ESG-focused asset management (AM) firms are facing increased regulatory pressure and scrutiny to prioritize and tackle “greenwashing”. The term greenwashing is generally used to represent the practice of identifying a business as more ‘sustainable,’ ‘green,’ ‘low-carbon,’ and ‘planet-friendly,’ when, in truth, an entity may be either creating a false impression or providing incorrect / misleading information on the environmental attributes of its products or services.

However, greenwashing may not always be deliberate; asset managers often rely on a multitude of data sets and ratings, some of which may be inaccurate and may lead them to inadvertently support claims about sustainability.

Why the spotlight on it?

As the support for climate-focused investors / consumer protection grows worldwide, there is increased scrutiny to spot and tackle greenwashing. Investors with a soaring appetite for ESG-focused investments are looking to ascertain whether their portfolio managers are investing responsibly. This is increasing the pressure on AM firms to ensure greater transparency, consistency, and disclosure requirements.

ESG assets are likely to cross USD41 trillion by the end of 2022 (from USD35 trillion in 2020, USD30.6 trillion in 2018, and USD22.8 trillion in 2016). As a result, the market will offer significant value and rewards to AM firms offering sustainable funds. To capitalize on the uptrend, many AM firms are falsely marketing their products / services as ‘sustainable’ or are overstating their positive attributes. Some are rushing product launches even without having the required responsible investment expertise.

To curb this growing malpractice, regulators are looking more closely into entities that misrepresent their ESG data, both deliberately or accidentally. Not only regulators, but also consumers, and environmental groups are calling this out and challenging greenwashing via regulatory complaints, lawsuits, and other actions.

A few examples of the increasing threat of greenwashing are provided below:

- A London-based not-for-profit organization found that 55% of the funds that were presented as low-carbon, fossil fuel-free, and green energy to investors had exaggerated their environmental claims, and more than 70% of those funds did not meet their ESG targets

- According to several reports, many of the largest ESG funds “are stuffed full of polluters and sin stocks.” The reports found that 8 of the 10 largest US sustainable funds invest in oil and gas companies

- A report by The Guardian stated that Europe’s biggest banks offered GBP24 billion to oil and gas companies for production expansion, just less than a year after pledging to target net-zero carbon emissions

- In a study including 593 ESG equity funds, 71% of the firms had portfolios that did not align with the Paris Agreement's global climate targets

Greenwashing can happen at any stage in an investor’s journey with an AM firm or in the fund / product lifecycle. A few examples of stages where greenwashing can occur are as follows:

- In the pre-contractual phase due to the lack of proper communication between the AM firm and the investor; e.g., in documentation and website disclosures, or by third parties (such as platforms or Independent Financial Advisors)

- In the post-investment stage due to incomplete or non-standardized sustainability data from investee companies

- During ongoing reporting, e.g., incorrect / incomplete review of investment activities, or reporting of non-financial performance / important changes

- While handling complaints related to the lack of communication on time horizon and sustainability objectives in prospectus; as well as complex / technical non-financial performance reporting

AM firms are trying their best to fulfil their climate pledges and bolster sustainability efforts, despite challenges in operationalizing ESG strategies

Insufficient and non-standardized disclosure of ESG metrics; conflicting and inconsistent regulatory guidelines and standards; and changing regulatory frameworks pose various challenges in operationalizing ESG norms in the AM industry. Amid these challenges, asset managers are striving to fulfill their climate pledges and enhance sustainability efforts.

In a survey conducted by the Independent Investment Management Initiative, 88% of AMs stated that ‘the fund management industry has a problem with greenwashing.’ Many of them believe that the limited availability of consistent climate performance data is the primary reason for greenwashing.

Greenwashing might occur at the firm, fund, or product levels, even when there is no deliberate misconduct. The chances of greenwashing increase when investment strategies and decisions rely on non-standardized or incomplete sustainability data, or an entity’s communication and sustainability terminology is unclear, confusing, or overly technical. The industry is yet to have any consensus on the terminology to be used for different responsible investing strategies, types, and levels of disclosures or even ESG performance metrics, scores, and methodology.

Evalueserve's ESG Solutions for Asset and Wealth Management

How can greenwashing be curbed?

The responsibility of addressing the risk of greenwashing extends beyond the compliance and risk functions within companies. To protect investors and encourage a fair endgame, governments and regulatory bodies are laying the foundation for a strong mechanism to tackle greenwashing. These entities are bolstering the rules and guidelines related to green finance amid an increasing flow of assets into ESG-focused funds and skepticism over the real impact of sustainable investments. Furthermore, governments across the globe are making climate change their national agenda.

A survey by Vanson Bourne found that only 45% of US and UK businesses have access to the right public web data required to make well-informed decisions regarding ESG-related objectives. AM firms need to adopt a holistic approach to cater to the needs of investors looking for sustainable investment solutions.

To boost ESG performance, firms need robust ratings and assessment mechanisms to process ESG data. As data is key to monitoring, identification, and quantification of risks and opportunities within potential investee companies, it should be gathered from multiple sources (websites of investee companies, annual reports, filings, etc.), accurate and unbiased, and collected in real-time. An open and direct communication channel with investee companies, influence via proxy voting, and other escalation strategies are also imperative. These steps are meant to cover the entire spectrum of ESG commitments (public statements, decarbonization pledges, CSR claims, etc.) to avoid the risk of greenwashing against fund companies as well as ‘facilitators’ such as advisors and PR agencies.

Regulatory bodies and governments worldwide are taking steps to tackle greenwashing

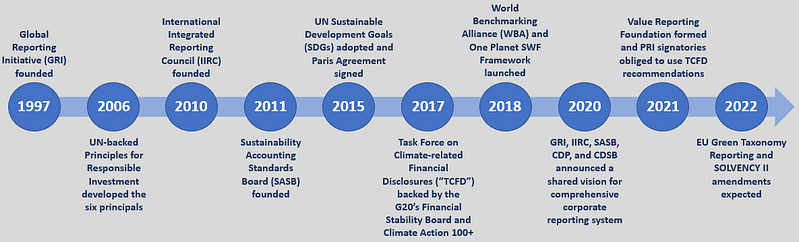

Over the years, many industry and regulatory bodies have been established to formulate standards and frameworks around responsible investment. Some of these bodies have also formed alliances to enable greater reach. For instance, International Integrated Reporting Council and Suitability Accounting Standards Board joined forces in June 2021 to form an integrated reporting framework with accounting standards.

Apart from the key milestones above, significant global developments, such as the ones listed below, indicate that government and regulatory bodies are planning strict action against all forms of greenwashing.

- In May 2022, the SEC proposed rules that will tighten ESG-related marketing and disclosure requirements to ensure consistent, comparable, and reliable information to investors

- In March 2022, the UK’s Competition and Markets Authority rolled out the Green Claims Code, which provides general guidance on sustainability goals designed to protect consumers from misleading environmental claims / greenwashing

- In the same month, Australian Securities & Investments Commission and the Australian Competition & Consumer Commission announced they will collaborate and act on all forms of greenwashing. The Australian Securities & Investments Commission is currently working closely with the International Sustainability Standards Board to develop a new green financing framework

- In February 2022, the European Securities and Markets Authority published its Sustainable Finance Roadmap 2022-2024, in which it listed priorities related to sustainable financing, including tackling greenwashing and promoting transparency

- In January 2022, the Monetary Authority of Singapore revealed that it is formulating anti-greenwashing measures, including ‘ESG-specific requirements on fund naming, prospectus disclosures, and periodic reporting disclosures,’ for AM firms

- The Task Force on Climate-Related Financial Disclosures, Markets in Financial Instruments Directive II, Undertakings for the Collective Investment in Transferable Securities, EU taxonomy, and Sustainable Finance Disclosure Regulation are some more examples of initiatives aimed at curbing greenwashing

With the unfolding of new and tighter regulations, AM firms will have to effectively mitigate the risk of greenwashing in every aspect, be it documentation, objectives, policies, strategies, or funds. Also, a collective and collaborative effort by portfolio managers, marketing / sales teams, and compliance / risk functions would be imperative to avoid misalignment between objectives and strategies, and potential confusion.

How can Evalueserve help?

As one of the largest third-party ESG research providers, Evalueserve can help AM firms in their ESG journey as well as address ESG integration challenges. We offer solutions that support various sustainability-related needs. Our consultative approach goes beyond data and includes custom methodologies, developed in consultation with clients, to achieve desired results. We work in tandem with AM firms, build their internal sustainability aligned ESG framework, and support them with transparent, comprehensive and comprehendible sustainability assessments

Evalueserve offers multi-faceted support to AM firms across their sustainable investment processes. We dig deeper, assess, and score portfolio companies to identify and mitigate the risk of greenwashing with supporting data and best practices.

Evalueserve’s Services

Support Asset Managers across their sustainable investment process:

Talk to One of Our Experts

Get in touch today to find out about how Evalueserve can help you improve your processes, making you better, faster and more efficient.