The Challenge

A private equity firm that was handling increased deal flow needed to scan multiple opportunities, analyze significant amounts of target company data, and build and analyze standard financial models. A rapidly increasing number of private equity firms and growing dry powder, and an equally large number of companies available for sale, forced the client to close deals within extremely tight time frames. The client approached Evalueserve to increase its bandwidth, while staying lean, focused, and cost-efficient through an improved deal analysis process.

Our Solution

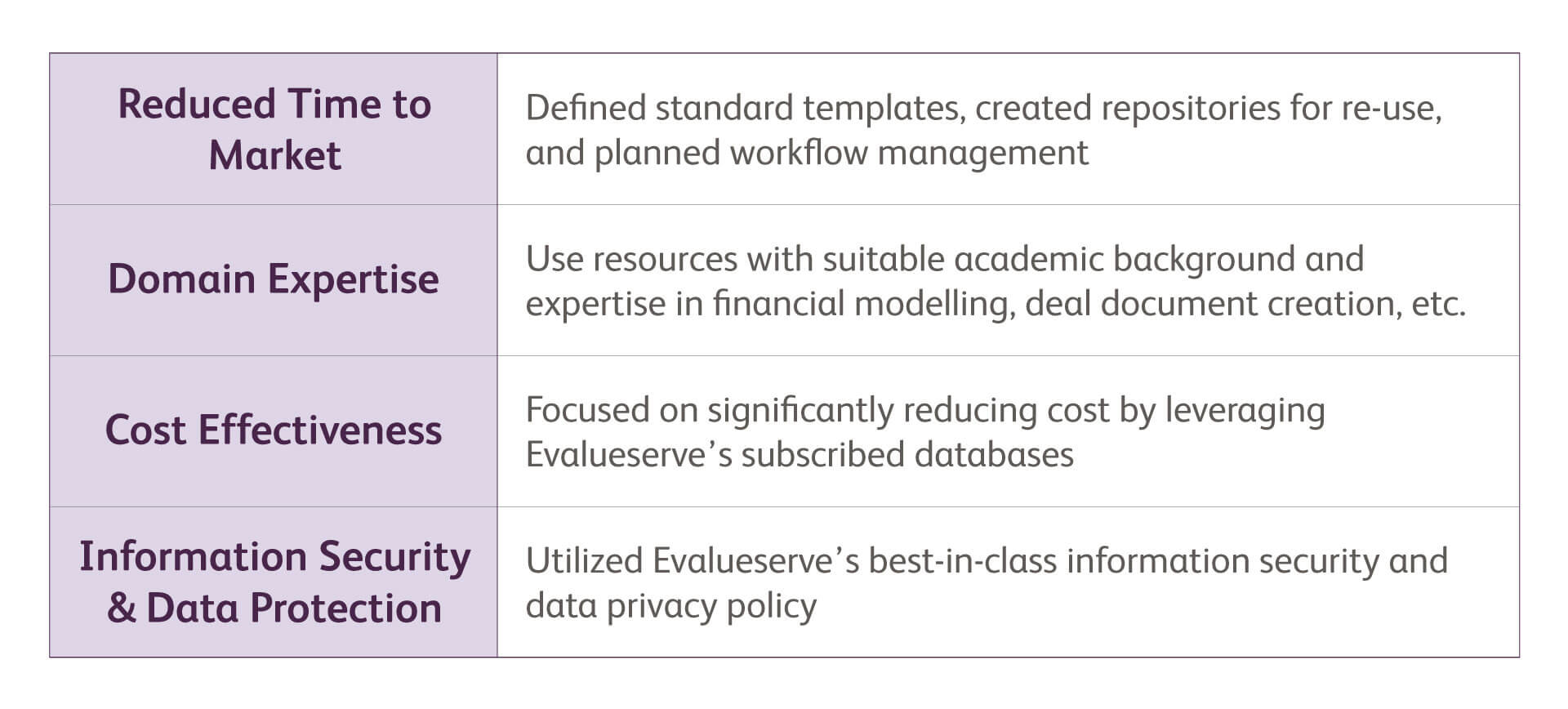

Evalueserve customized a multi-pronged deal analysis solution aimed at offering four key benefits:

Evalueserve supported the client across the deal cycle by focusing on:

- Deal sourcing/business development: We identified target companies based on the client’s criteria. We leveraged our subscribed databases, supplemented with secondary research, to screen targets in an efficient manner.

- Deal document preparation: Evalueserve scouted through information shared by the client, conducted additional research, and prepared a detailed Information Memorandum for the client’s investment committee.

- Financial modeling and valuation: Our team built standardized templates for initial valuation models. These were used to make decisions on the offer prices for target companies at the pre-LOI stage. We also built detailed financial models for target companies.

- Due diligence: Evalueserve undertook various ad hoc analyses as part of the operational and financial due diligence stage. We ran an in-depth analysis of more than 2000 companies to understand their revenue concentration, repeat revenue from existing clients, client retention strategies, and churn. Our team also reconciled and provided networking capital analysis, when required.

- Post-deal support: Evalueserve provided post-deal analysis on an ongoing basis by maintaining separate dashboards for the acquired businesses, monitoring their key financial metrics and KPIs, analyzing margins, etc.

Business Impact

Evalueserve’s robust deal analysis support helped the investment bank reap multiple benefits while continuing with its existing operational structure.

Discover more PE case studies here

Some of the key benefits were:

“The quality and speed of support extended by Evalueserve enabled us to analyze three times the number of deals, without altering our existing lean, focused, and cost-efficient team structure”.

Sourcing of 3X deals

Our support in sourcing and evaluating deals enabled the client to source and analyze 3X more deals

Saved ~50% time and effort

Our team freed up more than 50% of the client’s time spent on data sourcing, building and analyzing financial models, thus helping it focus on strategic and core deal-related tasks

Saved ~60% cost

We helped the client save ~ 60% on the cost of junior analysts and subscribed databases