The COVID-19 pandemic has brought unimaginable changes to our lives. Even though the social restrictions have receded in most geographies, businesses are still fine-tuning their optimum working models. Nearly 50% of workers returned to office after the week that followed the 2022 Labor Day weekend, according to a survey based on 160 major Manhattan employers compiled by The Partnership for New York City. Despite clear signs of employees returning to the office, a hybrid work-from-home model is likely to be the most preferred future option with 77% of employees voting in favor of this medium, the survey found. The Financial Services industry (with 56%) followed law firms (61%) and real estate (82%) in average daily office attendance during this period, a clear sign the future working model of Wall Street is going to be a hybrid one. Only the tech industry allowed for higher remote work flexibility than investment banks, with 47% average daily footfalls.

Many Wall Street banks are indeed encouraging their staff to work in-office, with Goldman Sachs seeing that number rise as high as 65% this fall. Despite a very high number of people going back to the office, it is not the end of the road for remote working as the banks would have to strike a balance between the two. A 2021 survey by The Conference Board revealed that millennials expressed more concern about returning to office than their older peers. The banks would likely address this challenge of retaining their younger talent by offering a hybrid model.

These radical changes in the working style also have a direct bearing on operations at these big banks such as business communication, which traditionally relied on in-person meetings and face-to-face interactions. Most of these interactions moved online as work from home and video conferencing became a new normal in the last two years as businesses were required to transition into virtual workspaces. For instance: Investor Relations teams mainly focus on events like roadshows, marketing trips, investor conferences, or business forums, etc., which typically required physical presence as attendees (mainly buy-side and sell-side participants) prefer direct interaction with the executive leadership team. Despite significant challenges in moving this whole IR function to a virtual space, its transition has been nothing but a success story.

Introduction to Evalueserve’s RSM Team

The Roadshow Marketing (RSM) and Corporate Access (CA) team at Evalueserve plays a pivotal role to help our clients connect with companies, investors, and subject-matter experts. The RSM team helps clients by providing useful information on their counterparts comprising hedge funds and individual and retail investors. Our personalized service offering includes scheduling and coordinating events to managing travel logistics for participants. Over the years, Evalueserve has become a reliable offshore partner in this area, as evidenced by the below testimonial.

Historically, face-to-face meetings had been a preferred method for IR professionals, but this changed at the onset of the COVID-19 pandemic. During the pandemic, virtual events became the new norm of communication between institutional investors and corporate clients, however, with the easing of the social restrictions, there has been a slight change in preference towards in-person meetings amongst different stakeholders in recent months. Whether it is an in-place or a virtual event, the RSM team is well-equipped and quick to adjust to their client needs, which is evident through their feedback.

Whenever our clients participate in investor meetings, roadshows, or attend business forums, the RSM team assists them with pre- and post-event services which include planning itineraries, scheduling business interactions/meetings, logging investor attendance, providing logistical information (flight, transportation, and accommodation), data management, compiling investor profiles and collecting feedback after the meetings.

The RSM team works in tandem with the Corporate Access team to organize roadshows targeting institutional investors. The team performs company analysis to put together reports on shareholders, competitors, investment trends, and top potential investors.

Paradigm shifts in the meeting preferences of clients in the post-COVID world

There are different types of corporate or investor events such as virtual, in-person, and hybrid. Each type has its own set of advantages and disadvantages that should be considered during the planning phase. Virtual events tend to have a wider reach in terms of audience than in-person events and are cost-effective given there is no need to rent a venue and requires limited logistical expenses such as travel and accommodation. However, these virtual events have their own limitations such as the lack of in-person engagement. Also, they require a robust technological infrastructure, as virtual events rely on technology, and one of the downsides of virtual events could be technical bottlenecks like weak connectivity, buffering, or slowness. In-person events, on the other hand, provide a direct and personalized experience as attendees could engage freely with presenters and other participants.

Hybrid events are a combination of virtual and in-person events so attendees can attend the event either in-person or online. They provide reach to a large audience while being more personal and engaging than virtual events. Moreover, hybrid events provide a cushion against disruption in the event of a sudden spike in COVID-19 transmission. However, hybrid events tend to be more expensive and logistically complex to plan.

Before the COVID-19 pandemic, investor conferences, marketing events, and corporate meetings were mainly in-person. In an internal study, Evalueserve found that the total number of events for its top investment banking clients fell roughly 60% in 2020 from pre-pandemic levels before rising by about 15% in 2021, aided by the restart of the economic activities after severe lockdowns. However, the 2021 numbers still stand about 50% below the 2019 levels.

IR magazine, in its most recent survey, found that IR professionals held a total of 85 meetings between June 2021 and January 2022, out of which; 79 meetings were done in a virtual format, while only six meetings were in-person meetings. Among different corporate size, the survey highlights that the Small-cap companies are more inclined to participate in a virtual format as 60% of the total meetings were conducted virtually, followed by 54% for mid-cap, 39% for large-cap and 31% for and mega-cap entities.

When asked how a meeting format affects the likelihood of its occurrence, investors appeared more in favor of in-person meetings. About 35% of respondents were in favor of in-person meetings, while 31% opted for virtual events. 34% of respondents were neutral and claimed it makes no difference to them. On the other hand, about 39% of North American investors are more likely to attend a virtual meeting.

The sell-side and buy-side also have contrasting preferences. Four out of ten sell-side professionals are inclined to attend an in-person event, while four out of ten buy-side professionals are more likely to participate in virtual meetings.

The same agency in a 2021 survey of 615 IR professionals worldwide found that respondents were more satisfied with their experience in virtual roadshows than in-person events. Nine out of ten IRs who attended virtual events in 2021 were more pleased with the experience. “Time” along with the “cheaper cost” of hosting the events were among the major reasons why respondents preferred virtual roadshows over in-place events.

Virtual events bring cost-related benefits

Our existing clients have benefitted in terms of cost savings by moving their Investor Relations (IR)-related operations online. The participants are not restricted to specific time zones or locations, and these events can host multiple people in the same virtual room, which could not have been possible otherwise. Virtual events facilitate the use of the latest technologies such as video webinars or Zoom calls such that a large group of attendees from across the world could join and listen, speakers could present their content with added features such as pre-recorded videos, screensharing, and moderator controls over the audience.

The RSM function has evolved with digital transformation happening across its core functions. With the gradual restart of business activities, the demand for in-person meetings has increased from the extremely low levels seen during the peak period of health crisis. That said, given the advantages in terms of flexibility, cost saving, and audience outreach, many events are still conducted in the virtual format. This is especially true given the enormous cost pressures that are placed on all industry participants with rising inflation and choppy financial markets.

To guarantee the effectiveness of their marketing initiatives in such a setting, banks and corporations will increasingly rely on specialized third-party service providers, like Evalueserve, with good experience in managing functions across all formats (including in-person, virtual, and hybrid).

Evalueserve RSM team offers Data Analytics support to clients

Evalueserve RSM is more than just your logistical partner. The team extensively uses advanced data analysis tools such as Python and VBA to provide structured reports with detailed historical performance on the type of events, attendees’ classification, and leading shareholders’ information, among others. These automated reports help clients gain a better understanding of investment trends in a sector over a specific period, which is evident through encouraging feedback.

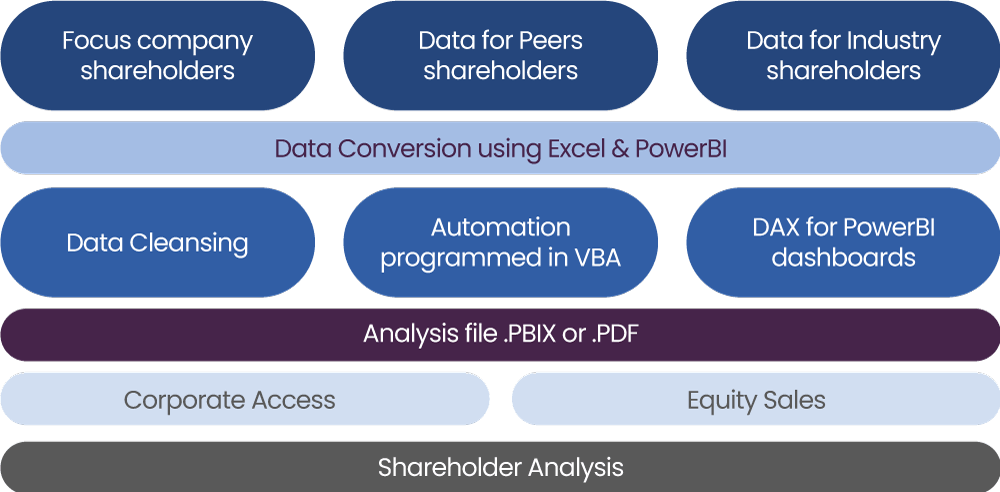

The below schematic is an example of such a smart solution where the team, using raw database from external vendors (IPREO/FactSet), puts together an analysis of securities that an investor account holds over target companies (Focus company shareholders), their peer group and their industries under which they operate. The team uses advanced Power BI and Excel tools to perform this kind of analysis as shown in the below diagram.

Solution schematics

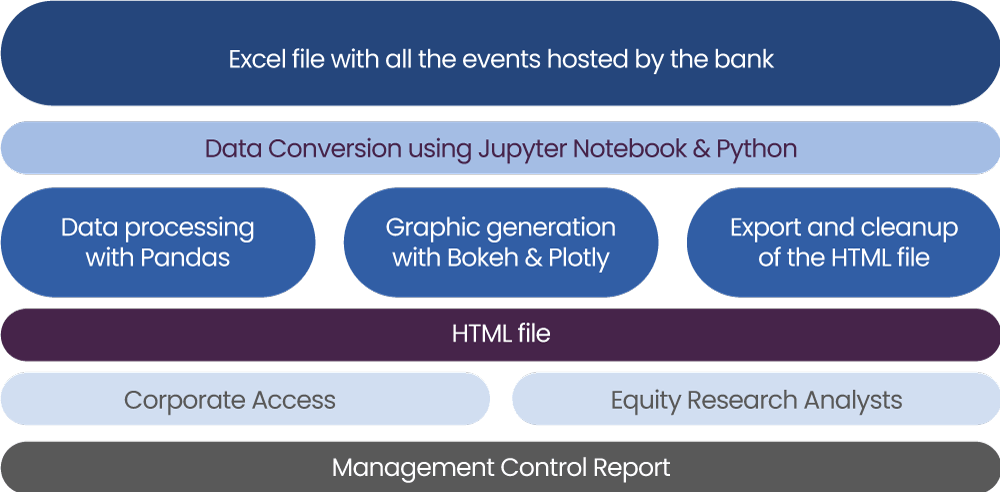

The team also helps our investment banking client with Management Control Reports using advanced analytics such as Jupyter and Python. The report is a detailed study of all events hosted by the I-Bank, wherein all participants are classified based on their preference towards different sectors. For example, we map buy-side investors to identify their sectoral preferences based on their meetings.

Solution schematics

Conclusion: Evalueserve at a critical juncture as virtual roadshows make inroads

Virtual roadshows and online IR events are some of the pandemic-driven legacies that would remain in a post-COVID world. Although many events have gotten back to their old in-person format, preference for online events would continue in a long run, thanks to “cost savings” and “less time” required to organize these meetings. Among corporate size, small-cap companies are more in favor of attending virtual events, while geographically, investors in North America are more inclined towards participating in virtual meetings.

As virtual roadshows and marketing events make further inroads, banks and large investment boutique firms would tend to offload these activities to third-party service providers, that have the expertise and experience in providing IR-related solutions. The Evalueserve RSM team follows a ‘quick-to-adopt’ approach i.e., it is flexible to adjust to client needs, be it organizing a virtual meeting or an in-person event. Utilizing our Mind+Machine™ approach, the RSM team has helped our existing clients with automation and has also provided technical support in putting together multiple analyses using advanced data analytics. In the current market environment, investor relations activities would continue to grow, and the banks would rely more on RSM-related services to enhance their relationships with their clients.