Demand for liquid alternatives regained strong momentum in 2021

The year 2021 witnessed a renewed interest in liquid alternatives (alts.), and 2022 continues to see a strong inflow of funds. The primary reasons driving this inflow are volatile equity market returns, weakening policy support, higher interest rates and inflation, market volatility, and geopolitical turmoil, as they forced investors to critically think about portfolio construction and seek strategy changes.

Investors are also evolving and are looking to diversify into strategies that are less correlated to their majority and core holdings in public markets. Therefore, liquid alts. are getting replacement and substitutional attraction.

In the August 2022 meeting, US Federal Reserve officials indicated there was "little evidence" that inflation pressures were subsiding and raised concerns over the risks of a possible recession. Industry experts believe that if inflation remains as high as it was in the 1970s, then liquid alts. funds will likely remain in favor and could enter the mainstream. Among other things, liquid alts. can take short positions in stocks, thus becoming less vulnerable to or even being profitable in a declining stock market. They can also go negative in bond duration, helping them gain profit from a rising interest rate environment. What also makes them a good diversification option is their ability to participate in various investment strategies that have virtually no correlation to traditional investments, such as arbitrage and futures trading.

Liquid alts. fund strategies, which are also known as hedge funds for the masses, enable individual retail investors to diversify their investment portfolios by using complex strategies earlier accessible only to institutional investors and hedge funds.

Key objectives of investors who adopt alternate investment strategies include diversification, growth / enhanced returns, volatility dampening, fixed income replacement, inflation hedging, and equity replacement.

It is profitable for managers to offer these funds, which have a higher management fee, due to their more complex trading strategies. The fee ranges between 0.5–3%, compared to traditional index-based products that can charge less than 0.1% in fees. Having said that, these liquid alts. funds are still relatively much cheaper than hedge fund fee structure, or a 2% management fee which is applied to the total assets under management (AUM) and a 20% performance fee is charged on profits beyond a specified minimum.

The inflows continue to pour in 2022 as well

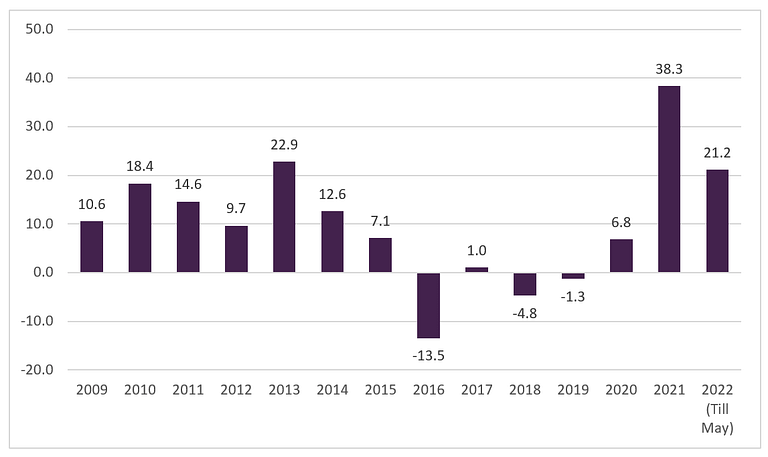

While liquid alts. still constitute a small percentage of overall funds, globally they had more than $500 billion in assets, as of May 2021 (as per Morningstar data). In 2021 alone, investors allocated $33.4 billion to liquid alts. funds, which was the highest allocation in any year since 2013.

As per the same source, in January–May 2022 period, investors already poured more than $21 billion into liquid alternative mutual funds and ETFs.

Top three players continue to capture the lion’s share of the inflows

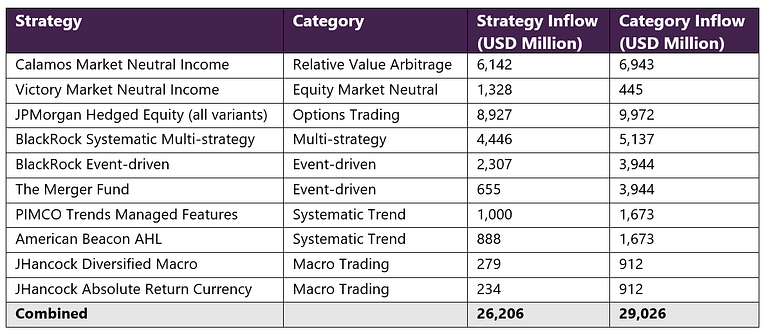

The largest players in the liquid alts. space continued to dominate flows. Blackrock, Calamos, and J.P. Morgan were the front-runners in FY2021 as well as 1Q22. BlackRock with three funds and J.P. Morgan with four, now have a total of seven of the top 20 funds by AUM. The top 10 strategies accounted for 90% of inflows in 2021.

As investor demand surges, new players are also entering the marketplace. In March 2022, Fidelity Investments ventured into this space and created a new division called Fidelity Diversifying Solutions, which will offer liquid alts. products. The firm plans to launch two funds (Fidelity Global Macro Opportunities and Fidelity Risk Parity), both of which use strategies that are commonly associated with hedge funds, relying upon derivatives and leverage to mitigate risk amid high-inflation environment.

Liquid alts. strategies are on top of the minds of advisors as well, and overall demand for alternative investments is surging. As per a Cerulli survey:

- Advisor respondents reportedly allocated an average of 14.5% to alternative investments in 2022, up from 10.5% in 2021. They plan to further increase that allocation to 17.5% over two years.

- Reducing exposure to public markets was advisors’ top reason for using alternative investment products in 2022, cited by 69% of respondents; volatility dampening and downside risk protection came a close second, with 66% of advisors.

Other reported goals included income generation, portfolio diversification, enhanced returns, inflation hedging, demonstrating their own practice value propositions, and responding to client requests. - Across all investment structures, liquid alternative mutual funds remain the most popular, with 68% advisors using them, followed by non-traded REITs (61%) and liquid alternative ETFs (54%).

- More than 50% of advisors mentioned that the illiquidity of other alternative products was not suitable for their clients.

Liquid alternatives, however, have a long way to go before they become mainstream

Liquid alts. have not been able to become a feasible substitute for traditional asset classes, due to their dismal performance in the past decade. They initially promised hedge fund managers and other asset managers an opportunity to venture into the growing individual investor market. But these institutional hedge fund strategies underperformed substantially when they were applied to individuals. The underperformance was led by allocators chasing ‘hot dot’ products and selecting only a few funds that had delivered actual hedge fund-like performance – even if that performance was driven merely by luck and not skill.

Asset managers also contributed to the failure as they launched scores of liquid alts. products, bundling the ones that didn’t work, and aggressively promoting the best short-term performers. As per Morningstar, 20 of the largest liquid alts. managers offer an average of 40 products each.

The overall annual return of these products was 4% over the last decade. Additionally, during the five-year period ending May 31, 2021, the average of US categories ranged from 0.32% annualized for equity market neutral to 5.6% for relative value arbitrage. For the same period, Morningstar’s U.S. target allocation with moderate risk returned 10.87 annualized.

Investors’ returns — derived when funds are bought and sold — were even lower. For the decade ended December 31, 2020, an average dollar investment lost about 0.3% annually, which was more than 4 percentage points (pp) lower compared to the funds’ total returns, and a whopping 12 pp lower than the dollar-weighted returns for US stock funds.

However, during the pandemic, which saw extreme price movements and volatility, liquid alts. performed relatively well. The Credit Suisse Liquid Alternatives index increased 6.2% for 1H21, which was equivalent to almost half the 15.2% increase in the Standard & Poor’s 500 index.

While the availability, diversification, and performance of liquid alts. have improved substantially, careful evaluation of all alternative investment opportunities would still be required to ascertain their suitability and whether they match the client’s objectives. Asset managers looking to allocate more funds to these strategies will have to first prepare for unique distribution challenges and allocate domain experts to understand these products and their fit within portfolios. The return potential of equity markets is becoming limited because of rising interest rates and the late stage of the market cycle, leaving many fixed-income portfolios exposed. In this scenario, liquid alts. can prove to be an excellent option for capital preservation, as proved during the past two major recessions and market crises – the dot-com bubble burst (2000–2002) and the financial crisis (2007–2009). Liquid alts. can still be profitable in a portfolio in rising markets and with a conducive economic environment, since they are good standalone investments.

About Evalueserve

Evalueserve solutions enable data-driven decision-making through a combination of domain-specific AI and subject matter experts. Our culture of innovation, agility, and global collaboration produces domain specific solutions that elevate client impact.

Evalueserve caters to multiple financial services clients, including asset and wealth management firms. We deliver differentiated digitally-enabled insights and intelligence to various asset and wealth management teams, including competitive insights on strategy, product development, marketing, sales and distribution, and client servicing, enabling quick, informed, and accurate decision-making.

Our AI-enabled digital platforms and managed services help asset and wealth managers stay ahead with actionable insights on competitors and their behaviors, industry disruptions, product development, pricing, brand positioning, and more.

Talk to One of Our Experts

Get in touch today to find out about how Evalueserve can help you improve your processes, making you better, faster and more efficient.