Making Waves in ESG Controversies Assessments: Evalueserve’s C.A.S.E. approach

Overview

This report highlights the importance of monitoring and understanding ESG controversies and their potential impact on a company's sustainability performance. Despite the potential implications for Investors, several challenges persist, including the overwhelming volume of news, the need to view controversies through an industry-specific lens, and reliance on generated controversy scores lacking critical nuance.

The report introduces Evalueserve's ESG Controversy C.A.S.E. methodology, which offers a comprehensive and transparent assessment of ESG controversies. The C.A.S.E. methodology evaluates four driving elements: Connection, Action, Severity, and Exposure, allowing users to customize assessments based on their investment objectives. The methodology combines human expertise with AI-powered algorithms to capture and analyze information from various sources. The resulting output offers a context-informed view of ESG controversies, enabling investors to make informed decisions and understand the impact on a company's stability and sustainability.

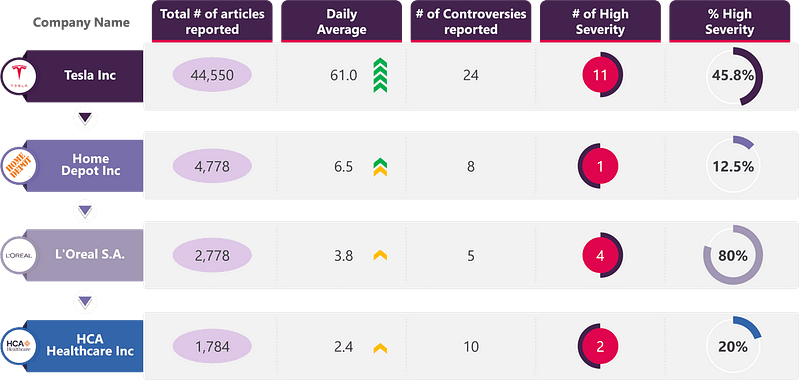

ESG Controversies as Part of Total Company News (over two-year period)

The volume and velocity of news cycles can make finding ESG controversies challenging. Yet, although a small percentage of the total news, ESG controversies are significant given the severity of the reported events.

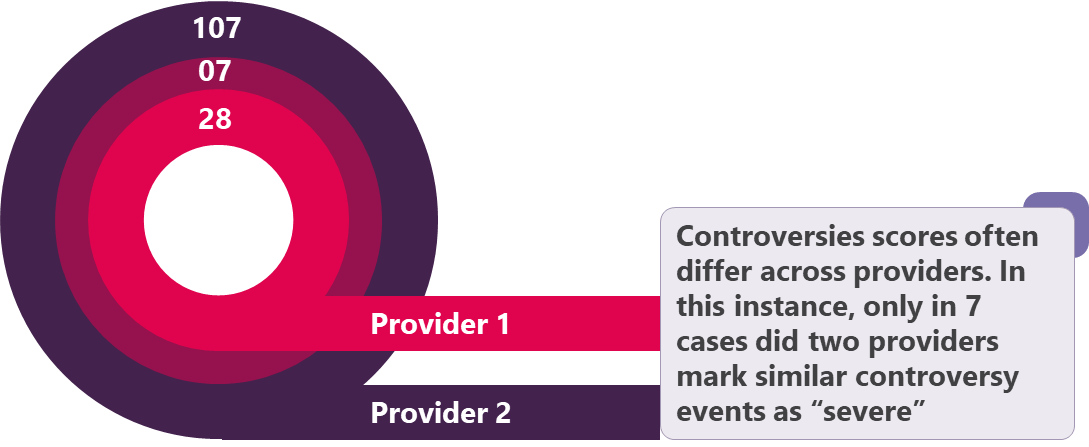

Inconsistent Controversies Assessments Across Providers

ESG controversy scores are not comparable across providers as the lack of a uniform methodology means differing scoring schemes can treat identical events very differently as to event severity.

Publication

Download the publication

Gain a competitive edge and stay informed about the latest industry trends by downloading our full publication.