Building Trust and Driving Growth through ESG Disclosure

Environmental, social, and governance (ESG) disclosure is rapidly evolving from a niche to a mainstream activity, mainly due to regulatory requirements and pressure from end clients and investors. More and more companies are creating transparency around their impact on the environment, their social practices, and their corporate governance structures. Therefore, ESG disclosure is emerging as a powerful tool that holds companies accountable for their actions and generates a range of positive effects that extend far beyond the companies themselves.

ESG disclosure can act as a catalyst for internal change, improve information dissemination, and reduce information asymmetry among companies and investors. It can also enhance investment efficiency, as investors may be more willing to provide capital to companies that have robust disclosure mechanisms in place. It is often believed that better disclosure can lead to tangible benefits, such as improved liquidity, lower cost of capital, higher asset prices (or firm value), and better corporate decisions.

This article delves into the positive impact of ESG disclosure and explores how it drives corporate accountability, fosters informed investment decisions, and improves access to capital.

Enhanced Transparency and Accountability

The Edelman Trust Barometer, an annual survey that assesses public trust in various institutions, has disclosed that nearly two-thirds of those surveyed believe that CEOs should be held accountable to the public, rather than solely to the board of directors or stakeholders. The results of the survey show that today’s consumers (along with shareholders) are not just interested in financial data but seek information on how companies are integrating factors like ESG into their core decision-making and working towards achieving sustainable growth.

Consumers and investors are increasingly demanding that organizations address ESG issues in a concrete and transparent manner and focus on purpose-driven operations. Both traditional and socially responsible investors are leveraging ESG data for informed investment decision-making, thereby putting companies with poor ESG performance at risk of losing favor and facing potential divestment. It is leading to the inclusion of ESG disclosures in investment analysis and engagement activities and pushing companies to operate in an environment of enhanced transparency and accountability.

Moreover, groups like Climate Action 100+ (CA100+), an investor-led initiative that aims to ensure that the world’s largest corporate greenhouse gas emitters take necessary action on climate change, are actively engaging with companies critical to the net-zero emissions transition. The financial pressure exerted by bodies like CA100+ incentivizes companies to improve their ESG practices to remain attractive.

Therefore, it can be stated without doubt that ESG disclosure is a key driver of sustainable business practices that promotes transparency and accountability and helps companies communicate their sustainability efforts to investors, customers, and employees. It creates a virtuous cycle where trust, engagement, and collaboration amplify the positive consequences of ESG disclosure, leading to a more sustainable and equitable future for all.

More Robust Investment Decisions

Although most investors understand that their decisions can significantly influence the sustainability practices of their portfolio companies, they (including those in the US) have traditionally been reluctant to incorporate ESG disclosure into their decision-making process. This is mainly due to perceived risks or a lack of clarity on how these factors impact financial performance. But as regulatory bodies like the US Securities and Exchange Commission are pushing for more transparency in disclosing climate-related risks, investors are gradually adapting to the growing importance of ESG factors.

Investors are exploring new ways that will help them identify and maximize opportunities arising from advanced sustainability disclosures. For instance, they are using sophisticated data analysis tools to assess a company's sustainability report to look for potential growth areas like renewable energy initiatives or waste-reduction programs to potentially enhance their financial returns.

Enhanced Access to Capital

Despite initial resistance, investors are realizing the growing importance of ESG factors in investment decision-making, driven by increasing environmental and social awareness. With this, companies with robust ESG disclosure data have the opportunity to access capital through ESG funds that invest in companies that have a sustainable and holistic approach to business.

Much is being done by stakeholders to not only ensure greater ESG transparency but also strengthen the market for ESG-backed products. For example, members of the Interfaith Center on Corporate Responsibility (ICCR) and the Investor Alliance for Human Rights (IAHR), among other investors, submitted a range of shareholder proposals addressing societal issues for the 2023 Annual General Meeting season. The ICCR proposed 37 worker rights for 30 firms (including Amazon, Dollar General, Starbucks, Uber, Union Pacific, and Walmart) with a focus on worker health and safety, paid sick leave, wages and equity, freedom of association, and workplace sexual harassment. Meanwhile, the IAHR put forward 15 proposals for major tech companies (such as Alphabet, Amazon, and Meta), addressing human rights issues like insufficient content moderation, the spread of hate speech, and the lack of transparency due to 'black box' algorithms.

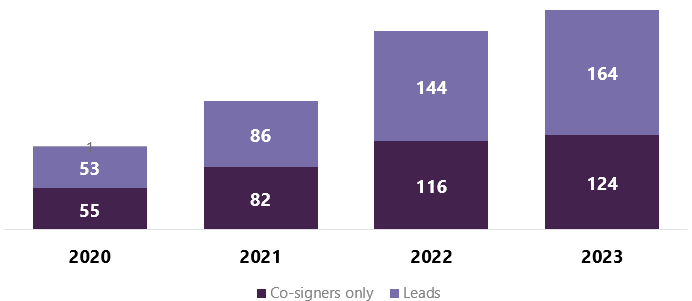

Similarly, the 2023 Non-disclosure Campaign (NDC) , supported by 288 financial institutions (FI) saw FIs engaging with 1,590 non-disclosing corporates and requesting them to disclose their climate, forest, and water impact through CDP. The NDC encouraged companies to respond to the CDP's disclosure request, following which companies were 2.2x more likely to disclose data. 221 companies (including Moderna, CK Infrastructure and Zoom Video Communications) disclosed information on climate change, 66 companies (including BMW AG, Equinix and Hugo Boss AG) on the water issue, and 58 companies (including Toyota Motor Corporation, SANOFI, and Home Depot) on the forest issue.

As the market matures, it is likely that ESG funds will become a more mainstream option for investors and will help companies achieve growth.

Conclusion

In today's world, businesses are increasingly judged not just by their bottom line, but also by their three-fold focus on ESG issues. Disclosing ESG metrics is no longer optional but a strategic move with several positive consequences. ESG disclosures shed light on a company's environmental footprint, labor practices, and ethical conduct. This transparency allows stakeholders, investors, consumers, and employees to make informed decisions. Such disclosures enable enhanced transparency and accountability, help investors make decisions based on prioritization of sustainable investments, and lead to the allocation of capital to companies that demonstrate strong ESG practices.

However, the positive consequences of ESG disclosures are not always immediate or easily quantifiable and require long-term commitment. Criticism of ESG practices and concerns about greenwashing and lack of standardization are pushing companies to improve their ESG reporting, indicating that the future may see the availability of more reliable data and an increasing importance of ESG factors for business entities.

Contributors

Ruchi Malhotra

Principal Consultant

Yulia Khisamova

Senior Consultant

Talk to One of Our Experts

Get in touch today to find out about how Evalueserve can help you improve your processes, making you better, faster and more efficient.