The Challenge

In order for oil & gas companies to maximize returns, acquisition strategy, and shareholder value, they need to replenish their upstream resource base and optimize their portfolio mix. M&A helps oil & gas companies fill gaps in their portfolio, open-up growth avenues, strategically enter or expand into key regions, and meet the production and Reserve Replacement Ratio (RRR) targets. However, oil & gas companies struggle with building the right bidding strategy, which would ensure that they outsmart the competition without leaving money on the table.

Our client, an oil & gas supermajor in Europe, had aggressive production increase targets where a large portion of their strategy was dependent upon inorganic expansion. Therefore, having a robust M&A program providing complete visibility on deal valuation dynamics, financial feasibility and attractiveness, and bidding patterns of other companies was imperative. Our client lacked the speed, visibility, and structured acquisition strategy to outbid competition in acquiring an asset.

We had to design a program that would not only establish a robust approach to making effective and efficient bids but would also provide the client insights into their competitors’ M&A strategy with the long-term assumptions for oil/gas prices.

Our Solution

We created a custom strategy program that enabled the client to:

- Track all upstream M&A (both asset and corporate deals)

- Understand the trends in valuation multiples

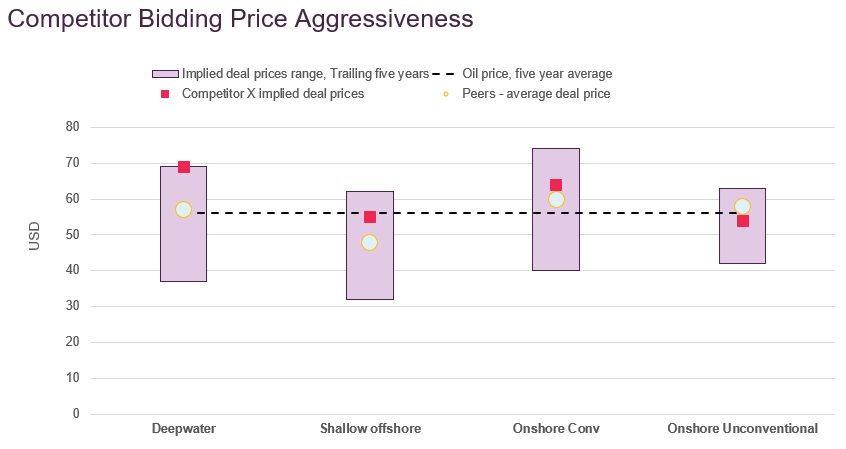

- Assess the aggressiveness of competitors while bidding for assets in a region

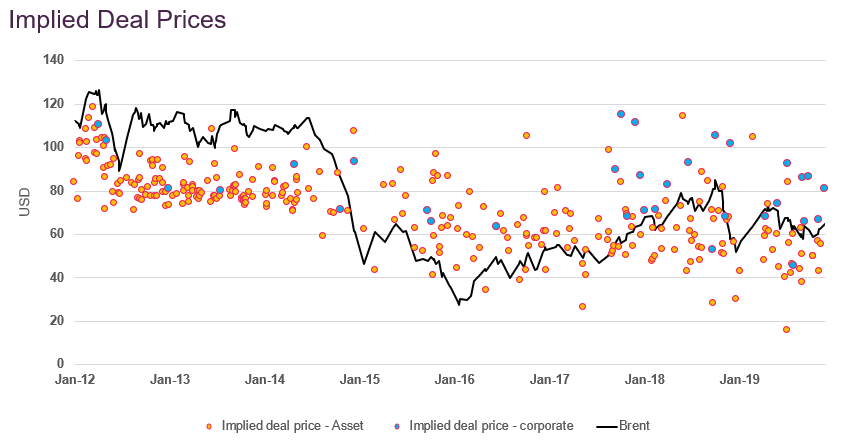

The program brought together financial modeling and analytics capabilities, which the client could access through a customized digital platform. This platform generated insights on implied oil & gas prices for various asset classes by region and competitors. Additionally, the platform enabled the client to interact with extensive M&A and company financial data from over the last 10 years, along with being able to access key trends and insights. The client was able to evaluate, analyze and disseminate insights due to platform capabilities.

The overall program empowered client stakeholders to drill down and analyze financial benchmarks and develop scenarios assessing the impact of each transaction on cash flow generation and ROCE-WACC spread of its competitors.

Business Impact

Deeper understanding of competitor behavior: the platform’s continuous tracking of upstream deals enabled the client to form a view of the regional and asset preference of its competitors. By tracking the client’s nine key competitors over 10 years, they could better understand:

- Key drivers for competition’s M&A strategy (low finding costs, production costs, reserves, extended production cycle, etc.)

- Long-term oil/gas price forecast view of its competitors (states vs. inferred)

- Development of scenarios on cashflow generation and deployment towards capex and dividend distribution.

Enhanced M&A strategy: through deep understanding of competitor activity and visibility of prices, our analysis helped the client:

- Improve the bidding price by understanding aggressiveness combined with implied price enabled our client to improve the quote, which won the client more deals with less money left on the table.

- Improved success rates through the analysis of 80-100 deals per year (each worth +100M USD per year,) while also tracking global upstream activity and providing the client with the latest insights.

80-100 deals per year

Around 80 to 100 deals per year were analyzed, with each worth +100M USD.

Improved bidding price

Won the client more deals with less money left on the table.

Talk to One of Our Experts

Get in touch today to find out about how Evalueserve can help you improve your processes, making you better, faster and more efficient.