The world is abuzz with ESG (Environment, Social and Governance) in public policy, economics and finance. We will focus on the relevance of ESG in finance and try to push the boundary of leveraging the ESG theme further by introducing the idea of going beyond the popular investments in ESG products focused on sectors such as Clean Energy, Urbanization, Electric Vehicles and Diversity. We introduce “ESG Enablers” – those sectors or industries that play a key role in making companies across industries ESG compliant and providing ESG data and analytics needed for high-quality investments in ESG.

ESG Enablers are classified as:

- Data, Rating & Index Services

- Consulting & Auditing Services

- Software, Reporting & Analytics

Both ESG data and index providers play a significant role in the investment decision‑making process. To create ESG-compliant investment products, reliable and transparent sources of ESG data, scores and indexes are required. ESG software providers and analytics services are helping companies and investment firms make meaningful inferences from the data. Reporting and auditing firms are helping companies comply with regulatory requirements, bridging gaps in the framework. These services help implement ESG practices or measure efforts following implementation.

ESG Data, Rating & Index Services:

Asset managers and index providers are increasingly including and upgrading ESG investment products in their investment mandate and product offering. Currently, there are more than 1,000 ESG indexes globally covering various geographies and asset classes. Investment is favoring ESG; ESG revenue growth of 21% was more than double that of the index industry growth of just 10% in 2020.

These products are based on companies’ ESG scores and ratings, which are derived from data on multiple ESG parameters. The demand for high-quality ESG data has led many players to expand and deepen their offerings of ESG data, scores and ratings. As per research firm Opimas, the value of the ESG data market was US$617 million in 2019. With an expected annual growth rate of 20% for ESG data and 35% for ESG indexes, the market could approach US$1 billion in 2021.

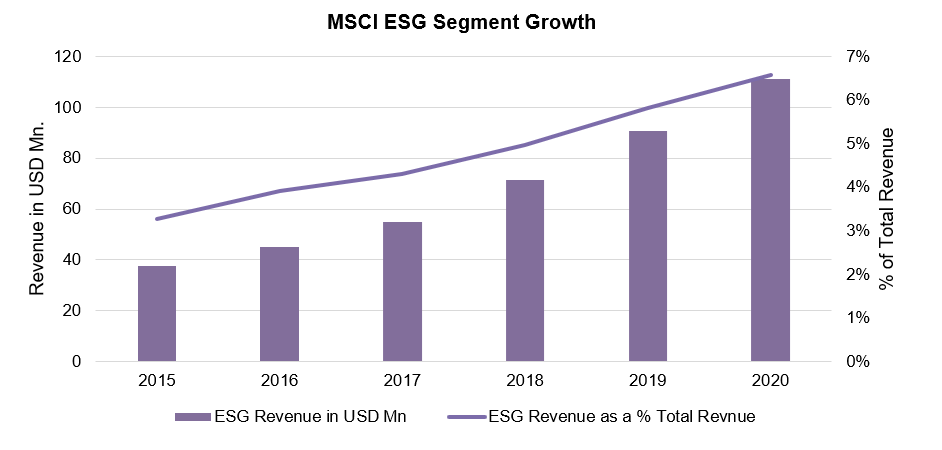

Several index and market data providers have diversified their service offerings to include ESG data and related products. Many index and data providers have taken the merger & acquisitions route to quickly scale their ESG business. Some examples include MSCI’s acquisition of GMI Ratings, Morningstar’s acquisition of Sustainalytics and SPDJI’s acquisition of Sam Robecco. These acquisitions have proven to be a smart business decisions. MSCI’s revenues from its ESG segment have grown consistently, registering 20% annual growth since 2016. In 2020, ESG revenues constituted more than 6% of MSCI’s total revenue.

Source: MSCI Annual Reports

ESG Consulting & Auditing Services:

Companies need ESG consultants to satisfy ESG-related regulatory disclosures and reporting requirements, integrate an ESG framework into their daily activities, and make actionable plans. Therefore, many consulting firms have started offering specialized ESG services including advisory, certification, and auditing. As per a global survey of managers and senior executives on company ESG practices conducted by NAVEX Global, 64% of respondents said their company increased its focus on ESG in 2020, and a similar number (63%) said their companies were planning on increasing spending on ESG in 2021.

ESG Software, Reporting & Analytics:

ESG-specific software and analytics are employed for portfolio construction, stress testing, reporting, risk and performance attribution. Moreover, these provide tools to highlight ESG risk, gaps and peer comparison and to offer recommendations on improving ESG score and perception.

Consequently, many ESG data providers are introducing analytical services. On the other hand, core analytics companies have started offering ESG analytics. According to a recent report, the ESG software, reporting, and analytics market was valued at US$ 489 million in 2020 and is projected to reach US$ 1,496 million by 2028, a CAGR of 15.4%.

Conclusion

ESG is expected to grow more rapidly in the foreseeable future. Currently, ESG‑related products available in the market are based on ESG scores and/or individual ESG themes (water, solar energy, gender parity, etc.) or a combination of themes (green energy/clean tech, etc.). In our view, there is a large, untapped thematic investment opportunity in ESG Enabler companies. Index/ETF providers stand to gain by developing products centering on ESG Enablers, independently or in combination with other ESG themes.

Evalueserve’s Index & Quant division works with financial services clients to support their ESG mandates by offering ESG research services for novel investment products and ESG index calculations and production services.