The Challenge

The chemicals industry value chain is evolving to accommodate circularity in view of the staggering waste that has been generated. The main challenges industry leaders face include the lack of recycling infrastructure and finding ways to improve the value creation from the end life of a product, which is coupled with technological limitations. Although regulators and policymakers are working on finalizing the blueprint, and in some areas (such as commodity packaging) announcing mandates, the questions surrounding ease of implementation and feasibility is still unanswered.

A leading chemicals and materials company that had a portfolio mix of a commodity (packaging, construction, etc.) and specialty polymers (aerospace, automotive, electronics), was facing challenges when charting out a robust circular economy roadmap. They had to find a way to create a roadmap that included future regulations vis-à-vis retaining their competitive edge in the market that accounted for the circular economy.

The key challenges faced by the client included:

- In the raw materials to production-to consumption-to waste management cycle: where, why and how to add maximum value within the circularity loop.

- Lack of clarity on their customers’ priorities, competitor’s best practices, product end-life scenario and presence of viable technologies.

- Lack of an external unbiased perspective when tallying internal ideas with external market scenarios, to arrive at realistic and achievable targets.

Our Solution

Our team kicked off the first step with a diagnostic workshop to understand the circular economy innovation themes and overarching goals of the client. This included assessment of the client’s current position (areas of gap, areas of no presence) in terms of product portfolio, technology span, ideas in the evaluation hopper, understanding challenges—both internal and external, and finally defining the problem statement. As a second step, the ‘to-be state’ was finalized in agreement with the client.

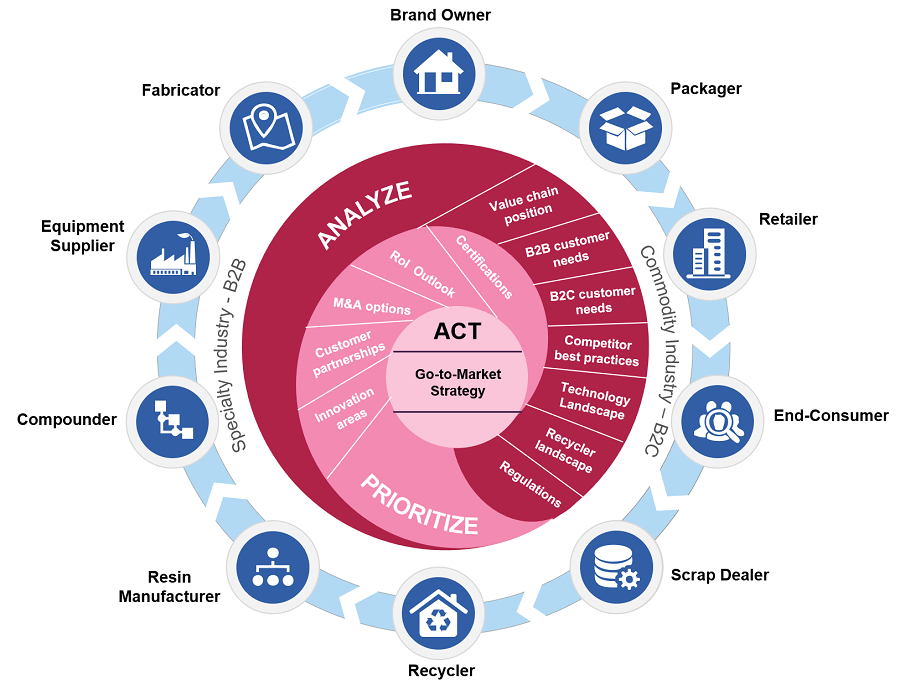

Following this, we presented an end-to-end solution for the client through our agile “Circular Economy Framework” to address both the commodity and specialty portfolio of the client.

The “Circular Economy Framework” entails a 3-step process—ANALYZE, PRIORITIZE, ACT—which enables companies to devise optimal strategies in the circular economy ecosystem. The framework threads signals from various nodes of the ecosystem, ranging from resin manufacturer- to brand owner- to retailer- to recycler. This helps with charting out opportunity areas and implications for the companies:

The “ANALYZE” step involved scanning the ‘external’ environment exhaustively and developing a robust “Outside-In” view landscape. This included the following sub-steps:

-

For the commodity portfolio, we focused on understanding business models and play areas from the B2C perspective. We analyzed segments such as rigid consumer goods and consumer appliances packaging across client portfolio areas which included PE, PP, PET, PC and PBT. We also presented a decision-flow for the client, which included the vision of CPG and appliance companies and the incumbent scrap collection ecosystem which were then linked to recycling technologies in use such as pyrolysis and mechanical recycling.

- For the specialty portfolio, we prioritized play areas and innovations in resin manufacturing and compounding related to recycling. We analyzed automotive, aerospace, and specialized consumer segments across specific client portfolio areas which included PU, PES, PPS, and HPPA. We focused on understanding resin innovation potential (supra-molecular, polymer auto-decoupling), the appetite of OEMs based on product life cycle of various items, and the fit of resin innovation with chemical recycling/Solvolysis technologies.

- Customer need identification, segmentation and prioritization allowed the client to have an in-depth view on the needs of direct (fabricators, OEMs) and indirect customers (packagers, retailers, consumers), which distilled and characterized the real needs/customer type into unique segments. A key finding was focused on OEM/CPG needs on recycled material performance vs. cost. Critical performance parameters included mechanical strength, elasticity, melt point/continuous use temperature and chemical resistance.

- Understanding the competition curve in terms of initiatives, success and failure analysis and future roadmap.

- Scouting novel technologies on material and process side and in-depth benchmarking to uncover the most attractive ideas for the client.

The “PRIORITIZE” step involved answering the ‘So What?’ element through intuitive scoring frameworks by combining the already gathered “Outside-In” view with the client’s “Inside-Out” view. This included the following sub-steps:

-

Zeroing in on the most lucrative areas for the client in terms of—innovation, validation partners and M&A opportunities. The assessment was then tailored into two buckets that aligned with client’s dual portfolio of commodity and specialty polymers.

- Various scenarios were drawn on “Return-on-Investment” options for the client. We focused on key elements such as profitability, economies of scale, regulations, sustainability and most importantly value proposition fit. We also mapped-out scenarios based on the client’s capabilities and business.

- This step focused on having the client both understand attractive ROI options and prioritize the portfolio of action items to manage potential risks.

The final step, “ACT” involved answering the ‘How?’ element through engagement and implementation roadmap development for client’s Go-to-Market strategy. This included the following sub-steps:

-

Route-to-Market layout – Creating an organic roadmap for internal R&D/ development and partnership with technology providers, customers and recyclers. We then created an inorganic roadmap that included portfolio evaluation, due diligence and high-level valuation of potential targets.

- Time-to-Market layout – Assessing timelines for organic and inorganic routes of entry by individual steps such as concept development, pilot and customer demos, scale-up, supply chain set-up and regulations.

Business Impact

Improved portfolio management strategy: Brought coherence and structure to the client’s long-term corporate strategy, while accelerating decisions on portfolio prioritization in-line with circular economy and capital goals.

Accelerated new technology investment strategy: We identified two best-fit technologies on the supra-molecular resin side, which would enable efficient polymer disintegration with less damage to the recovered material properties. We also identified a tailored version of one of the chemical recycling technologies, offering higher recovery efficiency with a 10-year ROI proposition.

Reduced time-to-market: Developed a robust customer prioritization and engagement roadmap. We shortlisted two potential technology partners for the client and identified one recycling partner within the Solvolysis space. We advised the client to engage in a three-party discussion with the identified recycling partner and the top two OEMs in the commodity and specialty segments.

Improved portfolio management strategy

Brought coherence to long-term strategy and accelerated decisions

Accelerated new technology investment strategy

Identified technologies offering higher recovery effiency

Reduced time-to-market

Identified a recycling partner and two potential technology partners that best suited the client

Talk to One of Our Experts

Get in touch today to find out about how Evalueserve can help you improve your processes, making you better, faster and more efficient.