How European Banks Are Navigating AI – London Executive Exchange Takeaways

Check out key takeaways from our discussion with leading banks in London on navigating the new AI efficiency frontier.

Check out key takeaways from our discussion with leading banks in London on navigating the new AI efficiency frontier.

Nordic lending is shifting fast—private credit surges, ESG evolves, and digital tools gain ground. Read Dan’s blog to see what’s driving change in 2025.

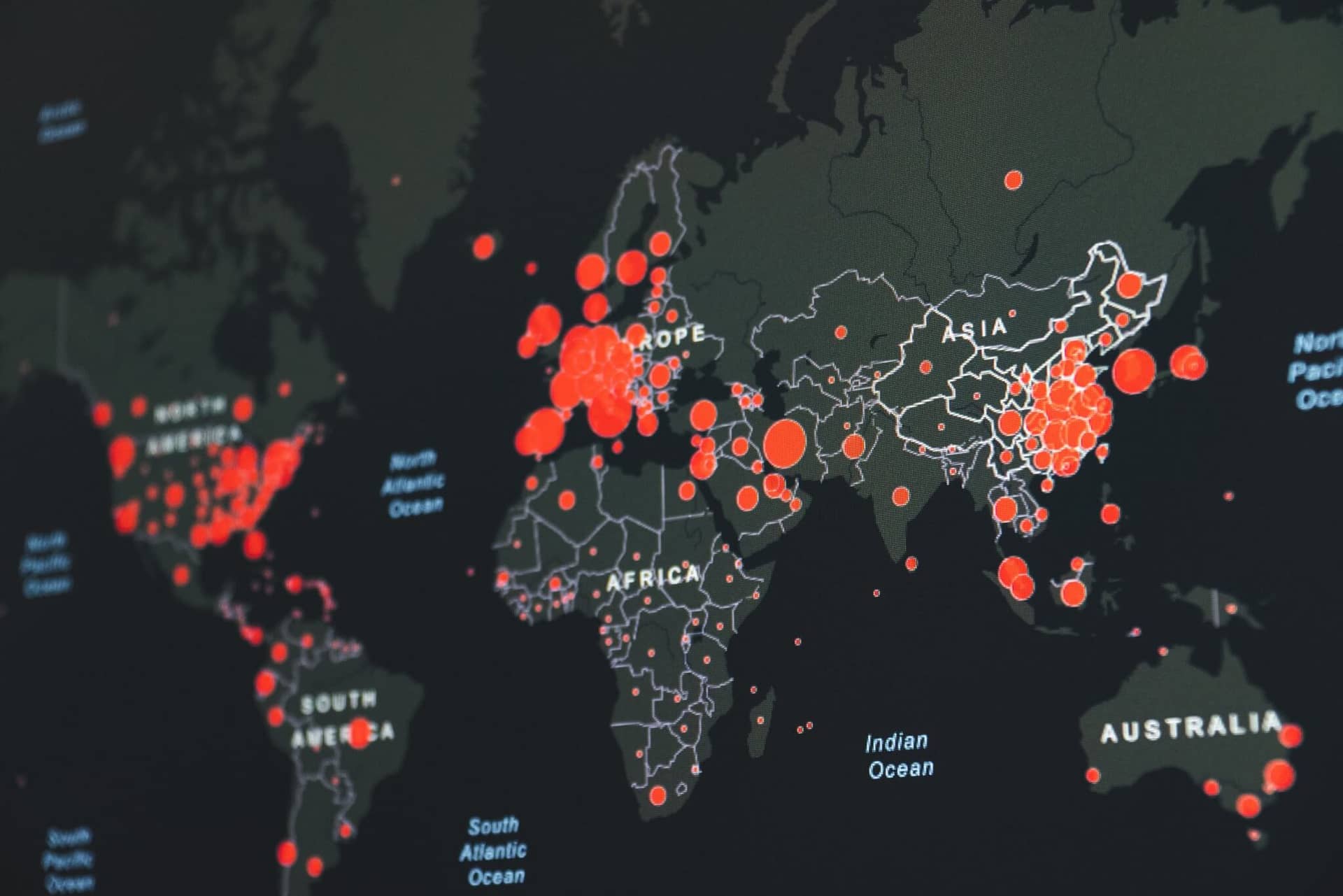

The global healthcare market witnessed slowdown in deal activity in Q1’25 as dealmakers continue to navigate the current challenging market environment.

Check our latest blog for key insights from the 2025 Frankfurt Loan Market Seminar on lending trends, policy shifts, and sector outlooks.

In Q1’25, the global financial services sector showed resilience amid inflation and geopolitical tensions, with strong M&A activity and a shift towards bonds and commodities for stability.

Discover the anticipated trends and pivotal changes in the US mortgage market for 2025, highlighting key risks and opportunities for lenders and investors.

Explore the Q1’25 financial landscape with a focus on M&A, DCM, and ECM activities, revealing notable increases in deal value and market resilience.

Read our blog to uncover the key takeaways from the Digital Banking CEE Summit 2025, where industry leaders shared how banks in Central and Eastern Europe are accelerating digital transformation. From AI adoption to next-gen payments and operational agility, explore the trends reshaping the region’s financial landscape.

Check out key takeaways from our discussion on navigating tariffs and policy changes from our recent NYC and Toronto Executive Exchanges.

The 2024 financial services market witnessed a resurgence in M&A activity, driven by interest rate cuts, investor optimism, and strategic deal-making.

Explore the 2025 outlook for private markets, including investment trends, private credit growth, sustainability strategies, and AI-driven value creation in private equity.

Global IPOs in 2024 showcased resilience and reinvention, with strong performances in the Americas, EMEIA, and India, while Asia-Pacific navigated a challenging yet promising landscape.

FY’24 was a pivotal year for investment banking, with M&A deal value rising 10% to USD 3.2T, record debt market activity, and a resurgence in equity capital markets.

In 2024, investors continued to view the healthcare sector in terms of its historical status as a “go-to” market amidst uncertainty and engaged in ‘big ticket’ deals, highlighting the industry’s resiliency and value creation.

The private equity landscape in 2024 is marked by the growing prominence of secondaries, innovative liquidity solutions, and technological advancements like GenAI. As the industry adapts to macroeconomic challenges, trends such as expanded deal structures, strategic exits, and ESG integration are shaping its future. Explore key insights and projections for 2025.

Check out key takeaways from our discussion on AI & transformation in financial institutions at our Executive Exchange in New York.

PowerPoint design plays a critical role in investment banking by simplifying complex data, enhancing communication, and building credibility. From pitching to due diligence, impactful visuals and clear formatting drive decision-making and successful deal outcomes.

The private equity sector faces challenges as interest rates rise, slowing deals, while potential rate decreases may boost buyouts and valuations. Stay strategic amid shifting dynamics.

The private equity landscape is evolving with advanced CRM tools. Learn how these platforms centralize data, automate workflows, and provide actionable insights, transforming deal management and investor engagement for growth-driven strategies.

Discover how InsurTech is transforming insurance with AI, ML, Blockchain, and IoT, driving innovation and personalization from underwriting to claims.

In Q3’24, the financial services sector witnessed broad-based recovery which was majorly driven better economies, interest rate reductions, and better than expected corporate earnings

Explore the benefits and challenges of earnouts in M&A transactions, and understand why excluding them from deal valuations can provide a clearer representation of the true cost to acquirers.

Discover the resurgence in investment banking and advisory firm revenues in 9M’24, driven by improved market conditions and a strong pipeline for M&A and debt capital markets.

In Q3 2024, investors continued to view the healthcare sector in terms of its historical status as a “go-to” market amidst uncertainty and engaged in ‘big ticket’ deals, highlighting the industry’s resiliency and value creation.

Check out four key takeaways from our discussion on digital transformation in banking at our Executive Exchange in London.

This paper looks at the basics of the traditional approach, proposes a new framing and shows how it can be implemented with consensus expectations.

GP led secondaries and continuation funds are transforming private equity, offering innovative solutions to liquidity challenges and asset retention in 2024.

Key insights from Q2 2024 show resilience in North America’s consumer and retail sectors, with retail sales growth, disinflation, and a Federal Reserve rate cut.

Get insights into the 2024 OTT market as streaming services redefine content delivery, consumer preferences, and industry competition.

In H1’24, the financial services sector witnessed broad-based recovery which was majorly driven better economies, impending interest rate reductions, and better than expected corporate earnings.

Discover the resurgence in deal activities in H1’24, driven by mega deals, strong earnings, and market optimism, with insights into M&A, ECM, and DCM markets and bulge bracket investment banks’ performance.

In H1 2024, investors continued to view the healthcare sector in terms of its historical status as a “go-to” market amidst uncertainty and engaged in ‘big ticket’ deals, highlighting the industry’s resiliency and value creation.

Gain insights into the evolving global IPO landscape, highlighting the strong performance in the Americas and EMEIA regions, the challenges faced by Asia-Pacific, and the factors shaping the market outlook for 2024.

Explore how fund finance is revolutionizing the investment fund industry by providing essential liquidity, enhancing returns, and driving growth through innovative financial solutions.

In Q1’24, the financial services sector witnessed broad-based recovery which was majorly driven by the confidence of a “soft landing” for the global economy with moderate inflation with minimal probability of a recession.

Dive into the Q1 update on Investment Banking trends, featuring insights on M&A activities, debt and equity capital markets, and the impact of global market conditions.

In Q1 2024, investors continued to view the healthcare sector in terms of its historical status as a “go-to” market amidst uncertainty and engaged in ‘big ticket’ deals, highlighting the industry’s resiliency and value creation.

Explore the critical role of deal marketing in the investment banking deal life cycle, and discover how Evalueserve’s expertise can navigate its complexities for successful M&A transactions.

In this testimonial, Lars Mitchell, Head of Research Publications at Peel Hunt discusses partnering with Evalueserve to come up with a unique solution for equity research distribution through our Insightsfirst platform.

Explore the global economic outlook of 2023, marked by resilience, restrictive policies, and a decline in APAC’s M&A activity, amidst the slow, challenging path to pre-COVID levels.

Discover how Evalueserve transformed a top global bank’s lending operations by automating the spreading process with AI-powered Spreadsmart, significantly enhancing efficiency and accuracy.

Explore the global financial landscape of FY’23, marked by a slowdown in M&A activity, robust debt capital markets, and a surge in equity capital markets, amidst challenging conditions for investment banks and advisory firms.

In 2023, the financial system was again put to the test by the ripple effects of the regional banking crisis and the tightening of financial conditions, with pockets of growth arising from the resurgence of investor interest spurred by the possibility of lower interest rates

Explore the dynamic landscape of Global Healthcare M&A in 2023, marked by a surge of deals, innovative structures, and a focus on complex partnerships, setting the stage for a transformative 2024.

Explore the 2023 global IPO landscape, understand the factors contributing to its decline, and gain insights into regional performance and the forecast for 2024.

Becoming sustainable is now vital for all sectors, driven by increasing customer, regulatory, and shareholder demands to reduce carbon emissions, reshaping how resources are procured, distributed, and utilized.

Explore the intricate landscape of M&A deal closure, its challenges, key considerations, and strategic approaches for a successful outcome with Evalueserve’s comprehensive assistance.

Explore how Evalueserve’s experienced team navigates deal execution, mitigating risks through comprehensive due diligence, ensuring successful transactions and protecting stakeholders.

Amidst the dynamic P&U landscape in YTD Sep 2023, disruptions like the war in Ukraine and supply chain disruptions posed challenges, while advancements like the EU’s energy independence opened doors to new deal opportunities.

Explore the transformative impact of AI on the payments industry, driving growth, streamlining transactions, enhancing security, and personalizing customer experiences in the fintech sector.

Explore the challenges and digital transformation in the US mortgage market, and discover how Evalueserve’s solutions enhance operational efficiencies for lending institutions.

The North American consumer and retail sector wrapped up Q3 2023 on a positive note, marked by robust retail sales, noteworthy M&A activities, and ongoing challenges.

Discover the latest trends in M&A, debt capital markets, and equity capital markets, as global deal-making slows, green bond issuances rise, and IPO activity declines in 9M’23.

Explore the challenges faced by the financial services industry in 2023 Q3, with a focus on M&A trends, ESG, and the impact of technology on key sub-sectors like banking, insurance, and FinTech.

Explore the global economic outlook in 2023, with a focus on APAC M&A activities, key market drivers, and the impact of inflation & borrowing costs on growth prospects.

Discover how AI revolutionizes the automotive industry, enhancing vehicle performance, safety, and manufacturing with advanced technologies and applications.

Discover the essentials of corporate valuation and financial modeling, key methodologies, and best practices for investment banking decision-making.

The Securities and Exchange Commission (SEC) has adopted new rules and amendments on August 23, 2023, to the Investment Advisers Act of 1940, which will impact private fund advisers in the US.

In Q3’23, investors continued to view the healthcare sector in terms of its historical status as a “go-to” market amidst uncertainty and engaged in ‘big ticket’ deals, highlighting the industry’s resiliency.

Explore the growing climate tech investment landscape, its challenges, and the importance of strategic approaches for achieving sustainable financial and environmental benefits.

Discover the factors driving private equity and venture capital firms’ interest in the EV industry, including surging demand, policy environment, and tech advancements.

While geopolitical instability is holding back the oil and gas (O&G) industry, automation and digital innovation are being increasingly considered strategic to process optimization, asset tracking, and data management. In this scenario, M&A activity across the industry is expected to remain muted in FY 2023.

Oil and gas industry shifts focus from M&A to resilience amid COVID uncertainty. Embracing low-carbon and capital discipline, external factors like the economy, rates, geopolitics, and regulations shape future M&A decisions.

Explore the importance of financial statement analysis in deal execution, its objectives, and the key types of analysis that drive informed strategic decisions for businesses and bankers.

Q2 2023 ended with mixed results for the North American consumer and retail sector. Although, the worries stemming from regional banks were addressed, headline inflation dipped to 4%, and the US debt ceiling concern were finally resolved, the sector continued to face macroeconomic headwinds, such as high-interest rates, ongoing geopolitical tensions, tightening labor market, and increasing raw material costs. Despite these challenges, the sector showcased resilience with moderate spending growth and positive financial market performance.

M&A deals in Asia Pacific region dropped to the lowest levels since the onset of COVID-19 pandemic, affected by economic volatility coupled with monetary tightening. Despite some relief given by domestic-level market resilience from major regional emerging economies, the overall sentiment for 2023 continues to be subdued and guided by key economic elements such as inflation and financial markets instability

In H1’23, investors continued to view the healthcare sector in terms of its historical status as a “go-to” market amidst uncertainty and engaged in ‘big ticket’ deals, highlighting the industry’s resiliency.

Explore the growth and future of Telehealth, as it transforms healthcare delivery, offering convenience, cost savings, and innovative solutions.

2023 YTD bankruptcies in the US are on a 13-year high, led by rolling back of easy monetary policy by the US Fed to combat high inflation.

Discover the ongoing regional banking crisis in the US and its potential impact on the financial sector. Explore the lack of regulations and the risks of a full-blown crisis.

Despite global instability, prioritizing optimization, asset tracking, and data management through automation and innovation offers a path to recovery for the Oil and Gas industry.

Discover the latest trends in global M&A deals, green bond issuance, and ECM activity. Learn how investment banks are navigating the current economic landscape in Q1’23.

Discover how the North American consumer and retail sector navigated through macroeconomic headwinds in Q1 2023, including inflation, rising interest rates, bank runs, geopolitical risks, labor shortages, and raw material costs

In Q1’23, the financial system was put to the test by the ripple effects of the regional banking crisis and the tightening of financial conditions, with some pockets of growth resulting from the resurgence of investor interest spurred by competitive valuations

The Global Healthcare Industry witnessed a surge of deals in Q1 2023 as investors continued to view the sector in terms of its historical status as a “go-to” market during uncertain times.

The art of deal execution in investment banking is a delicate process of taking a potential M&A transaction from idea to completion. The process can be complex and requires knowledge & experience, with confidentiality being a key component to a successful transaction. Evalueserve offers an unmatched deal execution support, with particular focus on live M&A deal mandates, through its vast experience of working with large, mid-market investment and boutique advisory firms.

M&A deal volumes drop lower in Q1 2023 due to economic uncertainties, with APAC contributing just 30% of global M&A. Improved volumes in Japan were the bright spot. Expectations are for a more normalised level of M&A activity resembling pre-2021 levels.

Explore the role of Small Business Administration (SBA) in supporting American small businesses through systemic crises. Learn how the SBA has been standing firm behind small businesses and keeping them afloat in challenging times.

Use Generative AI in banking to accelerate Enhanced Due Diligence (EDD) research and gain deeper insights for better risk management.

In the last three years, the consumer and retail sector has witnessed more disruption and transformation in consumer behavior and preference than in the past two decades. In 2022, the consumer and retail sector continued to witness major economic headwinds, including an unstable geopolitical environment, a sharp rise in the cost of living, and a looming recession, which added more uncertainty to consumers’ purchasing behavior and, ultimately, to the sector’s performance.

Asia-Pacific (APAC) has not been immune from the global macroeconomic headwinds that built steadily throughout 2022. Now, the region is also

The OTT market, which was riding high on the analysts’ expectations pushed by the pandemic, remained subdued as pandemic restrictions were uplifted. The market is still growing but the growth rates do not match the previously announced expectations. It is anticipated to take another surge with the introduction of 5G services and 4K content, especially in emerging countries such as India.

The global financial services market underwent a significant change in 2022 as the world economy struggled to recover from the effects of a protracted epidemic. However, the deal volume from 2021 did not produce a straightforward figure that could be easily repeated. Therefore, as economic and geopolitical volatility took its toll, businesses appeared to have started concentrating on concluding the correct deals to support strategic growth and capital returns rather than expanding the volume of deals.

The sharp decline in Global IPO activity in 2022 had a substantial impact on the financial markets, as it followed 2021.

The knock-on effects of COVID-19, labour force displacement, geopolitical uncertainties, and shortage of liquidity dominated discussion during 2022. The global healthcare industry is typically considered a recession safe haven, still faced financial strain due to these factors.

A Confidential Information Memorandum (CIM) is one of the first documents a buyer receives during the M&A process. It is a descriptive resume of the company curated by the M&A Advisor on the seller’s side.

Our detailed analysis of the Global FIG M&A and Capital Markets landscape captures the probable answer through deep insights on Investors’ behaviour, Recovery of the banking sector, Key M&A themes…

In our detailed Q3 review of the global investment banking industry, we have discussed the M&A, ECM, and DCM markets, along with the performance of bulge bracket investment banks and M&A advisory firms.

Deal activity across the global healthcare industry remained low, a stark contrast to the economic buoyancy witnessed during the same period last year. Investors continued to adopt a cautious approach amid the uncertainties related to global growth outlook…

Global O&G M&A activity slightly decreased in Q3 2022 amid indication of current global slowdown; however, North American M&A activity is up. Current geopolitical tensions and energy security is impacting the oil and gas sector majorly.

Despite low volumes, rising costs, supply chain interruptions, and lowered guidance in Q3 2022, the North American consumer and retail sector has continued to see modest growth, albeit at a considerably slower rate than in 2021…

In 2022, the prevalent geopolitical conditions and macroeconomic uncertainties caused a decline in broader market performance in general and the tech stocks declined to a high level, due to which sector experienced a downtrend in M&A and listing activity.

The risks to the M&A outlook for Asia Pacific markets are overwhelmingly tilted to the downside as rising prices continue to impact growth prospects worldwide. While taming inflation remains the top priority for policymakers, tighter monetary policies will inevitably have real economic costs.

The team at Evalueserve, a provider of banking and advisory support services, has undertaken research for the Over-the-Top (OTT) market globally and in India, covering Major Players and prominent modes of OTT streaming. The pandemic period has been a revelation for the industry with the market experiencing unprecedented increase in Market Size.

The global financial services market continued its frenetic pace of M&A and capital market activity at the start of 2022, keeping pace with a record-breaking 2021. However, it must be noted that the deal volume in 2021 did not yield an easy number that could be effortlessly replicated.

The first half of 2022 saw ~USD 2.2 trillion of M&A deals being announced, ~21% lower than the same period last year and the slowest opening six months for M&A in two years. Technology, financials, and industrials accounted for almost half the total deal value in the first half of 2022.

The team at Evalueserve, a provider of banking and advisory support services, is back with another iteration of our M&A Recovery Report, covering 10 Major M&A markets, as we move through 2022. M&A recovery in 2022 took a drastic downward turn from the blockbuster start witnessed in the previous quarter on the back of growing concerns of a global economic slowdown.

Deal making in the global healthcare industry has been relatively slow in 2022, compared with a blockbuster 2021. Investors were primarily forced to hold off on deal making because of the uncertainty regarding the global growth outlook.

We recently hosted an Investment Banking Executive Event in New York where senior leaders at top banks discussed Investment Banking trends such as the roles of AI, CRM, and Data Science in junior banker retention.

Financial statements, SEC filings, management presentations, etc., have long been the only reliable data sources for analysts. Not anymore.

See why young investors looking to invest for a long term should consider dividend stocks.

RPA For Risk Model Management

Market Intelligence

Financial Spreading

Competitive Intelligence

Sector & Account Intelligence

MICI For Asset & Wealth Management

CI for Management Consulting Firms

Knowledge Management

ESG Intelligence for Asset Managers

Fund Marketing & Digital Marketing

Intellectual Property Strategy

Intellectual Property Management

MICI for Real Estate

Sector & Account Intelligence

MICI for Asset & Wealth Management

CI for Management Consulting Firms

ESG Intelligence for Asset Managers Fund Marketing & Digital Marketing Intellectual Property Management MICI for Real Estate

ESG Controversy Monitoring for Asset Managers

Patent Analysis

RPA For Risk Model Management

© 2025 Evalueserve. All rights reserved.