Introduction

Carbon offsets are offering greenhouse gas (GHG) emission abatement for sectors and industries, with as-yet unavoidable carbon dioxide (CO2) emissions, which are looking to meet their Net Zero 2050 goals. Such participation also brings in much-needed support for climate action projects through carbon finance. This has made participation in the voluntary carbon market (VCM) an alluring option for companies from such sectors, wherein direct carbon removal or reduction solutions are still being developed. The nascent nature and rapid growth trajectory of the VCM as well as the prospects of carbon offset prices increasing in coming years has also prompted some major players to invest in and collaborate with climate action projects as well as carbon offset registries in recent years, triggering a slew of mergers and acquisitions (M&A).

However, as trends from the VCM would suggest, there is no one “silver bullet” or singular solution for all sectors. Added to this is the slight uncertainty over shifting policies, prompting some to wait and watch. Therefore, efforts should be focussed on maintaining a portfolio approach. With the VCM projected to grow in diverse directions as the scopes, project types, technologies, platforms, and solutions expand, there is room for even more diversified opportunities to minimise risk. This could not only prompt consolidation in the markets but also help increase the integration of carbon offsets into industry value chains, potentially opening the door for further M&A activity. We evaluate the status and feasibility of M&A as the route to a stronger presence in the just transition towards decarbonisation.

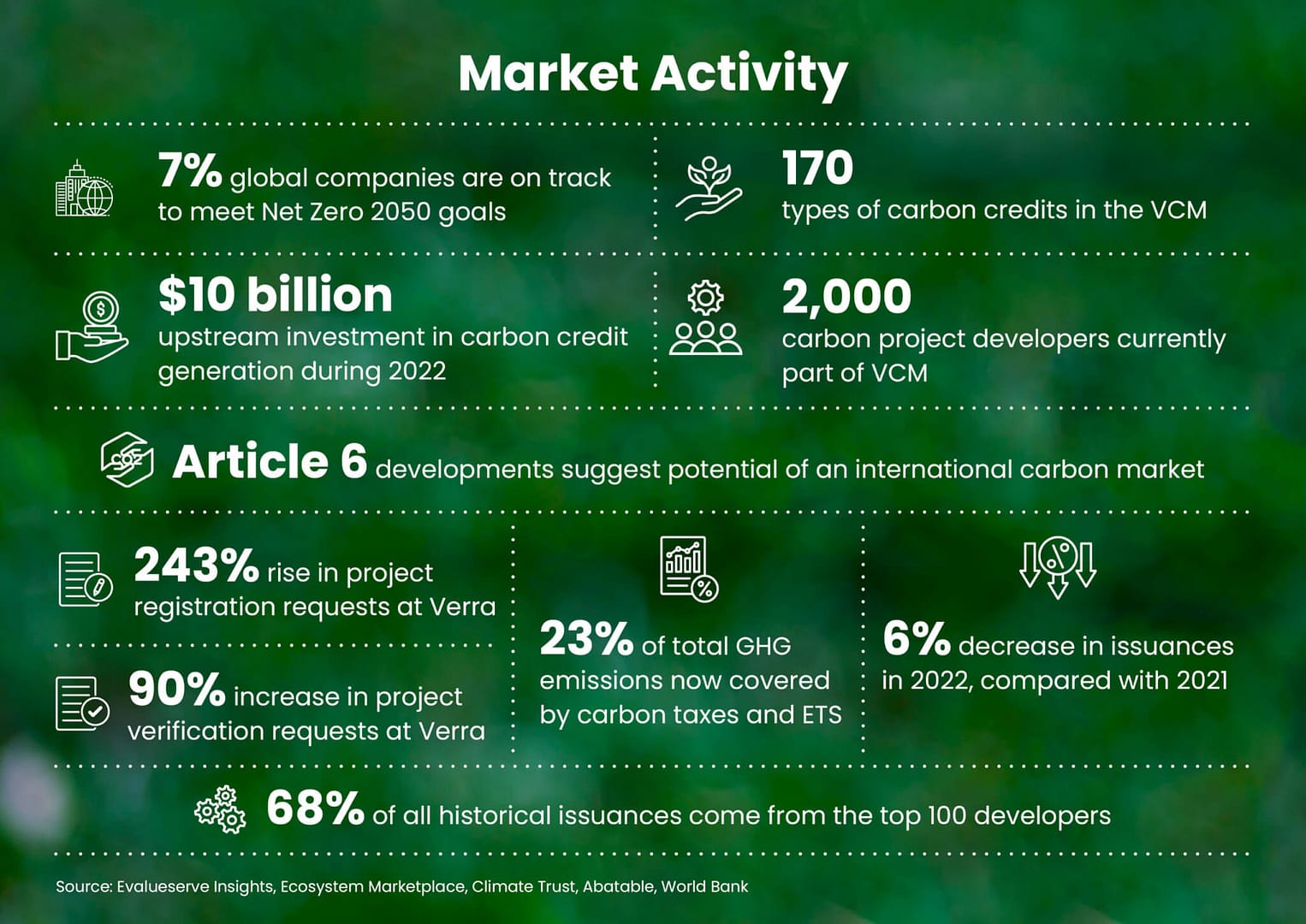

Market Activity

What’s happening?

Consolidation: in one word. The top 15 carbon project developers accounted for a larger share of historical issuances in 2022 than earlier, sending out possibly the first signals of market consolidation.

Global expansions: During 2022, a large number of project developers was seen shifting from country-specific to global operators, through project execution or commencement in new, nearby geographies.

Finance max: 2022 is also being seen as a record year for the number of financing rounds into carbon project developers. This is despite the challenges faced by the VCM over quality levels of certain offsets.

Transparent moves: To tackle the question of quality, various initiatives have been seeking to promote standardisation and increase transparency across carbon markets.

Essentiality: World Bank cites a survey of 500 medium and large businesses across the US and Europe, in which 90% of respondents consider carbon credits essential to offset their unabated emissions.

New entrants: 2022 witnessed a sudden influx of new market entrants as seen from staggering increases in registration and verification requests, which faced a bottleneck of under-preparedness, due to a scarcity of accredited validation and verification service providers. This could have contributed to delays in registrations and credit issuances.

Direct stake: With the demand for carbon credits remaining well above their 5-year average, and growing, investors, as well as project financiers, seem more inclined to take up direct stakes in project development endeavours at an earlier stage.

Why M&A?

Advantages:

- Streamlining scale: M&A activity can consolidate fragmented markets, allowing for larger-scale projects, streamlined operations, and increased efficiency in managing carbon offset portfolios.

- Collaborative expertise: Companies with complementary expertise can join forces, combining their knowledge, technologies, and resources to enhance project development, verification, and trading capabilities.

- Market access: M&A enables companies to access new markets and expand their customer base, driving increased demand and liquidity in the voluntary carbon market.

Challenges:

- Risk of greenwashing: M&A activity may increase concerns about the credibility and integrity of carbon offset projects if not properly regulated and verified. It is crucial to ensure robust standards and independent third-party verification to avoid greenwashing.

- Limiting competition and innovation: Consolidation through M&A can lead to market concentration, potentially limiting competition and innovation in the sector. Care should be taken to promote fair competition and encourage new entrants.

- Volatility and uncertainty: Voluntary carbon markets are relatively young and subject to regulatory changes and market fluctuations. M&A activity may introduce additional uncertainties and risks.

Conclusion

All these indicators during a time of economic issues and geopolitical instability in developed economies suggest the market is ripe for M&A activity. With investors ready to enter earlier in the chain, top developers taking up more room, a flow of excited new entrants, as well as a strong and growing awareness about the need for carbon abatement through offsets, we have many early signs of market consolidation. The time for integration of the carbon offsets across the value chain, particularly for heavy emitters, appears to have come. With these indicators in mind, it would be prudent for them to look at acquiring projects, methodologies, solutions, or services which work in tandem to cater to carbon emissions at each stage of their respective value chains. This would ensure the realisation of their carbon abatement potential in a continuous, consistent, and efficient manner.

Carbon Offset Platform: To tackle these challenges and gain all the advantages of participation in voluntary carbon markets, our team of experts at Evalueserve has developed our very own Carbon Offset Platform. This platform comprises a global database of projects from across various carbon offset registries, which helps you in analysing the best-fit project in terms of abatement as well as economics. To know more about how our Carbon Offset Platform can empower your decarbonisation journey, please connect with our team of experts today.

Get decarbonization publications delivered to your inbox by filling out the form below.