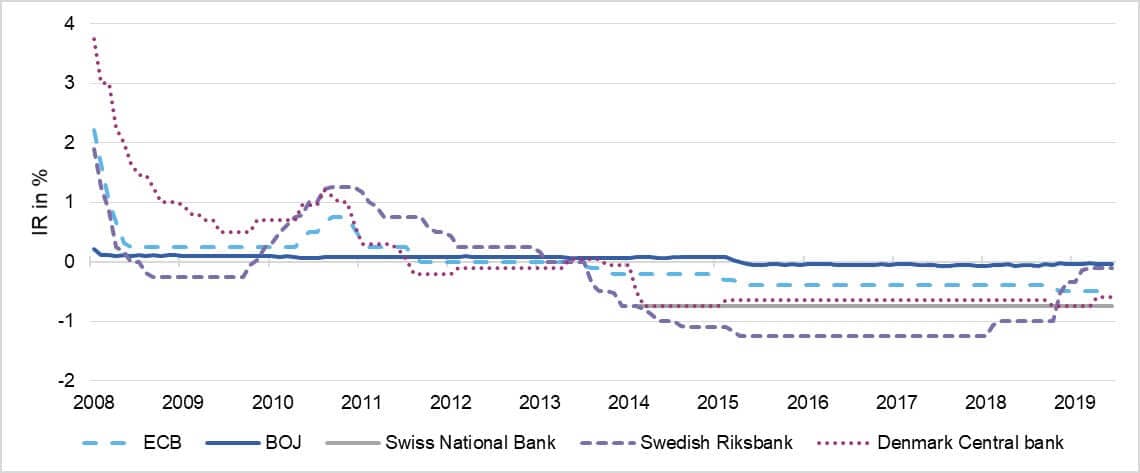

As of May 2020, four European monetary zones (the Eurozone, Denmark, Sweden, and Switzerland) along with Japan are firmly in negative interest rate territory. Moreover, a sizable number of G20 sovereign bonds are trading at sub-zero yields. In the US, the Fed funds rate implied by the eurodollar contracts has briefly crossed into negative territory and the eurodollar options that offer protection against a negative rate are actively in demand.

Interest paid on bank reserves deposited at central banks – ECB, BOJ, Swiss National Bank, Sweden’s Central Bank and Danmarks NationalBank

Source: European Central Bank, Bank of Japan, Swiss National Bank, Sweden’s Central Bank and Danmarks NationalBank

Negative Interest Rate Policy (NIRP), coupled with expansive quantitative easing, does not appear to trigger consumer price inflation, which indicates that negative interest rates are now part of the global financial landscape, and the resulting model risk must be analysed, quantified and adequately managed.

Managing zero and negative interest rates is challenging from a model risk and enterprise risk perspective. An additional complexity is introduced with the imminent demise of the IBOR and the transition to Alternative Reference Rates (ARR).

From a model lifecycle perspective, a thorough review of the model inventory must be undertaken, and each model’s performance and eligibility must be reassessed. The scope of model application, its limitations and compensating controls must be reviewed and updated. Models that are no longer accurate and stable under a NIRP regime should be decommissioned. The frequency of the model performance monitoring must be increased, as very few models are able to handle the full spectrum of IR regime switches, and stress testing might not be sufficient to comprehensively detect their limitations.

At a more basic level, operational concerns must be addressed to ensure that a given model is able to handle negative interest rates by executing simple tasks such as entry of negative coupons and negative yield. Coupons on Treasury notes are currently strictly positive, and Treasury bills cannot be auctioned at a premium. A number of models still have these limitations hard coded.

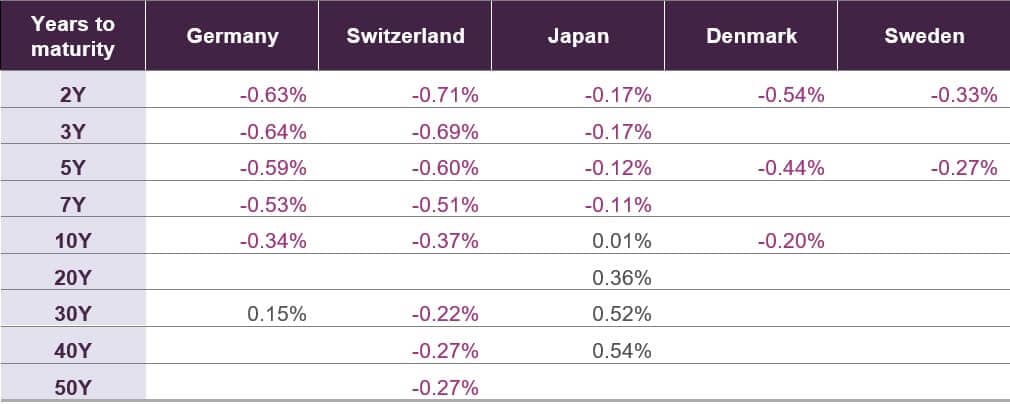

Yields on government bonds for Germany, Switzerland, Japan, Denmark and Sweden

Source: Bloomberg, Sovereign Debt Monitor (SOVM), data as of June 9, 2020

Normal IR models and shifted lognormal IR models have been used for a while now in the EUR and CHF derivatives markets. For a given IR model, practitioners must ensure that model prices of interest rate products are invariant to the choice of the volatility regime, be it normal, lognormal or shifted lognormal, and that the approximations used to switch between the risk factor sensitivities are sound and stable.

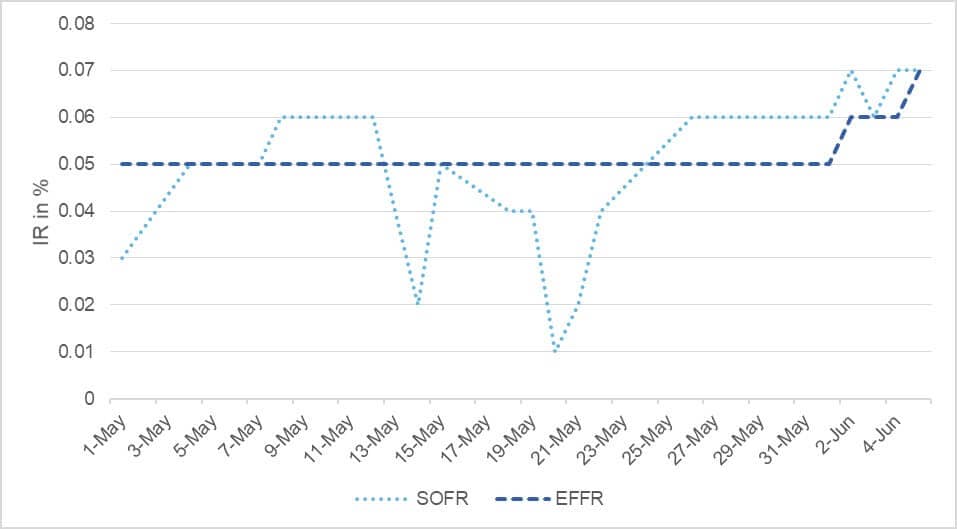

Eurodollar option contracts for September 20 – June 21 delivery

Source: Bloomberg, IMM Euro$ Fut Opt (HP), data as of June 9, 2020

For advanced stochastic volatility models, the instability at the put wings for low strikes is exacerbated with NIRP, and the impact must be carefully analysed and mitigated.

Concerns have risen regarding the lack of liquidity of some of the new instruments meant to replace the current LIBOR set-up (SOFR OIS, SOFR-Fed Funds basis swaps, and SOFR-LIBOR basis swaps), which results in a high bid-ask spread and therefore zero curves that cannot reliably reprice the most liquid instruments. A further challenging issue is that despite its imminent demise, the market is still pricing long-term LIBOR contracts, which adds confusion for long tenor curve bootstrapping, particularly with the lack of a long-term agreed-upon overnight swap index.

Plot of SOFR, federal funds rate and Libor for a business day in May

Source: Federal Reserve Bank of New York, Secured Overnight Financing Rate Data & Federal Funds Data

Risk measure definitions should be reviewed and amended, as the time value of money has a new meaning under NIRP and the switch to secured overnight rates introduces a paradigm shift.

IR models’ performance for risk-based P&L attribution analysis should be revaluated under extreme scenarios whereby rates may delve deeper into sub-zero territory.

From an enterprise risk perspective, evaluating the impact of NIRP on VaR models, Economic Risk Capital (ERC) models and balance sheet projection models is crucial. The marginal impact of rate decrease on the net interest margin with NIRP is much higher than at low but positive interest rates, which impacts banks earnings and consequently their capacity to absorb losses.

Comprehensively addressing the model risk management impact of NIRP across vertical silos, enterprise-wide risk and regulatory compliance is a daunting task.

As a trusted partner of major financial institutions, Evalueserve is in a unique position to provide critical support for NIRP model impact assessment, model validation, transition management and quantitative risk modelling.

If you’d like to learn more about how Evalueserve can help you establish a solid transition gap assessment and implement efficient model risk management solutions, click HERE to send us your query.