SAR was officially pegged to USD in 1986 at 3.75, before which it was a managed-float. To date, Saudi monetary policy makers prefer currency peg because it has been instrumental in shielding Saudi’s economy from crude oil price volatilities. The fixed exchange rate helped the kingdom of Saudi Arabia (KSA) to artificially keep SAR undervalued during Crude Oil boom period (2010-2014) that contributed to large accumulation of FX reserves. Historically, the peg has helped anchoring investor confidence during economic downturns and limit inflation by effectively linking Saudi’s monetary policy to USD. But is this 3.75 peg sustainable for SAR/USD, given the steady crude oil glut?

We question this, as the Saudi government struggles with fiscal deficit, with Brent trading at a low of c.USD50/BBL. KSA economy has gone from bad to worse, with the IMF cutting 2017 GDP growth to 0.4% from 2%, as well as contraction in corporate earnings (with 1% credit growth in 2016) and falling retail spending. Desperate times call for desperate measures – SAR devaluation should help KSA not only fix fiscal imbalance but also boost infrastructure spending (multiplier effect). Recently, Saudi Prince Alwaleed Bin Talal talked to Bloomberg about the possibility of a de-peg as the kingdom undergoes unprecedented social, political, and financial change, which supports our analysis.

Saudi Arabia – high fiscal deficit unlikely to disappear any time soon

More than c.50% correction in Brent price (from USD100/BBL level in 2010–14 to USD50/BBL level since October 2014) has led to a sharp decline in government finances. Consequently, the kingdom has recorded large fiscal deficit – 16% of GDP in 2015 and 17% in 2016. Successive deficits have compelled the government to adopt strict austerity measures – lower public spending on wages/subsides and cut in infrastructure investments. Moreover, the government is levying new taxes/fees and planning strategic asset sales (Aramco IPO planned in 2018) to improve its finances. Notwithstanding these measures, the IMF estimates KSA will record fiscal deficit (% of GDP) of 10% in 2017, 6% in 2018, and 5% in 2019.

Fiscal tightening stings – corporate earnings trending backward, falling retail demand

KSA’s attempt at fiscal consolidation has adverse impact on economic growth. The IMF, which has lowered KSA’s GDP growth forecast for 2017, expects subdued GDP growth (≤2%) until 2020 against 5% GDP growth in 2010–15. Tadawul earnings (benchmark stock index) are forecast to shrink in 2017–18, underlining weak corporate performance. Corporate credit growth declined to 1% in 2016 due to lower capital outlay. All in all, we see structural weakness in KSA until it revives investment.

Bite the bullet – expansionary monetary policy (SAR devaluation) needed

KSA has no room to adopt expansionary fiscal policy to boost investment. Given KSA’s high reliance on oil income to drive government spending, SAR devaluation could be an effective monetary tool to boost investment without jeopardizing fiscal prudence. To its credit, the government earns in USD and mostly incurs expenses in SAR. Ceteris paribus, SAR devaluation should yield higher revenue realization from crude oil sale in SAR terms (USD revenue unchanged, but translated at higher USD-SAR exchange rate), thereby narrowing revenue shortfall. Improved finances could help the government raise infrastructure spending and reignite the economy.

Countries such as India, Poland, Mexico, Thailand, Indonesia, Russia, Brazil have de-pegged/ devalued their currencies in the past 30 years. For most economies, their GDP growth rate rebounded immediately after the monetary policy intervention.

Five factors supporting SAR devaluation

- Wide gap between KSA’s budget breakeven crude oil price of USD82/BBL and spot Brent price (c.USD50/BBL) leads to large fiscal imbalance. KSA government has budgeted 2017 fiscal deficit of 7.7% of GDP using average oil realization price of c.USD50/BBL. On a separate note, lowering the breakeven oil price implies lower spending, which is equally damaging for the economy.

- The rebounding of Brent, which continues to trade at c.USD50/BBL level, to ≥USD80/BBL by 2020 looks far-fetched as the crude oil market is oversupplied and the US shale production grows higher.

- SAR-USD exchange rate looks overvalued, with widening gap between Brent (proxy for SAR) and dollar index.

- Forward currency market has started to factor-in SAR devaluation as SAR is trading above the official peg rate of 3.75/USD.

- Pressure is on KSA to devalue SAR against the backdrop of 20–100% depreciation in currencies of leading crude oil exporters (Russia, Brazil, Nigeria, Mexico) since January 2015 till date.

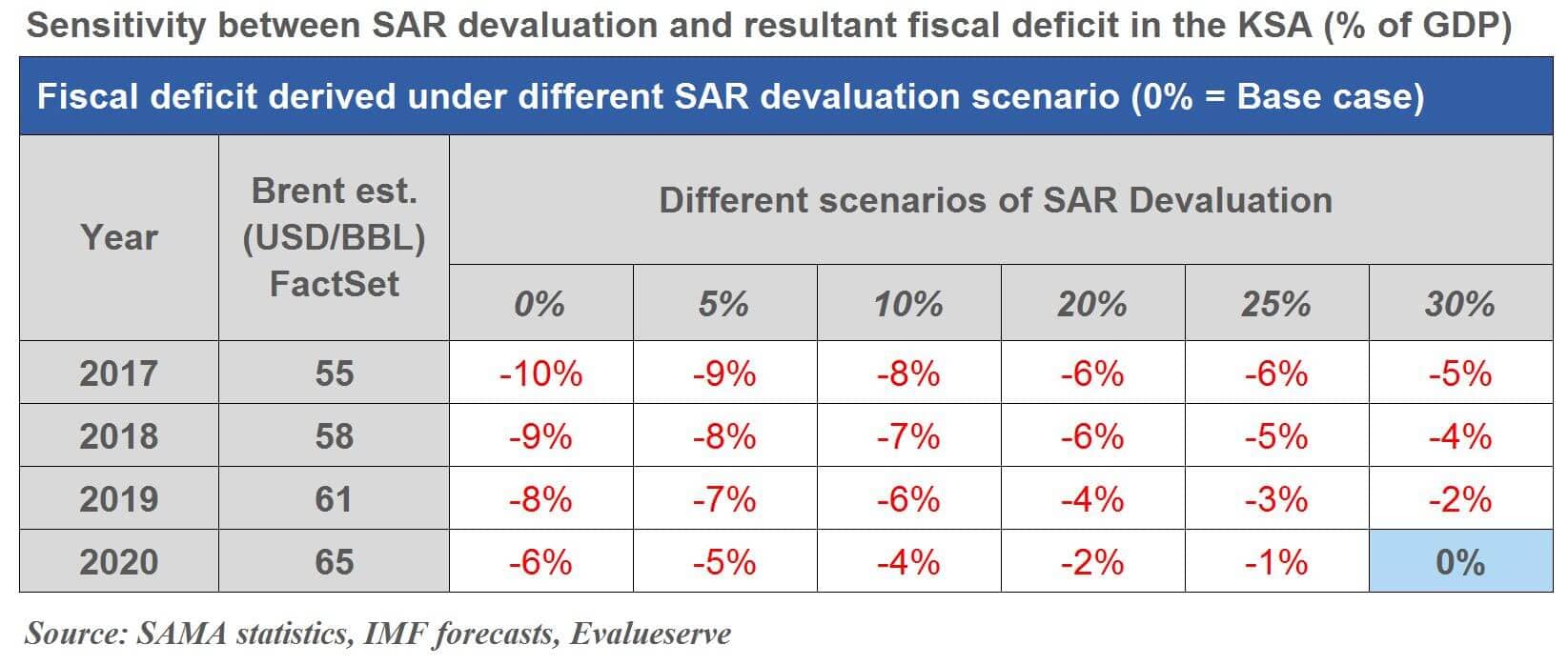

Our analysis shows that 30% SAR devaluation would effectively bridge KSA’s fiscal deficit

We see modest improvement in Brent from USD55/BBL in 2017 to USD65/BBL by 2020 (FactSet consensus), which seems probable given oversupplied global crude oil market. The table below highlights our calculations showing KSA’s fiscal breakeven scenario at ~30% devaluation by 2020.

For detailed insights on the topic, read our full report published on SmartKarma.