Data Analytics in Wealth Management – Then and Now

Discover how the focus of Wealth Management has shifted from information availability back to the quality of advice with the advancement of data analytics in the industry.

Discover how the focus of Wealth Management has shifted from information availability back to the quality of advice with the advancement of data analytics in the industry.

Explore the importance of financial statement analysis in deal execution, its objectives, and the key types of analysis that drive informed strategic decisions for businesses and bankers.

Published by Economic Times

Evalueserve provides credit review and underwriting support to a multinational bank, leading to efficiencies across the credit research spectrum.

Evalueserve, leveraging its expertise and automation capabilities, supports the wealth management division of a global bulge bracket bank. The partnership with Evalueserve ensured the timely and accurate delivery of crucial tasks and unlocked opportunities for the client to focus on strategic growth.

In the Power & Utility sector, M&A activity has declined due to inflation, high-interest rates, geopolitical uncertainties, and volatile commodity prices. Despite this, a rebound is expected in near future fuelled by available capital, energy transition, supply chain security, and value opportunities in the current macroeconomic setting

Explore the latest insights on global investment banking in our detailed H1’23 review. Learn about M&A, ECM, and DCM markets amidst economic uncertainty and pent-up demand for deals.

Q2 2023 ended with mixed results for the North American consumer and retail sector. Although, the worries stemming from regional banks were addressed, headline inflation dipped to 4%, and the US debt ceiling concern were finally resolved, the sector continued to face macroeconomic headwinds, such as high-interest rates, ongoing geopolitical tensions, tightening labor market, and increasing raw material costs. Despite these challenges, the sector showcased resilience with moderate spending growth and positive financial market performance.

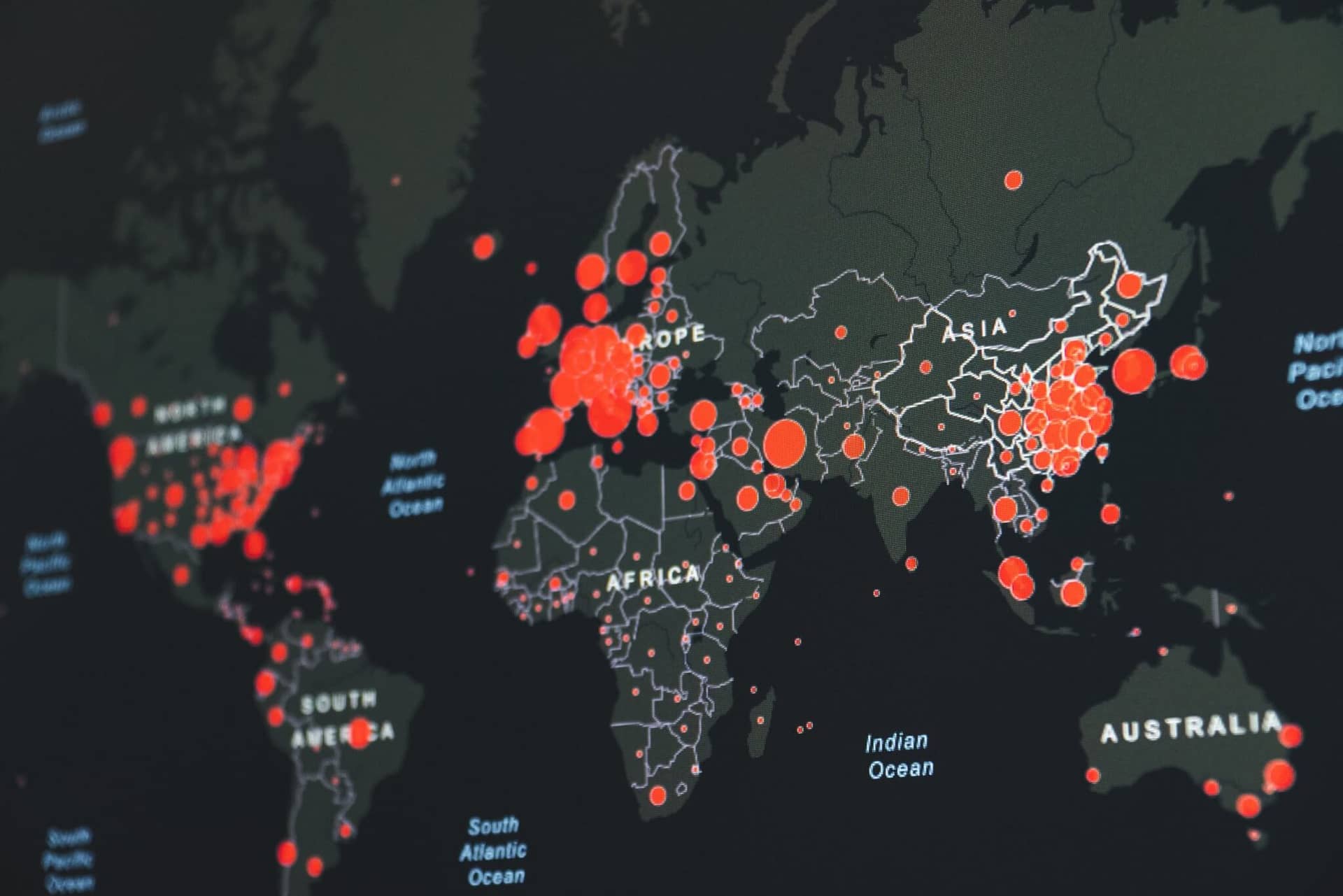

M&A deals in Asia Pacific region dropped to the lowest levels since the onset of COVID-19 pandemic, affected by economic volatility coupled with monetary tightening. Despite some relief given by domestic-level market resilience from major regional emerging economies, the overall sentiment for 2023 continues to be subdued and guided by key economic elements such as inflation and financial markets instability

Our latest blog dives into the current state of the Over-the-Top Streaming market and what to expect from the industry in the second half of this year.

The US retirement sector is witnessing a transformative shift as new trends begin to emerge. In this dynamic landscape, innovative practices and approaches are reshaping the way employees plan for their retirement.

A recent blog by our team digs deep into factors influencing real estate valuation which is required for a variety of purposes like financing, sales listing, investment analysis, property insurance, and taxation. Evalueserve provide valuable services to investment banks catering to real estate investors. Read more to find out some ways Evalueserve assists in real estate valuation.

In H1’23, the financial system was put to the test by the ripple effects of the regional banking crisis and tightening of financial conditions, with some pockets of growth resulting from the resurgence of investor interest spurred by competitive valuations.

Explore the H1’23 capital market landscape, highlighting trends in M&A, debt, and equity capital markets, as well as the impact on investment banks and advisory firms.

Discover how Evalueserve’s financial analytics support transformed a top 10 global investment bank’s decision-making process and operational efficiency. With 110 skilled professionals covering 10+ sectors across 15 client offices, they achieved a 26% increase in volumes and saved over 1,000 hours/year, delivering high-quality insights for data-driven decisions.

Explore the trends and factors impacting the global IPO market, including macroeconomic headwinds, investor sentiment, and regional performance in this comprehensive analysis.

In H1’23, investors continued to view the healthcare sector in terms of its historical status as a “go-to” market amidst uncertainty and engaged in ‘big ticket’ deals, highlighting the industry’s resiliency.

Discover the benefits of a consultant database for asset and wealth management firms, enhancing efficiency, data accuracy, and streamlining investment decisions.

Explore the rising trend of private equity partners acquiring and partnering with insurance companies to access permanent capital, transforming the industry landscape and creating value for investors.

During this year’s Risk Americas event, we had the honor of moderating a panel discussion featuring esteemed panelists from Blackrock, Mizuho, and Columbia University. The conversation centered around the new weaknesses in model governance and potential solutions.

Explore the power of forecasting stock prices using ARIMA and Reinforcement Learning models to construct high-performing portfolios.

Discover how our comprehensive competitor benchmarking study in the advice market empowered a large institutional asset manager to make well-informed decisions and enhance their strategy.

Explore the growth and future of Telehealth, as it transforms healthcare delivery, offering convenience, cost savings, and innovative solutions.

SS 1/23, Model Risk Management Principles for Banks, is bringing sweeping change to Model Governance in the UK. Our blog dives deeper into the requirements, what it could mean for your firm, and how Evalueserve can help.

Explore the rapidly evolving world of clear aligners and their integration into digital dental workflows. Learn about top dental companies, workflow compatibility, and the benefits of seamless integration for dentists and patients.

Discover the importance of identifying ideal M&A targets and overcoming common challenges in the target identification process for successful deal execution.

2023 YTD bankruptcies in the US are on a 13-year high, led by rolling back of easy monetary policy by the US Fed to combat high inflation.

Discover the ongoing regional banking crisis in the US and its potential impact on the financial sector. Explore the lack of regulations and the risks of a full-blown crisis.

Discover the highlights of ASGCT Annual Meeting 2023, featuring breakthroughs in biotechnology, novel approaches, and innovative technologies in the CGT space. Stay updated on the latest advancements and industry trends.

POV on Clear Aligners: Current & Future Trends Get My Publication Overview Traditionally, orthodontists used to treat malocclusion cases among kids,

Discover how our deep-dive analysis helped a leading asset and wealth management firm revamp its fee schedule, align with industry norms, and encourage positive consumer behavior, ultimately enhancing revenue and client retention.

Despite rising inflation and tightening credit measures, private credit is expected to remain strong. Discover 6 reasons why private credit is the future.

Discover how Evalueserve revolutionized a leading asset manager’s distribution process by optimizing the Seismic platform, resulting in improved data quality, reduced time to market, and a comprehensive knowledge repository.

Despite global instability, prioritizing optimization, asset tracking, and data management through automation and innovation offers a path to recovery for the Oil and Gas industry.

Discover the key factors in choosing a hearing aid, from severity of hearing loss to warranty and trial periods. Explore the latest technological advancements and growing demand for OTC products.

Discover the latest trends in global M&A deals, green bond issuance, and ECM activity. Learn how investment banks are navigating the current economic landscape in Q1’23.

With the consistent success of cell and gene therapies (CGTs), bioprocessing and the manufacturing facilities have taken centre-stage to meet global demands.

Discover how the North American consumer and retail sector navigated through macroeconomic headwinds in Q1 2023, including inflation, rising interest rates, bank runs, geopolitical risks, labor shortages, and raw material costs

In Q1’23, the financial system was put to the test by the ripple effects of the regional banking crisis and the tightening of financial conditions, with some pockets of growth resulting from the resurgence of investor interest spurred by competitive valuations

PE firms are investing billions in ProSports franchises given the scarcity and strong returns delivered by the asset class. Despite many challenges, stakeholders are willing to work with PE funds for growth prospect.

The whitepaper explores the evolving landscape of private credit markets, highlighting emerging trends and opportunities for investors seeking alternative fixed income assets. It provides insights on the increasing role of technology and data analytics in shaping private credit investment strategies.

Digital technology, such as AI, big data analytics, wearables, and robotics, has revolutionized healthcare in the past decade with surgical robotics, improving accessibility, efficiency, and equity.

Seismic postings were managed by multiple piece owners without any standard practice which resulted into pieces appearing in incorrect folders with incorrect meta data and hence was creating multiple issues in the front-end for stakeholders.

Evalueserve’s white paper examines the recent US Banking Crisis from a regulatory and lending decision lens.

Companies rebrand themselves to re-energize their business. Rebranding is a very important strategic direction that a company undertakes. While there may be different reasons a company goes for rebrand however the objective is purely to tell the world what the new brand stands for showcasing its direction.

The Global Healthcare Industry witnessed a surge of deals in Q1 2023 as investors continued to view the sector in terms of its historical status as a “go-to” market during uncertain times.

The art of deal execution in investment banking is a delicate process of taking a potential M&A transaction from idea to completion. The process can be complex and requires knowledge & experience, with confidentiality being a key component to a successful transaction. Evalueserve offers an unmatched deal execution support, with particular focus on live M&A deal mandates, through its vast experience of working with large, mid-market investment and boutique advisory firms.

M&A deal volumes drop lower in Q1 2023 due to economic uncertainties, with APAC contributing just 30% of global M&A. Improved volumes in Japan were the bright spot. Expectations are for a more normalised level of M&A activity resembling pre-2021 levels.

Discover why WhatsApp Pay is trailing behind its peers according to a Quick Byte Research study. Security concerns and limited interest due to current payment options are among the factors hindering its adoption.

Explore the role of Small Business Administration (SBA) in supporting American small businesses through systemic crises. Learn how the SBA has been standing firm behind small businesses and keeping them afloat in challenging times.

In the rapidly evolving field of ophthalmic surgery, staying at the forefront of technological advancements and understanding the competitive landscape is crucial for success. With increasing demands for better patient outcomes and cost-effective solutions, market players are constantly striving to innovate and outperform their competitors. Our medtech team has expertly curated a comprehensive analysis, delving into the strategic perspectives of key competitors, emerging trends, and future outlook across four essential pillars shaping the ophthalmology landscape.

Evalueserve’s investment banking experts put together an in-depth review of how the industry fared in FY 2022 and where it’s expected to go in FY 2023. This report includes a round-up of the activities and performances of many major investment banks and M&A advisory firms.

In this article, we discuss how our automation efforts have brought exemplary gains in Investment Research using a data-extraction tool developed by the Emerging Markets (EM) team as a reference case.

Almost 80-85% of the post-menopausal women population in the world suffer from vasomotor symptoms (VMS) such as hot flashes, night sweats and other associated symptoms. However, due to the stigma and misinformation associated with women’s health and especially menopause, it still remains an area that is understudied in research, often misunderstood by healthcare providers and patients, and unaddressed by most healthcare policies.

Asia-Pacific (APAC) has not been immune from the global macroeconomic headwinds that built steadily throughout 2022. Now, the region is also

The OTT market, which was riding high on the analysts’ expectations pushed by the pandemic, remained subdued as pandemic restrictions were uplifted. The market is still growing but the growth rates do not match the previously announced expectations. It is anticipated to take another surge with the introduction of 5G services and 4K content, especially in emerging countries such as India.

The global financial services market underwent a significant change in 2022 as the world economy struggled to recover from the effects of a protracted epidemic. However, the deal volume from 2021 did not produce a straightforward figure that could be easily repeated. Therefore, as economic and geopolitical volatility took its toll, businesses appeared to have started concentrating on concluding the correct deals to support strategic growth and capital returns rather than expanding the volume of deals.

As a central driving force for precision medicine worldwide, the Personalized Medicine Coalition (PMC) noted that more than 220 FDA-approved therapies with a biomarker mentioned in the label as ‘essential’ or ‘recommended for prescribing’ were available in the US market between 2015 and 2021. Further fuelling the movement of value-based care, a drug-diagnostic co-development model has been significantly prevalent, leading to a consistently growing usage of companion diagnostics assays – to target patients expected to benefit most from targeted therapy. As of 2022, 40+ commercialized CDx assays were listed exhaustively in the FDA’s List of Cleared or Approved Companion Diagnostic Devices.

Due to supply shortages and the need for real-time data, procurement and supply chain officials are seeking data-driven decision-makers and AI-powered insights to optimize their strategies. The time for a digital transformation is now.

The US Federal Reserve’s monetary policy to tackle inflation has brought the government and the Treasury at odds with the Central bank. Bhashkar Upadhyay in his new blog has carefully noted down how “fiscal deficit” has become a point of contention among different stakeholders and how a failure to end the deadlock over the “debt ceiling” could have grave financial consequences on the markets.

Private equity (PE) has had a great run in the last couple of years. However, we expect the PE industry to return to normalcy in 2023 as investors continue to seek stable, high-return investment opportunities in the face of economic uncertainty.

Acute Myeloid Leukemia (AML) is a uniquely challenging disease in which 50-80% patients eventually relapse following induction and/or post-remission therapies and with 5-year survival rate of merely 30%. Drug development in AML has been challenging in the past, with multiple failures and modest commercial success.

The sharp decline in Global IPO activity in 2022 had a substantial impact on the financial markets, as it followed 2021.

The knock-on effects of COVID-19, labour force displacement, geopolitical uncertainties, and shortage of liquidity dominated discussion during 2022. The global healthcare industry is typically considered a recession safe haven, still faced financial strain due to these factors.

The team at Evalueserve, a provider of banking and advisory support services, is back with another iteration of our M&A Outlook Report, covering 10 Major M&A markets, as we move into 2023. M&A activity in 2022 took a drastic downward turn in the second half of 2022 driven by a global economic slowdown fueled by elevated inflation, higher financing costs and geopolitical conflicts.

The Evalueserve medtech team summarizes highlights from key medical devices and diagnostic players presented and discussed at JP Morgan Healthcare Conference 2023.

A Confidential Information Memorandum (CIM) is one of the first documents a buyer receives during the M&A process. It is a descriptive resume of the company curated by the M&A Advisor on the seller’s side.

Rare-earth Elements (REE) are not actually rare but are found across the globe in Asia, the Americas, Africa, and Australia. They are referred to as rare only because of the limitations in mining and refining processes.

A global investment bank headquartered in Switzerland partnered with Evalueserve for over a decade to improve the junior banking experience. Today, junior bankers at the investment bank are assisted by Evalueserve’s full Deal Automation Suite.

Our detailed analysis of the Global FIG M&A and Capital Markets landscape captures the probable answer through deep insights on Investors’ behaviour, Recovery of the banking sector, Key M&A themes…

In our detailed Q3 review of the global investment banking industry, we have discussed the M&A, ECM, and DCM markets, along with the performance of bulge bracket investment banks and M&A advisory firms.

Deal activity across the global healthcare industry remained low, a stark contrast to the economic buoyancy witnessed during the same period last year. Investors continued to adopt a cautious approach amid the uncertainties related to global growth outlook…

Global O&G M&A activity slightly decreased in Q3 2022 amid indication of current global slowdown; however, North American M&A activity is up. Current geopolitical tensions and energy security is impacting the oil and gas sector majorly.

In 2022, the prevalent geopolitical conditions and macroeconomic uncertainties caused a decline in broader market performance in general and the tech stocks declined to a high level, due to which sector experienced a downtrend in M&A and listing activity.

The risks to the M&A outlook for Asia Pacific markets are overwhelmingly tilted to the downside as rising prices continue to impact growth prospects worldwide. While taming inflation remains the top priority for policymakers, tighter monetary policies will inevitably have real economic costs.

The team at Evalueserve, a provider of banking and advisory support services, has undertaken research for the Over-the-Top (OTT) market globally and in India, covering Major Players and prominent modes of OTT streaming. The pandemic period has been a revelation for the industry with the market experiencing unprecedented increase in Market Size.

The global financial services market continued its frenetic pace of M&A and capital market activity at the start of 2022, keeping pace with a record-breaking 2021. However, it must be noted that the deal volume in 2021 did not yield an easy number that could be effortlessly replicated.

The first half of 2022 saw ~USD 2.2 trillion of M&A deals being announced, ~21% lower than the same period last year and the slowest opening six months for M&A in two years. Technology, financials, and industrials accounted for almost half the total deal value in the first half of 2022.

The team at Evalueserve, a provider of banking and advisory support services, is back with another iteration of our M&A Recovery Report, covering 10 Major M&A markets, as we move through 2022. M&A recovery in 2022 took a drastic downward turn from the blockbuster start witnessed in the previous quarter on the back of growing concerns of a global economic slowdown.

Deal making in the global healthcare industry has been relatively slow in 2022, compared with a blockbuster 2021. Investors were primarily forced to hold off on deal making because of the uncertainty regarding the global growth outlook.

SPACs took the world by storm in 2021, however it also attracted the attention of regulators along with investors. 2022 proved to be the year of deceleration for SPAC industry but possibly it will speed up again in 2023. Read more in our latest overview on SPAC

Cryptocurrencies have seen massive adoption and have become one of the hottest investment products for investors and asset managers alike. This increased uptake has been driven by its growth potential that it has demonstrated over the years.

A leading Canadian bank possessed a large model data set from disparate sources. Evalueserve cleaned, standardized, and transformed the data set.

The biggest challenge for investment bankers is speeding up turnaround time while working on detailed and informative pitchbook presentations. Investment banking clients of Evalueserve can take use of a full range of presentation design services, including the templates and layouts creation, formatting support, and the pitchbook support using our in-house bankers’ productivity suite – Pitchready.

As per financial data provider Preqin, dry powder of the buyout industry stood at $873 billion as of June 1, 2022. Overall it estimates that the investment industry reported $1.86 trillion of dry powder (up 3% from the end of 2021), excluding venture capital. Through the end of May 2022, Preqin said that firms have raised $92 billion and the total is projected to increase to $221 billion by year end.

A global investment bank headquartered in Japan encountered regulatory issues with its model monitoring. Together, the bank and Evalueserve created a model monitoring program.

Digital healthcare gained great prominence following the outbreak of COVID-19, as patients wanted to feel more empowered than ever before. Many venture funds stepped up to fund advanced digital health technology companies that were focused on AI-based data-driven connected technologies.

Despite sky-high fuel prices providing historic profits for suppliers – the IEA expects net revenue for the world’s oil and gas producers to double to an unprecedented $4tn – “investment in oil, gas, coal, and low-carbon fuel supply is the only area that, in aggregate, remains below the levels seen prior to the pandemic in 2019.

With the help of an Early Warning Indicators (EWI) system, banks could effectively monitor their lending portfolios and could execute timely and appropriate actions to mitigate any upcoming risk.

There are signs hinting at an impending bullwhip effect on supply chains, which could mean that supply chain managers need to recalibrate their decisions with respect to the new emerging market realities. As governments eased COVID-related restrictions, economies across the globe witnessed a demand surge. Businesses ramped up production to meet growing demand.

The first quarter of the year has been characterized by geo-political tension, inflationary concerns, and extreme market volatility. These have had a detrimental impact on the investment banking revenues of all the bulge bracket banks. The only light at the end of the tunnel seemed to be the ‘normalisation’ of interest rates and a heightened trading activity which served as a surprise bailout factor.

They wanted to partner to bring process excellence in their Credit Review function. A partner that could scale up staffing support on demand during surged period while maintaining the quality work was provided to client that helped with review of 8,000 borrowers and 20,000 loans per year.

M&A activity is down in Q1’22. Shift towards energy transition, building ESG strategies, and portfolio optimization will drive M&A activities in 2022.

Supply chain management is undergoing a paradigm shift. In the current market, supply chain managers are faced with a few key challenges – ensuring business / production continuity, building safeguards against future supply chain disruptions, and contributing to their organizations’ sustainability journeys.

After experiencing record growth and a strong M&A environment in 2021, the North American consumer and retail sector was hit by a series of macroeconomic headwinds in Q1 2022, including inflation and interest rates, supply chain disruptions, and the Russia-Ukraine conflict. Amid tightening labor market and rising incomes, inflation is increasing the pricing of consumer staples, leaving less money available for discretionary purchases.

ASCO 2022, the premier global event in oncology is around the corner. The conference provides an opportunity to explore the latest advancements in oncology. Our pre-conference preview provides strategic presentations from key players (AstraZeneca, Bristol-Myers Squibb, Merck & Co., Novartis, and Roche), top 6 discussed abstracts by oncologists, and spotlight sessions from trending themes (breast cancer, lung cancer, hematology-oncology and immunotherapy).

In Q1 2022, the global economy was affected by several factors such as inflation, high interest rates, and the Russia-Ukraine conflict. These factors also affected the technology sector as it experienced lower listing activity, and weaker stock performances and valuations. However, the sector’s long-term outlook is positive and it is expected to experience normalized growth for the remainder of 2022. This update covers the technology sector’s Q1 2022 performance and 2022 outlook.

The Cannabis Industry has been emerging as a multi-billion dollar industry with legalization continuing to evolve amid growing public support and favorable bills and acts. North America, one of the major contributors of the Global Cannabis Market generated a net sales of $22.9 billion in 2020 and is expected to grow in line with the Global CAGR of ~17% for the next 5 years and reach ~$50 billion by 2025.

The ongoing geo-political tensions, inflationary pressures, and extreme market volatility has halted investment banking revenues of the bulge bracket banks in the first quarter of 2022. However, advisory revenues remained robust as firms ramped up their internal pipelines and hired senior executives.

Shockwaves from the Ukraine Crisis and tightening of financial conditions have tested the Financial System’s resilience in 1Q’22. Deal activity across all the sub-sectors declined as investors traded cautiously while deploying their capital.

In a world of traditional banking when a customer applied for a loan, it took weeks to get to the loan approval decision. Traditional banks made the process seem as difficult as swimming across an ocean!

Fueled by rising geopolitical tensions in the wake of the Russia-Ukraine conflict, worsening macro-economic outlook, higher interest rates, and supply chain disruptions have all led to dampening investments activity, particularly in M&A hubs in Asia-Pacific including China, Japan, and South Korea.

EdTech has been around for two decades, but it gained prominence worldwide during the COVID-19 pandemic. Educational institutions were forced to adopt digital solutions to ensure learning continuity.

The start of 2022 has been in stark contrast to the economic buoyancy witnessed last year. Even though it has been almost two years since the outbreak of COVID-19, the pandemic is still proving to a challenge for governments across the globe.

In this industry expert we discuss what DI is, it’s advantages, challenges and how it can provide a competitive advantage for investors.

As we transition through the first quarter of 2022, the team at Evalueserve brings you another iteration of our M&A Recovery Report for eight major M&A markets. Click here to read deeper insights on M&A Trends and Outlook in Q1 2022.

Our detailed review of the Q1 2022 results of the US bulge bracket investment banks captures the key factors impacting growth and the potential path forward.

Largest independent provider of research and analytics support, with a strong focus on innovation.

Our detailed analysis of the 2021 Global Investment Banking review captures the trends in the M&A, ECM & DCM markets, and full year performance of bulge bracket investment banks & M&A advisory firms.

Asset and wealth management firms outsource processes such as research, sales, and marketing to improve their functioning and gain cost efficiency.

Our detailed analysis of the M&A and Capital Markets landscape captures deep insights into the investors’ behavior, consolidator’s dry powder, M&A appetite across sub-sectors, availability cash runaways, SPACs’ sustainability and key sectoral outlook, among others.

The ongoing Russia-Ukraine situation has created a dynamic scenario in which index providers must consider all the aspects impacted in index management and respond accordingly.

In 2020, the COVID-19 pandemic catapulted various organizations into the future, as businesses rapidly accelerated their digital transformation efforts.

In its recent meeting, the Fed signaled an end to its accommodative monetary policy in what could be the first hike in Federal fund rates since September 2018 after cutting it by 1.5 percentage points to 0.25% at the onset of the covid-19 pandemic in March 2020.

It has been almost two years since the outbreak of COVID-19, but the pandemic still rages on. Vaccine rollout and policy support have continued to witness divergence across regions. The consistent and equitable implementation of tools to control the pandemic continues to be a challenge for governments across the globe.

March 3, 2022

This session will share how procurement and supply chain teams can bring together all discrete pieces to elevate their impact and help their organization excel.

In this Oil & Gas Industry update, we discuss oil price rise due to opening of economies coupled with how vaccination programs roll out have fueled much needed impetus to the M&A drive in the sector.

EdTech is one of the fastest-growing sectors globally, with skills development solutions receiving the highest funding in 2020.

RPA For Risk Model Management

Market Intelligence

Financial Spreading

Competitive Intelligence

Sector & Account Intelligence

MICI For Asset & Wealth Management

CI for Management Consulting Firms

Knowledge Management

ESG Intelligence for Asset Managers

Fund Marketing & Digital Marketing

Intellectual Property Strategy

Intellectual Property Management

MICI for Real Estate

Sector & Account Intelligence

MICI for Asset & Wealth Management

CI for Management Consulting Firms

ESG Intelligence for Asset Managers Fund Marketing & Digital Marketing Intellectual Property Management MICI for Real Estate

ESG Controversy Monitoring for Asset Managers

Patent Analysis

RPA For Risk Model Management

© 2026 Evalueserve. All rights reserved.