Summary

Evalueserve recently guided a client which specialises in the waste-to-energy space to zero in on their best-fit route to Voluntary Carbon Market (VCM) participation. As a part of the process, our team of decarbonisation experts utilised Evalueserve’s Carbon Offset Platform to help the client maximise the value of their carbon offset offerings in voluntary markets.

VCMs are gaining visibility, be it from the viewpoint of consumers, project developers, or investors. While still nascent, major industry players are driving forth the interest in VCMs with the mission to achieve Net Zero 2050 emissions goals, so as to reduce greenhouse gas (GHG) emissions and mitigate climate change.

Projects listed on VCMs vary vastly but have one thing in common – they are all solutions that have been benchmarked, or in the process of being so, to either reduce or remove carbon emissions from the atmosphere. Due to the vastness and variety of these solutions, there remains significant room for various potential participants to understand how exactly their projects can generate carbon credits in this developing space.

The Challenge

Since the voluntary carbon market is still maturing, there is still a fair amount of ambiguity around how the projects can generate carbon credits. With improving standards and stricter requirements for the eligibility of credit generation, as a project developer, the barrier to entry in the VCM gets even higher.

Moreover, the client’s intended project site for carbon credit generation involved a combination of multiple processes that were saving emissions at various stages. Therefore, due to the complexity, it was difficult for the client to answer - can they generate credits? If yes, which process of theirs can generate credits? If yes, how much can they generate, both credits and value?

Since these questions would require intricate knowledge of carbon offsetting programmes and methodologies, Evalueserve was able to guide the client in answering them.

Client Requirements:

The client wanted to discover new revenue streams and monetise the climate benefits (or emission savings) taking place due to their process using carbon finance, i.e., sale of carbon credits, as well as to maximise their value.

Our Solution

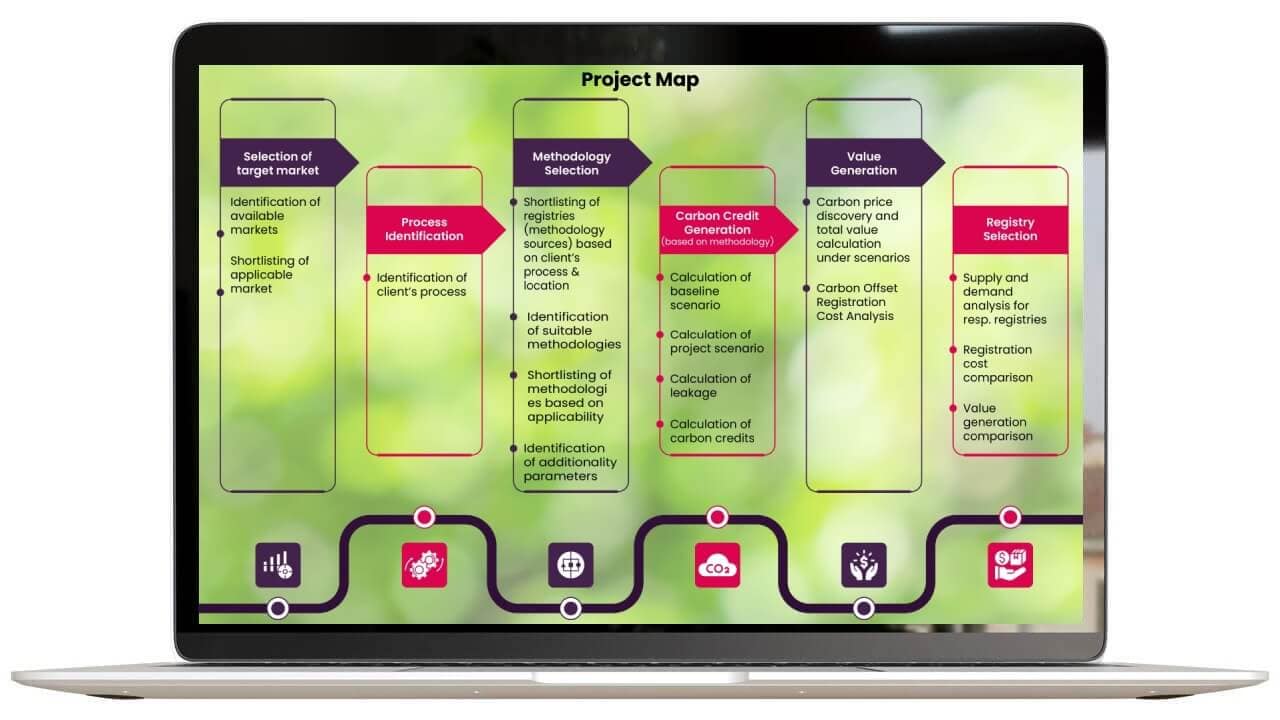

The client’s requirements led us to leverage our team’s expertise in creating insights to support decarbonisation initiatives at each stage from strategy formulation all the way to market execution. As this project required the understanding and constantly updated knowledge of various carbon offset programmes, Evalueserve’s Carbon Offset Platform was utilised for to ensure a thorough and efficient analysis. Our experts followed the incremental process below to arrive at the best solutions for our client:

- Identification of emission reduction activities Our team began with identifying as well as shortlisting the applicable activities or processes from those being carried out by the client at their target location.

- Eligibility of those activities for carbon credit generation Based on the applicability, the next step was to study the activities to prioritise ones that would be best suited for generating carbon credits.

- Carbon credit generation potential Calculations were carried out to project the carbon credit generation potential by estimating the carbon emissions during the project lifecycle.

- Identification of credit prices and value generation potential Leveraging the carbon offset database, our team identified the pricing, and based on the credit generation potential, the total value was also estimated.

- Selection of suitable carbon programme Our team leveraged their market expertise to compare the available carbon offset programmes based on various KPIs and the respective costs associated with each one.

- Overview of various value propositions and next steps Based on analysis of all the available programmes and taking into account the client’s requirements, our team was able to assist the client with mapping all available shortlisted options for VCM entry, and the related subsequent steps to implement each option.

Business Impact

Using this methodology and powered by our needs-tailored process, the team delivered on the following high impact areas for our client:

Carbon market landscape

Helping client gain a broad understanding of the carbon markets space as well as the specific details, registries, standards applicable to their target project.

Carbon finance opportunities

Identifying and shortlisting the activities that would return the highest value at their target location, along with projections regarding the estimated value generation potential through carbon credits.

Climate impact of processes

Carbon emissions calculations for target processes and activities would lead to the climate impact measurement, providing the client with a clear idea as to how much additional carbon they have available to generate carbon credits from potential options.

Carbon Offset Platform: To tackle these challenges and gain all the advantages of participation in voluntary carbon markets, our team of experts at Evalueserve has developed our very own Carbon Offset Platform. This platform comprises a global database of projects from across various carbon offset registries, which helps you in analyzing the best-fit project in terms of abatement as well as economics. To know more about how our Carbon Offset Platform can empower your decarbonization journey, please connect with our team of experts today.

Get decarbonization publications delivered to your inbox by filling out the form.