Early Warning Systems

Sometimes, lending institutions tend to miss the small yet highly destructive threats, as they remain focused on larger, clearly detrimental warning signals. The most recent example is the novel coronavirus outbreak. The first case was reported in Wuhan, China, as early as December 31, 2019, but it was declared a public health emergency of international concern only by January 30, 2020. Similarly, the 2008 bankruptcy filing by Lehman Brothers, supposedly the largest bankruptcy filing in the US to date, came as a result of migration of clients, devaluation of assets, and drastic stock losses. The Lehman collapse was closely followed by the sub-prime mortgage crisis.

In the case of banks, which usually transform short-term deposits into long-term loans, their vulnerability and exposure to risks result from a maturity mismatch. Funding liquidity risks can potentially spread, eventually leading to market liquidity risks. And if one bank is facing a liquidity crunch, more banks are bound to step back and withhold fund releases. Such holding back can diminish overall liquidity in a market, forcing banks in need of liquidity to sell their assets at a lower value. This is how a vicious circle begins leading banks to face high loan delinquencies (aka non-performing loans) downgrading the overall bank’s loan portfolio quality. In today’s world, commercial, corporate, and regional banks require an early warning indicator (EWI) system to measure systemic risk or credit risk to the financial system. EWI system provides an early signal of financial and non financial stress and are being used by central banks or regulatory authorities for policy decision-making.

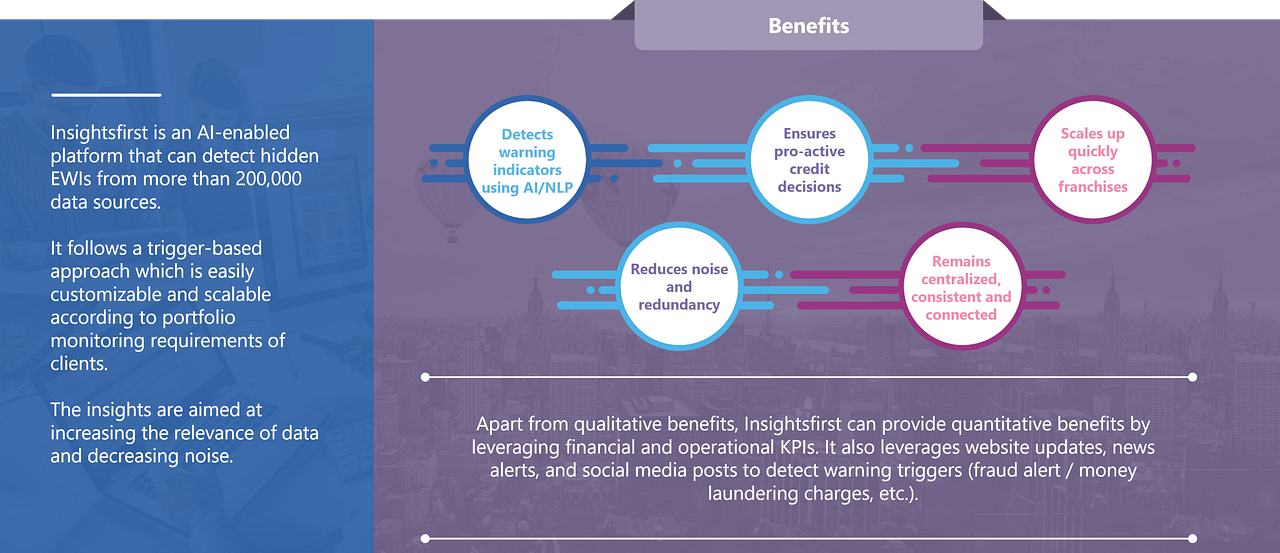

In today’s volatile economic environment, it is imperative for banks to have an automated (AI/ML enabled) EWI system to monitor and pinpoint delinquent loans or elevated credit risk. Banks need to implement these early warning systems as part of their current portfolio monitoring activities (on an annual / quarterly / day-on-day / event basis) to track events that may be prominent indicators of distress. To get the best results from an early warning systems, banks need to integrate it with their current loan management systems or lending platforms. To comply with complex regulatory requirements, financial institutions have started partnering with consulting or knowledge management firms that help create credit risk monitoring frameworks and support in smooth deployment of such systems. The fact is supported by Evalueserve’s collaboration with various lending institutions (majorly commercial banks, corporate banks, and SBA banks) to deploy its Insightsfirst EWI system, which empowers first line of defence (FLOD) and second line of defence (SLOD) to take calculative lending decisions. Financial institutions need copious amounts of data to make informed credit decisions and stay ahead of the competition. Insightsfirst collects, vets, and processes large amounts of data from specific user groups to identify clients that are exposed to potential financial or external risks. Apart from creating a framework, Evalueserve supports the daily management of EWI or risk management systems. The success of financial institutions will depend on their ability to adopt and implement systems that help mitigate credit risk amid a volatile economic scenario.

How can Insightsfirst help Banks spot Early Warning Triggers smartly?

To read our complete whitepaper, please click here

Talk to One of Our Experts

Get in touch today to find out about how Evalueserve can help you improve your processes, making you better, faster and more efficient.