Investment Banking Update Q2’23

Explore the latest insights on global investment banking in our detailed H1’23 review. Learn about M&A, ECM, and DCM markets amidst economic uncertainty and pent-up demand for deals.

Explore the latest insights on global investment banking in our detailed H1’23 review. Learn about M&A, ECM, and DCM markets amidst economic uncertainty and pent-up demand for deals.

Q2 2023 ended with mixed results for the North American consumer and retail sector. Although, the worries stemming from regional banks were addressed, headline inflation dipped to 4%, and the US debt ceiling concern were finally resolved, the sector continued to face macroeconomic headwinds, such as high-interest rates, ongoing geopolitical tensions, tightening labor market, and increasing raw material costs. Despite these challenges, the sector showcased resilience with moderate spending growth and positive financial market performance.

Our latest blog dives into the current state of the Over-the-Top Streaming market and what to expect from the industry in the second half of this year.

The US retirement sector is witnessing a transformative shift as new trends begin to emerge. In this dynamic landscape, innovative practices and approaches are reshaping the way employees plan for their retirement.

Discover how AI is reshaping innovation management in the face of evolving landscapes. Explore challenges, tools, and strategies to leverage AI’s potential for idea generation, evaluation, concept development, and commercialization.

In recent years, Artificial Intelligence (AI) has consistently proven its transformative potential in diverse industries, with data-heavy areas such as the banking sector no exception. Generative AI (Gen AI), perhaps the most promising variety of AI, has the potential to unlock unprecedented levels of productivity and efficiency. However, it requires careful, methodical implementation.

A recent blog by our team digs deep into factors influencing real estate valuation which is required for a variety of purposes like financing, sales listing, investment analysis, property insurance, and taxation. Evalueserve provide valuable services to investment banks catering to real estate investors. Read more to find out some ways Evalueserve assists in real estate valuation.

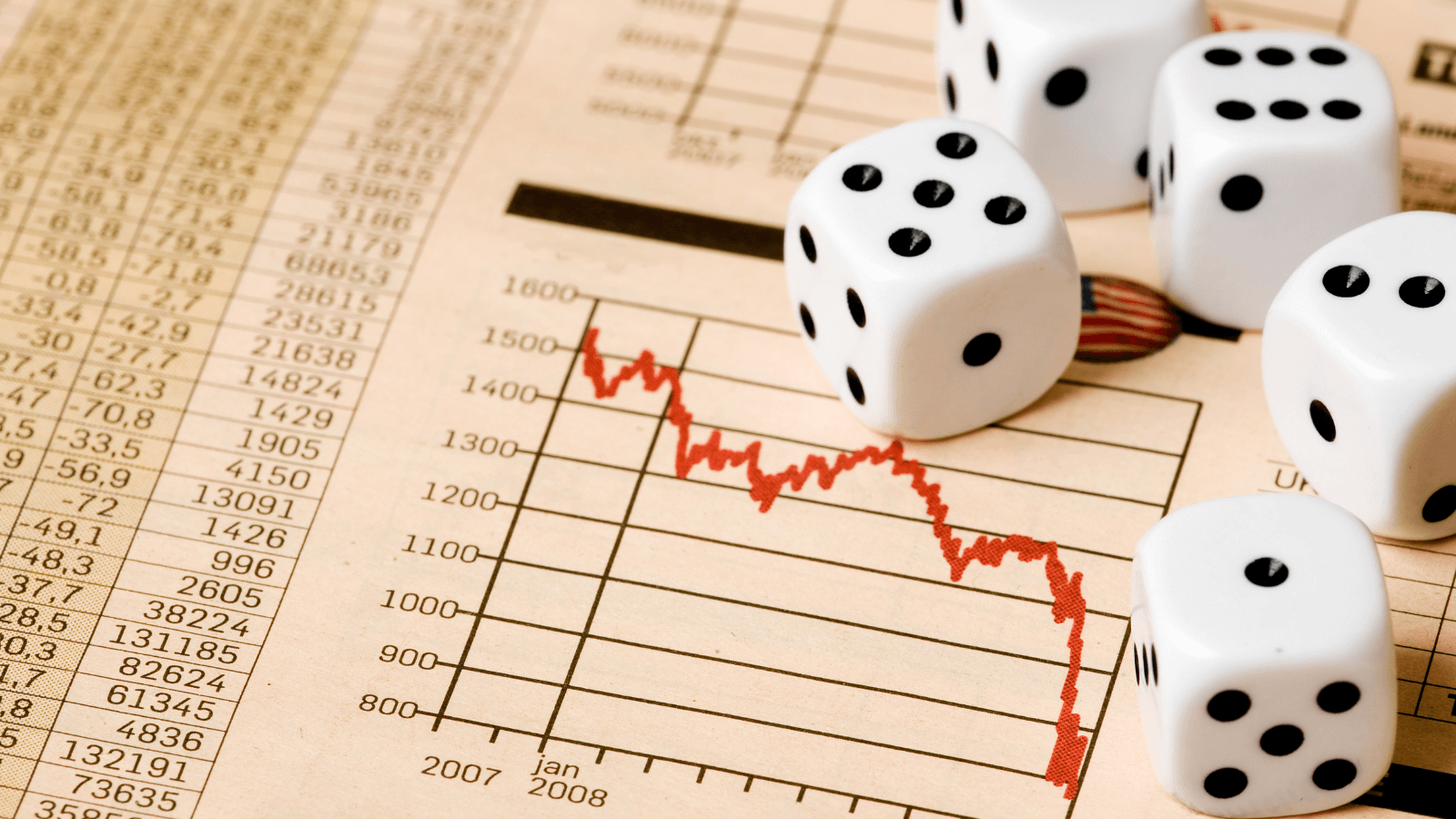

In H1’23, the financial system was put to the test by the ripple effects of the regional banking crisis and tightening of financial conditions, with some pockets of growth resulting from the resurgence of investor interest spurred by competitive valuations.

Generative AI (GenAI), with its unprecedented potential to create novel content, is rapidly transforming our world of work and commerce.By leveraging machine learning algorithms, GenAI can design virtual models, produce new music, generate written content, and predict future scenarios.

Unlock social influence using Digital Opinion Leaders (DOLs). Discover their role in shaping opinions through social media, blogs, and podcasts. Learn how Evalueserve identifies impactful DOLs for your success.

Explore the H1’23 capital market landscape, highlighting trends in M&A, debt, and equity capital markets, as well as the impact on investment banks and advisory firms.

Explore the trends and factors impacting the global IPO market, including macroeconomic headwinds, investor sentiment, and regional performance in this comprehensive analysis.

Both people and process are critical to a successful competitive intelligence program. But finding the right balance of the two can be a challenge. Here are 7 steps to achieving that balance.

Explore the transformative power of digitalization in heavy equipment manufacturing. Embrace IoT, AI, and analytics for enhanced efficiency and innovation.

Explore the potential of alternative raw materials (ARMs) in reducing CO2 emissions in the cement industry, as companies adopt low-carbon solutions and overcome challenges for a sustainable future.

Discover the importance of monitoring ESG controversies for asset managers and learn how to reduce risks while maintaining a positive reputation

Discover the expanding consulting landscape in the Middle East and learn how competitive intelligence helps to overcome challenges and unlock growth opportunities.

Unleash the potential of AI-Powered Automation in the Digital Age! Discover its benefits, success stories, and how it enhances innovation through human-AI collaboration

Discover the captivating world of Barbie and her impact on Intellectual Property ownership! Learn how IP safeguards innovation, brand recognition & commercial success in the toy industry. Explore case studies on Lego, Hasbro, and Nintendo, proving the pervasive power of IP ownership. Embrace astute IP strategies to navigate the ever-changing play landscape successfully.

In H1’23, investors continued to view the healthcare sector in terms of its historical status as a “go-to” market amidst uncertainty and engaged in ‘big ticket’ deals, highlighting the industry’s resiliency.

Discover the transformative power of AI and its growing impact on individuals, organizations, and markets. Explore how AI is becoming a virtual creative partner, driving productivity gains, and reshaping industries. Uncover insights on the future of AI from industry leaders and understand its potential for significant competitive advantage. Dive into the world of AI with Evalueserve, a trailblazer in adopting cutting-edge AI solutions.

Unlock the potential of Generative AI in Smart Buildings. Enhance efficiency, sustainability, and security with cutting-edge technology. Learn more now!

Discover how AI is transforming change management in the digital era. Learn about data-driven insights, benefits, challenges, and future trends driving successful digital transformations.

Evalueserve IP and R&D Drive Innovation with Strategic IP and R&D Solutions Visit Website Introduction Key Opinion Leaders (KOLs) are crucial

Generative AI, perhaps one of the most profound human inventions of the 21st century, is changing the way companies operate, particularly in the fields of content creation and business intelligence. As a tool for creativity, its power is unparalleled. However, Generative AI (GenAI) is often misunderstood, maligned, and mistrusted, in part because it’s ascendency has been so speedy.

Transform your IP searches with AI: faster prior art identification, automated drafting, predictive analytics, and more. Unlock the power of AI today.

Discover 13 game-changing ways to use generative AI in R&D and IP. Unlock innovation, streamline processes, and gain a competitive edge. Dive into our blog now!

The EU AI Act, passed by the European Union, aims to regulate Artificial Intelligence technology and strike a balance between safety and innovation. Evalueserve offers expertise in implementing the guidelines and supporting organizations with risk management frameworks.

Discover the benefits of a consultant database for asset and wealth management firms, enhancing efficiency, data accuracy, and streamlining investment decisions.

Explore the rising trend of private equity partners acquiring and partnering with insurance companies to access permanent capital, transforming the industry landscape and creating value for investors.

What is social media monitoring Social media monitoring is an integral part of competitive intelligence (CI). It involves tracking and analysis

During this year’s Risk Americas event, we had the honor of moderating a panel discussion featuring esteemed panelists from Blackrock, Mizuho, and Columbia University. The conversation centered around the new weaknesses in model governance and potential solutions.

According to Investopedia, the field of business intelligence (BI) encompasses “the procedural and technical infrastructure that collects, stores, and analyses the data produced by a company’s activities.” Stressing its centrality, a recent CIO article describes it as: “strategies and technologies for analyzing business information and transforming it into actionable insights that inform strategic and tactical business decisions”.

Every major software company is incorporating artificial intelligence into its product and service offerings. The implication is clear – get on board or miss the boat completely.

Discover how AI is revolutionizing Intellectual Property services. Benefit from improved efficiency, accuracy, and predictive insights for better IP management.

Explore the power of forecasting stock prices using ARIMA and Reinforcement Learning models to construct high-performing portfolios.

Discover the benefits of leveraging databases for asset and wealth management firms, enhancing competitive intelligence, and driving informed decision-making.

Explore the growth and future of Telehealth, as it transforms healthcare delivery, offering convenience, cost savings, and innovative solutions.

SS 1/23, Model Risk Management Principles for Banks, is bringing sweeping change to Model Governance in the UK. Our blog dives deeper into the requirements, what it could mean for your firm, and how Evalueserve can help.

Explore the future of cleantech solutions driving the clean energy transition, empowering global industrialization, and supporting Net Zero 2050 goals.

A MedTech company partnered with Evalueserve to thoroughly examine its competitors, gaining valuable insights to enhance its market position. Through in-depth analysis and research, they proactively anticipated market shifts, refined strategies, and made informed decisions to strengthen their position.

Discover the importance of identifying ideal M&A targets and overcoming common challenges in the target identification process for successful deal execution.

2023 YTD bankruptcies in the US are on a 13-year high, led by rolling back of easy monetary policy by the US Fed to combat high inflation.

Discover the ongoing regional banking crisis in the US and its potential impact on the financial sector. Explore the lack of regulations and the risks of a full-blown crisis.

How does upgrading the power grid affect transitioning to clean energy and meeting Net Zero 2050 goals without compromising energy security? What solutions can address this?

Discover best practices for asset and wealth management firms to differentiate themselves in a competitive landscape, with a focus on clear communication, market insights, and continuous monitoring of competitors’ strategies.

Explore the global shift towards renewables as clean energy investments surge, transforming the energy landscape and driving the emergence of new leaders in sustainable technologies.

Hari Baskar, Chief Data & Analytics Officer at SAB (Saudi Awwal Bank), was awarded with a Data Impact Award at Cloudera’s Evolve 2023 event for his significant contributions to data architecture modernization.

Explore the factors driving the growth of solar PV technology and its role in the global energy transition. Learn about policy, efficiency, and supply chain challenges in achieving a sustainable future.

Explore top insights on the rapidly growing voluntary carbon market, its trillion-dollar potential, emerging trends, and how it supports global decarbonization efforts towards Net Zero 2050 goals.

Explore the growing voluntary carbon market and its potential for M&A activity, as companies seek to meet Net Zero 2050 goals and integrate carbon offsets into industry value chains for a sustainable future.

Employing generative AI in banking provides the unique opportunity to streamline lending services and enhance customer service. Explore 6 ways banks can use generative AI to revolutionize lending.

Utilizing generative AI in lending has the potential to transform the financial world. There are, however, limitations that banks need to consider if they want to maximize the benefits of this new technology.

We recently gathered with a group of top banking executives in NYC to discuss the business impact and high-potential use cases of generative AI. Here’s what we discussed.

Businesses need to ensure they’ve covered all sources of valuable competitive intelligence insights. But they might be missing a critical source: industry conferences.

Despite rising inflation and tightening credit measures, private credit is expected to remain strong. Discover 6 reasons why private credit is the future.

Discover the power of Insightsfirst CI platform’s data combination, unlocking comprehensive insights, innovative marketing ideas, and real-time trends to drive revenue growth and achieve sustainable business success.

Explore Evalueserve’s Research Bot, a domain-specific AI chatbot that debunks common generative AI myths, ensuring accurate, unbiased, and transparent insights for users.

The failures of SVB and Signature Bank underline how crucial risk management in banking is. Discover the key lessons banks can learn from the 2023 banking crisis.

Unlock the potential of continuation patent applications in corporate patent strategy. Build a robust portfolio, maximize value, and achieve broader coverage for your inventions. Learn more about our practical framework at Evalueserve.

Explore the growing demand for nature-based solutions and voluntary carbon markets, as industries aim to meet Net Zero 2050 goals and reduce greenhouse gas emissions.

Discover the revolutionary impact of generative AI on competitive intelligence, as Evalueserve’s Insightsfirst platform and Researchbot empower businesses to make informed decisions with actionable insights.

Fierce competition in a challenging economic environment has created something of an AI “arms race,” with rival companies trying to outdo one another by employing AI to augment their human expertise. Generative and predictive AI are increasingly in demand, across a wide range of use cases. Evalueserve is at the forefront of this new frontier in competitive, automated business analytics.

Explore Evalueserve’s Artificial Intelligence and Machine Learning capabilities in the Risk domain for Financial Institutions.

Despite global instability, prioritizing optimization, asset tracking, and data management through automation and innovation offers a path to recovery for the Oil and Gas industry.

Discover the latest trends in global M&A deals, green bond issuance, and ECM activity. Learn how investment banks are navigating the current economic landscape in Q1’23.

Discover how the North American consumer and retail sector navigated through macroeconomic headwinds in Q1 2023, including inflation, rising interest rates, bank runs, geopolitical risks, labor shortages, and raw material costs

In Q1’23, the financial system was put to the test by the ripple effects of the regional banking crisis and the tightening of financial conditions, with some pockets of growth resulting from the resurgence of investor interest spurred by competitive valuations

Explore why experts recommend adding ‘resilience’ to the ESG framework (ESG+R) in real estate to ensure long-term sustainability in the face of climate change.

Explore reinforcement learning’s role in optimizing portfolio asset allocation by comparing Proximal Optimization models with the performance of the underlying index and a mean-variance portfolio.

Logistics companies are finding it challenging to accurately estimate their CO2 emissions as they strive to mitigate the impact of climate change. To achieve net-zero goals and comply with Scope 3 emission reporting requirements, companies must tackle data availability, accuracy, and transparency issues.

Generative AI for enterprises works best when it is domain specific. This resource guide provides research articles on methodologies and insights for executives interested in Generative AI case studies.

Generative AI technology in Insightsfirst ORAD allows users to leverage its power in multiple ways, as can be seen in the adjoining image. These include: Querying content, and allowing users to find quick leads.

To be successful with Generative AI tools like ChatGPT, enterprises need specific use cases that address a business need or challenge within their particular industry, what we call domain-specific.

This blog explores the benefits of patent watch services for protecting intellectual property. It covers the different types of patent watch services and provides a general guide for conducting a patent watch. It also highlights the limitations of the patent watch and suggests a comprehensive approach to overcome them.

Customer Analytics Service Providers (CASPs) use AI-enabled domain experts to maximize automation and deliver insights to the right people at the right time. Find out how to make microservices, APIs, and reusable code work for your enterprise.

Healthcare is rapidly transforming with digital health, offering benefits like improved patient outcomes, greater efficiency, and cost reduction. However, realising these advantages requires close collaboration between healthcare providers, policymakers, and technology companies. By working together, a cohesive ecosystem can be created that uses technology to deliver patient-centric care.

Discover the key challenges facing companies in the future mobility landscape, from technological advancements and infrastructure development to regulatory frameworks and public acceptance. Learn about the importance of sustainability, integration and interoperability, and security and cybersecurity.

Evalueserve CTO Rigvi Chevala details the company’s five-year product journey from mind+machine™ to the AIRA platform.

Companies rebrand themselves to re-energize their business. Rebranding is a very important strategic direction that a company undertakes. While there may be different reasons a company goes for rebrand however the objective is purely to tell the world what the new brand stands for showcasing its direction.

Learn how Customer Analytics Service Providers (CASPs) transform customer data into insights for growth, retention, and personalization. CASPs ensure data quality, deploy models, and enhance customer experiences for long-term business success.

Discover how a tailored Business Intelligence strategy can drive your business forward by leveraging data analytics and technological tools. Stay competitive, optimize resource allocation, and uncover hidden opportunities with the right approach to BI. Avoid common mistakes and align your strategy with organizational goals for maximum impact.

The Global Healthcare Industry witnessed a surge of deals in Q1 2023 as investors continued to view the sector in terms of its historical status as a “go-to” market during uncertain times.

The art of deal execution in investment banking is a delicate process of taking a potential M&A transaction from idea to completion. The process can be complex and requires knowledge & experience, with confidentiality being a key component to a successful transaction. Evalueserve offers an unmatched deal execution support, with particular focus on live M&A deal mandates, through its vast experience of working with large, mid-market investment and boutique advisory firms.

M&A deal volumes drop lower in Q1 2023 due to economic uncertainties, with APAC contributing just 30% of global M&A. Improved volumes in Japan were the bright spot. Expectations are for a more normalised level of M&A activity resembling pre-2021 levels.

Over the last decade, market and competitive intelligence (MI/CI) has emerged as a focus area for all organizations, including asset management (AM) firms, looking to gain strategic agility.

Persistent, bioaccumulative, toxic (PBT) or very persistent and very bioaccumulative (vPvB) chemicals threaten human health and the ecosystem.

Explore the transition to advanced E/E architecture in automotive industry: architecture types, challenges, and upcoming trends.

As a product lead with extensive experience in creating digital solutions in market and competitive intelligence, I’ve witnessed how the volume of insights has increased multifold in the last few years. My clients are primarily professional services firms, and this sheer volume of information available across various platforms makes it difficult for businesses to act swiftly and effectively.

The start of 2023 sees sustainability at the top of businesses’ priority lists. A recent survey conducted in Q1 found that 71% of respondents ranked sustainability as their top near-term (next six months) priority. Respondents were collectively optimistic about their progress, with over 90% suggesting they were somewhat or extremely successful in reaching their sustainability goals over the past 12 months. Further, they expressed increased optimism about meeting goals for the next year (72%) and for 2030 (77%).

Discover how future mobility is transforming transportation systems with electric and autonomous vehicles and integrated transport solutions.

Explore the role of Small Business Administration (SBA) in supporting American small businesses through systemic crises. Learn how the SBA has been standing firm behind small businesses and keeping them afloat in challenging times.

Voluntary carbon markets (VCMs) are crucial for achieving Net Zero carbon emission goals. With most credits generated from land-based projects, it’s time to explore the high-growth potential of Blue Carbon, which focuses on oceans and coastal wetlands.

Artificial Intelligence (AI) has gained steam in recent years and is playing an increasingly prominent role in almost every industry – including education. Whether it’s personalized learning, automated grading, intelligent tutoring systems, or virtual learning assistants, AI tools have become essential for educational institutions. They provide invaluable help leading to cost savings and improved learning outcomes.

Discover how innovationcan help your business stay ahead of the competition. Learn about the seven types of innovation intelligence and how market leaders utilize them. Stay on top of the game with insights into the latest industry trends and strategies.

Generative AI is taking the business world by storm. Evalueserve already offers several products and services enriched by generative AI — with more to come. Here’s a sampling of the generative AI apps we offer for our clients.

Pharma companies must attend industry conferences to capture competitive intelligence, adapt to emerging trends, outpace competitors, and seize opportunities for collaboration and investment. Doing so allows them to make informed strategic decisions, respond to customer needs, and drive innovation within the organization. Learn more about the importance of attending these events here.

With the AI revolution upon us, businesses have countless analytics and automation use cases to implement. Our CRUISE Framework takes the guesswork out of prioritizing an analytics and automation roadmap.

Use Generative AI in banking to accelerate Enhanced Due Diligence (EDD) research and gain deeper insights for better risk management.

There are two ways to measure a company’s performance. First, you can look at how the business is doing with regard to the KPIs, targets, and goals it sets for itself. Secondly, and perhaps more importantly, you can compare the company’s performance to those of its significant competitors.

FY 2022 was a challenging year for investment banks. However, hopes are higher for FY 2023. Here are 9 takeaways from our FY22 Investment Banking update.

Discover how the Sustainable Finance Disclosure Regulation (SFDR) affects asset managers. Learn how complying with this EU regulation can reduce risk exposure and improve financial performance.

Sustainability is the way of the future – that part is canon by now. So, what values can companies expect from the markets of this future? Well, the answer is right in front of us. The world is already witness to the emergence of a new type of market, where the highest valued ‘commodity’ is the decarbonization solution of paramount quality.

Exploring the importance of CDPs and providing practical tips for maximizing their value and ROI.

Procurement teams in the oil and gas industry face various challenges, from volatile market conditions to complex supply chains and regulatory requirements.

Voluntary carbon markets (VCMs) are a new-age solution that can not only help companies incentivize projects aimed towards climate change mitigation to meet Net Zero 2050 goals, but also help in the reduction and offsetting of greenhouse gases (GHG) and carbon dioxide (CO2) emissions for their investors and participants.

In the last three years, the consumer and retail sector has witnessed more disruption and transformation in consumer behavior and preference than in the past two decades. In 2022, the consumer and retail sector continued to witness major economic headwinds, including an unstable geopolitical environment, a sharp rise in the cost of living, and a looming recession, which added more uncertainty to consumers’ purchasing behavior and, ultimately, to the sector’s performance.

Discover how CPG marketers can navigate the shift to a cookieless digital world and continue to gather customer data. Learn about the latest marketing strategies and data-driven insights for successful online advertising.

Asia-Pacific (APAC) has not been immune from the global macroeconomic headwinds that built steadily throughout 2022. Now, the region is also

The OTT market, which was riding high on the analysts’ expectations pushed by the pandemic, remained subdued as pandemic restrictions were uplifted. The market is still growing but the growth rates do not match the previously announced expectations. It is anticipated to take another surge with the introduction of 5G services and 4K content, especially in emerging countries such as India.

While large language models generate lots of press, it’s in industry-specific use cases that AI proves its value. Here, we outline real-world domain-specific approaches to generative text-based chat tools.

The global financial services market underwent a significant change in 2022 as the world economy struggled to recover from the effects of a protracted epidemic. However, the deal volume from 2021 did not produce a straightforward figure that could be easily repeated. Therefore, as economic and geopolitical volatility took its toll, businesses appeared to have started concentrating on concluding the correct deals to support strategic growth and capital returns rather than expanding the volume of deals.

Discover how an IP strategy roadmap can boost revenue and attract investment. Learn why SMEs with IP rights have higher revenue per employee.

The modern business landscape is more competitive than ever. If you want to succeed, you need exact, timely information. In short, harnessing the power of BI leaves you better equipped to make informed decisions, identify opportunities, and remain competitive.

Want to stay ahead of the curve? Strap in and keep reading: We’ll cover everything from the latest BI-powered leadership trends, tools, and best practices to game-changing tips and resources for data analysts and front-line adopters.

Conference intelligence is a crucial piece of competitive intelligence, particularly in the pharma sector. And employing AV analytics and AI adds new layers of value to traditional conference intelligence offerings.

The US Federal Reserve’s monetary policy to tackle inflation has brought the government and the Treasury at odds with the Central bank. Bhashkar Upadhyay in his new blog has carefully noted down how “fiscal deficit” has become a point of contention among different stakeholders and how a failure to end the deadlock over the “debt ceiling” could have grave financial consequences on the markets.

Evalueserve recently conducted a survey of private equity professionals to understand the industry’s current state and gain insights into its direction in 2023. Here are 9 of the main takeaways from that survey.

The heightened level of risk in today’s world, combined with increasing regulations, necessitates that financial institutions employ RiskTech.

Data scarcity can be a barrier for companies looking to implement AI. But generative AI has a huge potential to resolve data scarcity issues.

On Friday, February 17, 2023, Duke University hosted its 2023 Provost’s Forum. This year’s topic was Big Problems in Big Tech. Here are some key takeaways.

RPA For Risk Model Management

Market Intelligence

Financial Spreading

Competitive Intelligence

Sector & Account Intelligence

MICI For Asset & Wealth Management

CI for Management Consulting Firms

Knowledge Management

ESG Intelligence for Asset Managers

Fund Marketing & Digital Marketing

Intellectual Property Strategy

Intellectual Property Management

MICI for Real Estate

Sector & Account Intelligence

MICI for Asset & Wealth Management

CI for Management Consulting Firms

ESG Intelligence for Asset Managers Fund Marketing & Digital Marketing Intellectual Property Management MICI for Real Estate

ESG Controversy Monitoring for Asset Managers

Patent Analysis

RPA For Risk Model Management

© 2025 Evalueserve. All rights reserved.