What is a Win/Loss Analysis?

A win/loss analysis is a thorough discovery process that enables companies to dive deep into their customers’ motivations and objections. It reveals the true reasons behind a purchase, or behind the decision not to buy something.

This analysis provides sales teams with invaluable customer feedback. This feedback helps them understand why they’re losing or winning sales opportunities, why, and why not. Product managers, customer success teams, and marketing teams will also benefit from win/loss analyses.

Why Perform a Win/Loss Analysis?

Competitive win/loss analyses equip teams with data-driven insights to inform future sales processes. Instead of relying on hunches that may not work and cost the company a lot of money, it’s smarter to trust educated decisions.

According to Think With Google, consumer behavior is increasingly “messy.” Decision-making methods vary wildly from person to person. Thus, the only way to know why consumers choose to buy from you is to ask them.

With the right people, the right competitive intelligence strategy, and the right questions in place, you’ll get a wealth of qualitative information. Not even the most robust CRM would be able to provide this amount of intelligence.

Statistics by Accent Technologies show that a win/loss analysis is essential if you want your company to be best-in-class. According to the research, “teams who used win/loss analysis on a regular basis outperformed those who did not have any sort of analysis process.”

The same statistics show that win/loss analyses have helped teams increase their sales quota achievement by 5%. They also saw a 12% increase in their customer retention rates.

Plus, according to a recent Gartner report, “teams that take a more comprehensive approach to the analysis have seen a 15% to 30% increase in revenue and up to 50% improvement in win rates.”

When performing periodic win/loss analyses, you’ll discover:

- Where your solution stands in the market

- Wher your competitor’s solution stands in the market

- Which benefits and features are worth front-loading on your website

- Fresh insights into modern customer decision-making

- Which areas of your funnel you should optimize, and which areas you should keep the same

And many more eye-openers you couldn’t uncover with numbers alone.

The Ultimate Guide to a Integrating AI into Competitive Intelligence Programs

What Data Do You Need to Perform a Win-Loss Analysis?

There are specific data points you’ll need to collect and document to perform a successful win/loss analysis. These can be divided into quantitative and qualitative data.

Part of gathering that data is to keep it in a single source of information, so you can have easy access to it. 80% of best-in-class companies have their quantitative and qualitative data stored in a central dashboard for recurring reference.

To gather that data, you should first determine the right sources to analyze. Ideally, you’d collect both quantitative and qualitative data from different sources, such as:

- CRM data (qualitative)

- Sales team feedback (qualitative)

- Customer and prospect feedback (qualitative)

- Social mining (qualitative and quantitative)

Quantitative Data

While useful, quantitative data will only give you quick checkpoints on what is happening – not exactly why it’s happening. Examples of measurable quantitative data include:

- Annual revenue

- Industry

- Job title

- Number of email opens

- Conversion rate

- Won leads count

- Lost deals count

Qualitative Data

When done correctly, qualitative data can be a source of detailed information on decision-making. It’s time-consuming and requires outsourcing, but this is the type of information that gives organizations an edge over the competition.

Qualitative data involves:

- Feedback from loyal customers.

- Feedback from past customers.

- Feedback from prospects.

- A step-by-step visual representation of the prospect’s buying process.

- Insights on competitors and alternative solutions.

- Insights on support and customer experience.

- Assessment of strengths and weaknesses.

You’ll also want to triangulate your data with social mining. Social mining refers to the act of looking for honest customer feedback on social media channels, forums, and comments. This way, you can fill in any existing gaps in your research.

If you need unbiased opinions about people who have used or are currently using your solution, you can add the following sources to your qualitative data:

- Product Review Site (e.g. G2Crowd, Trust Radius, Capterra)

- Quora

- Facebook groups

- Social media comments

The goal is to rely on more than a single data source to inform your future marketing decisions. If you have at least three sources to inform your research, it’ll be easier to find patterns in customer feedback.

Make Better Decisions with Insightsfirst

Get a market-centric pulse to helps shape future developments, alerts on trends, updates on eminence activities, and monitor supply chain for better sourcing decisions.

How to Successfully Perform a Win/Loss Analysis

Determine Goals For Win/Loss – What Will You Get Out of Doing One?

You’ll only be able to create a focused strategy if you have narrow-scope goals in mind. Before you start organizing your analysis, think about what insights this research should bring. What are some key questions you need answered? Do you want to:

- Improve your sales strategy?

- Find out which obstacles are preventing website visitors from buying?

- Identify a new value proposition (or unique selling proposition) for your solution?

- Improve customer experience?

- Get a better understanding of customer behavior?

A win/loss analysis will help you answer any customer-facing questions you may have. Yet, for better results, you should be precise. Focus on the current problems you need to solve, and only ask questions that will help you find solutions.

Once you have your goals in place, it’s time to determine where your company stands.

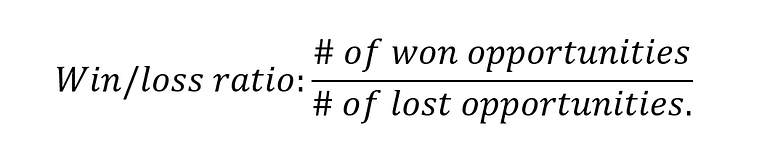

Calculate Your Current Win/Loss Ratio

You can’t fix something if you don’t know where it’s broken. To avoid wasting time and resources, you’ll need to find where your company currently stands. For that purpose, you’ll need to calculate your win/loss rate. All you need is a simple formula:

This is one of the places where quantitative data matters. Your CRM will tell you the exact number of won and lost sales opportunities.

Determine Who Will Be Leading the Interviews

Ideally, you should hire a third-party organization to conduct the win/loss interviews – even if the interviewees are your prospects and customers. That’s because customers will feel more at ease when talking to people who are unrelated to your company. Knowing that they’re openly talking to an employee may result in poor, even “sugarcoated” feedback.

If you must do the interviews in-house, the interviewer shouldn’t be someone who’s directly connected to the sale in question. The interviews must be unbiased from both sides.

Remind yourself that this analysis isn’t about confirming pre-existing beliefs about your company. Instead, it’s about receiving impartial feedback from those who have first-hand experience with your solution.

Determine Which Questions You’ll Ask

Next, you’ll need to prepare an interview guide that lists all of the questions that need detailed answers.

The questions you’ll ask will depend on the goals you’ve already established for your win/loss analysis. Based on your core challenges, which questions should you absolutely ask in order to get the answers you need?

Avoid creating long-winded questions, and avoid asking questions that aren’t connected to your goals for this process. If there are specific questions that pertain to a single group (such as past customers), filter those questions, as well. Your interviewee’s time is valuable, and you won’t want them rushing through the answers.

A few common questions to get you started:

- What made you want to decide to buy from us?

- What made you decide not to buy from us?

- What pains/problems were you initially trying to solve?

- What desirable outcome were you expecting?

- Which features do you find the most interesting/helpful?

- Before choosing us, were you familiar with any competing solutions?

- Would you say that our solution has solved your pain/problem?

- Who was involved in your decision-making process?

- What is your perception of the sales team?

- How would you improve your experience?

You can tweak those questions to fit your company’s context or add your own.

Determine Who Will Be Interviewed

Will you interview prospects? New customers? Loyal customers? Past customers? This decision will also depend on the initial goals you set for the interview.

If you’d like to understand the obstacles customers may be facing en route to purchase, the experience should be fresh on their minds. Especially if you’ve made recent changes to your funnel, it’s interesting to reach out to new prospects and customers who will remember their journey.

Here’s a good rule of thumb: schedule more interviews than you need.

More often than not, scheduling the exact number of interviews you need to conduct will result in several last-minute cancellations. To keep this from happening, reach out to 15 customers instead of just five, or 60 prospects instead of 20.

Schedule and Conduct Interviews

Interviews should be scheduled up until two months after the sales team wins or loses a deal. Again, you want the interviewees to remember their buying process, as well as the reasons behind the decisions they’ve made.

It’s no secret that you should hire a well-trained interviewer to go through the questions with your audience. Not only will they know how to properly conduct an interview, but they’ll be able to deliver the accurate results to your company.

Here are other tips to make sure every interview goes as planned:

- The interviewer should avoid treating the interview like a questionnaire. You’ve created the interview guide as a helpful resource, not as reading material.

- While the interviewer should ask all of the necessary questions and guide the interview, the prospect or customer should do 90% of the talking. Listening is what counts the most.

- There should be no interruptions or corrections while the interviewee is speaking. Although a professional interviewer will have this in mind, this is a useful tip for conducting the interviews internally.

- If a customer or prospect hasn’t answered a question according to plan, be sure to clarify the question to them. After all, this interview should bring insightful answers.

Each interview shouldn’t last longer than 30 minutes — hence the importance of focused questions and professional guidance.

Analyze the Findings

The third-party company you’ve hired should provide you with a comprehensive report of their findings.

If your sales team conducted the analysis, they should assemble the data into a comprehensive report for later distribution. Whenever possible, they should break up the data in firmographics. This can help you with your go-to-market (GTM) strategy when redefining your target market and offers.

When conducting interviews internally, there are a few key rules you should follow in order to better analyze your results.

- First, you should identify repetitive language. Were there any messages that kept coming up in different interviews? If the answer is yes, these are worth documenting.

- Note any complaints or objections, such as competitive prices or any obstacles when trying to close the deal.

- Keep an eye out for any interesting language you could incorporate in your messaging. Smart value propositions are built out of what your customers think is interesting about your solution.

It’s a good idea to collectively analyze this data and brainstorm new strategies. Share the report with sales, product, customer success, and marketing departments. Following that, schedule separate meetings to go over those findings with each department.

Incorporate the Results

With your comprehensive analysis report in place, it’s time to look at the data and ask the following question:

Which recurring aspects played a part in multiple wins or losses?

Here’s an example:

Let’s say multiple prospects and customers said that your solution helped them in a particular use case. They’ve said your solution helps them save 5 hours of work every week – but you’re not saying that anywhere on your website. If that’s the case, consider front-loading this selling point or highlighting it in your next marketing campaign. As always, be sure to use proof for all of your claims.

In addition, pay attention to mentions of competing solutions and challenger brands. If interviewees have mentioned high competitor prices or bad customer experience, this is another point to address for competitive advantage.

You can also incorporate your win/loss data into battlecards, or keep it in a living document to inform your upcoming sales strategies.

Final Considerations

A win/loss analysis isn’t a one-and-done process. In ideal conditions, you should conduct this analysis on a yearly or quarterly basis.

Though this may seem like a short time for some companies, your consumers’ behavior isn’t cyclical. There’s no definitive buyer journey or funnel, and no two customers are the same. Win/loss analyses should accompany their ever-changing nature.

Remember to always share the results of win/loss analyses with the departments within your company. When everyone is aware of the company’s strengths and weaknesses, there’s a collective effort to win better business.

As a final word of advice: listening to your customers is the best investment you can make toward your company’s success. Customers know everything you don’t. So listen intently.

Forrester Research Named Evalueserve's Insightsfirst a Strong Performer