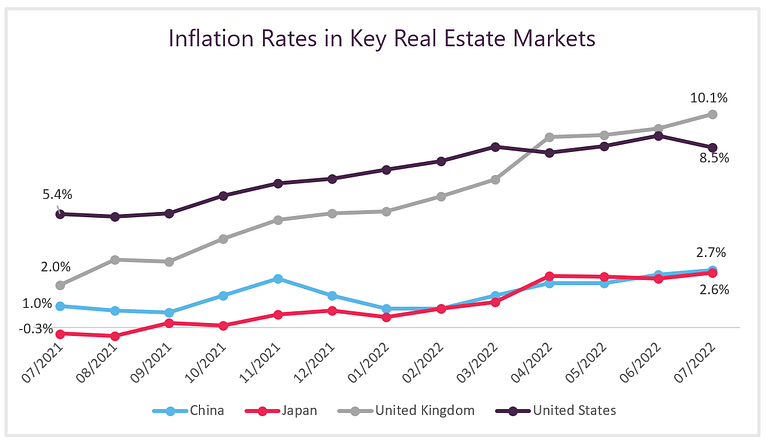

Supply chain disruptions caused by the pandemic and Russia’s invasion of Ukraine have led to the highest-ever inflation in decades in many major countries. It has since emerged as a serious concern in investor markets, including real estate. As stated by Fed Chairman Jerome Powell during the recently held Jackson Hole Economic Policy Symposium 2022, the central bank will ‘use its tools forcefully’ to control inflation, which is still at its highest in over 40 years. Therefore, the higher interest rates will likely persist for some time.

Inflation and Real Estate

Historically, real estate has been an inflationary hedge medium. However, this time, surging inflation in key markets has forced central banks to make more aggressive interest rate hikes, which has countered the effectiveness of real estate as a hedge medium. The banks’ moves could potentially lead to a recession or at least an economic downturn, which will further hurt the real estate market. We are already beginning to see a slowdown in transactions across the real estate sector, indicating that the effects of these aggressive measures are already weighing on some markets.

Commercial and Residential Buyers Approach to Real Estate

Commercial investors view real estate investments as a hedging tool in uncertain times. On the other hand, residential consumers invest only when there is surety of value appreciation. Therefore, increasing interest rates have the potential to slow down overall investor activity.

Residential

YoY decline in transaction volume (July 2022)

Commercial

YoY increase in commercial real estate investment (Q2 2022)

Developments in Global Real Estate Market

Dipping global property prices:

Real estate prices and valuations are on a downward trajectory.

- According to the European Central Bank (ECB), property prices in Europe could drop if interest rates rise faster than inflation; properties in almost all European markets are highly overvalued.

- The values of existing office property in the U.S. and Europe are expected to fall by 28% and 12%, respectively, in TIMEFRAME, due to the growing prominence of hybrid or remote working, as well as the push for greener buildings as mandated by new regulations.

- As the Canadian central bank is increasing interest rates to safeguard the broader economy, the country’s residential real estate market is witnessing a steep decline.

- We see the global rental market growing amid these devaluations because when buyers lose the ability to purchase property, the demand for rental property will increase. According to CIJ Europe, prime rent in Europe will go up by 10 cents/sqm/month by December 2022 and further by 20 cents/sqm/month by the end of 2023.

Other real estate developments:

- U.S. real estate transactions are on a decline. The sale of previously owned U.S. homes fell for a sixth straight month in July 2022, indicating rising borrowing costs and waning demand.

- Homebuyers in China are stopping the re-payment of loans taken for houses that are under development because many projects have been delayed or stalled due to a cash crunch in the country, according to China Real Estate Information.

Facts on Mortgage Repayment Boycott in China

- Office availability in central London is at its highest level in 15+ years due to the pandemic-driven shift to remote working and declining demand for commercial properties.

Available Office Space in Central London

20 mn ft2

31 mn ft2

- Rising interest rates, coupled with unstable property prices and economic uncertainties, have led to a decline in major global real estate indexes.

YTD 2022 Drop in Major Real Estate Indexes

S&P 500 Real Estate Index

Dow Jones U.S. Real Estate Index

MSCI World Real Estate Index

- Amid increasing interest rates, there has been a more than 50% drop in potential commercial real estate buyers in the U.S., Asia, and Europe in Q2 2022 compared with Q4 2021, according to MSCI.

Buyers in U.S., Asia, and Europe Actively Seeking New Properties

3,395

1,602

Looking forward

Many industry experts, agents, and property owners expect the uncertainties to continue, but only a few expect a repeat of the 2008 financial crisis, because risk appetite and lending practices have moderated since then.

Increasing rental prices across major cities globally may lead to a favorable situation for property owners as rising interest rates will drive home seekers towards the rental market. The situation is likely to continue at least until the central banks do not change their approach.

Despite a slowdown in the office space market in some regions, investors have high hopes from the broader commercial real estate market. This is because public traffic at commercial spaces (malls, retail stores, hotels, etc.) has normalizing after the end of the peak COVID period.

Properties that meet green or smart building-related regulatory criteria are somewhat immune to the ongoing uncertainties as they are both limited in number and witnessing high demand. We believe businesses with a first-mover advantage in this space will be the only ones to remain largely insulated in the current market situation.

Talk to One of Our Experts

Get in touch today to find out about how Evalueserve can help you improve your processes, making you better, faster and more efficient.