Summary

A Big Four accounting and advisory firm wanted to monitor small and medium companies in the UK’s wealth management sector. They sought to identify companies with high growth potential and look for green-flag companies that their PE/VC clients could invest in.

Evalueserve helped implement its AI-driven Insightsfirst Opportunity Radar (ORAD) to detect opportunities from over 200,000 public and industry-specific sources. To ensure high relevancy and avoid noise, all opportunities were curated by our in-house experts. ORAD identified over 600 verified business opportunities for the client and its use resulted in an 80% reduction in manual efforts.

The Challenge

A Big Four accounting and advisory firm wanted to identify and monitor private companies in the UK’s wealth management sector. They wanted to detect small and medium companies with high growth potential and target green-flag companies for PE/VC clients to invest in.

Our client did not have a structured program to track opportunities in their target companies. Team members used different tools and KPIs to monitor their sectors. Our client felt that it was important to implement an effective monitoring program to ensure they were not overlooking important business opportunities.

Our Solution

Evalueserve deployed Insightsfirst ORAD to identify new opportunities against a set of defined, growth-related triggers. The objectives were to:

- Generate additional revenue from hidden opportunities

- Ramp up and supplement the lead identification process

- Identify disruptive and emerging trends through a forward-looking sector view

- Build a stronger relationship with PE/VC clients by sharing interesting opportunities

Evalueserve deployed Insightsfirst ORAD in 3 steps:

- Step 1 – Our experts prepared a landscape of potential growth companies to monitor. Using various databases and industry-specific sources, Evalueserve built a list of over 500 target companies in the UK’s wealth management sector. The companies were further classified into sub-sectors, such as traditional asset management, traditional wealth management, online investment platforms, and fintech.

- Step 2 – In collaboration with the client, we defined 20 specific growth-related triggers to monitor targeted companies. These business triggers included financial performance, alliances, investments and innovations, M&As, and senior hiring.

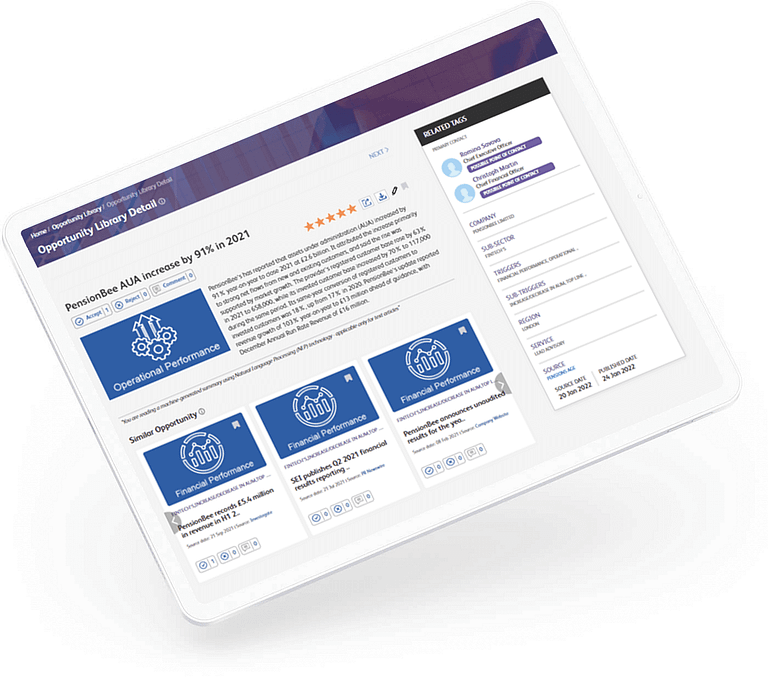

- Step 3 – Evalueserve leveraged proprietary AI-based engines to detect opportunities from more than 200,000 public and industry-specific sources. To ensure high relevancy and avoid noise, all opportunities were curated by our in-house experts. In addition, alternative data sets — such as website traffic, headcount growth, and social media presence — helped detect growth companies.

The key Insightsfirst ORAD features leveraged in this project include:

- An AI-based data collection engine that detects opportunities from over 200,000 sources.

- A custom newsletter that keeps users up-to-date on developments in target companies.

- A button (called “Ask the Analyst”) that allows users to order additional reports on shortlisted companies.

- Tools to enable collaboration between team members by allowing them to comment and share interesting opportunities.

- The ability to sync selected leads with the client’s CRM system.

Business Impact

Benefits were achieved just three months after Insightsfirst ORAD was deployed. The benefits included:

600+ business opportunities identified for the client

Most of those opportunities came from small and medium private companies previously unmonitored by the client.

80% reduction in manual efforts

Related to opportunity identification process thanks to AI engines.

Faster time to market.

Automatic opportunity detection and alternative data sets helped highlight growth companies much quicker.

Education of junior team members

Data captured on Insightsfirst ORAD was used as training material for junior team members.