Let me tell you the story of paradoxes and opportunities pertaining to LatAm-based investors who want to do something different than traditional asset managers. It has to do with factor indices, also known as smart beta, which aim to combine regular benchmark performance with elements of active strategies (alpha) in order to beat the benchmark.

Factor indices have a proven track record and are very common in the US. For example, the S&P 500 Low Volatility Index is based on stocks from the S&P 500, but it selects the 100 securities with the lowest volatility. This has proven to be highly useful for investors who want to be exposed to the gains of the US stock market, but with limited volatility and increased Sharpe Ratio (ratio of performance / volatility – the higher, the better). Over the past five years, many indices based on factors such as growth, value, and momentum have been created in many capital markets.

Which brings us to our paradox – such successful indices do not exist in LatAm. Well… at least not yet.

For the last 10 years, Evalueserve has been supporting the index maintenance and research divisions of major I-banks and index providers. So, when we approached our clients and financial institutions in Chile with a proposal for a robust factor index for the untapped market, we were not only confident in our capabilities but also in the positive response we expected to get.

Our Approach and Expectations

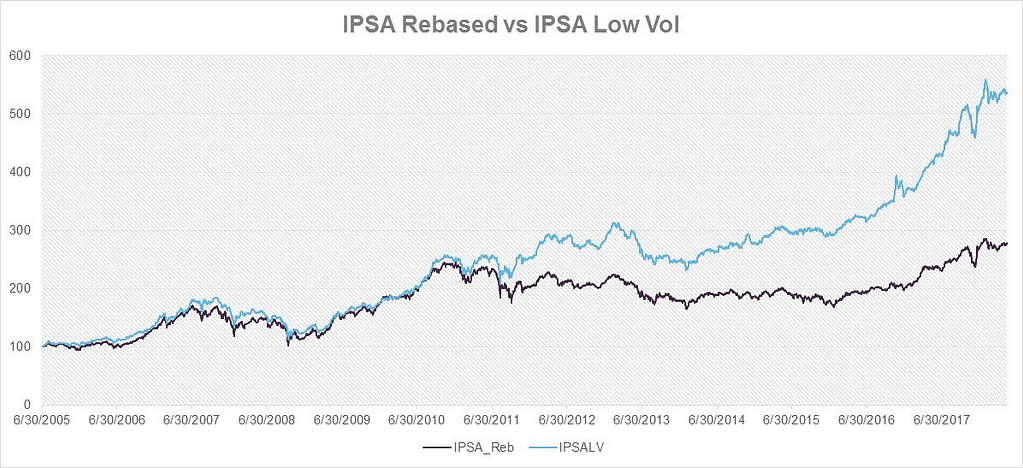

Let’s look at a local example. Imagine an IPSA (Chile’s equity benchmark) Low Vol Index that follows similar rules as the S&P 500 Low Vol, but has been modified for the Chilean market. See the graph below for the back-tested period (June 30, 2005 to May 11, 2018) where the IPSA was rebased as of June 30, 2005 (the inception month for the hypothetical IPSA Low Vol (IPSALV).

Source: Investing.com.

The IPSA Low Vol posted an annualized return of 13.92%, with an annualized volatility of 13.07%, whereas the IPSA posted an annualized return of 8.25% with an annualized volatility of 16.00%, yielding a higher Sharpe Ratio of approximately 0.52 (using 2% as an interest rate, in line with the secondary market for inflation-linked bonds).

This shows that the IPSALV would clearly be useful during high volatility periods. For example, when calculating volatility between 2005 and 2010 (period when the subprime crisis impacted markets), we found that the IPSALV had around 4% less annualized volatility compared with the benchmark.

For reference, the IPSALV is constructed using one-fifth of the stocks that form the IPSA (before the latest change in methodology driven by the alliance between S&P DJI and the Santiago Exchange). The strategy is rebalanced on a quarterly basis and weighted relative to the inverse of the corresponding realized volatility over the past month. Since the IPSA is a total return index, we included dividends in the IPSALV.

As most investors fear loss, strategies that reduce risk are frequently used. Loss aversion is a more powerful motivator than gain satisfaction, as pointed out by Amos Tversky and Daniel Kahnmen, the two psychologists who identified the concept. We believe that rolling out products that apply these strategies in LatAm could benefit investors by bringing more investment options and fostering risk reduction in the region.

The Actual Reaction – What Should Be the Next Step?

However, when we approached our clients and financial institutions in Chile with these ideas, the reaction was anything but positive! So, here are my questions to our readers from financial institutions in LatAm:

Is it time to embrace the global trend of factor indices and take controlled risk with proven strategies?

Should LatAm-based investors tread an investment path different from the one taken by traditional asset managers? Is there an appetite for more information about factor strategies in LatAm?

If you want to better understand the factor indices and how you can benefit from them, click HERE to send us your query.

Stay tuned or subscribe to our newsletter to receive our next blog article on indices in LatAm.