The US Banking sector continues to be challenged by a deteriorating macroeconomic environment, affected by several factors including sustained high inflation, increased regulatory measures, and geopolitical tensions. In this high-rate environment and the possibility of a rate cut only in the second half of FY24, we believe that the outlook for US banks is deteriorating.

In our view, strong capital and liquidity standards make the US mainstream banks resilient to some extent and they seem better positioned now than during the previous Global Financial Crisis due to tighter supervision, and mandatory resolution and recovery plans. However, we believe they remain vulnerable to declining profitability and asset-quality pressures given the weak economic outlook.

Below are our key takeaways:

- Declining profitability and asset-quality pressures in a weak economy are the key reasons behind our negative outlook for US banks.

- Higher for longer interest rates and tighter financing conditions prevail.

- Declining profitability and asset quality pressures are persistent headwinds.

- Low business volumes and high deposit costs put pressure on profitability as we inch towards the last leg of interest rate hike/stabilisation.

- Funding conditions and unrealized losses on securities portfolios aggravate the situation.

- Firms with high commercial real estate (CRE) exposures are at greater risk amid a slowing US economy and work-for-home culture.

- Cost discipline and efficiency management along with a greater contribution of non-interest income will remain the key competitive differentiator for banks, in our view.

- Banks business models and risk planning may be challenged by digitalization, cyber and climate change dynamics.

- However, tougher supervisions as well as mandatory resolution and recovery plans suggest that the banks are better positioned now than they were during the 2008 Global Financial Crisis.

- Operating environment remains tough for the banking sector, more so for regional banks, exacerbated by spill-over risks relating to the Russia-Ukraine and Israel-Hamas wars.

The macro-economic scenario

Demand and inflation pressures remain higher and stickier than expected, prompting higher for longer policy rates.

The Fed has implemented a series of interest rate hikes (500 bps +) since launching its tightening campaign in early-2022 while also reducing its security holdings by more than $1 Tn. However, we believe these measures have yet to play out fully, with their impact being limited so far. The main risk is that demand and inflationary pressures remain higher than targets and stickier than expected. Therefore, it remains difficult to predict how long this quantitative tightening will continue and when it will start easing. We do note, however, that the Federal Reserve Board’s Summary of Economic Projections (SEP) forecasts 75 bps of interest rate cuts in 2024, spread over various policy meetings starting around mid-year.

Profitability pressures loom given lower NIMs amid high deposit costs and slower lending growth

US Banks earnings have been adversely affected by higher funding costs as well as profitability pressures resulting from a rapid and material monetary policy tightening. We expect the profitability pressures to continue in the near term, implying pressure on internal capital generation. Some banks have reduced their lending to preserve capital, which has in turn reduced the proportion of high-yielding assets. Either ways, this is exerting pressure on the bank profits.

Moreover, higher interest rates have reduced the value of US banks' fixed-rate securities. Although US banks should continue to benefit from the Fed’s liquidity backstops and funding from the Federal Home Loan Bank System, these tend to be shorter duration than core deposits.

Given the pace and steepness of the current rate cycles, the rise in deposits costs has had an adverse impact on banks’ profitability. US banks have a significant percentage of funding coming from deposits (~80%), and banks are finding it difficult to lower deposit rates as they intend to attract customers and shore up liquidity amid rising competition.

In the charts below, we show the declining return ratios for the US banking sector.

Source: Bloomberg

We believe that banking sector NIMs have peaked and look poised to fall from here. Modest loan growth and high deposit rates are likely to pressure future NIMs. In the charts below, we see a declining NIM trend, indicating pressure on profitability due to higher deposit costs.

Source: Bloomberg

Loan growth is expected to be modest as many banks have already tightened credit standards across all product categories and are likely to maintain their restrictive credit-lending policies in lieu of the unfavourable economic outlook and a likely deterioration in collateral values. As we can see from the table below, loan growth for the last reported quarter (3Q23) was modest.

Source: Company Filings

Stable fee-based income acts as a mitigant to some extent for declining NIMs. Therefore, banks with stronger advisory, underwriting, and corporate banking franchises with a higher proportion of fee-based income should be in a better position.

Source: Company Filings

Cost discipline and efficiency management will remain the key competitive differentiator for banks

Banks are likely to face an increase in efficiency ratio in mid-term owing to sluggish revenue growth, higher operating expenses, increased compensation expenses and higher technology expenses. While compensation expense would increase in lieu of attracting talent in specialized areas such as artificial intelligence, cloud, data science, and cybersecurity, many banks will also continue to invest in technology to remain competitive. Tight labour markets are also likely to add to the cost pressures.

The efficiency chart below also indicates pressure on profitability due to rising cost-to-income (C/I) ratios.

Source: Bloomberg

Pressure on asset quality; particularly for banks with greater CRE exposure

Given the challenging operating environment, we believe that credit metrics such as asset quality and operating profits for US banks will remain under pressure in 2024. As businesses and consumers feel the impact of inflation and monetary tightening, their ability to pay off loan diminishes, affecting banks credit quality. There is already evidence of rising delinquencies in certain loan categories, such as credit cards and CRE.

Given the slowdown in US economic growth and a significant proportion of the workforce continuing to work from home, the demand for office space has reduced amid high interest rates. Therefore, banks with greater CRE exposure (especially in construction and office lending) are likely to see a more material negative impact than peers with lower CRE exposure.

Source: Company Filings

The charts below indicate rising NPL ratios and lower coverage. In addition, we see that the banks have started to increase provisions in anticipation of rising delinquencies.

Source: Bloomberg

Source: Bloomberg

However, these negatives should be partially offset by the banks’ broadly diversified loan portfolios and conservative underwriting.

Banks with higher levels of uninsured deposits are at greater risk

We note that funding conditions in the US are seeing the impact of higher policy rates and quantitative tightening. We believe that the banks with higher uninsured deposits (like Citigroup and JP Morgan, for example) are more at risk.

The recent hike in interest rates by the Federal Reserve has made the American banking sector more vulnerable, putting a significant number of institutions in danger of failing should there be a run on these banks by uninsured depositors, when uninsured depositors decide to withdraw their funds in a perceived crisis scenario.

Source: Company Filings

Strong capitalisation and adequate liquidity are key offsets

Despite the profitability and asset quality pressures we discuss above, the main US banks remain strongly positioned with respect to liquidity and capital buffers to withstand a severe downturn, as evidenced by the charts below and the Fed’s recent stress-test results.

There has been a significant transformation in the financial system since the recession of 2008. Tougher prudential standards are the new norm with a focus on higher capital and liquidity requirements, more stringent supervisions as well as mandatory resolution and recovery plans.

Capital requirements have strengthened since the Global Financial Crisis. The minimum regulatory requirement for the ratio of common equity to risk-weighted assets has roughly quadrupled since then. Liquidity requirements have also been tightened, requiring banks to now maintain liquidity coverage ratios that would ensure they could survive for 30 days without central bank intervention. These stricter regulatory requirements have led to enhanced safety margins that would diminish the negative impact on banks’ performance in the event of a recession.

Source: Bloomberg

Source: Bloomberg

Regional banks at greater risk than mainstream US banks

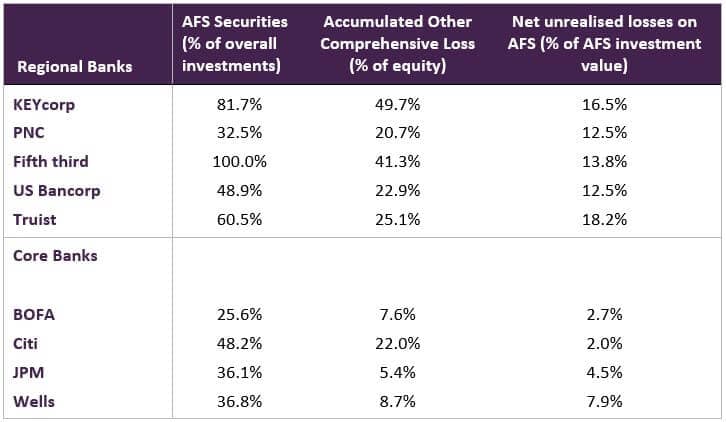

Given the deteriorating operating environment, we believe that regional banks are at greater risk than core US banks because they have lower regulatory requirements for capital ratios. Moreover, some of these banks are allowed to exclude unrealized losses on available-for sale (AFS) securities from their regulatory capital ratios. In an effort to preserve their capital ratios from erosion, the banks might avoid the forced sale of fixed-rate securities or loans and are therefore likely to face higher funding pressures as they become more reliant on higher cost deposits and wholesale borrowing.

Source: Company Filings

Although regulators have proposed an increase in regulatory capital requirements for banks with assets above $100 bn which is a credit positive in the long term, we believe that it would entail costs in the near term, further pressuring profitability.

Conclusion

Overall, our outlook for the US banking sector is deteriorating given that the challenging operating environment for the sector, more so for regional banks that do not work under the same strict regulatory requirements as their more mainstream counterparts. In general, recessions can be very damaging for the banking sector as it increases credit losses and leads to a decline in the value of investments. Opportunities for new business revenues also tend to fade in a recession. In addition, we could see a spiral effect due to a lack of credit availability forcing banks to reduce operations further. That being said, strong capital and liquidity standards this time around should position them better than during previous recessions.

Talk to One of Our Experts

Get in touch today to find out about how Evalueserve can help you improve your processes, making you better, faster and more efficient.