Risk Assessment Platform

Scale Risk Assessments. Strengthen Decision Quality. Navigate Risk with Confidence.

RiskSight combines AI-powered automation with human expertise — so you can trust every decision.

RiskSight Overview

Stay Ahead of Evolving Risks with AI-Powered Insights

Financial institutions face growing complexity — processing vast volumes of structured and unstructured data, spanning market data, external insights, and internal information. Evolving market conditions demand continuous, up-to-date insights to drive effective risk management and underwriting.

Yet legacy, manual processes can’t keep pace. Inconsistent, subjective approaches undermine decision quality. All while regulatory expectations for transparency and auditability continue to rise.

RiskSight helps you stay ahead. The platform combines generative AI-powered data processing with advanced quantitative models to deliver rigorous, standardized risk assessments and scorecards. From insurance underwriting to credit portfolio management, it gives your teams the clarity and confidence to make better decisions faster.

Scalable

Analyze vast volumes of internal and external, structured and unstructured data.

Holistic

Combine quantitative models and qualitative insights for a complete risk view.

Accurate

Equip your analysts with trusted, decision-ready risk insights.

Transparent

Standardize underwriting with clear, traceable decisions.

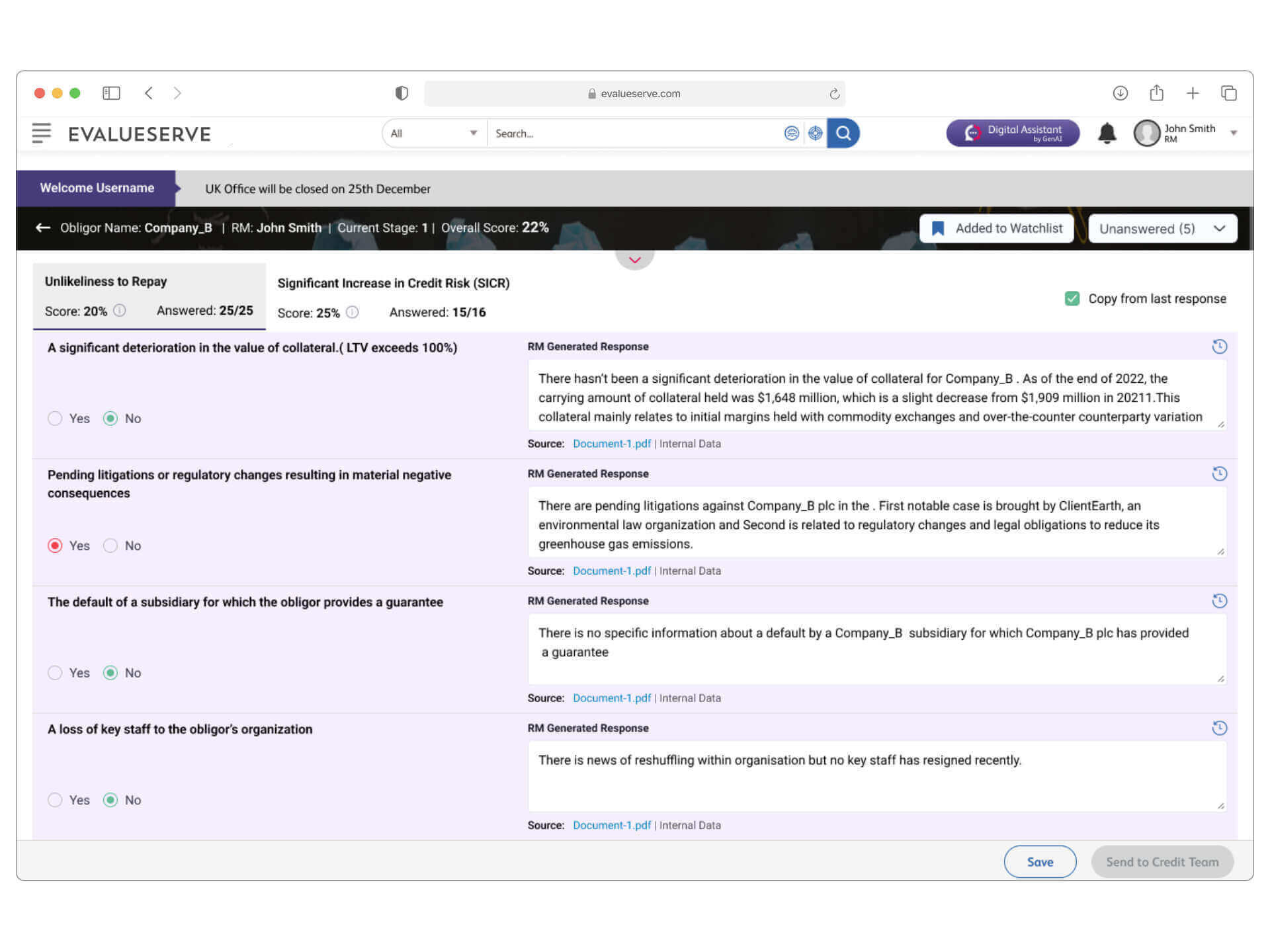

Combine Quantitative and Qualitative Insights

RiskSight delivers a dual approach to risk assessment, blending advanced models with generative AI-enhanced qualitative analysis to give you a complete view of risk exposure.

- Quantitative models — apply advanced loss models, EP curves, and statistical methods to evaluate financial risk.

- Qualitative scorecards — automate the extraction of key risk factors from internal and external sources using generative AI to populate standardized scorecards.

This scientific approach to qualitative insights delivers a more consistent, transparent, and comprehensive view of risks.

Standardize and Streamline Your Workflows

Drive consistency and rigor to every risk assessment with RiskSight. It offers the flexibility to integrate with existing workflows and the power to standardize key underwriting and credit monitoring processes.

- Integrated workflows — embed our models and insights with your existing underwriting systems and approval processes.

- Consistent evaluations — standardize inputs and assessment workflows so every risk is evaluated against the same criteria and standards.

- Efficient processes – eliminate bottlenecks and process more data at scale.

Accelerate with AI, Rely on Human Judgment

Augment your risk professionals with AI. Use RiskSight to automate time-intensive data extraction and processing so your teams can focus on higher-value analysis and decision-making.

- AI as an enabler — accelerate risk evaluation by putting key insights at the fingertips of decision-makers.

- Human-in-the-loop — analysts review and validate all risk scores and recommendations.

- Final decisions remain with your team — our AI workflows process inputs and draft outputs while ensuring full accountability, transparency, and human oversight.

Security

Built for the Enterprise: Secure, Auditable, Compliant

RiskSight works seamlessly within your environment. The platform offers single-tenant deployment and is built to meet the demands of enterprise risk and compliance teams.

-

Enterprise-Grade Security

Ensures data integrity, confidentiality, and regulatory alignment.

-

Full Auditability

Provides clear, traceable records to support regulatory compliance and internal governance.

-

Compliance-Ready

Supports frameworks such as IFRS 9, CECL, Basel III, and internal standards.

*RiskSight Terms of Use and Privacy Policy

Success Stories

Client Testimonials.

300+ enterprises count on Evalueserve technology to power their decisions.

It's about organizing and creating structure to make the best or more informed underwriting decisions.

We are impressed with how Evalueserve understood our processes and brought in the idea of using Generative AI to solve a pain point on risk scoring.

The platform is doing exactly what we expected it to do: Spark meaningful conversations about the risk of underwriting a specific company and help us think through what this means.

(Swipe to see more)

Related Resources

Optimize Your Outcomes

How European Banks Are Navigating AI – London Executive Exchange Takeaways

Check out key takeaways from our discussion with leading banks in London on navigating the new AI efficiency frontier.

Embracing Generative AI in Cloud Migration: Two Key Lessons for Success

Read our blog to learn what generative AI can and cannot accomplish in a SAS to Python migration.

Securing Tomorrow’s Payments: A Client Story in Advanced AI Model Assessment

Explore how we assisted a leading cross-border payment provider by independently reviewing model risk and AI frameworks against regulatory benchmarks and providing targeted remediation strategies

Exploring the Potential of Generative AI in Enhanced Due Diligence

Explore how Evalueserve’s test demonstrates AI’s transformative impact on Enhanced Due Diligence (EDD). Discover the efficiencies and capabilities unlocked, shaping the future of risk management.

RiskSight

Request a Custom Demo.

Get in touch today to find out about how Evalueserve can help you improve your processes, making you better, faster and more efficient.