April 9, 2024

After raising interest rates 11 times in the past two years, the Fed is expected to cut them for the first time (three times in 2024), fueling a surge in equities, bonds, and caution in money markets. While doing so, the Fed may have to strike a balance between managing inflation and maintaining liquidity, originating from an ongoing quantitative tightening (QT).

Key highlights

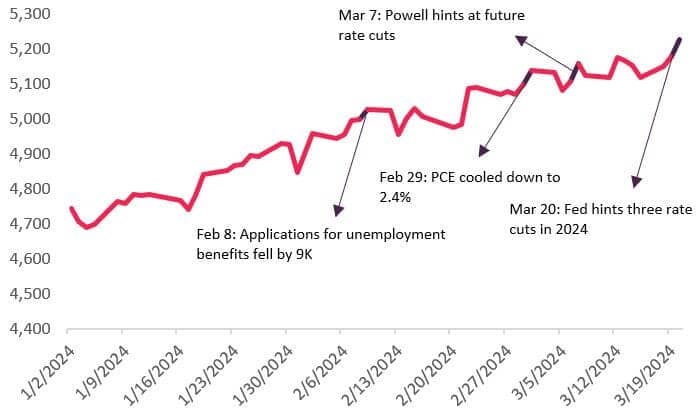

- A strong US economy has led the Fed to consider cutting rates this year after leaving them unchanged at the March FOMC; however, an uptick in core inflation (February) could see a more gradual pace of declines, of which three are expected in 2024. Rate cut expectations have led US stock markets to hit record highs, with the S&P 500 breaching the 5,000 mark for the first time. The index surged 10.2% in the month ending March 2024, outperforming the Dow Jones Industrial Average (DJIA) and Nasdaq Composite Index, which grew 5.6% and 9.1%, respectively (see further details in the index performance table that follows these highlights).

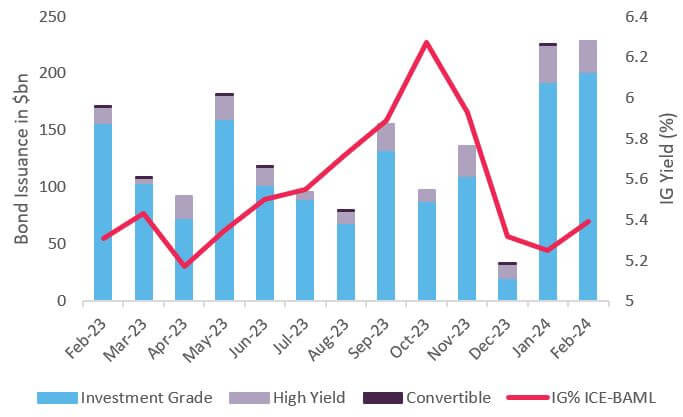

- Investment-grade (IG) corporate bond issuances crossed $200bn for the first time in February, as investors took advantage of a fall in borrowing costs emanating from rate cut expectations. The IG yield averaged 5.4% in February, down from 6.3% in October last year. Markets have been bullish on bond markets, with Goldman Sachs forecasting ~$1.3tn in issuances in 2024, similar levels to those of last year.

- Money market funds, which had become the preferred alternative for investors seeking short-term investments, saw their asset level in 2023 break the $6tn mark for the first time, with yields on these assets rising to 5.4% at the end of last year from 0.02% in 2022. We have seen a fall in asset levels in recent weeks, as the yields that made these assets attractive during a high-rate environment have also fallen. More such declines are expected as we get closer to the anticipated rate cuts.

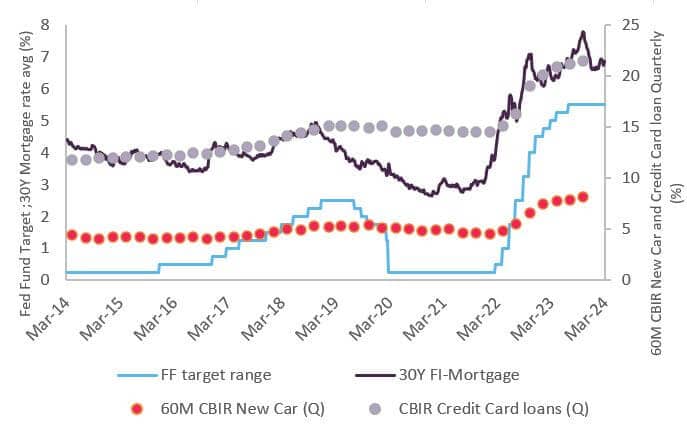

- High interest rates had a particularly adverse effect on consumers, as average interest rates on homes, cars and credit card loans surged over the past two years. The 30Y FI Mortgage Index in October 2023 surged to its highest level since early 2000, although it fell to 6.9% in March 2024 on rate cut expectations. The average interest on credit card loans and auto loans also remained high during this period. We could see a modest decline in average interest rates on consumer loans once the Fed starts to cut rates.

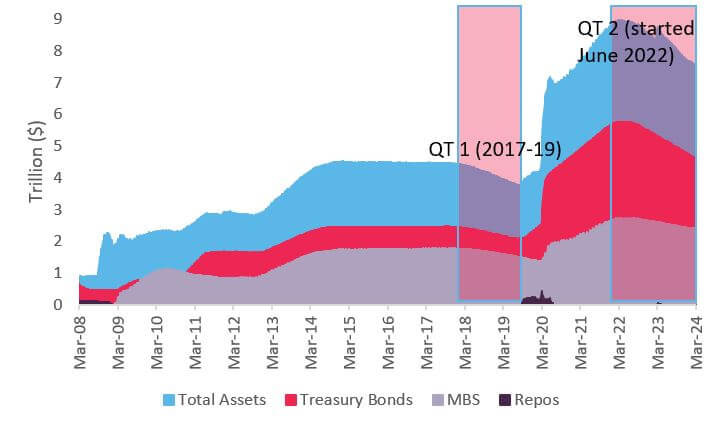

- The Fed may use quantitative tightening (QT) to offset the impact of any rise in prices coming out of future rate cuts. However, it should be noted that the committee has already reduced its balance sheet by ~$1.5tn since June 2022, and any additional tightening could add to liquidity concerns in bond markets, similar to the scenario that occurred in 2017-19. The Fed is treading cautiously, as it is evident from recent testimony that, if necessary, it is willing to slow the pace of withdrawals from the current $95bn/month.

|

|

2023

|

Jan 2024 (YTD)

|

Feb 2024 (YTD)

|

Mar 2024 (YTD)

|

|---|---|---|---|---|

|

DJIA

|

13.70%

|

1.22%

|

3.47%

|

5.62%

|

|

S&P 500

|

24.23%

|

1.59%

|

6.84%

|

10.16%

|

|

Nasdaq

|

43.42%

|

1.02%

|

7.20%

|

9.11%

|

|

Stoxx Euro 600

|

12.74%

|

1.39%

|

3.26%

|

7.03%

|

|

FTSE 100

|

3.78%

|

-1.33%

|

-1.33%

|

2.84%

|

|

Shanghai Composite

|

-3.70%

|

-6.27%

|

1.35%

|

2.23%

|

|

NIKKEI 225

|

28.24%

|

7.45%

|

17.04%

|

20.63%

|

|

Gold

|

13.47%

|

-0.21%

|

-0.82%

|

8.04%

|

|

Oil

|

-10.73%

|

5.86%

|

9.62%

|

16.08%

|

|

Bitcoin

|

153.32%

|

-0.20%

|

45.93%

|

63.85%

|

Performance of major indices in Q1 2024 (YTD)

Note: Refer to the opinion piece Financial Markets Just Delivered a Powerful Reminder by Mohamed A. El-Erian to get a better perspective on how markets across the world have performed in the last year and what is in store for us for the rest of this year.

Rate cut expectations send US equities to record highs

It has been two years since we first reported on this story1 when the US Federal Reserve started to raise interest rates after keeping them at near-zero levels to stimulate growth in the pandemic-hit economy. The Fed left rates unchanged at a 23-year high in the 5.25%-5.50% range at the March 2024 meeting2 after raising them 11 times between March 2022 and July 2023, marking the fastest pace of rate hikes since the 1980s. The committee signaled its intention to slash benchmark rates by a cumulative 75bps this year3, but the pace of cuts could be gradual, as the Fed’s preferred core inflation gauge (excluding food and energy prices) rose to 2.5% y-o-y4 this February from 2.4% in January (remaining higher than the 2.0% target). Markets are betting that the Fed will skip a policy decision in May and possibly cut interest rates by 25bps at its June5 meeting, while some economists speculate that it won’t come until July or even later. “Reducing rates too soon or too much could result in a reversal in the progress we’ve seen on inflation and ultimately require even tighter policy to get inflation back to 2%…But easing policy too late or too little could unduly weaken economic activity and employment.” Fed chief Jerome Powell said in a speech6 while addressing a crowd at Stanford University.

Markets have already reacted to the possibility of rate cuts this year, with the S&P 500 hitting a fresh high on March 20 as the committee outlined its rate outlook for 2024. The index had already hit new highs earlier in March and February (as shown in Figure 1), rising above the 5,000 mark for the first time on upbeat jobs data7 and a strong economy that boosted expectations of a rate cut in the coming months. Although the AI “gold rush” also had much to do with the record index levels, with Nvidia in particular pulling the overall index up on bumper Q4 2023 earnings8. However, statements from the Fed and strong economic data were also closely tied to the overall performance of the broader S&P 500 index.

Description: The S&P 500 breached the 5,000 mark for the first time on February 8 as strong economic data boosted expectations of future rate cuts. Since then, the index has reached new highs on multiple occasions, backed by encouraging Fed testimonies and future rate outlook. Source: S&P 500

Decline in borrowing costs fuel record corporate bond issuances

US corporate bond issuances have also risen to record highs, crossing $200bn for the first time in February 2024 (see figure 2), as major blue-chip firms, including IBM and Capital One9 tapped into the IG bond market. Investors took advantage of a drop in borrowing costs (as shown on the secondary Y-axis in Figure 2), and the tightening of credit spreads stemming from the rate cut expectations. IG index yields averaged 5.4% in February, down nearly 87bps from 6.3% in October last year, according to ICE BAML data. Winnie Cisar, the global head of strategy at CreditSights, has attributed the fall in average IG yields to be the main reason behind the increased demand for corporate bonds, stating, “We always say that supply follows demand. And demand is very strong, which means corporate issuers are going to take advantage of that … So, I think there are a lot of investors looking at current yields and saying, “Hey, this might be the last hurrah, this is my last opportunity before the Fed starts cutting.”10

Goldman Sachs11 has a more bullish outlook on this segment, with its co-head of Global Investment Grade Capital Markets, Eric Jordan, forecasting that the US IG bond market will see $1.3tn of issuance this year, similar to 2023 levels. However, most sales are likely to occur in the earlier part of 2024 to avoid uncertainties coming out of November’s presidential election.

Description: US corporate bond issuance has surged past $200bn (as shown on the primary y-axis) for the first time in February as cheaper borrowing costs, particularly in the form of lower IG yields (as shown on the secondary y-axis), have attracted interest from major corporate giants looking to tap into IG bonds. Source: Securities Industry and Financial Markets Association (SIFMA) and Fred.stlouisfed.org

Higher short-term financing rates push money market fund assets to record highs

Investors have also taken advantage of higher interest rates that drove up yields on money market funds (MMF), whose assets rose to a record ~$6.1tn in the week ending March 13, 2024 (see Figure 3). Investors looking to invest for the short-term preferred MMF over parking their cash in bank accounts, as they provided higher yields and had shorter overnight-to-six-month maturities. Investors also used MMF as a cushion against inflation, which rose to over 40-year highs during the pandemic. High interest rates drove money market yields to 5.4% at the end of last year (as shown on the secondary Y-axis in Figure 3) from 0.02% two years ago; however, expectations of rate cuts this year led yields to fall to 5.27% during the week ending March 20 and MMF assets to decline by $61.9bn during that same week. We could see more declines in asset and yield levels as expectations of rate cuts amplify.

Description: Money Market Fund assets rose to a record ~$6.1tn in the week ending March 13, as short-term yields shot up thanks to high interest rates. Expectations of rate cuts in 2024 have led to a slight decrease in yield levels, which also led to a fall in total asset levels by $61.9bn during the week ending on March 20. Source: Investment Company Institute (ICI) and Office of Financial Research (OFR)

Average interest on consumer loans skyrocketed

High interest rates took a particular toll on consumers, as they had to pay higher interest rates on their home, auto and credit card loans. Mortgage rates remained exorbitantly high last year, with the 30-year fixed rate mortgage averaging ~7.8% in October 2023, its highest level since early 2000. It has since fallen to around 6.9% in March 2024 (as shown on the primary Y-axis in Figure 4) on rate cut expectations, providing some relief to new homeowners. Greg McBride, chief financial analyst at Bankrate, sees rates easing in 2024 but not falling to their pre-pandemic levels. “Mortgage rates will spend the bulk of the year in the 6s, with movement below 6 percent confined to the back half of the year”, said McBride.12

Commercial bank interest rates (CBIR) on credit card loans rose to ~21.5% in the last quarter of 2023 from ~16.6% in March 2022 (as shown on the secondary Y-axis in Figure 4), when benchmark rates were at about 0.25%. The finance rate on new auto loans also continued to rise, with 60-month average interest on new car loans rising to 8.15% from 4.52% during that period. We expect the average rates on car and credit card loans to decline modestly, in line with the fall in mortgage rates, as a decision on rate cuts approaches.

Description: Consumers were badly hit as average financing costs for new homes, autos, and other credit card loans soared after the Federal Reserve started to hike rates in March 2022 after keeping them at record lows in the wake of the COVID-19 pandemic. Although average mortgage rates are slightly down from last year, they are expected to remain above 6% in 2024, providing little relief to new homeowners. Source: Fred.stlouisfed.org

The tightrope between QT and rate cuts

Higher interest on consumer loans directly affects US households, and it has been a top concern for the government and the Federal Reserve. Lower rates would make consumer loans modestly cheaper, but it would also lead to increased money supply, meaning inflation could rise. The Personal Consumption Expenditures (PCE) index has already inched upward (2.5% y-o-y in February), and any further increase due to rate cuts would only exacerbate tensions, especially this being an election year. The Fed is expected to continue with QT, which has already seen ~$1.5tn of bonds being rolled off its asset portfolio since June 2022, compared to $650bn of assets that were withdrawn during 2017-19. The Fed reduced its balance sheet by nearly 15% during QT1, which led to a drop in reserve levels that dried up liquidity in bond markets. Although asset levels have fallen to ~$7.5tn from a record ~$9tn in June 2022 (see figure 5), they remain well above the 2019 mark. Despite significantly higher levels, the Fed is cautious about liquidity concerns, and it does not rule out slowing the pace of QT13, which currently stands at $95bn/month.

Description: The Fed has reduced its balance sheet by $1.5tn since June 2022 and it currently stands at $7.5tn as of March 2024. Comparing this to QT1 during 2017-19 period, the fed had shrunk its asset reserves by $650bn to nearly $4.0tn. Source: Fred.stlouisfed.org

1 Read our blog “All Eyes on the Fed as the March FOMC Meeting Draws Closer” (Evalueserve)

2 Read the March 2024 FOMC statement (US Federal Reserve)

3 Federal Reserve officials still expect to cut interest rates by 75 basis points this year (Financial Times)

4 US inflation ticked higher last month, reversing some recent progress (CNN)

5 Most brokerages stick by forecast of Fed rate cuts starting in June (Reuters)

6 Powell: Fed still sees rate cuts this year; election timing won’t affect decision (Associated Press)

7 February Jobs Report (New York Times)

8 Why has Nvidia driven stock markets to record highs? (The Guardian)

9 US Corporate Bond Sales Hit $188 Billion in Record January (Bloomberg Finance LP)

10 Corporate bonds are in demand amid optimism and declining yields (Marketplace)

11 Capital markets are open, and risk appetite is poised to grow in 2024 (Goldman Sachs)

12 Forecast: Mortgage rates to gradually decline in 2024 (Bankrate)

13 Powell Says It’ll Soon Be Appropriate to Slow Pace of QT (Bloomberg Finance LP)

Talk to One of Our Experts

Get in touch today to find out about how Evalueserve can help you improve your processes, making you better, faster and more efficient.