Increasingly, ‘alternative’ or non-market data holds the promise of smarter investments and superior returns. But how can you get to grips with the mass of information out there and use it to make better decisions?

Faced with a highly competitive environment, investment banks and asset managers are turning to so-called ‘alternative data’ in the quest for superior returns and an insight into emerging trends.

Alternative data is simply information on a firm, industry trend, customer behavior, etc., that originates from sources other than company or industry reports, financial or industry databases, or other readily available syndicated reports. Any dataset that can be analyzed to generate insights on a product, client segment, industry, geographical region, etc. can be categorized as alternative data.

For example, analyzing the dynamics of airline fares over time provides insights on travel trends, which in turn can be used to predict the economic performance of a city/region, hotels’ occupancy rates and prices and the resulting impact on the tourism and hospitality sectors. Price discounts on e-commerce websites can be analyzed to identify trending products and brands and evolving consumer preferences, and hence predict the performance of an e-tailer.

Alternative data is often derived from sources such as financial transactions, sensors, mobile devices, satellites, public records, social media and the internet. As a result, it can be much more extensive – and less structured – than traditional financial data. For example, lenders in some low-income nations use alternative data such as phone bills, rental payments and transaction data to score individuals without a credit history.

If investors can analyze and interpret alternative data correctly, they can use it to obtain unique insights and make timely moves before the competition is even aware of the opportunity – or threat.

Responding to these changes, brokers and other intermediaries have begun to specialize in sourcing and providing alternative data to investors and analysts. In fact, buy-side spending on alternative data is expected to touch $1.7 billion by 2020 – nearly three times the amount spent in 2018. Even established providers of traditional data, such as Bloomberg, have started to offer alternative data. And as technology advances, the types and volume of alternative data available will only expand even further.

Alternative data in action

Several asset managers have begun to make investments into alternative data. For example, in 2015, RS Metrics analyzed satellite images of car parks at branches of JCPenney, the US retail chain, and discovered heavier traffic in April and May, suggesting higher sales. By acting on this knowledge, RS’ hedge-fund clients were able to ride a 10% rise in JCPenney’s share price following its Q2 results.

Another example is hedge funds watching the job postings and website product prices of Under Armour, the sportswear brand, to foresee sub-par financial results in Q2 2017. Investors without access to this alternative data got a nasty shock, and suffered a one-day 9% drop in UA’s share price.

A strategy for alternative data

So, how can you tap into alternative data?

The first thing to understand is that alternative data is a highly specialized domain. It demands deep skills in technology, analytics and specific business domains.

It’s tempting to set up a compact innovation lab, assign a few programmers and hope for the best. But the sheer volume of data out there means that such an approach will probably be neither effective nor efficient. And it won’t enable you to use alternative data to meet a wide range of challenges. Several asset managers have discovered this the hard way, throwing significant cost and human resource at the problem without achieving any truly valuable results.

Instead, you need a scalable, cost-efficient alternative data strategy that tracks the performance of datasets against business problems and allows you to reuse data in a smarter way.

Five steps to an alternative data infrastructure

We’ve seen that alternative data originates from multiple sources, and results in diverse, ever-expanding datasets. So it follows that your first job is to create an infrastructure that can cope with this volume and variety of data and allow you to unlock the insights it contains.

Here are our five steps to building an alternative data infrastructure.

1. Build a proof of concept

The first step is to determine how and where alternative data could add value for your organization. There’s little point hunting out new data if no one will use it, or if it won’t actually help solve their problems.

Shortlist a user group and define the specific investment problems they’re facing that could be solved with alt data. This will help you understand your own functional requirements and internal challenges, and build awareness and trust among potential users.

Once you’ve established a successful proof of concept, and tested it with a user group who buy in to the alternative data setup, you’ll be in a strong position to market the proposition to the broader organization.

2. Develop automated workflows

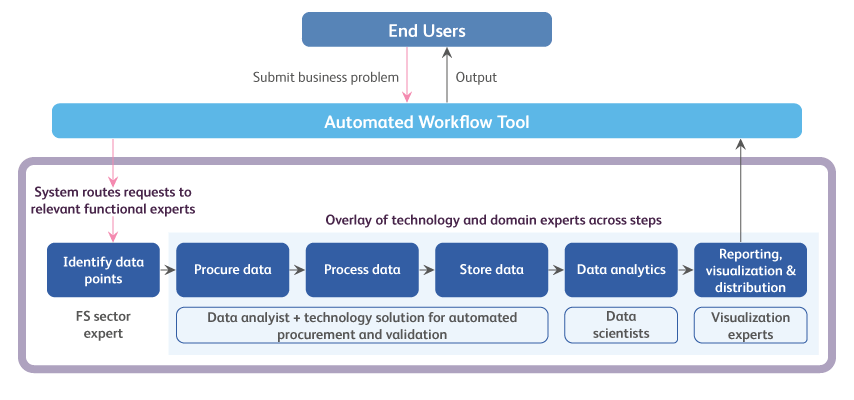

When end users and business functions raise requests for alternative data, you need a workflow for dealing with them. The workflow should automatically route requests to the right team, and prioritize them according to predefined rules.

This will help to track requests, tasks and follow-ups; improve MIS reporting; and track and process data updates. It will also improve delivery speed and help to automate KPI tracking and reporting.

The diagram below shows how end users interact with sector experts, analysts, data scientists and visualization experts to access and use alternative data, mediated by an automated workflow tool.

3. Build infrastructure

The next step is to design and build the right infrastructure for working with alternative data.

Your infrastructure will need several key capabilities:

- Deal with a wide range of ever-changing data sources, and seamlessly adopt and integrate new ones

- Link datasets to investment problems and use cases

- Support manual data extraction and cleansing

- Support straight-through processing and ‘smart’ data retrieval, so end users can access business intelligence with search strings, filters and indexes quickly and easily

- Integrate with customizable front ends (such as QlickView) for self-service visualization

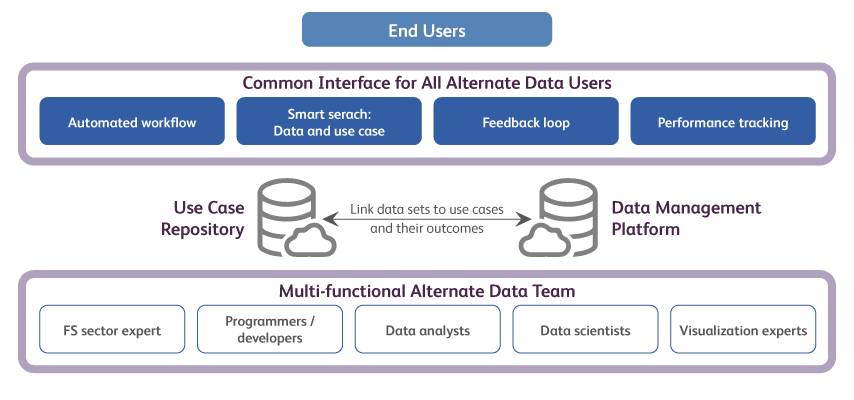

4. Track outcomes

By creating a use-case repository, you can document dataset usage and evaluate the outcomes of previous use cases. Such a repository also allows users to search for precedent use cases that might highlight the potential to reuse a dataset, helping you create a self-service environment for portfolio managers and research teams.

The diagram below shows end users using a single interface to interact with a use-case repository and data management platform, backed up by a team of experts, analysts and programmers.

5. Evaluate RoI

The fifth and final step is to make sure your use of alternative data is genuinely creating value, in the form of better investment decisions.

Data is an asset just like any other, and it should be subject to the same evaluation of costs versus benefits. As well as investment returns, your analysis should also consider the total consumption of specific datasets, and the cost of maintaining them, against their dollar impact on investments.

The infographic below sums up the key issues to consider when developing your alternative data strategy.

Downlaod as .pdf Five-steps-to-an alternative-data-strategy

If you need expert help tapping into the power of alternative data, click HERE to get in touch.