The Challenge

Financial crimes are, as we know, becoming more prevalent in the financial services industry, and has become every institutions’ goal to take this challenge head-on.

Finding a solution that can address specific requirements in managing financial crime compliance processes has proved to be difficult for a global financial services firm . The bank needed help with bringing together and refining diverse risk management processes surrounding their high-risk portfolio management, in order to improve their report turn-around times.

Our Solution

Based on the bank’s existing tools and processes, our risk experts and proprietary micro-automation toolkit, we designed a bespoke solution for the bank. By adopting a modular approach to the problem solving, we were able to provide a compliant, low cost solution.

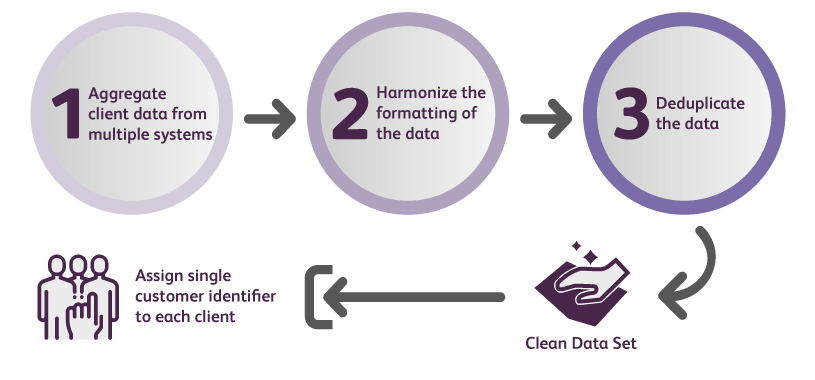

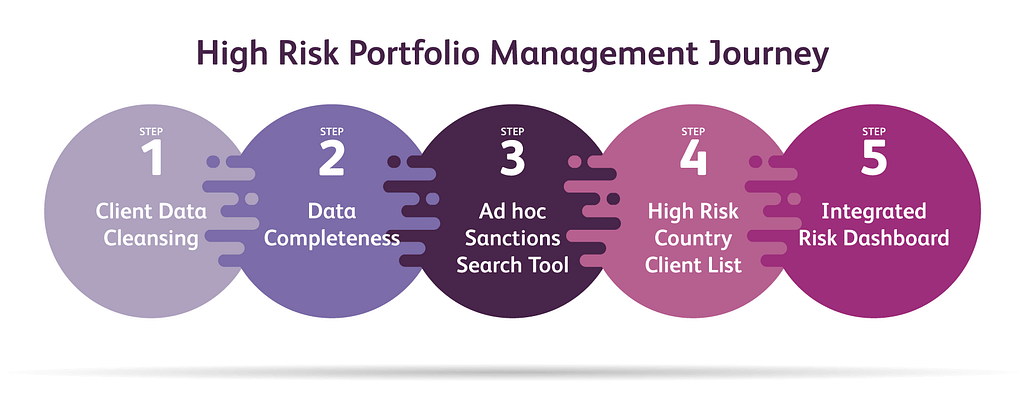

We adopted a 5-step process to map the “High Risk Portfolio Management Journey”. This enabled us to prioritize the segment of the high-risk customers based on their country of residence.

Step 2: Data Completeness focused on alerting the bank when they have incomplete files. This was done by using the clean data set to index each data point, creating a customer file flag alert for incomplete files. We made sure the flagging rules were based on the bank’s customer identification program (CIP) standards and weighted in such a way that only CIP-relevant data was producing a flag for review. This process not only helped the initial update of the data field, but has also continued to be used for ongoing CDD updates while reducing the volume of periodic reviews.

Step 3: Ad hoc Sanctions Search Tool enabled the bank’s analysts to perform a single search that integrated multiple external sources that included OFAC, UN, HMT and others. Instead of manually searching from these sources one-by-one, the search tool showed searches that applied to multiple sources. The capability of the tool was then taken further to include PEPs and regulatory warnings, as well as Panama and other papers’ information, making it a one-stop-shop for adverse information with regards to the 6 million customer portfolio.

Step 4: High Risk Country Client list was then built using the clean data and matching it against the bank’s AML Country Risk list. From this simple list, a dashboard was developed to monitor behavior on an ongoing basis in real time.

Step 5: Integrated Customer Risk Dashboard displays a timeline of changes and searches completed on a client in order to track their behavior, enabling the bank’s financial crimes and compliance officers to identify risk at a glance. We created the dashboard by aggregating all the customer data points and tracked them over time.

Business Impact

This systematic segmentation and prioritization enhanced the bank’s financial crime controls in response to the new FinCEN requirements, in areas ranging from data quality to ongoing know your customer (KYC) monitoring. Streamlining the bank’s processes (by implementing modular micro automation) ensured that the bank would experience a decrease in manual input and swift turnaround time.

Swift turnaround time

The streamlined financial crime controls made it easier for the bank to find and search for relevant information.

Enhanced financial crime control processes

The quality of the bank’s information was able to be enriched by the data cleansing and data completeness processes.

Improved KYC monitoring

The bank was able to rely on the integrated customer risk dashboard when tracking client behavior in order to identify risk at a glance.

Talk to One of Our Experts

Get in touch today to find out about how Evalueserve can help you improve your processes, making you better, faster and more efficient.