floor are firmly opposed to the overhaul in international tax code as they would lose their attractiveness amongst large MNCs.

At least 55 large US companies paid no federal corporate taxes in 2020

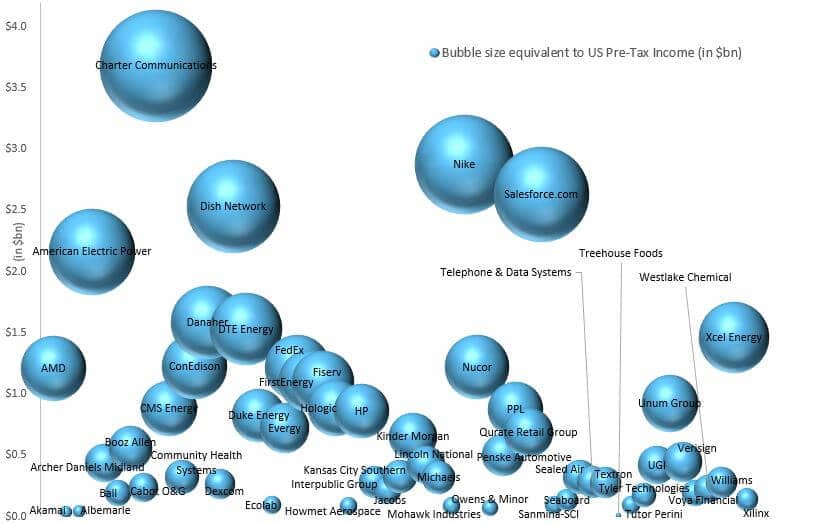

A research study by the Institute on Taxation and Economic Policy (ITEP) found that at least 55 of S&P 500 or Fortune 500 US companies paid no federal corporate income taxes in the fiscal year ending 2020, despite generating collective earnings before taxes to the tune of $40.5bn9. Taxing this income against the current corporate tax rate of 21% would have generated $8.5bn in taxes during this period (see figure 2). On top of that, these firms received an additional $3.5bn in tax rebates, implying net federal tax losses of around $12bn in 2020.

Figure 2: ITEP study found that 55 large US corporations avoided paying taxes on ~$40.5bn of their combined 2020 EBT

Source: Institute on Taxation and Economic Policy

Description: Corporate giants including Charter Communications, Nike and Salesforce are among the companies that avoided ~$8.5bn in corporate tax payments in the fiscal year ending 2020. Moreover, these companies received ~$3.5bn in tax rebates.

However, global minimum tax would have a limited bearing on S&P 500 earnings

Implementing a global minimum rate would discourage the companies from moving their profits to overseas tax havens and this would result in higher tax collection for their domiciled governments. However, we foresee significant regulatory and operational challenges to enact such reforms. Though, the proposed tax framework would have a limited impact on earnings of large multinational companies. According to Goldman Sachs analyst David J. Kostin10, a 15% global minimum rate would shave only $1 from S&P 500 FY22 earnings of $203/share. On contrary, the proposed corporate tax hike to 28% would be an $8 drag on S&P 500 EPS, while the doubling of the GILT income rate to 21% would slash another $5 off the index’s projected earnings for the next year.

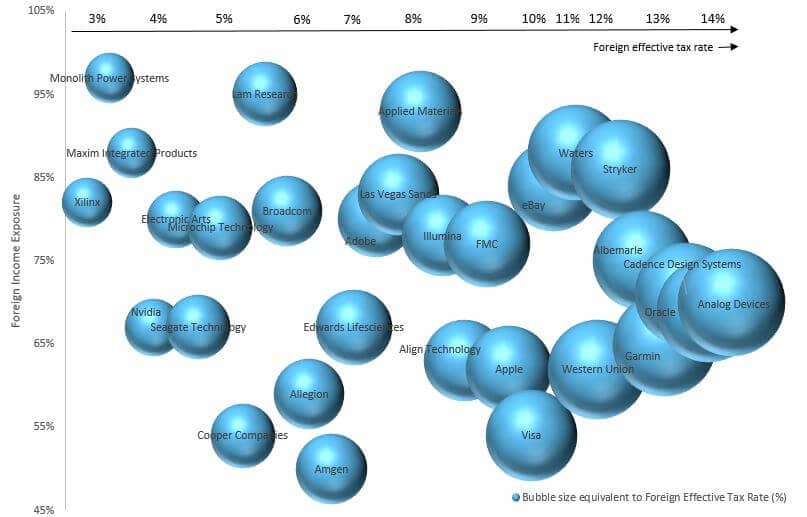

The companies with revenues attributed to intangible assets would be impacted the most by the G7 proposals, as it is relatively easier for tech giants such as Facebook, Amazon, and Google-parent Alphabet to establish headquarters in tax havens like the Cayman Islands, Switzerland, or Bermuda. In a study on S&P 500 firms, Kostin found that 30 companies in the 2020 fiscal year generated at least 50% of their earnings abroad and were subject to less than 15% in foreign effective tax.

Figure 3: Kostin’s S&P 500 foreign income exposure with low tax rate model

Source: Goldman Sachs

Description: Kostin’s model serves as a warning sign to companies, including Apple, Adobe, Visa and Oracle that had their effective tax rates less than 15% with at least 50% of their earnings coming from foreign territories. The measures are likely to eat into earnings of major US corporations.

Huge tax leakages….

In a November 2020 report11, the Tax Justice Network estimated that countries lose about $427bn each year through both corporate tax abuse and private tax evasion, with higher income countries losing a major portion of it, some $382.7bn/yr. It was no surprise that the group of seven wealthiest nations after their two-day meet on June 13 in Cornwall, UK, released a joint communiqué, underscoring the need for a global minimum tax.

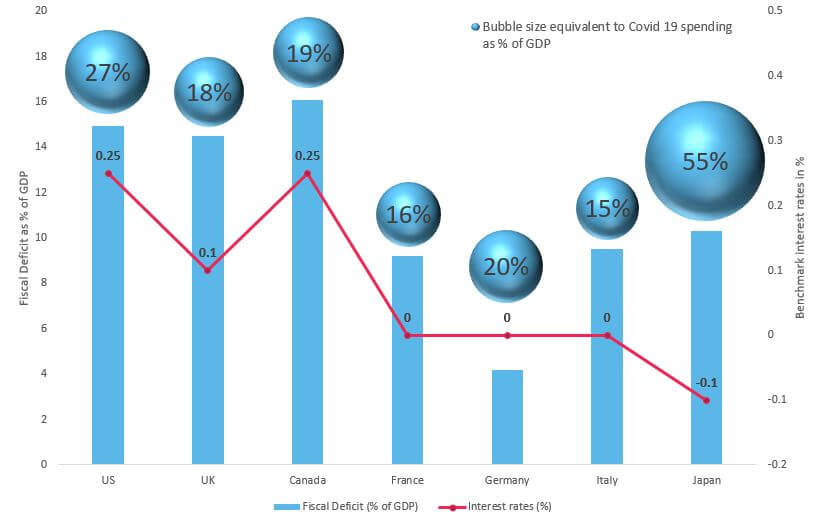

…and massive fiscal deficits accelerated the G7 acceptance of a global minimum tax rate

The G7 member countries have spent the most in response to Covid-19 crisis (see figure 4) and their share of pandemic relief spending in % of GDP are all in double digits, sending their fiscal deficits to the highest levels in past several decades. The US fiscal deficit as a share of GDP (~15%) is already at its World War II level and the country’s fiscal response to the pandemic has risen to 27% of its GDP, leaving the government with little to no room for additional borrowing. The benchmark interest rates in all the member countries have also been either zero, near-zero, or in negative territory, making it almost impossible for the central banks to cut them any further to induce demand. In our view, any kind of assistance to support the economy in the current scenario is likely to come in the form of spending packages eventually financed through higher taxes. The Biden administration expects to finance the boost in new spending through its tax reforms, which includes a global minimum tax. The initiative could very well set a precedent for fellow G7 members and more countries with a high debt burden are likely to follow suit.

Figure 4: G7 Covid-19 spending sends fiscal deficit to decades high, while policy rates are near all-time lows

Source: Center for Economic Policy Research, Fred.stlouisfed.org and Trading Economics

Description: High fiscal deficit (% of GDP) owing to Covid-19 related spending by G7 countries (which in case of Japan and US has reached as high as 55% and 27%, respectively) could severely impair additional government borrowings. Low interest rates would further cut chance for implementing growth stimulating measures, making additional spending (financed through tax reforms) as a much more viable option in our opinion. .

Countries with high debt-to-GDP ratio like Greece, Italy, Spain, and Portugal stand to benefit from the proposed tax floor, as revenues generated from the new measures can be diverted to finance social and infrastructure programs that had been left grossly underfunded after years of austerity following the 2007-08 financial crisis.

End to the ‘race to the bottom12’ in sight?

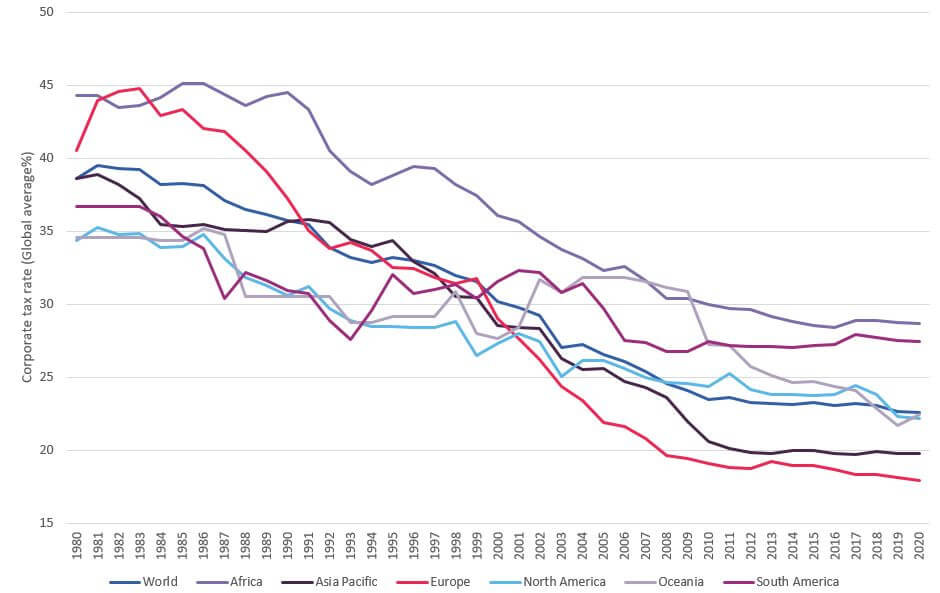

In order to compete with low-tax havens, the countries across the globe have been consistently cutting down their corporate tax rates over the past 40 years (see figure 5). The global average statutory rate has declined by about 41% since 1980, with Europe seeing the biggest drop (by more than 55%) and South America the least with a 25% reduction. The US Treasury Secretary Janet Yellen, who described the phenomenon as a ‘race to the bottom’ in a speech on May 3rd, has vowed to close loopholes that allow US companies to shift earnings overseas.

Figure 5: Global average corporate rates have declined ~41% over the past 40 years

Source: The Tax Foundation.

Description: The global average corporate rate has declined by ~41% over the past 40 years. The Biden administration and the G7 plans aim to break this long 40-year trend by introducing a global minimum tax of 15%.

Conclusion: Getting it together

The bottom line is clear. Rolling back some of the 2017 Trump tax cuts to fund infrastructure and social programs has received some criticism from the corporate America as well in the Senate and House of Representatives. A global minimum tax is expected to offset the impact in the case that only a partial or smaller increase in corporate taxes is implemented. Putting such a measure in place would require a coordinated effort from the global community. The plan was first endorsed in the G7 meeting in early June and has recently been approved in the G20 summit on July 10. However, getting all countries together would not be an easy task, as there are certain countries like Ireland that would probably not agree to the proposals, as Dublin has attracted billions of dollars in investment from foreign multinationals, due to its low corporate tax rate of 12.5%. Similarly, other tax havens like Cyprus, Hungary, and Estonia may not agree to such a proposal.

Although President Biden has offered to drop plans to raise corporate tax rates to as high as 28% in favor of a 15% global minimum tax, to what extent the taxes would be raised or if they would be raised at all depends on additional tax receipts from the global minimum tax floor.

Leveraging OECD projections of $150bn/annum in incremental global tax revenues post the tax code implementation, the United States could generate ~$37.5bn/yr in additional tax receipts, given that it represents ~25% of the world GDP as per the 2020 World Bank estimates. The Biden administration expects to use this additional tax revenues to partly fund its infrastructure program that would cost $1.2tn over the next eight years. In other words, the global minimum tax code could potentially finance a quarter of the massive infrastructure spending bill (i.e. $300bn) over next eight years.

Tax avoidance as a common problem has brought together many countries, as it has directly or indirectly put immense strain on their economies while running high fiscal deficits. As flagged earlier, 55 major US companies have dodged taxes on ~$40.5bn of their combined pre-tax 2020 earnings, and the trend is broadly consistent across the world. Apart from tax heavens losing their shine, the plans are likely to face resistance from multinational companies, as the proposed tax rates are likely to eat into their forecasted earnings, albeit <1% impact on S&P 500 FY22 earnings. Within the mix, the large US tech giants including Apple, Adobe, Visa, and Oracle stand to lose from the proposed tax rate, as at least 50% of their earnings come from overseas countries with effective tax rates less than 15%.

The new tax also calls for the removal of the digital services tax (DST), which some countries have imposed on US tech firms like Facebook, Alphabet, and Amazon. Negotiating a tax deal with such countries would not be easy, as they are not expected to completely roll back their DSTs without a hard bargain i.e. compensatory increase in tax collections. Lastly the issue of sovereignty. Many countries would like to set their own rates, which they see as their fundamental right, and committing to a fixed statuary rate would come across as a compromise with their fiscal sovereignty.

References:

1. The Made in America Tax Plan (The US Treasury Department)

2. U.S. Inflation Is Highest in 13 Years as Prices Surge 5% (WSJ)

3. ‘We have a deal’: Biden reaches $1.2 trillion infrastructure compromise with bipartisan group of senators (USA TODAY)

4. The Build Back Better plan (The White House)

5. 130 countries back global minimum corporate tax of 15% (WEF)

6. Republicans draw ‘red line’ on increasing taxes to fund Biden’s infrastructure plan (CNN)

7. GILTI is the income earned by foreign affiliates of US companies from intangible assets such as patents, trademarks, and copyrights. The Tax Cuts and Jobs Act imposes a new minimum tax on GILTI.

8. Biden administration proposes global minimum tax of at least 15% (CBS NEWS)

9. More Than 50 Major U.S. Corporations—Including Nike And FedEx—Paid No Federal Taxes Last Year (Forbes)

10. Goldman’s Kostin Warns Biden Tax Plan Will Slash Earnings (Bloomberg Finance LP)

11. The State of Tax Justice 2020: Tax Justice in the time of COVID-19 (Tax Justice Network)

12. Yellen says U.S. pushing to end global ‘race to the bottom’ on corporate taxes (CNBC)