Introduction

Electric vehicles (EVs) are the future of the automotive sector, and not a distant one. EVs, in their various forms, from plug-in hybrids (PHEVs) to battery electrics (BEVs) as well as the upcoming hydrogen fuel cell EVs (FCEVs), are racing towards ubiquity carried along by the fervour for the net-zero carbon emissions by 2050 mission. With battery packs at the heart of each of these EVs, the demand for batteries is growing too, and will not abate for at least the coming decade. In fact, with the rapid uptake of renewable energy sources to aid global decarbonisation, the scope for energy storage extends beyond mobility.

Hence, its projected growth is even greater than that of EVs. Currently, the energy storage of choice for EV makers is the lithium-ion (Li-ion) battery pack. However, Li-ion batteries in their current form are not seen as a final solution, as there is much room for improvement in terms of energy density, temperature range, recharging cycles and life, technology and infrastructure, material supply stability, costs, lifecycle management, and recycling among others. With this in mind, we look at the vast potential of opportunities within optimisation of present battery tech as well as the nascent technologies and chemistries still under development.

Figure 1. Global EV and Li-ion battery market, 2020-2030 (GWh)

Source: Evalueserve Insights

Global EV stock has grown from just around 17,000 units in 2010 to more than 10 million units in 2020. What’s more surprising was the 2020 figure represented a 43% growth from 2019, in the year of the worldwide pandemic, when overall car sales dropped around 16%.

And the global fleet is only projected to get higher, estimated to reach around 125 million EVs by 2030. This indicates that the EV consumer profile is moving from early adopters of new technology and technophiles, towards mass adoption. In line with this, the battery market is set for a bumper decade of demand, estimated to go from around 110 gigawatt-hours (GWh) in 2020 to 1,910 GWh in 2030, even with efficiency of potential future energy solutions factored in.

Battery Market Outlook

- Demand Outlook: Global battery demand is expected to grow by 25% annually to cross 2,600 GWh in 2030, states a joint report by TÜV SÜD and Siemens. The main demand drivers will be electrification of transportation and deployment of batteries for energy storage.

- Passenger cars will account for the largest share (60%) of global battery demand, followed by the commercial vehicle segment with 23%, estimates Waygate Technology, a Baker Hughes Company.

- China will continue to dominate the battery market demand to adhere to ever-tightening regulatory emission requirement.

- Overall, the Li-ion battery market has the potential to grow to $116 billion per year by 2030 from $41 billion in 2021, states a MarketsandMarkets report.

Figure 2. Global Battery Industry Growth by Industry and Region by 2030 (GWh)

Source: Evalueserve Insights

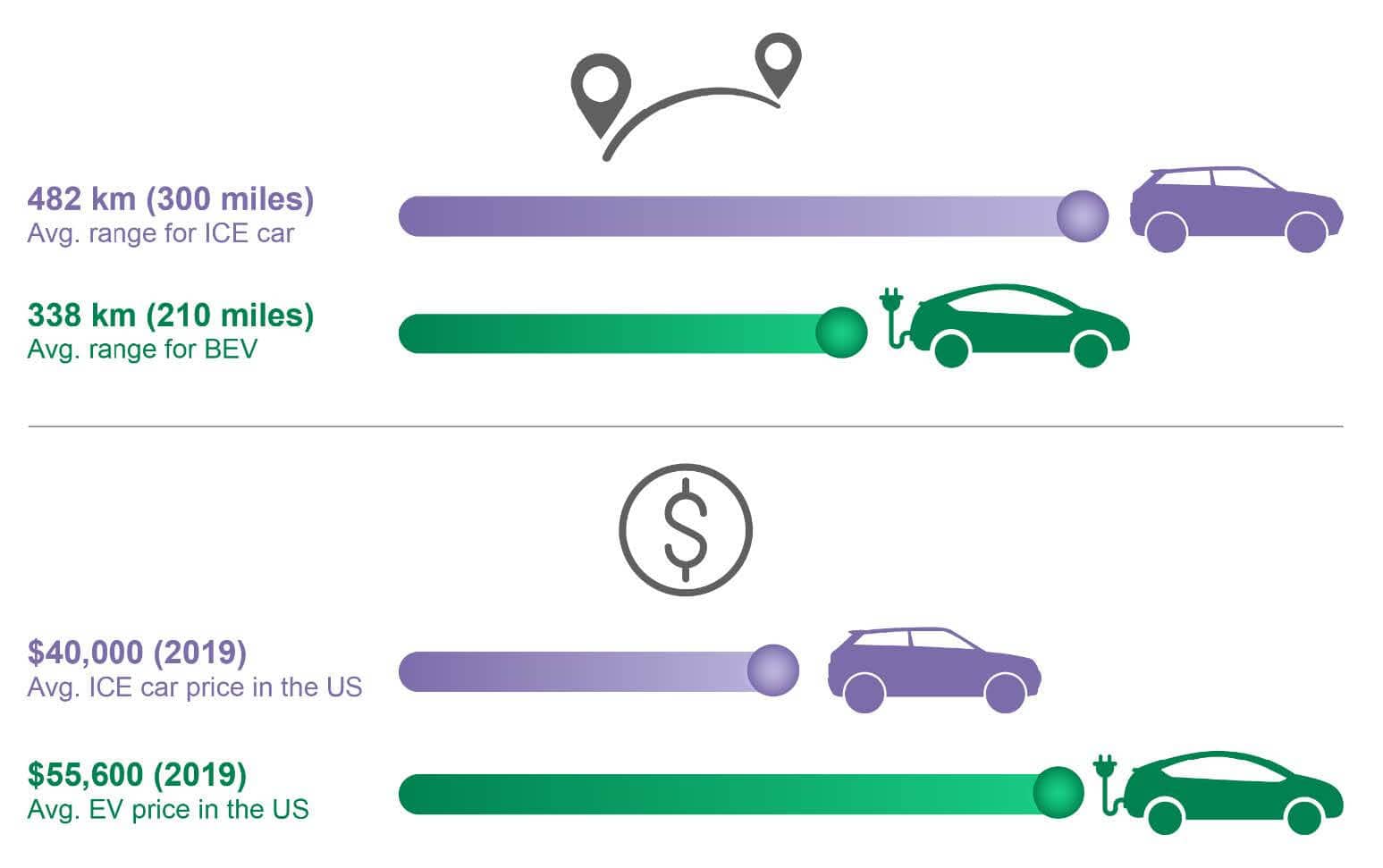

Figure 3. Internal Combustion Engine (ICE) car vs. BEV range and price

Source: Evalueserve Insights

As it stands now, the initial cost of purchase for BEVs still outweighs its benefits. While the average range per charge for EVs has improved from 211 km (131 miles) in 2015 to 338 km (210 miles) in 2020, more efficient and energy dense storage will certainly help bring parity with ICE cars. Once the delta of initial purchase cost between ICE cars and EVs closes along with comparable range per charge (or refuel), adoption and use of EVs could see a significant jump. The price difference is currently being offset with rebates and tax credits being offered on the purchase of BEVs and PHEVs by various governments, but it is not uniform across geographies. For example, the US federal government currently offers $7,500 in tax credits towards EV purchase, with some additional localised incentives as well.

Battery Technology: Now and the future

Figure 4. Battery costs are reducing ($)

Source: BloombergNEF

Even with the closing price gap between BEVs and ICE cars, battery packs still account for around 39% of the total cost of an EV right now and are hence an important factor affecting price democratisation, resulting in wider uptake. And the race to reach cost optimisation is on. According to BloombergNEF, Li-ion battery prices which averaged above $1,100 per kilowatt-hour (kWh) in 2010, have fallen 89%, averaging around $137 per kWh in 2020. They are projected to reach $100 per kWh by 2023, with a target of $50 per kWh within this decade to reach parity with current fossil-fuelled cars.

The reduction in prices during 2020 is on the back of increasing order sizes, BEV sales growth, and the introduction of new battery pack designs. This pursuit to meet the $100/kWh projection is fuelling the development of more efficient, energy dense, quicker recharging, safer to make and run battery packs into a high-interest area.

Types of Li-ion batteries:

- Lithium Cobalt Oxide (LCO)

- Lithium Iron Phosphate (LFP)

- Lithium Manganese Oxide (LMO)

- Lithium Nickel Cobalt Aluminium Oxide (NCA)

- Lithium Nickel Manganese Cobalt (Li-NMC)

- Lithium Titanate Oxide (LTO)

While lithium is the key component of the cells, Li-ion batteries also include other metals such as cobalt, graphite, nickel, and manganese. Supply of these materials is critical to maintaining the growing demand of the batteries, and there are already some concerns.

Cobalt, for example, is generated as a by-product of other materials including nickel and copper, both of which have volatile markets. In addition, the biggest source of cobalt is the Democratic Republic of Congo. Sourcing cobalt from DRC has ethical as well as geopolitical constraints, which furthers the cost and impact of the material. This makes cobalt supply less secure.

Changing or securing material supply chains will open new avenues and could be a key driver to meet rising EV, and resultant battery pack, demand in coming years. For, Germany’s Center for Automotive Research (CAR) estimates that limited capacity for Li-ion battery cell manufacture could cause shortage of around 18.7 million electric cars between 2022 and 2029.

Owing to these and other factors, there appears to be a rush to develop more advanced, newer battery technologies. Here are some of them:

1. Advancements in Lithium-ion

- Li-ion battery technology continues to be the dominant energy storage solution owing to having among the highest energy densities, in the range of 100 to 265 watt-hour per kilogram (Wh/kg).

- This has made it the most preferred battery type for use in mobile phones, laptops, cameras and automobiles. In automobiles, Li-NMC is the favoured chemistry occupying around 71% of the total sales, followed by NCA and a tiny share of LFP.

- Lithium-ion batteries are the biggest focus area in EV development right now. As a result, new chemistries to customise their temperature range, cycle rates, and extending pack life are constantly under development.

- LFP is a high-interest area as it reduces reliance on cobalt, eliminating the cost volatility factor.

- However, given the rapid pace of development, research suggests that the energy limit for lithium-ion batteries could well be reached within this decade, by when other energy storage solutions should also have achieved full marketability.

2. Solid-state batteries

- One possible way to achieve that $50/kWh battery cost could be the adoption of solid-state battery technology. Produced at scale, these batteries are pegged to cost around 40% less to manufacture compared to current Li-ion batteries, while also offering higher energy density, faster charging and reduced degradation, retaining up to 90% capacity even after 800 recharge cycles.

- They utilise high energy density cathodes and their overall bill of materials and production processes also support cost-effective manufacturing at scale.

- Price parity is possible with the establishment of a supply chain for some key materials, including solid electrolytes, which aren’t used in current Li-ion batteries.

- Despite these reduced costs, solid state battery cells can have 45% higher energy density than their liquid electrolyte counterparts.

- Solid electrolytes also prove safer than conventional Li-ion batteries owing to being non-flammable.

- Until the economies of scale tip in their favour, solid-state battery packs will likely debut in more premium long-range EVs which can justify the high initial cost of mass production, before trickling down to mass-produced EVs approximately within the next 5 years.

3. Battery swapping

- Battery swapping technology can immediately address one of the top inhibitors to current EV adoption – refuel/recharge time. With shorter time spent waiting for a fully charged battery, it can take care of the range anxiety for outstation drives in EVs.

- Currently, battery swapping is available for electric two and three-wheelers, with China leading the charge. There are over 550 swap stations there.

- While still a new concept, there are already more battery swapping stations in China than there are hydrogen refuelling stations (HRS).

- There exists a big opportunity for the US and EU markets as automation advancements are being made to automate battery swaps for EVs with larger battery packs, where an electric car could potentially drive away with a fully charged fresh battery within 3 to 5 minutes.

- The biggest market for battery swapping could be ride-hailing, taxi services, public transport as well as short-haul trucks, which require short refuelling time due to continuous operating cycles. The ease of standardising batteries across such vehicle fleets is also high.

- A notable challenge for this technology remains the defining of universal battery pack shapes, sizes, and standards.

4. Charging solutions and infrastructure

- All battery technology developments need to be supplemented with the right charging solutions, and the number

of directions from which EV charging and energy management is being researched is truly impressive. - China currently leads the charge here, offering over 800,000 public charging outlets by the end of 2020. This constitutes a majority of the 1.3 million global outlets. China has 1 charger for every 5 EVs, while the U.S. has 1

for every 20. - Rapid charging is a big demand from EV users. Ultra-fast charging outlets, which can offer EV drivers 32 km (20 miles) of range per minute of charging, are being developed and installed across geographies. Governments including Australia plan a network of such ultra-fast chargers along their major highways to facilitate EV use in outstation driving. Battery makers on their part are ensuring their packs can handle the rapid charging cycles.

- Vehicle to grid (V2G) technology looks at each EV as a small energy storage, whose excess energy can be fed back into the grid at peak demand to mitigate strain from decentralised energy storage resources. V2G can incentivise this activity for EV owners, reducing costs further while also helping stabilise increasing power demand.

- Wireless EV charging is the invisible power source that everyone wants. Using charging plates installed under charging locations, EVs can be automatically charged without requiring any physical contact with a power source. The solution has great potential, particularly for taxi and shared mobility solutions which are constantly in use.

- One way to circumvent the large infrastructure requirements for setting up charging stations is to put them on wheels. Mobile charging stations are being developed to deploy in remote locations where permanent charging infrastructure may not make sense yet, or at locations where demand is temporarily beyond typical supply, such as large events or gatherings as well as tourist locations. It can also help fleet EVs stay charged without having to take a long recharge break.

5. Battery recycling

- With EVs proliferating, so will their used Li-ion batteries. A recent study estimates that around 400,000 tons of Li-ion batteries are likely to reach their end-of-life (EOL) by 2022, considering an average life of 10-12 years.

- Presently, China is responsible for recycling around 67% of the total Li-ion batteries globally.

- By 2025, around 15 GWh of spent batteries are expected to be either available for recycling or repurposing from electric mobility applications. Large-scale battery manufacturing and EV deployments in China and South Korea are primarily responsible for significant recycling capabilities.

- Efficient lifecycle management of Li-ion batteries will ensure that the batteries are effectively used, refurbished and repurposed for effective second-life use, and efficiently recycled to extract key raw materials for reuse.

- Recycling paves the way to secure future supplies of critical as well as valuable raw materials such as lithium, cobalt, nickel, and manganese. Reusing the recovered raw materials can help battery manufacturers tackle the price volatility of these materials.

- Achieving complete circular economy in batteries will prove a strong contributor towards meeting the growing lithium demand, which by 2050, is projected to exceed the total available supply of the resource.

Conclusion

The question of the coming EV wave was yesterday. Developments in the EV space are taking place so rapidly, and will continue to, that potential investors will have to make measured decisions so as to ensure their returns are not only limited to the near term. Not only is each stride towards truly zero-emission vehicles (ZEVs) a remarkable feat but also a step towards reducing the impact that human activity has had on the planet.

Sustainable solutions towards energy storage on the whole, as well as EVs in particular, will offer resounding returns for generations to come and pave the way for a cleaner energy future wherein energy losses will be minimised to a great extent. We are talking about a future wherein sustainably generated energy powers electric vehicles for ranges of 1,000 km (621 miles) without ever having to be parked for more than a few minutes at a time. The same vehicle could then supplant the energy needs of the home or grid it draws power from. And all this from a battery pack that could possibly be as thin as the body panels of current cars and could prove even safer! Are you ready for your electric future?

Download the full industry insight here

To discover how you can adapt for tomorrow, contact decarbonization@evalueserve.com .