Global events and their impact on O&G sector

Current geopolitical tensions and energy security are weighing on the oil and gas sector recovery. However, we believe the lifting of COVID-19 restrictions is nullifying this effect.

- Geopolitical tensions: According to Blackrock’s risk indicator, the geopolitical risk is slightly higher than the historical average. The conflict between Russia and Ukraine and the sanctions against Russia have created an unpredictable environment for the energy market. Meanwhile, China’s military drills around Taiwan have further strained its relationship with the US. These international crises have a chronic effect on the global energy market.

- Energy security: According to the IEA (International Energy Agency), the definition of energy security is the uninterrupted availability of energy at affordable prices. The instability across global economies, triggered by unwarranted issues over the last couple of years, has highlighted energy security as one of the major issues that will likely affect the whole world. For example, European countries that depend on Russian oil and gas are looking for alternative energy sources to boost their supply.

- Ease of COVID-19 restrictions globally: Pandemic is gradually coming to an end. As per recent Worldometer data, daily new COVID-19 cases are continuously decreasing over the last few months. In July 2022, daily new cases stood at ~1.2 million, which came down to 0.5 million by the end of Sep 2022. It has resulted in the opening of economies. Many offices globally have started operating in hybrid mode, thereby increasing the demand for energy.

- Lockdowns in China: China is one of the largest importers of crude oil. With few COVID-19 cases emerging, China has implemented its zero COVID-19 policy, which resulted in lockdowns. It can have considerable effects on crude oil demand and prices in the short term.

- Small glitch in LNG supply in the US: Recent fire at the Freeport LNG facility in Texas has shut down the processing plant, which accounts for ~20% of US LNG processing. It may disrupt LNG demand and supply in the short term.

Outlook for global economy indicates stagflation despite positive O&G output

- Global economic outlook: According to the World Bank June 2022 report, the global economy is expected to fall from 5.7% in 2021 to 2.9% in 2022, which is significantly lower than the estimated 4.1% in January 2022. Also, the forecast for 2022 and 2023 is almost the same. The IMF’s 2022 and 2023 outlook for the global economy indicates stagflation, which means low growth and high inflation.

- Demand and supply: Global oil demand increased to 99.4 MMb/d in August 2022. However, oil demand remained low compared with 100MMb/d in June 2022. Nonetheless, this shortfall is balanced out by a 0.5 MMb/d monthly demand increase in the US. According to a recent OPEC report, oil demand will likely increase by 3.1MMb/d and 2.7MMb/d in 2022 and 2023, respectively. Also, world oil consumption will likely average 102.73MMb/d in 2023, which is above the pre-pandemic level (2019). We believe this increased production in OPEC will boost the oil supply.

- Top growth drivers in 2022 and 2023: Due to increased oil prices, companies are expected to use additional funds to invest in energy transition projects, including decarbonization and green energy solutions, such as carbon capture, utilization, and storage (CCUS). On the other hand, Europe’s pressing need for a natural gas supply will increase the role of LNG in the O&G sector. Electrification will play a crucial role in industrial decarbonization, focusing primarily on oil and gas, cement, iron and steel, and chemicals industries.

- Top growth drivers in 2022 and 2023: Due to increased oil prices, companies are expected to use additional funds to invest in energy transition projects, including decarbonization and green energy solutions, such as carbon capture, utilization, and storage (CCUS). On the other hand, Europe’s pressing need for a natural gas supply will increase the role of LNG in the O&G sector. Electrification will play a crucial role in industrial decarbonization, focusing primarily on oil and gas, cement, iron and steel, and chemicals industries.

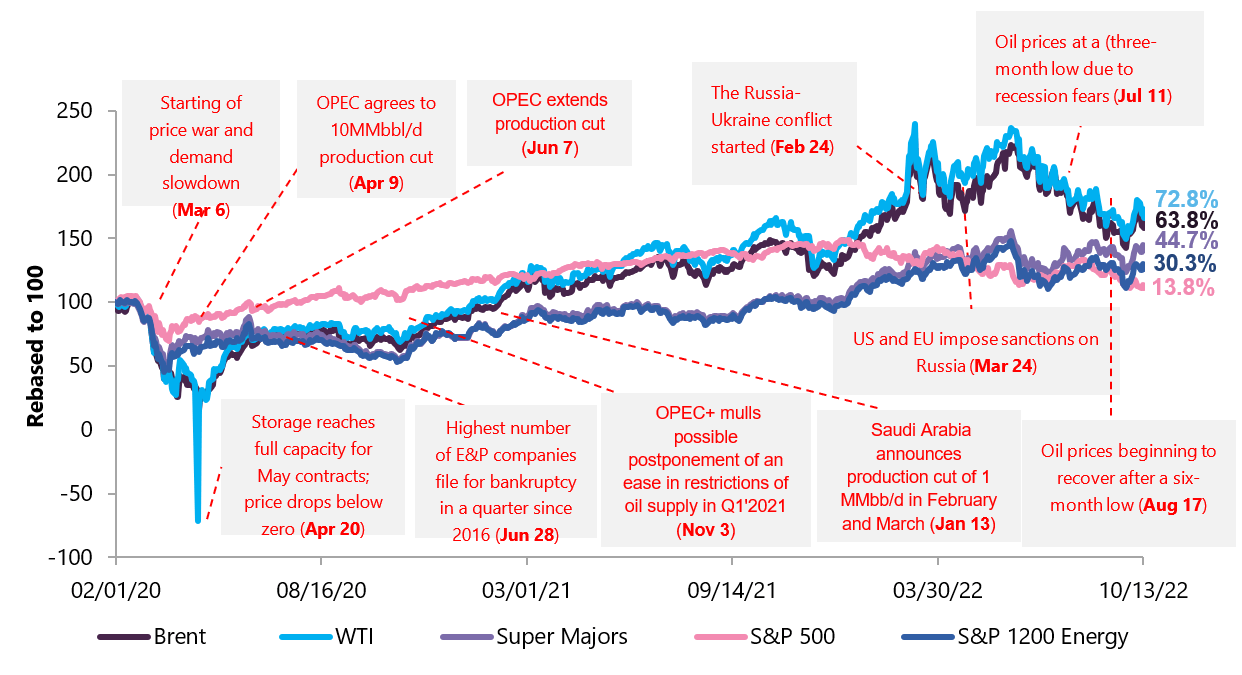

O&G companies slightly outpacing S&P 500 companies

Supermajors versus S&P oil and gas versus S&P 500

Source: FactSet.

Note: Supermajors include Exxon Mobil, Royal Dutch Shell, Chevron, BP, Total, Eni, and Equinor.

Until May 2022, oil prices outpaced the share prices of super majors and S&P indices because of fear of disruptions in demand-supply dynamics due to the ongoing geopolitical tensions.

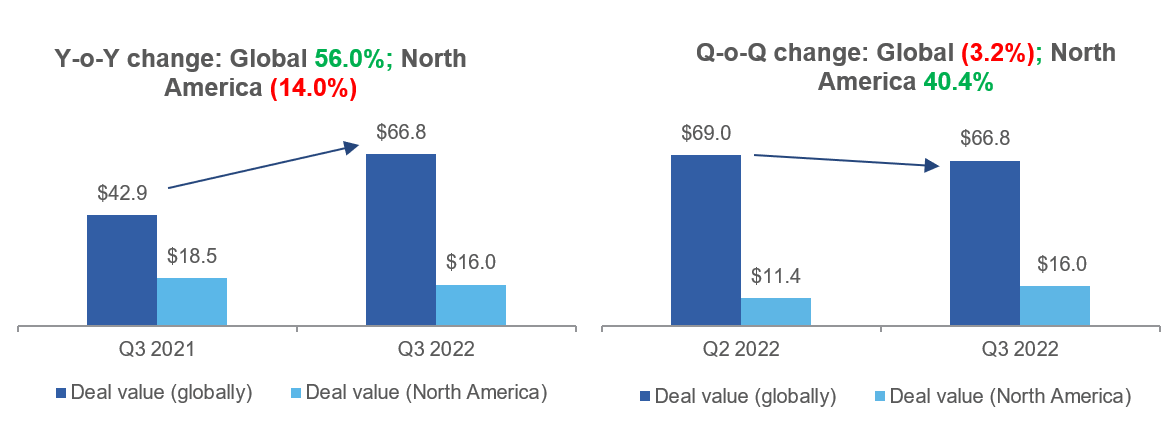

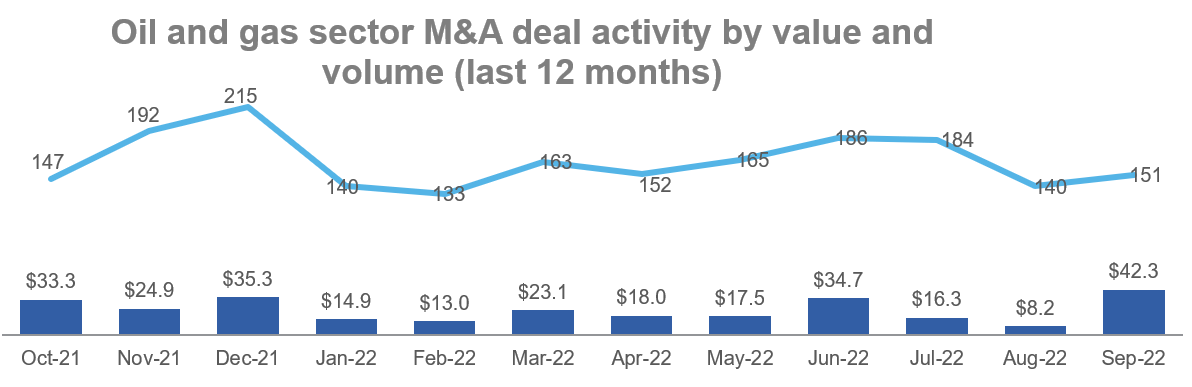

M&A scenario in Q3 2022

Global O&G M&A activity slightly decreased in Q3 2022 amid indication of current global slowdown; however, North American M&A activity is up.

Key deals in Q3 2022 are as follows:

- EQT to acquire the upstream assets of Tug Hill in southwest Appalachia for USD5.2bn

- Sito Royalties and Brigham Minerals to combine in all-stock merger, with an aggregate enterprise value of USD4.8bn

- Devon Energy to acquire Validus Energy for USD1.8bn

- IKAV to acquire Aera Energy from Shell and ExxonMobil for USD4.0bn

- Talos Energy to acquire EnVen Energy Corp for USD1.1bn

|

Source: Globaldata |

Non-traditional factors are shaping M&As in oil and gas sector

Threats from pandemic and geopolitical tensions

Although the pandemic is subsiding, its effects linger. Shortages in the supply chain, ongoing vaccine mandate issues, and China’s ‘zero-COVID-19’ policy are taking a toll on energy demand growth. Although the industry is going through a volatile period, the OPEC forecast suggests a growing oil surplus beginning of Q4 2022

On the other hand, the Ukraine-Russia conflict has cut off oil supplies globally, which increased oil prices. The volatility is driving uncertainty and making it difficult for companies to forecast and make investment plans. The US upstream oil and gas sector witnessed insignificant M&A activities after March 2022, as oil prices shot up due to the Russian invasion of Ukraine. As per GlobalData’s Financial Deals Database, 13 cross-border M&A deals with targets based in Russia or Ukraine were announced before the war. However, their fate is uncertain, and some might get shelved.

Increasing pressure for ESG compliance

ESG is gaining prominence in the oil and gas sector, which is often associated with multiple types of environmental pollution. Most major economies are implementing stringent ESG regulations to tackle environmental pollution and climate change issues. For instance, in November 2021, the EPA proposed a rule that requires oil and gas companies to reduce methane emissions. This rule can reduce methane emissions by 41 million tons by 2035. Furthermore, companies need to show their social commitment by adding value to local communities, exhibiting no gender biases in their workforce, and adopting fair governance processes. In May 2022, the SEC proposed new rules that set up mandatory climate change disclosure and has also expressed its views on keeping a strict eye on ‘greenwashing’ as a priority. It will certainly affect M&As in the energy sector, as companies need to adopt a more transparent process and truly depict their ESG claims.

Increasing interest rates

High inflation has emerged as a common problem across regions as economies re-open and consumers exhibit high spending behavior. There is a demand-supply gap, which is increasing the prices of oil and gas products. Governments across the globe are increasing their interest rates to curb this inflation. The current Federal funds futures prices hint at US interest rates peaking at 3.50–3.75% in Q1 2023, up from 1.50–1.75% in Q2 2022. It suggests a significant cyclical slowdown by the end of 2022. The increasing need for capital for expansion to meet the growing demand amid increasing interest rates is compelling companies/investors to focus only on low-risk investments that will be accretive to their future earnings. As a result, M&A activity could slow down as no one would want to take risks after experiencing difficult times in the last two years.

Development of green portfolios through energy transition deals

Over the last couple of years, investors in oil and gas companies have been demanding more investments in sustainable and resilient assets. Therefore, many oil and gas companies are aligning their long-term strategies with a zero-carbon emissions goal. As a result, the traditional oil and gas market will likely witness an increase in M&A activities, as companies will try to reduce their carbon footprint through relevant partnerships and acquisitions. According to Bain, Shell has sold acreage in the Permian Basin to ConocoPhillips for USD9.5bn as part of its energy transition strategy. LyondellBasell’s JV with Suez (now Veolia) has acquired Quality Circular Polymers, a plastics recycling company, to mechanically convert consumer waste into 25,000 tons of polypropylene and high-density polyethylene annually.

M&A outlook for FY 2022 – Focus is shifting toward green and sustainable portfolio

Oil prices have been surging since the beginning of FY 2022, resulting in a high cash inflow in the sector. However, despite this positive development, factors such as geopolitical tensions, increasing influence of ESG, high inflation, and focus on energy transition are driving M&A activities in the sector.

Consolidation to continue but at a slower pace: The sector witnessed substantial consolidation over the last two years. However, the pace of consolidation is slowing due to higher oil prices. As of now, companies do not need to undertake M&As for survival and scalability. Therefore, they are focusing on fine-tuning their portfolios. However, in Q4 2022, if the geopolitical tensions subside and oil prices become stable, small, and mid-size oil and gas players could play a critical role in consolidation. Furthermore, large players that want to exit their non-core businesses will look for buyers to divest those segments. Key M&A done to signify consolidation in the sector:

- Sito Royalties and Brigham Minerals all-stock merger, with an aggregate value of USD4.8bn

- Targa Resources acquired Lucid Energy Group for USD3.55bn.

- WhiteCap Resources acquired XTO Energy Canada for USD1.47bn.

- Chesapeake Energy acquired Chief E&D Holdings and Tug Hill for USD2.65bn.

Greener operations and stronger ESG assets: Companies are focusing on deals that can help them reduce carbon emissions and meet net-zero emission targets. According to a Deloitte report, ESG-related investments (USD1.7tn) account for ~10% of fund assets across industries globally. However, only 10% of the oil and gas deals in 2021 cited ESG as their key deal rationale or openly communicated their ESG considerations in deals to stakeholders. This is not a big number but given that ESG compliance is not easy to follow in this sector, it is a great start. Companies will likely follow this trend and mold their investment strategies accordingly. One such example is, in June 2022, Chevron acquired Renewable Energy Group for US$3.1bn in cash. The transaction will likely help Chevron in achieving its goal to grow renewable production capacity.

Focus on energy transition or green acquisitions: To decrease the number of carbon-emitting assets in their portfolios, large oil and gas companies plan to acquire or develop renewable energy sources. For example, BP, Eni, Equinor, Total, and Repsol aim to develop 50 GW by 2030, 25 GW by 2035, 12–16GW by 2035, 35 GW by 2025, and 15 GW by 2030, respectively.

- In August 2022, Shell completed the acquisition of renewables platform Sprng Energy group.

- In December 2021, Aker BP proposed the acquisition of the E&P business of Lundin Energy for USD14.0bn. The transaction is characterized by Aker as creating an E&P company that will have high free cash flow, low cost and CO2 emissions, and an attractive growth pipeline.