Client Ask

A leading firm in the private equity (PE) consulting space launched a strategic initiative to create a comprehensive PE deal book. The primary goal was to build and maintain a reliable, continuously updated database of historical PE and corporate transactions across North America and Europe.

The client wanted the database to be designed to capture detailed information across more than 40 data fields for ~40,000 deals. The client needed this level of granularity to get valuable insights into each deal.

The ask was aimed at strengthening the firm’s analytical, market trend analysis, and performance benchmarking capabilities, as well as its ability to make more informed investment decisions in a competitive PE environment.

Our Solution

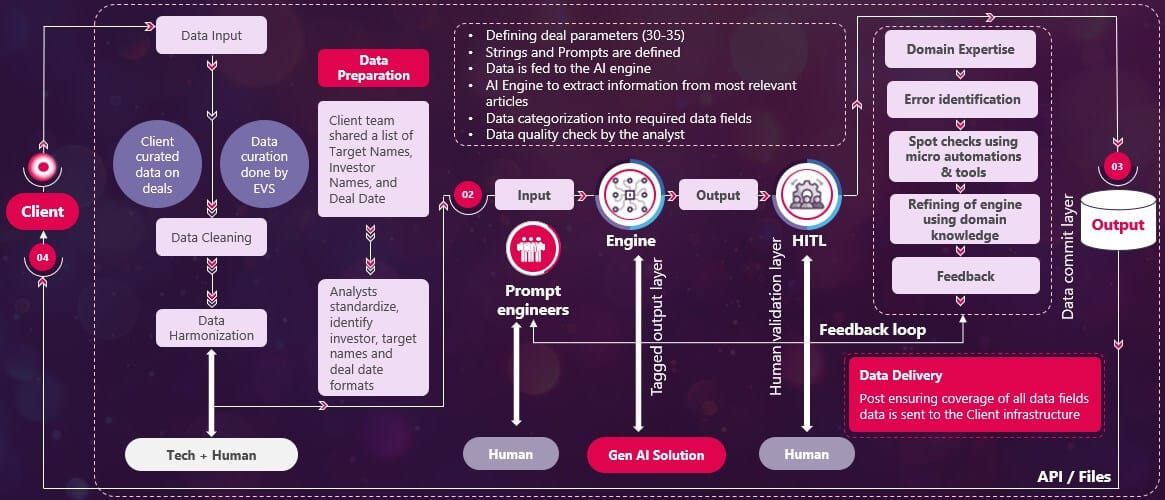

Evalueserve implemented a structured, three-phase approach to help the client build a comprehensive PE data asset. The solution combined an advanced agentic AI framework with expert human oversight to ensure both efficiency and accuracy in deal data extraction.

Phase 1: AI Agent Development and Pilot

The first phase focused on developing and testing the core AI capabilities for extracting deal data.

- AI Agent Development and Automation: Evalueserve created specialised AI agents and automated workflows to manage all aspects of deal data extraction. A pilot was conducted using a sample of 5,000 historical deals to train and validate the AI agents’ performance.

- Human-in-the-Loop Optimisation: Experienced analysts improved the AI agents by designing detailed prompts, reviewing outputs, and evaluating model accuracy. This iterative process was essential for refining the AI agents’ performance.

- Client Collaboration: We also provided regular progress updates and organised review sessions with clients to ensure transparency and alignment with their expectations. Client feedback was incorporated throughout the development process.

Phase 2: System and Data Integration

With the AI agents optimised, the second phase focused on scaling data extraction and integrating the solution into the client’s systems.

- Completion of Historical Data: The remaining backlog of PE deals was processed using the enhanced AI system, completing the historical database.

- System Integration: The solution was integrated directly into the client’s infrastructure, enabling real-time ingestion of new deals and API-based data export for seamless access.

- Incremental Updates: A process was established to monitor and update deal metrics as new information became available, ensuring the database remained current and accurate.

Phase 3: Scaling and Maintenance

The final phase expanded the solution’s scope and established a sustainable model for continuous data management.

- Broader Coverage: The database was extended to include deals from additional regions and industries, increasing its depth and analytical value.

- Continuous Updates: A system was implemented to regularly refresh existing deal data, capturing any changes or new developments to maintain reliability over time.

This phased strategy enabled Evalueserve to deliver a scalable, high-quality PE data asset. By combining AI-driven automation with human expertise, the solution ensured consistent accuracy, adaptability, and long-term value for the client.

Agents are autonomous entities designed to perform specific tasks or answer queries based on the data and knowledge bases they are connected to. They can automate repetitive tasks, provide intelligent responses, and support various business functions and tools efficiently.

Tools are automated scripts or functions that perform specific tasks, from LLM calls to complex operations like web scraping or API calls. Each tool takes specific inputs, processes them, and provides outputs.

A dataset is a collection of data that you can upload in various formats. This data can then be processed and used to create knowledge bases for your tools and agents.

Business Impact

Evalueserve’s solution delivered measurable business value by improving data quality, streamlining operations, and reducing costs.

-

Enhanced Data Accuracy and Coverage

Our AI engine, powered by advanced machine learning, produced a data asset with higher accuracy, broader coverage, and richer detail than manual methods.

-

Expert Oversight for Quality Assurance

Evalueserve’s domain specialists managed the entire delivery process by conducting multi-step accuracy checks and applying supervised learning techniques. This human-in-the-loop model was essential for refining the AI agents and ensuring consistent data quality.

-

Significant Reduction in Manual Effort

The AI-driven approach reduced manual workload by ~75%. This allowed the client to reassign resources to more strategic and analytical functions, rather than routine data compilation.

-

Continuously Updated Dataset

The system’s automated data collection and regular updates ensured the dataset remained current and responsive. This capability is especially important in the fast-paced PE sector, where timely and relevant data supports better decision-making.

Talk to One of Our Experts

Get in touch today to find out about how Evalueserve can help you improve your processes, making you better, faster and more efficient.

Overview & Impact

Evalueserve assisted a leading firm in private equity by developing a strategic PE deal book, enabling detailed analysis of corporate transactions. This effort led to streamlined operations and reduced costs.