ETFs Hit a Historic High: What It Means for the Future of Investing

Explore the U.S. ETF industry’s historic achievements in 2025, including record inflows, trading volume, and new product launches, signaling a shift in modern portfolio strategies.

Explore the U.S. ETF industry’s historic achievements in 2025, including record inflows, trading volume, and new product launches, signaling a shift in modern portfolio strategies.

Discover how UAE wealth growth is reshaping markets and attracting global investors with unique tax policies.

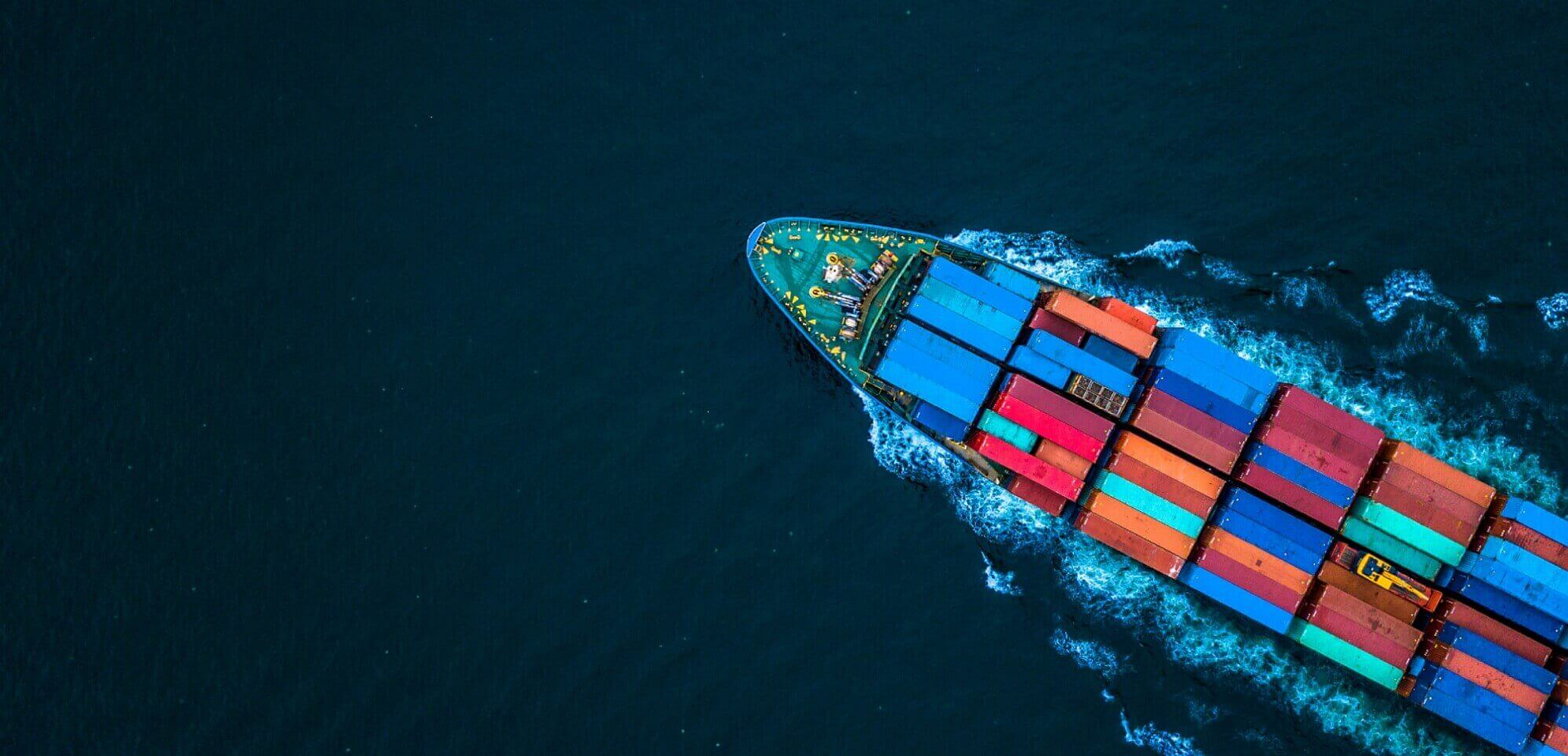

Trade confirmation is the backbone of accurate and compliant transactions. Evalueserve ensures every trade is verified with precision, helping firms reduce risk, avoid disputes, and trade with confidence.

The global OTT industry is entering a new era of consolidation and reinvention. Giants like Netflix, Amazon, and Disney are reshaping

Corporate actions are significant company-initiated events—such as mergers, acquisitions, stock splits, and dividends—that impact shareholders, stock prices, and regulatory obligations. Staying informed and compliant is essential for accurate investment decisions.

Discover how a leading North American bank streamlined portfolio monitoring and annual reviews with scalable, tech-aligned support—accelerating turnaround times and freeing portfolio managers to focus on client relationships

Discover Dr. Anna Slodka Turner’s practical approach to generative AI—cutting through hype with problem‑led design, strong governance, and real business impact. Her insights show how organizations can turn AI from a trend into a truly transformative capability.

A leading Canadian bank streamlined its U.S. expansion by partnering with Evalueserve for financial spreading and data integration support, improving data quality, reducing migration costs, and enabling teams to focus on higher‑value credit and risk decisions.

Investment operations support ensures accurate trade processing, position tracking, and cash management, forming the operational backbone of effective fund management.

From late-night print deadlines to digital-first delivery, desktop publishing has transformed how investment research is produced, reviewed, and shared.

Private equity is entering a new phase where operational alpha, AI-enabled insights, and data-driven strategies are redefining value creation amid macro uncertainty and longer hold periods.

See how automation and optimized workflows delivered 30–40% cost reduction for a leading investment manager with over $50B in AUM.

Discover how a major exchange modernized index operations through advanced technology and process improvements, enhancing scalability and performance.

Collateralized Loan Obligations (CLOs) bundle loans into structured tranches tailored to different risk profiles. With SPE protection, active management, and a clear life cycle—from warehousing to amortization—CLOs play a pivotal role in structured finance and market liquidity.

Explore the future of ESG investing by discovering emerging markets and their vital role in sustainable portfolio innovation.

Private equity involves acquiring and strengthening privately held companies to create long-term value. PE firms invest capital, improve operations, and drive strategic growth to enhance business performance before exiting through a sale or IPO.

RFPs have shifted from routine tasks to strategic tools that influence client relationships and growth. As complexity rises and teams face tighter deadlines, it’s time to explore a smarter, more efficient way to manage them.

Agentic and gen AI are redefining private equity operations, helping firms overcome structural market challenges and execute with speed and precision. By embedding AI into workflows with strong governance and human oversight, leading firms are achieving efficiency gains of up to 30%, freeing analysts to focus on strategic judgment and improving decision quality.

Learn how private credit is transforming asset management and driving stronger returns, resilience, and diversification across an evolving global investment landscape.

Private capital transformation 2025 is driven by evergreen funds, thematic strategies, and Europe’s deal revival, opening new avenues for investors.

Q3’25 saw bold financial services consolidation, strong equity issuance, rising private credit, and transformative global capital market activity.

Global DCM activity surged in 9M’25, hitting record highs with strong investment-grade, high-yield, and green bond issuance growth.

Healthcare investment surged in Q3 2025, with renewed deal activity, rising AI adoption, and strong interest in digital health and biotech.

Get up to speed on how European investment research is evolving — from CSAs and AI-powered research to the new premium on corporate access — with insights from Unbundling Uncovered London.

Evalueserve is proud to be named “Research Solution of the Year” at the Private Equity Wire US Awards 2025, recognizing our leadership in technology-enabled research and analytics. This award underscores our dedication to empowering private equity firms with deeper insights, greater efficiency, and a competitive edge in a dynamic market.

Collateralized Loan Obligations (CLOs) offer significant advantages to investors, such as diversification, risk-return optimization, and enhanced yield. Evalueserve provides a comprehensive

Evalueserve partnered with a leading North American bank to scale FIG counterparty credit reviews, accelerating turnaround and strengthening consistency aligned with internal governance. By combining specialized domain expertise with an optimized global delivery model, the bank achieved ~50% lower per-review costs without compromising quality.

Risk.net highlights how Evalueserve is transforming cyber underwriting through generative AI and probabilistic modeling, enabling insurers to assess risk faster and more accurately. By automating data extraction and analysis, Evalueserve’s platform empowers underwriters to make smarter decisions in minutes instead of days.

rivate markets in 2025 show growth in private credit, equity, and infrastructure, driven by diversification, innovation, and sustainable investment strategies.

Discover how Evalueserve is using AI to transform financial services—from private equity screening to credit decisioning, risk assessments, and index strategies. These powerful use cases are helping clients accelerate workflows, improve accuracy, and unlock higher-value opportunities.

Traditional credit monitoring often reacts too late — missing crucial borrower risk shifts. Discover how Evalueserve uses generative AI to create real-time, auditable risk signals, automate data curation, and empower credit teams with proactive, intelligence-led decision-making.

Evalueserve helped a global financial institution restore mortgage model accuracy with unified data, evidence-based recalibration, and stronger governance—improving run reliability, boosting analytics trust, and shortening approvals for faster decisions with control and precision.

Explore how Agentic AI’s transition to production in private equity enhances research efficiency, targeting precision, and auditability through agentic AI and expert oversight.

From traditional trade calculations to a dynamic KPO model, middle office operations outsourcing now drives transparency and efficiency. Evalueserve empowers financial institutions with expert-driven, technology-powered solutions across trade operations, accounting, reporting, and more.

This month’s highlights cover private credit growth, continuation funds, carve-out momentum, and AI’s impact—key signals shaping private equity opportunities and risks in 2025.

A U.S.-based boutique investment bank sought end-to-end M&A advisory support to divest a portfolio company. Targeted buyer identification, strong deal documentation, and financial analysis streamlined sourcing and sped up closure.

In H1’25, the global financial services market grew steadily, fueled by digital innovation, ESG, and M&A. Emerging markets gained momentum, while investor confidence in banking, insurance, and fintech drove sector outperformance.

Global IPOs in H1 2025 highlighted fragmented momentum with strong proceeds growth despite fewer deals. Asia-Pacific, led by Greater China, drove listings, while the Americas showed late recovery and EMEIA slowed. Investors are favoring quality IPOs, reshaping market dynamics and sector leadership.

The private equity landscape in 2025 reflects both turbulence and opportunity. While fundraising and exits remain challenging, firms are leveraging AI, ESG, and infrastructure to enhance resilience. Private credit and continuation funds emerge as critical levers to navigate uncertainty.

Explore how credit memo automation can transform workflows and improve efficiency in financial institutions by leveraging AI.

See how Evalueserve enabled a leading global investment bank to boost accuracy, transparency, and compliance in index verification—validating 6,000+ indices daily across multiple asset classes with speed and precision

Global healthcare M&A in H1’25 slowed amid volatility and valuation gaps, with focus shifting to mid-market deals, portfolio reshaping, and data-driven strategies.

In H1’25, global M&A values climbed 33% despite a decline in deal count, debt capital market activity hit a record USD6.4 trillion, and equity markets reached a four-year high, driven by strong US and APAC contributions.

Predictive analytics is revolutionizing private equity by enabling firms to uncover investment opportunities with greater precision. By leveraging AI and machine learning, PE firms can forecast potential returns, enhance valuations, and stay ahead in a competitive landscape.

Explore how a leading private equity firm partnered with Evalueserve to scale early-stage investment research using generative AI—achieving faster insights, broader coverage, and transformative impact across key investment teams.

Private equity and private credit markets are adapting to global volatility with a strong pivot toward secondaries, AI infrastructure, and continuation vehicles. As fundraising remains tight and exits delayed, firms focus on operational excellence, data readiness, and sector convergence to deliver returns and future-proof portfolios.

Join our webinar to discover how Gen AI is transforming credit risk management in the financial services sector.

Learn how modern consultant databases are revolutionizing data management with automated aggregation, AI-driven insights, and enhanced security, ensuring companies thrive in the digital transformation era.

Check out key takeaways from our discussion with risk leaders in NYC on navigating market volatility, AI disruption, and increasing system complexity.

Much like the #FreeBritney movement that drew widespread millennial support, a similar groundswell is building to end the federal conservatorship of Fannie Mae and Freddie Mac. With Wall Street voices like Bill Ackman leading the charge, this movement echoes the desire to return control to private hands, nearly two decades after the 2008 crisis.

AI-powered research and portfolio management for private credit. Enhance due diligence, risk assessment, and reporting with expert-driven solutions.

Boost efficiency in private markets with tailored tech, AI-powered tools, and expert-driven accelerators for smarter decisions and faster ROI.

Streamline investment operations with AI-powered support across trade, middle, and back office. Drive efficiency, reduce risk, and maximize portfolio value.

Discover how a top 5 U.S. bank boosted credit innovation and efficiency by partnering with Evalueserve to scale financial spreading support.

Great fund marketing is more than data—it’s storytelling. Discover how asset managers can craft impactful content, align messaging across channels, and use technology to connect with investors more effectively.

Fund marketing is undergoing a digital transformation. With AI and analytics, asset managers can craft personalized content, forecast market trends, and engage investors more meaningfully. From automated factsheets to predictive insights, discover how these technologies are reshaping the future of investor communications.

Discover innovative fund marketing strategies to enhance investor engagement through digital transformation, omnichannel communication, and personalized experiences.

Explore strategies to streamline fund marketing with process re-engineering, automation, and collaboration for faster, compliant, and impactful investor communication.

This edition highlights private markets’ rebound in Q1–Q2 2025, growing momentum in infrastructure and private credit, and ESG’s deeper integration into PE strategies.

Check out key takeaways from our discussion with leading banks in London on navigating the new AI efficiency frontier.

Learn about the strategic importance of mergers and acquisitions in the evolving US retirement market, highlighting the benefits of operational excellence, technological advancement, and data intelligence.

Nordic lending is shifting fast—private credit surges, ESG evolves, and digital tools gain ground. Read Dan’s blog to see what’s driving change in 2025.

Discover how retirement providers are tackling rising costs and industry challenges through digitization, offshoring, and outsourcing to streamline operations and maintain competitiveness.

The global healthcare market witnessed slowdown in deal activity in Q1’25 as dealmakers continue to navigate the current challenging market environment.

Elevate your fund marketing with Evalueserve’s five-step process, ensuring high-quality, compliant marketing collaterals that attract and retain investors.

Check our latest blog for key insights from the 2025 Frankfurt Loan Market Seminar on lending trends, policy shifts, and sector outlooks.

In Q1’25, the global financial services sector showed resilience amid inflation and geopolitical tensions, with strong M&A activity and a shift towards bonds and commodities for stability.

Discover the anticipated trends and pivotal changes in the US mortgage market for 2025, highlighting key risks and opportunities for lenders and investors.

Private market investing is evolving rapidly. From record-breaking co-investment capital to rising private credit secondary sales and a mega AI-driven VC deal, 2025 is shaping up to be a transformative year.

Explore the Q1’25 financial landscape with a focus on M&A, DCM, and ECM activities, revealing notable increases in deal value and market resilience.

Discover the diverse opportunities in the retirement sector, from innovative products to holistic financial wellness programs.

As ESG investing becomes mainstream, asset managers face growing pressure to align with sustainability goals. From stricter regulations to greenwashing risks and the need for operational excellence, this blog explores how firms can adapt their strategies to thrive in an increasingly ESG-focused investment landscape.

Learn about the transformative journey of the A&WM industry and how leveraging innovative technologies can drive productivity, optimize performance, and secure a competitive edge.

Explore how Portfolio Reassessment can help asset managers adapt to new challenges in a dynamic investment landscape.

Explore how personalized marketing in asset and wealth management, powered by generative AI and data analytics, can enhance investor engagement and drive sustainable growth in a competitive landscape.

Read our blog to uncover the key takeaways from the Digital Banking CEE Summit 2025, where industry leaders shared how banks in Central and Eastern Europe are accelerating digital transformation. From AI adoption to next-gen payments and operational agility, explore the trends reshaping the region’s financial landscape.

Discover the importance of mobile optimization for asset managers, ensuring seamless user experiences on smartphones to drive business growth and meet modern consumer expectations.

Check out key takeaways from our discussion on navigating tariffs and policy changes from our recent NYC and Toronto Executive Exchanges.

April’s edition delivers powerful insights on the global private equity landscape—rising deal volumes in Europe, megadeal momentum in Asia-Pacific, infrastructure investment rebounds, and strategic pivots in private credit.

Uncover how a leading bank in Saudi Arabia partnered with Evalueserve to revolutionize its data architecture, enhancing performance and reducing costs with the Denodo Platform.

Discover key market trends, the impact of higher interest rates, and strategic opportunities shaping 2025.

Explore the transformation of research distribution at a top investment bank with Insightsfirst, offering advanced search, interactive visualizations, and real-time insights for improved efficiency and engagement.

Evalueserve is excited to sponsor the Exchange Conference 2025, reinforcing our continued commitment to the index and quantitative investment community.

Read our blog to learn what generative AI can and cannot accomplish in a SAS to Python migration.

Explore the impact of new tariffs on North American trade, businesses, and diplomatic relations, as steep import duties strain economic partnerships and risk further inflation and market instability.

Discover how a government entity optimized spending and prevented budget overruns with a GCP FinOps Dashboard, enhancing cost visibility and supporting digital transformation initiatives.

Learn the significance of accessibility in PowerPoint and how to create universally accessible presentations that communicate successfully to diverse audiences.

Uncover the benefits of migrating to Google Cloud Platform for a major financial services firm, including superior uptime, faster queries, and enhanced security, all achieved through a meticulously planned strategy.

The 2024 financial services market witnessed a resurgence in M&A activity, driven by interest rate cuts, investor optimism, and strategic deal-making.

Explore how our AI-driven solution transforms the underwriting process for a prominent US cyber insurance provider.

Explore the 2025 outlook for private markets, including investment trends, private credit growth, sustainability strategies, and AI-driven value creation in private equity.

Lifetime income solutions like annuities are gaining traction as plan sponsors ensure retirees have stable, predictable income. This article covers key adoption drivers, regulations, and evolving products.

Discover the future of Asset & Wealth Management in 2025. Find out how technology impacts efficiency and revenue streams.

Discover the ongoing liquidity challenges in the banking system, driven by high mortgage rates and tight liquidity, as QT is expected to conclude by mid-year.

Global IPOs in 2024 showcased resilience and reinvention, with strong performances in the Americas, EMEIA, and India, while Asia-Pacific navigated a challenging yet promising landscape.

FY’24 was a pivotal year for investment banking, with M&A deal value rising 10% to USD 3.2T, record debt market activity, and a resurgence in equity capital markets.

In 2024, investors continued to view the healthcare sector in terms of its historical status as a “go-to” market amidst uncertainty and engaged in ‘big ticket’ deals, highlighting the industry’s resiliency and value creation.

Generative AI is revolutionizing credit risk management by boosting efficiency and decision-making. In our latest blog, we share key takeaways from our panel at RiskMinds International.

Amid rising geopolitical tensions and economic uncertainties, businesses face increasing pressure to balance sustainability with profitability. Discover how companies are adapting their ESG strategies in response to global political and economic shifts.

The private equity landscape in 2024 is marked by the growing prominence of secondaries, innovative liquidity solutions, and technological advancements like GenAI. As the industry adapts to macroeconomic challenges, trends such as expanded deal structures, strategic exits, and ESG integration are shaping its future. Explore key insights and projections for 2025.

Stay ahead in the lending industry by exploring the latest trends, industry themes, and market updates in this newsletter.

Check out key takeaways from our discussion on AI & transformation in financial institutions at our Executive Exchange in New York.

Discover the concept of double materiality and its significance for asset managers. Learn how integrating ESG factors can enhance risk management and create long-term portfolio resilience.

PowerPoint design plays a critical role in investment banking by simplifying complex data, enhancing communication, and building credibility. From pitching to due diligence, impactful visuals and clear formatting drive decision-making and successful deal outcomes.

Understand the growth and trends in the private banking market, driven by wealth accumulation, globalization, and advancements in technology.

The private equity sector faces challenges as interest rates rise, slowing deals, while potential rate decreases may boost buyouts and valuations. Stay strategic amid shifting dynamics.

Private and public equity offer unique benefits: private equity drives long-term value, while public equity provides liquidity and transparency. Learn how blending both enhances portfolio performance.

The private equity landscape is evolving with advanced CRM tools. Learn how these platforms centralize data, automate workflows, and provide actionable insights, transforming deal management and investor engagement for growth-driven strategies.

Explore private equity trends for 2024: ESG integration, asset-based finance, AI-driven private credit, and future strategies shaping the industry.

Discover how InsurTech is transforming insurance with AI, ML, Blockchain, and IoT, driving innovation and personalization from underwriting to claims.

Read our client story to discover how Evalueserve helped a leading private credit firm transform its portfolio monitoring capabilities through custom solutions.

In Q3’24, the financial services sector witnessed broad-based recovery which was majorly driven better economies, interest rate reductions, and better than expected corporate earnings

India’s data center ecosystem is evolving rapidly, driven by 5G adoption, OTT services, digital healthcare, and financial innovations. Discover the factors shaping this growth and how India is positioning itself as a global digital powerhouse.

AI excels in speed, but human designers ensure creativity, trust, and security. Explore the perfect balance for high-stakes presentations.

Discover the key trends shaping the US recordkeeping industry in the context of declining fees and rising operational costs. Learn how cross-selling can diversify revenue sources and ensure long-term success.

Read our latest expertly curated newsletter to stay informed on news and trends shaping the dynamic private markets industry.

Executive Exchange events provide an unparalleled opportunity for senior executives to connect, share insights, and explore innovative ideas in a relaxed setting.

Explore the benefits and challenges of earnouts in M&A transactions, and understand why excluding them from deal valuations can provide a clearer representation of the true cost to acquirers.

Discover the resurgence in investment banking and advisory firm revenues in 9M’24, driven by improved market conditions and a strong pipeline for M&A and debt capital markets.

In Q3 2024, investors continued to view the healthcare sector in terms of its historical status as a “go-to” market amidst uncertainty and engaged in ‘big ticket’ deals, highlighting the industry’s resiliency and value creation.

RPA For Risk Model Management

Market Intelligence

Financial Spreading

Competitive Intelligence

Sector & Account Intelligence

MICI For Asset & Wealth Management

CI for Management Consulting Firms

Knowledge Management

ESG Intelligence for Asset Managers

Fund Marketing & Digital Marketing

Intellectual Property Strategy

Intellectual Property Management

MICI for Real Estate

Sector & Account Intelligence

MICI for Asset & Wealth Management

CI for Management Consulting Firms

ESG Intelligence for Asset Managers Fund Marketing & Digital Marketing Intellectual Property Management MICI for Real Estate

ESG Controversy Monitoring for Asset Managers

Patent Analysis

RPA For Risk Model Management

© 2026 Evalueserve. All rights reserved.