Future Minerals Forum 2026

Evalueserve is proud to sponsor the Future Minerals Forum 2025 in Riyadh, January 13–15, a global gathering that shapes the future of mining across Saudi Arabia and beyond.

Evalueserve is proud to sponsor the Future Minerals Forum 2025 in Riyadh, January 13–15, a global gathering that shapes the future of mining across Saudi Arabia and beyond.

Explore the shift from traditional to zonal vehicle architectures and how it’s transforming the future of mobility for OEMs, suppliers, and the broader ecosystem.

Learn how a leading Oil & Gas firm gained complete Scope 3 visibility, improved reporting credibility, and built internal sustainability capabilities through a structured partnership with Evalueserve.

In this powerful episode of Decisions Now, Erin Pearson sits down with Melanie Courtright, CEO of the Insights Association, to explore how AI, massive data shifts, and evolving buyer expectations are transforming the insights and analytics industry.

Join us at the RefComm Expoconference 2025 to discover technical drivers for upgrading coking units and boosting profits.

A premier gathering of pharmaceutical leaders exploring how AI, cross-functional collaboration, and data-driven strategies are shaping the future of the pharma industry.

In this episode of Decisions Now, Erin Pearson sits down with Dr. Rob Handfield to explore how companies can strengthen supply chains amidst rising global trade uncertainties. From stress testing and AI integration to nearshoring and tariff workarounds, learn how leading firms are preparing for the unpredictable.

In this episode of Decisions Now, Charlie Render shares how businesses can move beyond AI experiments to full-scale implementation. He discusses key success factors, measuring ROI, and balancing innovation with responsible AI governance.

How can businesses balance technical innovation with a human-centered approach to energy transition? In this episode of Decisions Now, Erin Pearson speaks with Marine Cornelis, an expert in energy fairness and sustainability, about how companies can foster trust while implementing AI-driven energy solutions.

An unparalleled platform for industry leaders, government stakeholders, and global companies to discuss the future of mining in Saudi Arabia and beyond.

Discover the growth and challenges of Europe’s GH2 project pipeline. Learn about the potential impact on global hydrogen production.

Learn how Evalueserve’s comprehensive approach helped an industry-leading energy company improve its pricing, product bundling, and sales strategy, leading to significant business impact.

Leveraging data and analytics to identify the right target audience and tailor marketing efforts.

Celebrate Earth Day 2024 by integrating sustainability as a fundamental value in your business and implementing comprehensive strategies for environmental protection and prosperity.

Explore the transformative power of ESG disclosure in driving corporate accountability, fostering informed investment decisions, and improving access to capital.

Explore the potential of clean hydrogen as a sustainable energy solution. Learn about green and blue hydrogen production methods, environmental benefits, and its applications in various industries.

In this webinar, join decarbonization experts, Gauraveet Singh and Tarik Arora, as they share insights on emerging hotspots of activity, regional leaders and laggards, and all you need to know on new regulations for your sector.

Clarios, a leading global battery producer, was looking to make more informed decisions around commercial strategy, inventory build-ups and capacity planning. They chose to implement Insightsfirst to facilitate such strategic decisions.

Discover how Evalueserve’s macrotrends tracker and competitor intelligence monitor empowers energy industry players to navigate disruptions and seize opportunities in a dynamic market.

Explore the future of cleantech solutions driving the clean energy transition, empowering global industrialization, and supporting Net Zero 2050 goals.

Explore the US Securities and Exchange Commission’s proposed rule for climate-related disclosures, including Scope 3 emissions reporting, reactions from industries, and potential scenarios. Stay ahead in the journey to net-zero emissions.

How does upgrading the power grid affect transitioning to clean energy and meeting Net Zero 2050 goals without compromising energy security? What solutions can address this?

Explore the global shift towards renewables as clean energy investments surge, transforming the energy landscape and driving the emergence of new leaders in sustainable technologies.

Explore the factors driving the growth of solar PV technology and its role in the global energy transition. Learn about policy, efficiency, and supply chain challenges in achieving a sustainable future.

Explore top insights on the rapidly growing voluntary carbon market, its trillion-dollar potential, emerging trends, and how it supports global decarbonization efforts towards Net Zero 2050 goals.

Explore the growing voluntary carbon market and its potential for M&A activity, as companies seek to meet Net Zero 2050 goals and integrate carbon offsets into industry value chains for a sustainable future.

Explore how Evalueserve assists clients in navigating the growing voluntary carbon market, helping them stay updated on policies, investments, and long-term carbon offset projects.

Explore the growing demand for nature-based solutions and voluntary carbon markets, as industries aim to meet Net Zero 2050 goals and reduce greenhouse gas emissions.

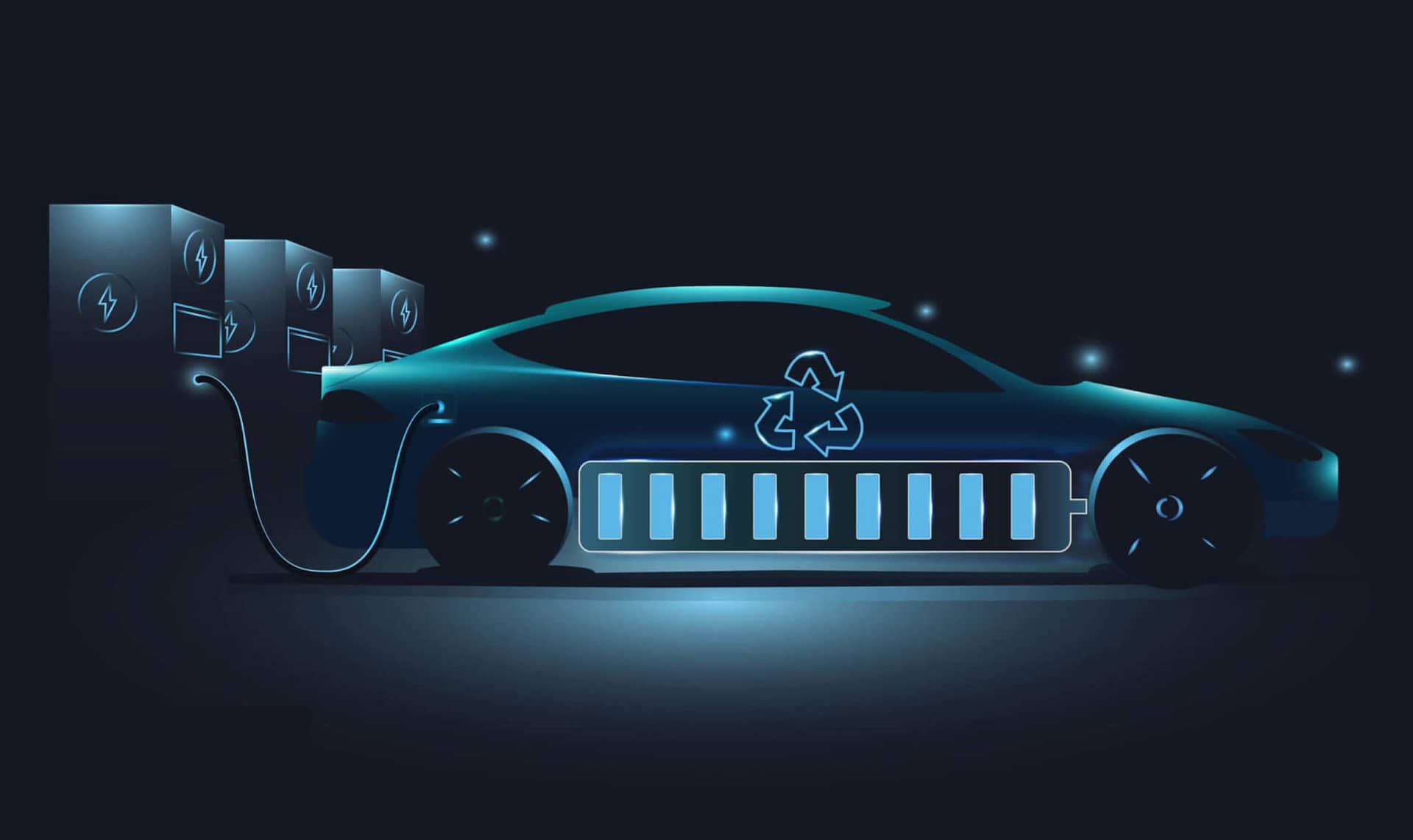

Multinational electronics corporation uses Insightloupe to enhance their electric vehicle (EV) fleet strategy. The platform provides R&D intelligence, IP trends analysis, and white space research. Opportunities identified in the EV battery management system market include battery scheduling, fraudulent battery detection, and battery swapping. Insightloupe helps the client with IP and market strategy, enabling them to capitalize on market potential and expand their business.

Evalueserve helped a waste-to-energy client identify their best-fit route to Voluntary Carbon Market participation. Our experts used our Carbon Offset Platform to guide them in maximizing the value of their carbon offset offerings. With VCMs gaining visibility, understanding how to generate carbon credits in this developing space is crucial.

Explore the transition to advanced E/E architecture in automotive industry: architecture types, challenges, and upcoming trends.

Voluntary carbon markets (VCMs) are crucial for achieving Net Zero carbon emission goals. With most credits generated from land-based projects, it’s time to explore the high-growth potential of Blue Carbon, which focuses on oceans and coastal wetlands.

Sustainability is the way of the future – that part is canon by now. So, what values can companies expect from the markets of this future? Well, the answer is right in front of us. The world is already witness to the emergence of a new type of market, where the highest valued ‘commodity’ is the decarbonization solution of paramount quality.

Procurement teams in the oil and gas industry face various challenges, from volatile market conditions to complex supply chains and regulatory requirements.

There is a global sprint towards reduction of carbon dioxide (CO2) emissions and greenhouse gases (GHG) across industries, in response to decarbonization needs outlined in the Net Zero 2050 goals as a part of the 2015 Paris Agreement.

2022 marked a tumultuous year for ESG and sustainability. The recent COP27 talks required overtime to produce a final document to avoid derailing years of progress on climate change. Moreover, geopolitical events and their economic impact upset the momentum fueling the prolific ESG investing of late. Nevertheless, despite headwinds, ESG-related investments remain substantial.

In the last quarter of 2022, Hong Kong jurisdiction unveils vigorous initiatives toward sustainable development. Meanwhile, China’s national ETS achieved a 10-billion-yuan (US$1.4 billion) transaction value in December.

Diversification is the name of the game once a business grows and takes on the moniker of an empire. And one major area of diversification, both from a growth and visibility standpoint going forward is sustainability.

Whether driven by investors’ concerns, regulatory mandates, or broader social norms, the number of corporations pledging net zero GHG emissions goals continues to increase. More than 750 of the world’s 2,000 largest publicly traded corporations have announced net zero goals.

In this quarter, China’s carbon emission trading market has turned one year old. The country’s cumulative trading volume of carbon emission quota had reached 194 million tons, with a total trading value of 8.49 billion yuan. Also, following the national Dual Carbon goal, provinces and cities in China have successively published their own Implementation Plan for Carbon Peaking.

At a time when various initiatives and long-term targets for achieving carbon emissions neutrality have been announced at the global, policy, as well as industry levels, respectively, we came across the opportunity to help shape the future of packaging in a high plastics consumption sector.

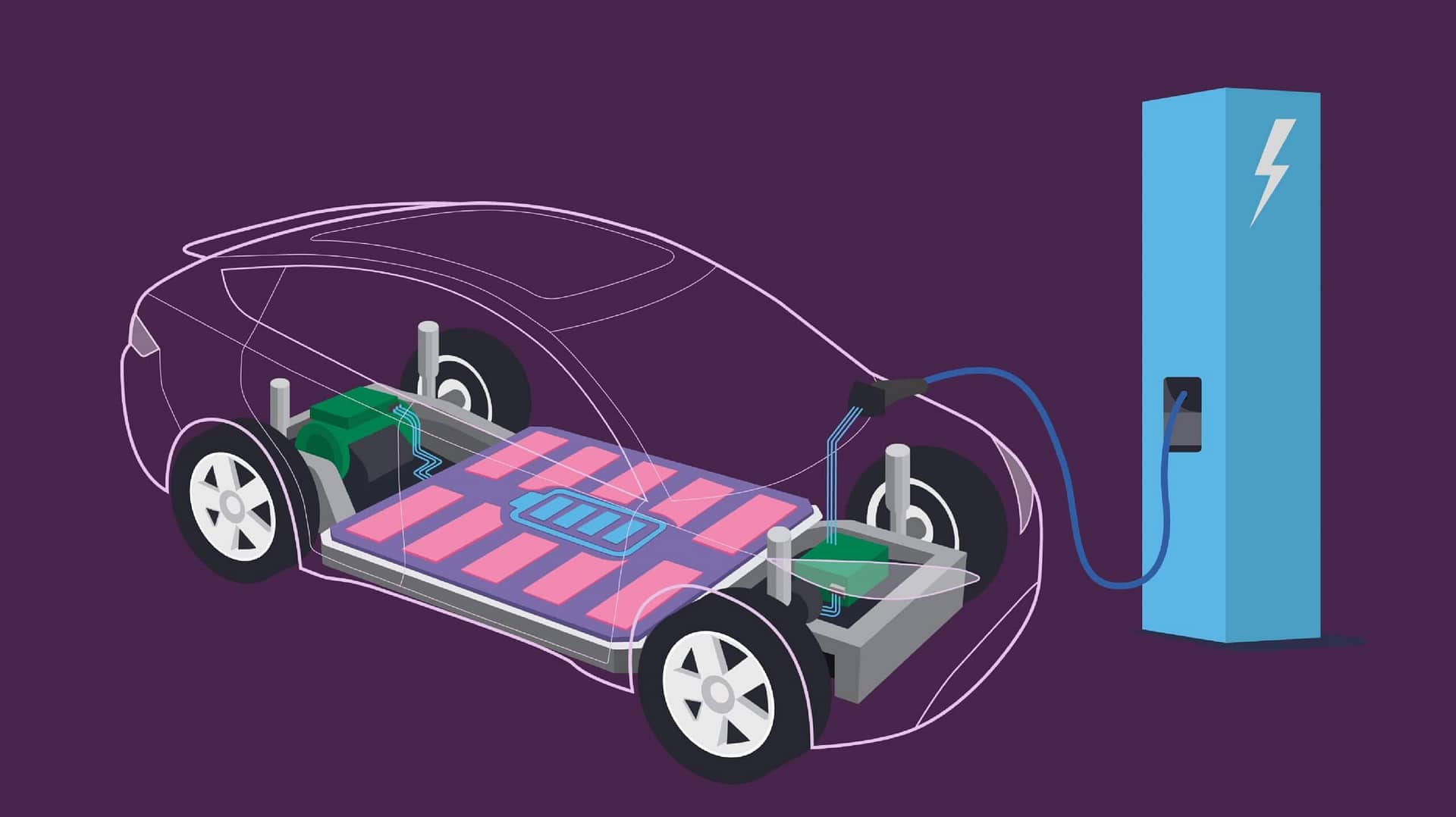

The global EV charging market is expected to reach USD 30.4 billion by 2023 and USD 35 billion by 2026. Extensive research in EV charging tech is vital for sustainable growth.

While the Indian EV market is growing at a brisk pace and so are plans and investments related to the development of charging infrastructure, the utilization rate of public charging stations in the country stands at a mere 7%…

In this quarter, China is strengthening its disclosure by taking into effect the new ESG Disclosure Standard on 1 June. Also, a series of policies was published to promote energy efficiency and renewable energy transition for achieving the national Dual Carbon targets.

Despite sky-high fuel prices providing historic profits for suppliers – the IEA expects net revenue for the world’s oil and gas producers to double to an unprecedented $4tn – “investment in oil, gas, coal, and low-carbon fuel supply is the only area that, in aggregate, remains below the levels seen prior to the pandemic in 2019.

Evalueserve has been helping a global manufacturer in the energy-storage industry in building and managing a cloud-based portal that assembled competitive information, created briefs on leading companies and assessed market changes that helped to fill in blind spots and complement their understanding of emerging trends.

M&A activity is down in Q1’22. Shift towards energy transition, building ESG strategies, and portfolio optimization will drive M&A activities in 2022.

Largest independent provider of research and analytics support, with a strong focus on innovation.

Our client, a leading global player in the cleantech solutions space, has an existing gas purification solution that could potentially expand into the hydrogen production process.

In this Oil & Gas Industry update, we discuss oil price rise due to opening of economies coupled with how vaccination programs roll out have fueled much needed impetus to the M&A drive in the sector.

Evalueserve provided category and supplier intelligence for a multinational oil and gas company that had previously struggled with knowledge management.

This update of the China ESG Newsletter from Q4 of 2021 covers a series of measures that aim to accelerate the development of a green economy have been taken in mainland China, Hongkong, Macao, and Taiwan.

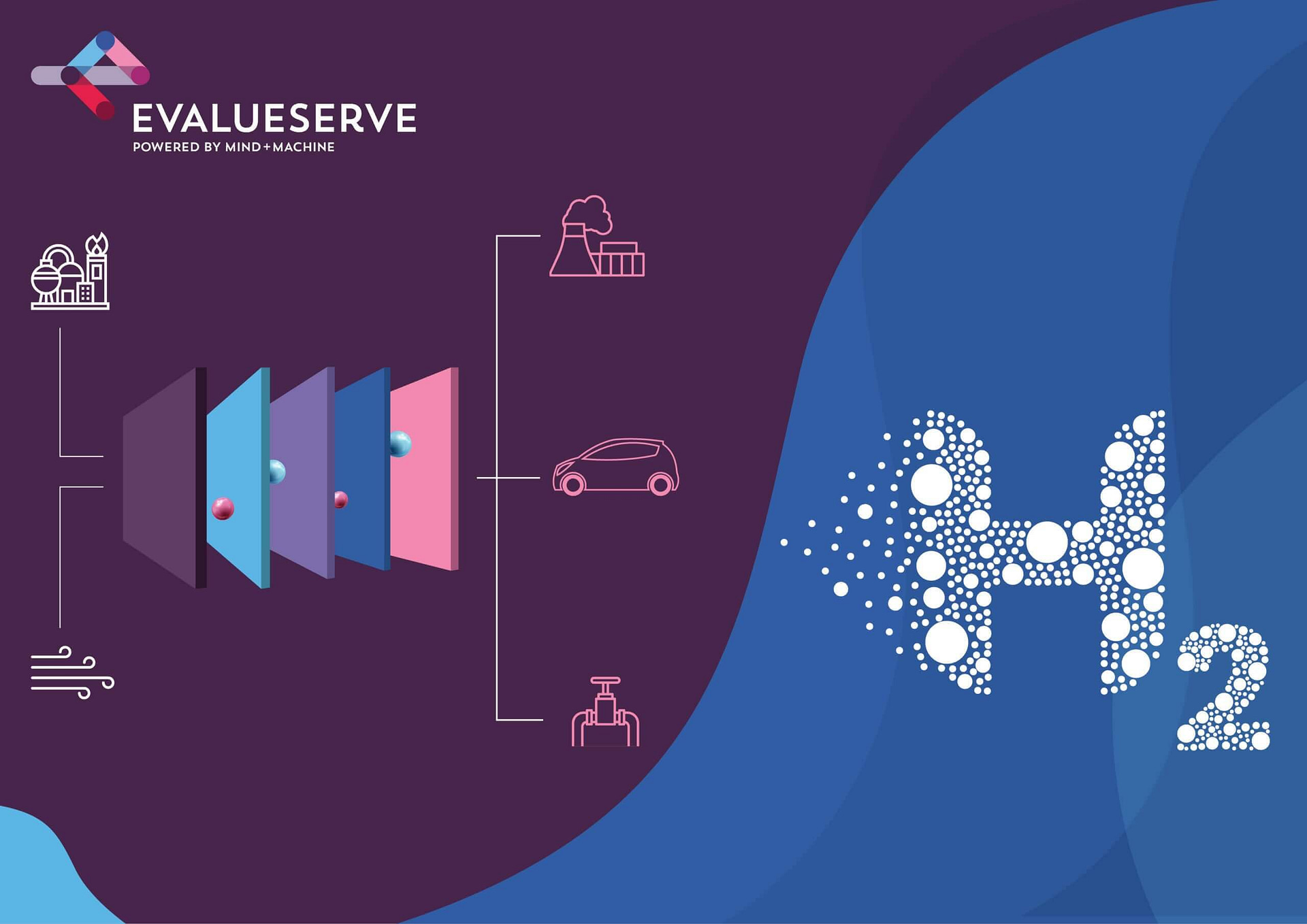

Hydrogen is seemingly everywhere when it comes to the future of green energy. Advancements in generating green hydrogen from efficient processes such as Alkaline, proton exchange membrane (PEM), and solid oxide electrolysis cell (SOEC) electrolysers are constantly pushing forward towards a competitive market.

Hydrogen is fast gaining ground as the fuel of the future, be it for power generation or powering the next generation of fuel cell electric vehicles (FCEVs). Hence, ways to generate, transport, and utilize it to fuel this energy transition are constantly being developed and optimized.

The 2030 vision of the Paris Agreement has forced businesses to focus on reducing their carbon emissions. Oil and gas producers

How soon can solar power become constant with the addition of energy storage, be cost-competitive with fossil fuels and how close is solar + storage to compete with conventional electricity sources like coal and gas?

Germany outlines roadmap for the use of power-to-liquid (PtL) fuels for its aviation industry.

A multinational gas and power company was looking for a comprehensive competitive intelligence program that would showcase all CI data on a single platform.

The rise in steel prices over the last year has had significant effects on the solar power industry, let’s take a look at the impacts and the market.

A global conglomerate that designs, manufactures, and markets professional, industrial, and commercial products and services – wanted to understand where opportunities existed within the EV landscape.

One of the largest near-term opportunities for hydrogen is blending hydrogen gas into the existing natural gas network to cut down greenhouse gas (GHG) emissions. This insight discusses it’s potential and how.

Goals of carbon neutrality and decarbonization are paving the way for opportunities within optimization of present battery tech.

Electric vehicles (EVs) are the future of the automotive sector, and not a distant one. EVs, in their various forms, from plug-in hybrids (PHEVs) to battery electrics (BEVs) as well as the upcoming hydrogen fuel cell EVs (FCEVs), are racing towards ubiquity carried along by the fervor for the net-zero carbon emissions by 2050 mission.

Energy transition is the core component of the global target to achieve net-zero carbon emissions by 2050 across geographies and industries. Although, as we dive deeper into the scale and pace of the efforts needed to limit global temperatures from rising by 1.5 degrees C, the word “energy transition” loses some of its relevance.

The oil field services (OFS) business suffered a double whammy in 2020 – depleting oil prices as well as COVID-19 – both of which led to deep cuts in capital expenditure by their customers and a negative impact on their profit margins.

Decarbonization is no longer simply a buzzword. It is here and the voices echoing it will only multiply and get louder as the global economies inch towards 2050. By this year, most developed nations have pledged to become carbon emissions neutral economy wide.

On April 22, 2021, United States President Joe Biden made a remarkable, if ambitious, announcement. Contrary to the previous Trump administration’s climate change denial, Biden has said that the government will cut America’s greenhouse gas (GHG) emissions 50 to 52 percent from their 2005 levels within this decade.

Lithium, the most important metals used in clean energy technologies and is widely perceived as the metal that will catapult the world into a low-carbon future.

A leading provider of bio-fuels and sustainable aviation fuel is tackling two of the behemoths of un-sustainability – what to do with municipal solid waste and how to decarbonize the aviation industry.

The COVID-19 pandemic overwhelmed the world in 2020. No one anticipated the social and economic scenarios that unfolded in 2020. However, 2021 started on a positive note, with the rollout of the first phase of COVID-19 vaccination programs across many countries.

As major LNG demand centers across the globe have started to ease lockdown measures and are gradually opening the economy, LNG markets are witnessing significant changes.

The disruption caused by the COVID-19 pandemic has severely affected the already debt-laden oil & gas companies. Many companies are finding it difficult to sustain amid the current crude price levels. This is leading to a growing wave of bankruptcies in the sector.

The global economy is still reeling under the pressure of the COVID-19 pandemic. Starting June 2020, many economies began lifting lockdown measures that were implemented to curb the spread of the virus.

It will be during 2021 where we could truly expect the recovery to begin, assuming that the demand effects of Covid-19 are mitigated by then.

Ripple effects of demand shock from COVID-19, felt across the value chain. Given the current state of outbreak it’s unlikely that the demand loss from COVID-19 would diminish before Q3 2020 and despite the optimistic recovery, 2020 oil demand will still face substantial decline.

Global oil market was expected to balance in the second half of 2020, driven by production cuts from OPEC+, favorable demand growth, and stagnant non-OPEC supply growth. However, the Covid-19 outbreak lowered oil and oil products’ consumption of the largest consumer (China), and the Saudi Arabia-Russia disagreement will result in an extremely oversupplied market (at least in the short term).

Evalueserve estimates that the COVID-19 pandemic could wipe off 13–30 MMT of LNG demand in 2020. The pandemic has added further

In our previous analysis, Covid-19: Repercussions for Oil Markets, Evalueserve predicted that the price war between Saudi Arabia and Russia wasn’t sustainable due to economic ramifications.

If the Covid-19 driven erosions of crude oil demand weren’t enough, then the fall-out of the OPEC+ alliance has further dented the oil markets.

An oil & gas giant envisioned reducing its carbon footprint by modifying its existing supply chain.

An oil & gas supermajor in Europe had aggressive production increase targets where a large portion of their strategy was dependent upon inorganic expansion.

RPA For Risk Model Management

Market Intelligence

Financial Spreading

Competitive Intelligence

Sector & Account Intelligence

MICI For Asset & Wealth Management

CI for Management Consulting Firms

Knowledge Management

ESG Intelligence for Asset Managers

Fund Marketing & Digital Marketing

Intellectual Property Strategy

Intellectual Property Management

MICI for Real Estate

Sector & Account Intelligence

MICI for Asset & Wealth Management

CI for Management Consulting Firms

ESG Intelligence for Asset Managers Fund Marketing & Digital Marketing Intellectual Property Management MICI for Real Estate

ESG Controversy Monitoring for Asset Managers

Patent Analysis

RPA For Risk Model Management

© 2025 Evalueserve. All rights reserved.