Background

The chemical industry has been grappling with unforeseen volatility for the past few years, which geopolitical events and raw material inflationary trends have exacerbated. To top this volatility, the industry has also witnessed a significant number of acquisitions, which have hung the competitive dynamics in multiple product value chains. This unique combination has made it challenging to sustain a profitable assortment of products.

Our client, a middle-market chemical company, was also grappling with a similar product portfolio that was not performing profitably. In particular, one of the raw material suppliers acquired a competing facility which dried up the supply for our client. Our client was concerned about low utilization, which would have pulled the profitability further down.

The company needed to act decisively to restructure the product gradeslate of one of its biggest plants and yet, they wanted to incur minimal additional capex, maintain the broad structure of the plant intact, and ensure that the portfolio was adjacent to their manufacturing and marketing competence.

Leadership knew selecting products for development, promotion, or discontinuation was critical to profitability and had to consider customer loyalty and contractual commitments. Downstream operations, with their fluctuating material costs, regulations, and changing demands, added complexity. The company’s goal was to effectively build product lineup to match market trends, satisfy customer needs, and maintain flexibility in response to industry shifts.

The Solution

Evalueserve evaluated 700+ compounds across multiple product families to identify high potential and best-fit compounds for its Client.

Comprehensive Portfolio Analysis

- Which compounds can be manufactured on the existing reactor technology?

- How is the demand outlook for these products?

- Is the market size and growth rate attractive for a new market entry?

- Are there any regulatory disruptions anticipated?

- How established is the raw material supply chain in Client’s region?

Identification, Prioritization and Streamlining

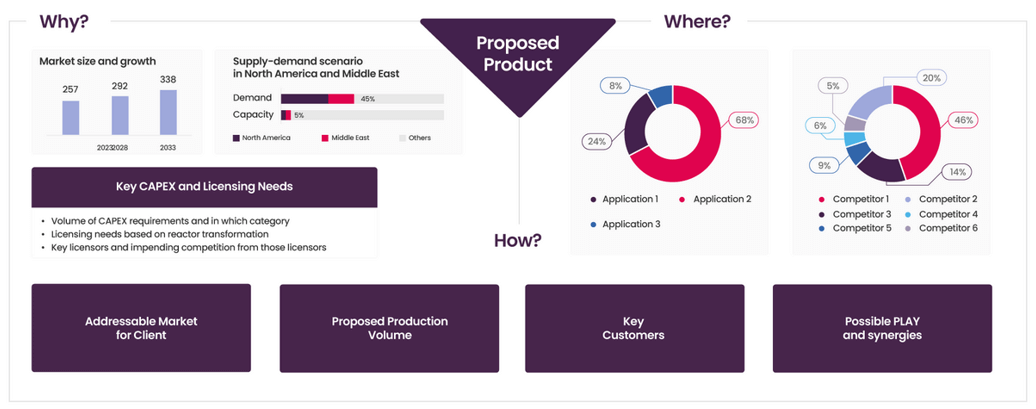

- What is the market gap based on supply-demand scenario?

- What are the key applications and related market trends?

- What are the average gross margins in different application end-applications?

- Who are the key competitors? Where are they located? What are their capabilities?

- Who are the key customers? Who are the key raw material suppliers?

Strategic Market Integration

- What equipment modification will be required for production of the new products?

- Will there be a new licensing requirements?

- What will be the overall CAPEX needed?

- What is the recommended production level based on addressable market and other synergies?

- What are the expected margins? And when can the client achieve break-even point?

Phase I: Comprehensive Portfolio Analysis

In Phase I, Evalueserve conducted an extensive audit of the company’s existing manufacturing set-up. We evaluated multiple product families to identify high potential and best-fit compounds. This entailed tracking and evaluating each of their lifecycle costs, licensing needs, resulting margins, and alignment with future regulatory compliance. Additionally, the phase involved a granular analysis of the company’s technological capabilities and partnerships for licensing agreements.

Phase II: Identification, Prioritization and Streamlining

Through a combination of technology, market, and competitive assessments, Evalueserve collated a broad list of products that included products which could be manufactured on the available reactor technology.

The identified products were then assessed on their market potential. As part of the product assessment, we evaluated over 700 compounds. We eliminated products which did not meet the desired growth trajectory or provide the desired margin profile. Then, the remaining 80 products were assessed for their alignment with the client’s infrastructure, manufacturing capabilities, competitive landscape, contribution to a sustainable product lineup, and their fit within the company’s core competencies.

The shortlisting involved a criterion of minimal modifications were needed to the existing plant equipment, and that the new portfolio could be marketed within the customer industries where the firm had relationships. The eventual result was a precise list of 5 products which were technically feasible on the client’s facility and commercially in line with the desired margin profile.

Phase III: Strategic Market Integration

In the final phase, Evalueserve provided a detailed roadmap to manufacture and commercialize each of the recommended products. Detailed business cases were prepared for each of the final 5 products – we quantified the capex involved, the potential margins, and detailed the modifications needed in the plant as well as in the company’s Go-to-Market strategy for each of the options.

The recommendations encompassed potential partnerships for joint development and distribution, benchmarking and analysis of regional market access, examination of both organic and inorganic growth avenues, and a detailed risk assessment for each product to guide investment decisions. The final recommendation included a prioritized list of 3 products which were a good fit to the client’s need of portfolio transformation to combat the business disruption.

Business Impact

The result was having a well-tested list of 3 competitive options for the desired portfolio transformation to combat the business disruption. We mapped these 3 alternative profitable avenues to invest in, all of which potentially improved the client’s portfolio’s health with varying trade-offs between capex, upside, and execution risks without disrupting the company’s base line operations.

Evalueserve's granular recommendations on investments were particularly appreciated, as they laid out the pros and cons of each of the options clearly. The execution not only responded to the immediate challenge but also equipped the client with a robust methodology for future portfolio decisions, setting a new framework for New Product Introduction (NPI) programs in the firm.

Talk to One of Our Experts

Get in touch today to find out about how Evalueserve can help you improve your processes, making you better, faster and more efficient.

Overview & Impact

Our middle-market chemical client tackled supply disruptions, optimizing their product lineup for profitability and market adaptability.

- Streamlined Decision-Making

- Product Portfolio RoI