Summary

In a constantly evolving Asset & Wealth Management industry, the client wanted to have a comprehensive view on the digital financial planning, advice, guidance and educational resources/tools that competitors provide and benchmark them with their own capabilities to identify the gaps and subsequently address these gaps.

Evalueserve's Asset & Wealth Management Competitive Intelligence team conducted a detailed competitive benchmarking evaluating the digital financial planning and advice capabilities that competitors offer as a self-service option to its customers. The research aided client in assessing gaps in their capabilities and areas to focus on to bridge these gaps.

The Challenge

The wealth management firm needed a detailed competitive benchmarking to assess the digital financial planning, advice, guidance and educational resources available as part of self-service capabilities. The key challenge was to locate the gaps within its offerings versus its competitors.

Our Solution

Our team conducted a competitive benchmarking analysis comprising of a five-step approach.

Framework

Identified Subject Areas

Drawn Comparison Matrics

Calculated Scores

Benchmarking

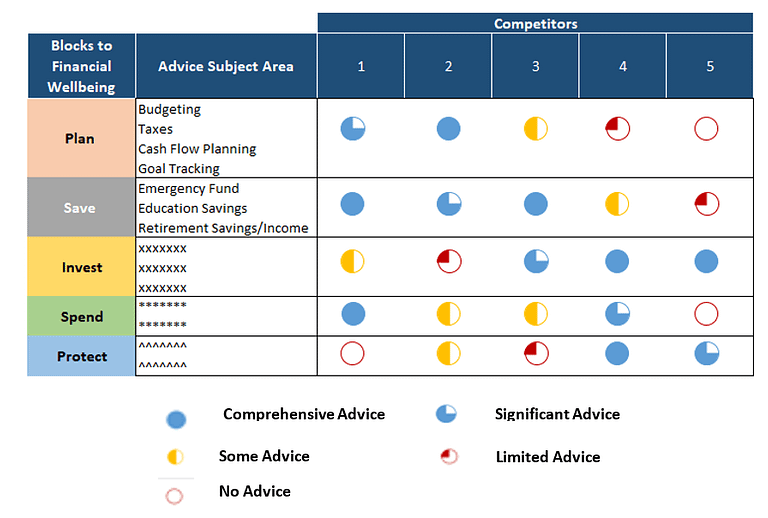

Step 1: Created a framework where we dissected advice given to the consumers basis the dominant need served (cash management, saving/investing, debt, protection, legacy, health and others) and organized into five blocks – Plan, Save, Invest, Spend and Protect

Step 2: Identified Subject Areas – Using the framework, we identified relevant subject areas in each block.

Step 3: Drawn Comparison Matrics – Created a detailed comparison matrix against each subject area, highlighting tools/calculators/diagnostics available and education/guidance/content each competitor offers. This gave a comprehensive view of competitors’ capabilities.

Step 4: Calculated Score based on information gathered against each subject area. Also calculated a consolidated score against each block.

Step 5: Benchmarked each competitors’ score with our client’s score. This step allowed to measure client’s performance and made them understand how they stand against their competitors.

Evalueserve's Competitive Intelligence Solutions for Asset and Wealth Management Firms

Business Impact

- Detailed analysis of competitor’s digital advice, guidance capabilities allowed client to gain an independent standpoint of their performance compared to peers.

- The competitive benchmarking helped the client deep dive into gap areas to identify areas for improvement. In this case, client was able to identify areas they lag. Their digital financial planning and advice capabilities were strong in saving, investing and protection but were lagging in other areas. This helped them focus on building digital capabilities for Planning and Spending blocks.

- The assessment allowed client to determine where they can leverage strength and bolster weaknesses.

Pins:

Gain an independent standpoint of their performance compared to peers

Deep dive into gap areas to identify areas for improvement

Talk to One of Our Experts

Get in touch today to find out about how Evalueserve can help you improve your processes, making you better, faster and more efficient.