At Evalueserve, we work with risk management teams in financial institutions of all sizes around the world. In this post, we take a look at the key trends and themes in risk for 2020 – and some smart solutions too.

Over the last 12 months, risk organizations have continued to transform, under the influence of three main drivers.

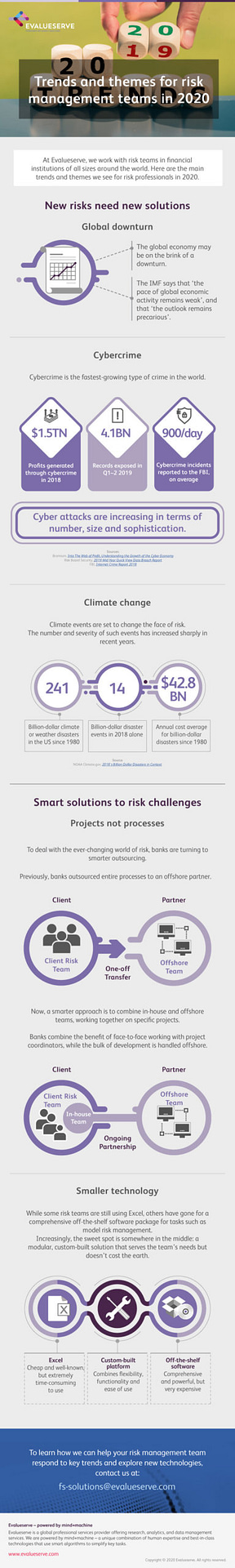

The first is the emergence of new risks, and new ways of looking at those risks. While cybercrime is probably the largest single source of new risk, banks also need to take account of climate change events.

The second driver is the widespread perception that a global economic downturn is on the way. In its latest World Economic Outlook, the IMF observes that ‘the pace of global economic activity remains weak’, and warns that ‘the outlook remains precarious’. Obviously, banks need to be prepared for adverse conditions – both for their own sake, and for their clients’.

Finally, banks are continuing their journey along the path to profitability. Rather than pursuing pure cost reduction, they want to make their operations as efficient as possible, in an environment where regulatory pressures are ever more stringent and talent is ever more scarce. While the need to improve efficiency may not be the main driver for change, it’s still an important one within risk functions.

New risks need new solutions

As new risks emerge, so does the pressure on risk management teams. As a risk practitioner, you need to understand each individual risk, your overall portfolio of risk, and your various levels of exposure.

Say you have historically been interested in your exposure to credit risk in Russia, given the sanctions in place against that country. That risk is still important, and still needs to be tracked.

However, you might also need to start thinking about your exposure to companies that are heavily reliant on oil, or on oil economies. Or, on the regulatory side, you might need to consider the implications of the forthcoming phase-out of IBOR (inter-bank lending rate). Even though you may not have tracked these things before, they may now be crucial.

To take the right actions, you need to access the right information at the right time. You might need new knowledge from new sources, or new indicators. To get the early warning signals, you might need to create a new set of management information, new dashboards and new indicators that are better suited to the nature of the risk.

This is exactly what we do at Evalueserve. We can help with exploring alternative data sources, developing benchmark models, creating AI/ML-based ‘smart but light’ automations, advanced dashboards or ‘BOTs’, early warning indicators and automated reporting systems – across the entire value chain of risk management. To back up these tools, we can create new database structures, so risk management teams can move on from using Excel for everything and start focusing on what really matters.

Model risk management

As risks change, so risk models must also change. There’s a clear trend towards greater transparency over models – not least to keep regulators happy. You need to know what your models are based on, and which ones are most relevant. And, given the forecasts, you need to consider what will happen if the prevailing dynamic within the economy changes.

In the area of model risk management (MRM), we can help create and stress-test new models that take account of new factors such as climate change, changing economic conditions and advanced quantitative techniques such as AI/ML.

Many risk management teams are facing the need to improve the transparency of model risk, as well as the data used in their models – and we can help with that too.

MRM is also transforming its use of technology, with many banks moving towards open-source. Projects in this space include creating pre-vetted data series for use and reuse, creating the right libraries, version maintenance and supporting user adoption. Model testing and documentation can be partially automated to allow for smarter use of resources and focus on quality, while also introducing a certain level of standardization and consistency between reports.

AI/ML techniques are here to stay, so you need validation and transparency for more sophisticated, AI/ML-driven models too. You need to know what the machine is actually looking at, or learning from. And we can help in this area too.

Projects not processes

When you move house, you don’t carry all the boxes yourself – and banks are no different. As risk management teams adapt to their new environment, they need help with making changes at scale.

Traditionally, banks might outsource a single process or function, after which the outsourced partner managed it themselves. That’s fine for clearly delineated, static, predictable processes that can be spun off cleanly. But it’s far too rigid when the client organization is in a process of continuous change.

What we see in the market right now is a move from basic outsourcing to a ‘rightsourcing’ model. It’s all about getting the right resources in the right configuration. And the way to do that is to focus on projects rather than processes.

At Evalueserve, we play the role of partners in change. For example, we can design and build additional micro-automations, in order to assist clients on their journey to automated operations.

Multi-location teams

The setup of teams and locations is changing too. Previously, banks ‘offshored’ non-core processes in their entirety. But now, they’re realizing that a combination of on-site and offshore staff works far better.

In our experience, technology projects are highly challenging to offshore, because you always need face-to-face interaction. Client and provider must sit down together to agree aims, scope out the brief and collaborate on designs and user interfaces. Otherwise, the output simply won’t be fit for purpose.

Today, our standard approach to supporting risk management teams is with 20% of our people on site and 80% offshore. That allows (for example) automation to be done in New York, while the development is carried out in India. And while the technology delivered may vary, the delivery model is nearly always the same.

With this approach, clients swap one consulting model for another, more efficient one. So while they reduce their consulting spend, they don’t necessarily lose any capacity. That allows them to make their resources go further, and get more done with less.

The approach makes sense in a context where local recruitment of skilled staff is a problem. It also allows clients to replace retiring staff who have no obvious successor.

Smaller technology

Another trend we’re seeing is that banks have lost their appetite for major, multi-year transformation programs. Instead, they’re moving towards simpler, smaller, project-based technology solutions such as Quantum Computing or GPU CUDA.

When clients choose a technology – to support MRM, for instance – they can make do with Excel, opt for custom development, or simply buy a ready-made platform.

You might assume that buying ‘off-the-shelf’ would be cheaper. But when you buy a comprehensive package, you’re paying for functions you’ll never use. User adoption can be a challenge. And the full cost, including implementation, may run into millions.

In contrast, a technology partner with the right domain expertise can build a solution to fit your team’s specific needs and preferences, using powerful modular techniques that deliver great results, fast.

For instance, they can build you a dashboard showing different elements of your risk models, review schedules, team responsibilities and so on, bringing in elements of your current solution, and integrating everything with the way you work.

The road ahead

As we’ve seen, the next few years could be challenging for risk management teams, with new risks and new ways to manage them. To meet that challenge, the smartest teams are already building the tools and processes they need for rapid reporting, deep insights, and powerful modeling. We’re proud to play our part in helping them prepare for the future.

The infographic below highlights some of the key trends and themes that will affect risk management teams in 2020.

Download as .pdf from here.