Global Financial Services Market H1’25: Steady growth & shifting dynamics!

In H1’25, the global financial services market surged ahead with digital innovation, ESG investing and cross-border connectivity reshaping the landscape. Despite macroeconomic headwinds, dealmakers pursued high-quality assets and transformative partnerships, signaling for long-term growth and operational scale. Emerging markets particularly in Asia-Pacific and Africa attracted record capital flows, signaling a shift in global financial influence. Meanwhile, traditional institutions raced to modernize amid rising competition and regulatory complexity.

Geopolitical uncertainty continued to cast a shadow over global dealmaking. Tariff concerns, regulatory shifts and regional instability have prompted many firms to adopt a more selective and strategic approach to M&A. Cross-border transactions are increasingly focused on markets with regulatory clarity and growth potential, while domestic consolidation remains a key theme in regions facing political or economic headwinds.

Equity markets started the year with caution marked by defensive postures and sector stress, driven by geopolitical tensions, volatile energy prices and uncertainty around U.S. trade policies. However, the second quarter saw a broad-based rebound, led by technology, industrials and financials, as investor sentiment improved and monetary conditions eased. European markets benefited from stable energy prices and consistent earnings with broader sector participating in driving gains.

Furthermore, the financial services (FS) sector saw strong momentum globally. Investor confidence was buoyed by expectations of robust corporate earnings, especially in banking and insurance. Overall, financial services outperformed other sectors, reflecting optimism around economic recovery and policy clarity.

At the end of the H1’25, market participants prioritized strategic M&A and divestitures, focusing on high-quality assets and core business optimization. Institutional investors and corporates leaned into digital assets and AI-driven fintech, all of which may shape the trajectory of financial markets in the coming months of 2025.

The following key developments had a strong bearing on M&A and Capital markets’ activities across the global financial services market during H1’25:

- Companies explored foreign investments to bring in cutting-edge technology, global best practices, increased product offerings and improved access to capital for the next level of growth.

- Large financial institutions focused on acquiring regional banks and fintech firms to expand their digital capabilities and market presence.

- Macroeconomic conditions and geopolitical tensions remained challenging, trade tensions and economic uncertainty influenced capital flows, with investors favoring defensive sectors and stable jurisdictions.

- Spotlight were also on divestitures of non-core assets as businesses attempted to strengthen their balance sheets and make their business models more resilient.

- The focus seemed to be shifting to long-term planning and M&A as a way of addressing strategic issues in the sector, leading to a return of investor confidence and stability to banking markets.

Financial markets worldwide showed resilience amid heightened geopolitical tensions and tariff uncertainty, with investors focusing on strong earnings and AI-driven growth despite volatility and shifting monetary policy

Key Sectoral Performance: Tale of 4 Key Sub-Sectors

Banking

- The M&A deal volume increased in H1’25 as compared to H1’24.

- One of the major factors being the regulatory easing improved deal approval timelines and reduced capital hurdles.

- In the US, 20 transactions took place in the Midwest, making it the most-targeted region, followed by the Southeast region with 11 announced transactions.

- US bank M&A activity anticipates strong rebound due to easing regulatory hurdles, lower interest rates, and renewed strategic confidence.

Asset Management

- Companies are prioritizing integrated solutions that combine advisory, distribution and product capabilities to meet evolving client needs.

- Traditional active managers are expected to collaborate to gain scale, diversify offerings and meet rising demand for integrated investment solutions.

- Mergers and acquisitions with direct pension fund involvement soared high in first half of 2025.

- The Wealth Management M&A market remains robust, with 102 announced transactions in Q2’25.

- Asset management business volumes are expected to expand moderately, driven by interest rate easing, resilient economic growth and increased investor demand for alternative assets, while geopolitical uncertainty and regulatory shifts may create short-term volatility and selective capital reallocation.

Insurance

- Insurance corporations continue to divest capital-intensive life and annuity businesses to focus on core products and reduce complexity in their operations.

- As per OPTIS Partners, there were a total of 319 announced insurance agency mergers and acquisitions in H1’25, down 8% from 345 in H1’24.

- Insurance companies are collaborating with InsurTechs to take advantage in areas such as machine learning and artificial intelligence capabilities.

FinTech

- Despite growth in broader venture funding, fintech funding declined by 18% in H1’25, compared to H1’24.

- The total capital invested in FinTech globally were amounted to $44.7bn in H1’25, compared to $54.2bn in H1’24.

- Although private equity is making fewer bets, they are increasing in size as late-stage fundraising rounds become the primary focus of investment.

- Significant developments in blockchain, digital banking, mobile payments, cybersecurity and API integration gained traction.

Global Financial Services M&A H1’25: M&A remains selectively optimistic

In H1 2025, global financial services M&A activity remained robust as acquirers targeted high-quality assets and resilient business models. Strategic consolidation in banking, insurance and asset management was driven by both corporate and private equity firms, while cross-border transactions gained traction amid diversification efforts and sovereign fund participation. The fintech segment saw a notable shift toward strategic investments, with corporates divesting non-core assets and doubling down on digital infrastructure and AI capabilities. Deal activity in APAC market saw selective deal-making, with firms pivoting to lower-risk assets, particularly in Australia and Southeast Asia.

As financial services firms recalibrate for the second half of the year, themes of strategic reinvention, digital acceleration and geopolitical awareness will remain central to growth and competitiveness.

Private equity (PE) players returned aggressively, focusing on bolt-on acquisitions to enhance portfolio value, while strategic buyers prioritized mid-market transactions over megadeals. Additionally, dealmakers anticipate a further increase in M&A volumes from activist campaigns in the upcoming quarters due to prior challenging growth factors, which had already provided a chance for some notable activist investors to start new proxy battles.

Mergers and acquisitions rebounded in the first half of 2025 after a downbeat in 2024, thanks to the return of mega deals.

Worldpay’s acquisition by Global Payments for $24.3bn and RSC Topco by Brown & Brown for US$9.8bn were some of notable big-ticket deals (where the transaction value is greater than or equal to US$1.0bn) in H1’25

Some of the key observations during H1’25

- Steady flow of carve-outs, spin-offs and joint ventures offered creative ways to achieve strategic goals.

- Due to strict merger scrutiny by the regulators the buyers had to wait longer for deal negotiations.

- Corporates with strong balance sheets and sound M&A processes had a competitive advantage in the current market as they had enough dry powder and the ability to extract synergies.

- Activism remained a significant factor, with many campaigns pressing for M&A transactions to enhance shareholder value.

- After a cautious few years, private equity firms returned aggressively, deploying dry powder into large strategic bets, prioritizing deals with strong revenue visibility and operational resilience.

Key M&A Themes

Strategic Alliances

Cross-border consolidation

Business Expansion

Refinancing

Boosting Market Share

Operational Synergies

Regulatory adaption

Enhancing Capabilities

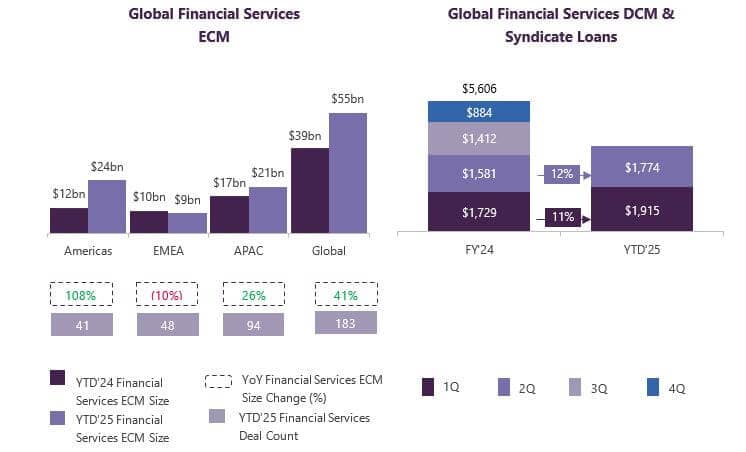

Funding: Volumes Rebounds as Optimism Grips the Market

The Debt Capital Market (DCM) showed high optimism in H1 2025 despite significant challenges mostly arising out of geopolitical instability. Issuers largely been able to push out near-term maturities amid tight credit conditions. Most of the deals were related to refinancing and repricing which were driven by the lack of new supply. Investors also exhibited greater risk tolerance as banks have been more active, resulting in increased M&A financing in the syndicated debt markets and more favorable pricing during the year. Aided by strong investor interest and tighter spreads, borrowers refinanced more costly private credit with more affordable widely syndicated loans. Overall, looking ahead we expect refinancing deals to remain under focus in H2 2025 with interest rate cuts and Central Bank stimulus globally, likely to give an improved market tone for deals offset a bit by some political headwinds.

The much-anticipated Liberation Day events triggered a notable market correction, briefly dampening sentiment and slowing activity across capital markets. However, a combination of mid-course U.S. policy adjustments and the passage of time helped restore investor confidence. By May and June, momentum had returned, with both equity and debt markets showing clear signs of recovery. Encouragingly, this upswing is carrying into Q3, supporting a constructive outlook for deal flow and broader market engagement. FinTech companies dominated deal activity, as investors concentrated on innovation-driven and high-growth opportunities. The IPO pipeline remains strong, with a sizeable cohort of companies preparing to list on the back of improving aftermarket performance—an encouraging indicator for continued healthy volumes into the remainder of 2025.

ESG: Key to Long-term and Sustainable Value Generation

The COVID-19 pandemic has demonstrated that adhering to ESG factors is key to crisis-resilient long-term value creation. Companies with dynamic business cultures were relatively more resilient during the shutdowns, given their ability to absorb the shock. Globally, investors have started to recognize the potential benefits of announcing an acquisition that is ESG accretive.

Global financial regulators have identified scenario analysis as a potentially useful means of evaluating and managing financial institutions' exposure to climate-related financial risks. Regulators in the US have begun to investigate how to use scenario analysis to better evaluate the long-term, climate-related financial risks that financial institutions face, as well as how these risks may emerge and vary from past events.

As the ESG investment market continues to grow rapidly, Banks are strategically deploying fintech ecosystems to drive sustainability in their products and operations which is referred to as ‘Sustainable Digital Finance’. Several banks have joined the UN-convened Net-Zero Banking Alliance. Under this, they have committed to align their lending and investment portfolios with net-zero emissions by 2050.

2025 Outlook: Spotlight on Adaptability and Rebuild

Despite the recent slowdown, the long-term fundamental M&A themes remain intact. We foresee the following trends to define the overall deal-making in 2025:

- Digital payments: Despite the ongoing macroeconomic difficulties and their implications on the M&A market, the payments sector continues to be quite appealing for the investors. The payments business is seen as more profitable, scalable, and less regulated than other areas of the financial services industry by corporates in the banking and payments sectors as well as private equity firms.

- ESG: ESG mandates and climate-related risks are reshaping underwriting, investment, and reporting standards. They have refocused their attention from asset managers and insurers on the ESG risks in their private investment portfolios due to recent geopolitical tensions.

- Emerging markets are expected to become centers for FinTech: Global governments will make more investments in South-East Asia, the Middle East, and Africa to expand their fintech ecosystems and bolster the regions' digital economies.

- Restructuring: Participants in the FS market are observing increasing indications of a decline in credit quality. Regulatory adjustments, including global tax rule refinements, are prompting financial institutions to restructure operations for better compliance. Additionally, banking sector consolidation is expected, with regional banks divesting assets and fintech-driven mergers accelerating.

- Digital transformation: Digitalization and artificial intelligence (AI) continue to be strategic goals for financial services players to address consumer expectations and establish market position. Transaction activity in 2025 is expected to focus on deals to leverage data, implement solutions to growing cybersecurity concerns, drive operational efficiencies, and expedite transaction process

- Private Equity: Insurance brokerage, platforms, fintech, insurtech and regtech are expected to be in the crosshair of deal makers. We therefore anticipate more M&A activity in these sectors as increased cost of capital and restrictions on leverage putting pressure on returns for PE investors, value creation will be more crucial than ever.

Talk to One of Our Experts

Get in touch today to find out about how Evalueserve can help you improve your processes, making you better, faster and more efficient.