Overview

A leading Canadian bank’s U.S. expansion through a major acquisition created substantial data integration challenges, including consolidating CRM and credit platforms, validating borrower and loan data, and ensuring governance‑aligned accuracy across millions of newly migrated records.

Evalueserve deployed a dedicated financial spreading and data integration team to standardize templates, deduplicate records, create unified customer views, and validate critical credit data. This solution improved data quality reduced migration costs by approximately $500,000 USD, and enabled internal teams to focus on higher‑value portfolio and risk management activities.

Challenge

In early 2023, a leading Canadian bank completed the acquisition of a regional U.S. bank to expand its footprint from the Midwest to the West Coast. This strategic move nearly doubled its U.S. customer base, adding 1.8 million new customers and significantly accelerating growth in commercial banking services and wealth management.

However, the merger introduced complex integration challenges. The institution needed to consolidate CRM and credit platforms, migrate large volumes of customer and loan data, and ensure data accuracy throughout the process. Critical elements such as borrower details, risk ratings, and probability of default (PD) calculations had to be validated to maintain compliance and operational integrity. Achieving a seamless transition without disrupting customer experience or regulatory standards was paramount.

Our Solution: Financial Spreading and Integration Support

Evalueserve engaged early in the integration journey, initiating discussions with stakeholders across commercial banking services, wealth management, and risk functions to identify areas of support for M&A integration.

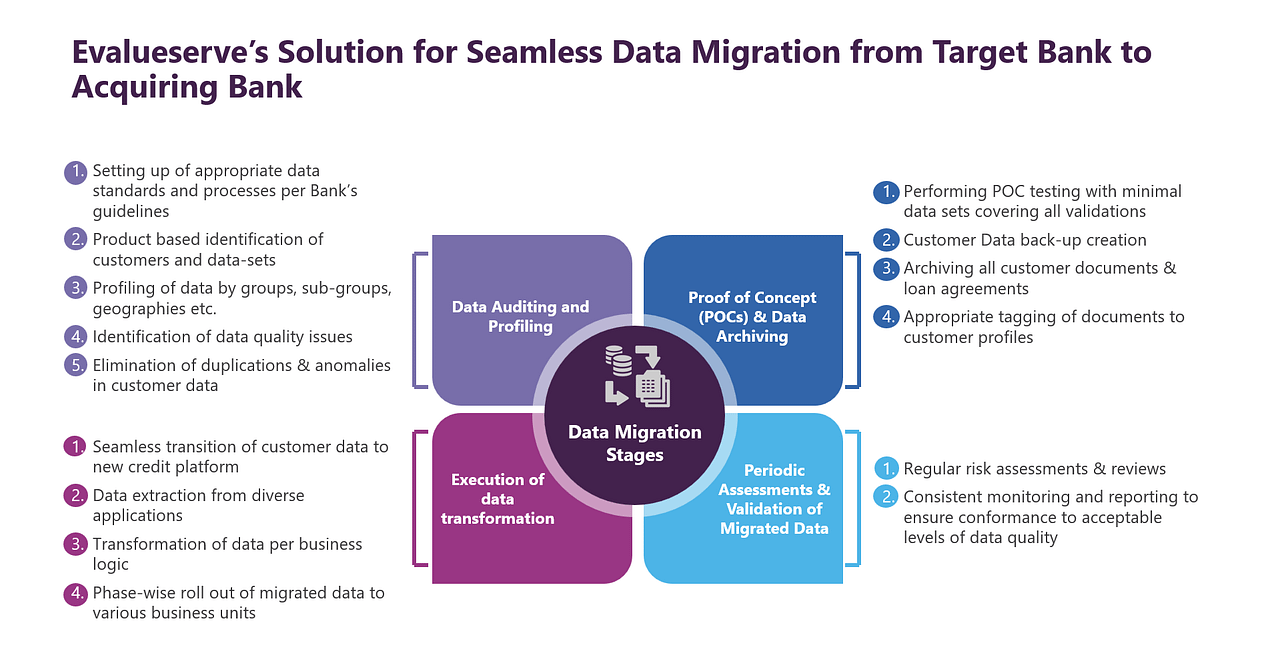

We provided financial spreading support with a dedicated team of seven full-time equivalents (FTEs), implementing proof-of-concept testing, data auditing and profiling, document archiving, and phase-wise rollout of migrated data. These measures ensured a seamless transition while maintaining compliance and data quality at every stage.

Beyond financial spreading, once the client finalized their technology integration strategy, Evalueserve played a critical role in credit platform integration. This included:

- Standardizing templates to store customer data

- Deduplicating records

- Creating a single customer view

- Generating ghost accounts

- Addressing customer account number considerations

- Normalizing different naming conventions

- Migrating account types

- Validating data (borrower details, PD calculation, etc.)

Business Impact

Evalueserve’s financial spreading support enabled the institution to integrate systems and data smoothly, reducing duplication, and improving overall data quality while positioning the bank to leverage its expanded footprint effectively. This support resulted in approximately $500,000 USD in cost savings across the bank's overall migration efforts.

As the integration progressed, the scope broadened to include support for additional commercial banking portfolio monitoring areas such as risk ratings, covenants and triggers (C&T), data validation, and comprehensive reviews of the commercial real estate (CRE) portfolio—further strengthening our relationship.

Currently, we are exploring several generative AI initiatives with the bank to drive 30-40% efficiency gains across workflows. These initiatives will strengthen the institution’s ability to deliver superior customer experiences and maintain robust risk management practices as it scales its U.S. operations.

Talk to One of Our Experts

Get in touch today to find out about how Evalueserve can help you improve your processes, making you better, faster and more efficient.

Overview & Impact

How Evalueserve enabled a leading Canadian bank to accelerate its U.S. expansion—enhancing data quality, streamlining credit platform integration, and saving ~$500K in migration costs while strengthening readiness for scalable, AI‑driven growth.