Risk & Compliance Analytics Solutions

Improve RoI, Efficiency and Rigor

Improve your risk management process, shorten turnaround times, and create custom applications

Overview

Ensure Risk Management Process Identifies, Mitigates and Predicts Liabilities

Risk managers need to deliver more insights through intuitive and interactive reports, add new controls, and automate current ones; all while managing costs. Digital transformation enables stronger automation.

Current financial institution and corporate architectures are often fragmented and outdated. Any new solutions need to work around these challenges.

Our wide range of domain-specific AI products, technologies, custom application development, and micro-automations bring efficiency to your risk management processes. Further, they maintain the rigor of model quality and documentation, preparing your organization for anything.

Benefit from decision-ready data insights, RPAs, and automations across your risk disciplines. Get the best possible RoI, efficiency and rigor for your risk management process.

Un-burden your risk management team by leveraging analytics, so more time can be used to make quick judgements.

Automations and smart algorithms to streamline reporting tasks.

Data driven insights and visualizations allow your analysts to take a deep dive into data, so they can quickly make informed decisions.

Automated audit search and ops research applied to risk management ensure that suspicious activity can be quickly spotted and assessed.

Our Advantage

Delivering Results

Productivity improvement

Cost savings

Increase in efficiency

Our Capabilities

Leverage AI for Risk & Compliance Analytics

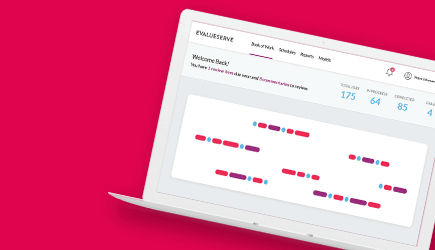

Build Custom Risk Applications: From Limit Monitoring, Counterparty Credit Risk Analytics, Capital Consolidation, Market Risk Reporting and more, our custom risk AI solutions deliver in 3-6 months. More than just products, our expert team of UI/X designers, risk experts, database engineers ensure these solutions meet your bank’s specific requirements.

Enhanced Model Risk Management Process: Enhance your model risk management framework with our methodology for parallelization of processes, micro-automations, RPA and machine learning for recurring tasks

Holistic Aml And Internal Fraud Prevention: An excessive number of alerts and false positives can hinder effective monitoring of suspicious activities. Minimize your risks by deploying analytic-based false positive controls to your processes.

Bespoke Management Information For Risk Management Governance: Bespoke visual analytics enable your team with a better understanding of your risk program’s RoI. Team members can optimize time on value added tasks that impact the organization in the best ways possible.

Reporting And Data Solutions: Streamline regulatory reporting by leveraging best-in-class reporting AI products guided by our risk data quality and regulatory management subject matter experts.

Model Risk Management

Manage your risk more efficiently through a range of services with embedded automations.

- Regulatory and non-regulatory model validation

- Automated model monitoring, testing and report generation

- RPA in model monitoring and annual revenue

- IBOR Transition for pricing, VaR and margin models

- Model development acceleration applications

Risk Analytics & Application Development

Our team of subject matter experts sharpen your monitoring and reporting processes, including:

- Limit monitoring

- Counterparty credit risk monitoring and reporting

- Single counterparty risk limit monitoring and reporting

- Liquidity risk monitoring and reporting

- Securitization deal dashboards and databases

- Market risk and VaR reporting

- Model risk KRI dashboards

Financial Crimes and KYC

We offer financial crimes and KYC services that combine the power of human input and technology.

- Suspicious activity and transactional analysis

- Smart algorithms for EDD process optimization

- False-positive reduction techniques for negative news screening

- Management information and visual analytics for decision-making and insights

- Pro-active strategy development

- Advanced analytics test and learn

Conduct and Control

Tailor-made conduct programs allow your organization to leverage multiple data sources.

- Conceptualization and development of data driven typology controls

- Design and implementation of conduct alerting systems

- Analytics to improve usability and reduce false positives on existing alert systems

- MI for conduct program governance

- Custom automated connections between systems

Data Quality and Governance

We ensure the quality and governance of your data through products and automations.

- Use case data quality assurance tools align with regulatory requirements

- Data governance and documentation support regulatory requirements

- Automation for data lineage tracking

- Risk reporting CoEs, with automated online reporting portals, or more traditional tools (e.g., Tableau)

Related Resources

Optimize Your Outcomes

RiskMinds Discussion Highlights: Implementing a Risk-Based Approach to Model Risk Management

The recent pandemic significantly stressed the model tiering approach presenting a clear to need for a model risk management system.

SR 21-8: Rationalizing Model Risk Management for BSA/AML Models and Systems

The recently issued interagency statement SR 21-8 is a non-binding guidance note with very useful and practical suggestions on how banks can juggle resources between SR 11-7 and AML/BSA compliance.

SR 21-8, SR 11-7 and NYDFS Part 504: How a Top US Bank Achieved Best Practice Baseline Model Validation of Its Anti-Money Laundering Model

A top US Bank was searching for a partner who could conduct a baseline validation as per SR 11-7 requirements.

Key Highlights from RiskMinds In Focus 2021

RiskMinds event key takeaways – managing uncertainty, credit risk and systems, second generation risk models

and ESG stress testing.

Related Products

AI-Optimized Products That Scale

We offer a distinct suite of products with careful attention to client-specific agility and seamless integration into existing platforms.

Spreadsmart

Automate financial data extraction for valuation. Improve accuracy and increase the speed of financial spreading by 70%.

Insightsfirst

AI-enabled platform that empowers you to get an edge in the market through differentiated insights and recommendations.

Publishwise

An AI-powered platform that lets users swiftly recommends content for proposal creation using intelligent search, NLP and ML.

- Solutions for Financial Services

Related Industries

Additional Industries

Investment Banks

Corporate & Commercial Banks

Asset & Wealth Management

Talk to One of Our Experts

Get in touch today to find out about how Evalueserve can help you improve your processes, making you better, faster and more efficient.