Blockchain technology is used widely to secure transactions and solve problems in the Banking and Finance industry, in Supply Chain management and in Healthcare. To better understand how this technology is being used, and evaluate its growth trends for the future, Evalueserve conducted an in-depth report compiling 15 years of data, patent documents published around the world, scientific articles, existing products and the latest news in the Blockchain domain. The report reveals rapid growth for Blockchain technologies across all these sectors.

What is Blockchain?

The buzz around Blockchain has been building for a while- but what exactly is Blockchain and how is it used? Blockchain is a way of securely linking records, called blocks, using cryptography through decentralized, distributed databases. Each block contains a timestamp and a link to a previous block. Blockchain can serve as an open, distributed ledger that can record transactions between two parties efficiently and in a verifiable and permanent way. It is a very powerful tool through which various digital, virtual currencies such as Bitcoin, Ethereum, etc. can transact in a secure and anonymous manner.

Satoshi Nakamoto first introduced the Blockchain concept in 2007. Today, Blockchain is used to secure transactions and solve problems in the Banking and Finance industry, in Supply Chain management and in Healthcare:

Blockchain in Banking and Finance: When used in the Banking and Finance sector, Blockchain technology can help reduce transaction processing costs while improving the accuracy and security of transactions. The Banking and Finance sector faces various operational challenges such as central supervision, privacy concerns, trading inefficiencies, high transaction processing fees, scalability, and transparency among others. Modern Blockchain systems offer various solutions for overcoming the many challenges the Banking and Finance industry face today. Some of these solutions are an inherent part of Blockchain technology such as distributed ledger, smart contracts, user authentication, data privacy, fraud prevention, digital wallet, and many other such disruptive solutions.

Blockchain in Supply Chain Management: Blockchain addresses and resolves prevalent problems in Supply Chain Management such as lack of interoperability between various divisions, asset tracking, lack of transparency and security, non-scalability, high costs, time delays and human errors. In Supply Chain Management, manufacturers, suppliers, distributors, end consumers, etc. all must work together to carry out their operations. Blockchain helps to manage the workflow of all the parties involved, providing a transparent view to everyone involved along the entire value chain.

Blockchain in Healthcare: The Healthcare sector has always been mired in problems such as storing patient records, lack of privacy, confidentiality and security, lack of adequacy, deficiency in data integrity, etc. The unique benefits and solutions of Blockchain such as reducing complexity, providing high security, eliminating middlemen and improving transparency and trustworthiness makes the technology a boon for the Healthcare sector.

Blockchain technology landscape study

Evalueserve recently conducted a detailed study of the Blockchain technology landscape in Banking and Finance, Healthcare & Supply Chain Management. The goal was to provide carefully researched actionable insights about Blockchain technology. The study examines 15 years of patent documents published around the world, scientific articles, existing products and the latest news in this domain.

The study includes a formal analysis of all the patents published before April 2020. These patents were obtained from fully subscribed patent databases such as Derwent Innovation, Questel Orbit and IFI Claims to identify the leading innovators and prolific inventors active in the Blockchain domain. The report also analyzes paid scientific journals like IEEE, EBSCOHOST and DeepDyve to enhance the findings obtained from the patent study to identify the top universities, emerging start-ups and collaborations among the different innovators in this domain. The patent and non-patent findings were augmented with the existing products of different innovators including technology companies, FinTech, Start-ups, Banks, Ecommerce giants, Healthcare companies, OEMs, Distributors, etc. to illuminate a complete and accurate picture of Blockchain in the target sectors.

Evalueserve analysis that stands out

There are many blogs and articles about Blockchain or cryptocurrencies floating around in the market. These usually focus either on the market potential of Blockchain or who is doing what. Evaluserve’s report is unique in nature as it covers various aspects such as:

- Complete analysis on patent literature, non-patent literature and products.

- All findings are hosted and analyzed in the same platform: Insightloupe provides interactive, flexible report building, dynamic filtering and expertly curated insights about Blockchain.

- Multiple databases approach increases the recall of the results.

- Manual analysis conducted all the data types in order to maintain very high precision. Unlike many similar online reports, there is virtually no automated analysis in this report.

- Problem-solution approach illuminates the burning issues in Blockchain technology and the solutions that have been proposed by different innovators.

- Native language speakers (German, Chinese, Japanese and English) conduct the analysis in order to provide accurate and high-quality analysis.

- Subject matter experts analyze and verify the findings. Technology Experts, Business Leaders, Subject Matter Experts, IP Managers, among others work together to carve out a report that is high quality and up-to date

Rapid growth for Blockchain technology

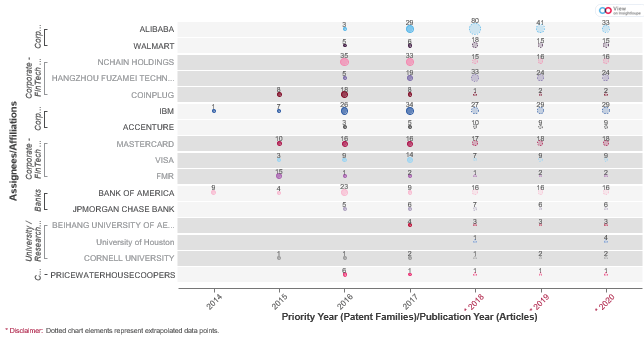

The report shows that various companies started filing patents, publishing articles and news and launching products using Blockchain technology since 2010. However, the real boom in this technology space took off after 2014 as various innovators ventured into this field to gain an early-mover advantage. Everyone from Banks to FinTech, Ecommerce to Technology Firms, Start-ups, Universities, Consulting companies, even individual inventors started innovating using Blockchain technology. Figure 1 shows a glimpse of the major innovators in this domain.

Figure 1. Major innovators using Blockchain technology

As per the Global Forecast of Blockchain in Banking and Finance, Blockchain is expected to rise to 22.46 Billion USD by 2026 as compared to 227.1 Million USD as of 2018, a compound annual growth rate (CAGR) of a whopping 73.8%. This growth can be attributed in part to the many benefits of adopting Blockchain technology in Banking & Finance such as traceability of transactions, lower operating costs, data security, privacy, accuracy and new revenue generating avenues.

Blockchain—one name for many challenges

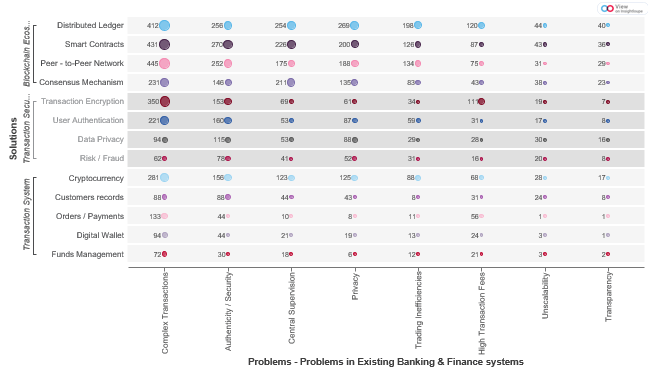

There have been persistent problems in the Banking and Finance, Healthcare and Supply Chain Management sector for a while. As we discussed in earlier in this blog, these challenges include complex transactions, data security, high operating costs, transparency, etc. Blockchain has revolutionized these sectors by providing several benefits and solutions. Various Blockchain concepts such as Distributed Ledger, Smart Contracts, Consensus Mechanism, Transaction Encryption, User Authentication, Funds Management, among many others have truly given an edge to various innovators who have adopted this technology as compared to their competitors. An excerpt from MasterCard website is included here as a reference:

“We believe the transformative power of Blockchain. We hold the third-largest number of Blockchain patents and patent applications, and from our provenance solution to commercial payments, our exploration of Blockchain applications span our entire business ecosystem”

Blockchain technology solves many challenges that exist in the Banking and Finance sector. A few of them are depicted in Figure 2.

Figure 2. Blockchain problems and solutions

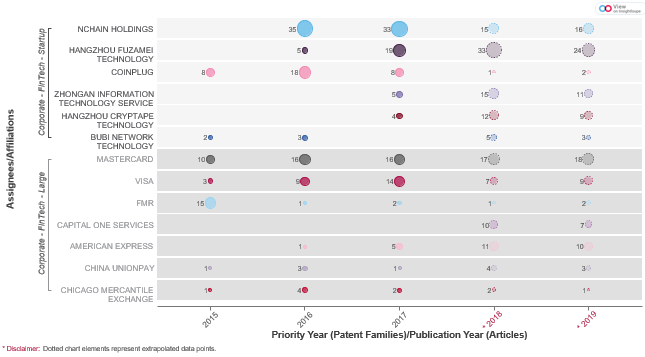

A closer look at Blockchain innovations done by FinTech

FinTech and Banks have been the front runners in securing maximum innovations in this domain. Since the benefits and advantages of Blockchain are enormous and widely accepted, the innovations continue to increase every passing year. Some of the major FinTech companies who have adopted Blockchain and are reaping its benefit are listed in Figure 3.

Figure 3. FinTech companies adopting Blockchain

What’s the future of Blockchain in Banking in Finance, Healthcare, and Supply Chain Management?

Blockchain is a very powerful concept and is here to stay. With all the benefits and advantages that various companies are reaping through the adoption of this technology and as the number of patents, products and scientific articles continue to increase every year, Blockchain as a technology has a very bright future. Along with this, the collaborative efforts of various innovators in this domain – Banks, FinTech, Technology Firms, Innovative Start-ups, OEMs, Distributors – can enhance the potential of Blockchain technology in the way transactions are done in a more secured, transparent and consensual manner.

Access our full report on blockchain technologies by following the link below:

Blockchain Technology Landscape: A mind+machine™ View of Blockchain Technology

Contact us to speak to one of our experts about Evalueserve’s Blockchain report and find out how your company can benefit from Insightloupe.