Investment Banking – Q1’25 Update

Explore the Q1’25 financial landscape with a focus on M&A, DCM, and ECM activities, revealing notable increases in deal value and market resilience.

Explore the Q1’25 financial landscape with a focus on M&A, DCM, and ECM activities, revealing notable increases in deal value and market resilience.

Explore the impact of new tariffs on North American trade, businesses, and diplomatic relations, as steep import duties strain economic partnerships and risk further inflation and market instability.

Learn the significance of accessibility in PowerPoint and how to create universally accessible presentations that communicate successfully to diverse audiences.

Discover the ongoing liquidity challenges in the banking system, driven by high mortgage rates and tight liquidity, as QT is expected to conclude by mid-year.

Generative AI is revolutionizing credit risk management by boosting efficiency and decision-making. In our latest blog, we share key takeaways from our panel at RiskMinds International.

Understand the growth and trends in the private banking market, driven by wealth accumulation, globalization, and advancements in technology.

As the 2024 U.S. Elections approach, both Kamala Harris and Donald Trump propose starkly different trade and tax policies. From targeted tariffs under Biden to Trump’s sweeping import levies and corporate tax cuts, the economic future of the U.S. hinges on these key issues.

Discover the evolving landscape of European corporate lending in 2024, driven by digital transformation, easing credit conditions, sustainable practices, and strategic cost management amidst regulatory pressures.

Discover how rising federal rates and inflation impact the financial situation in U.S, and how banks are innovating and adapting to these challenges.

Modern lending faces challenges like slow approvals, data inaccuracies, and poor service. AI and automation streamline processes, enhance accuracy, and improve customer interactions. These technologies help lenders achieve efficient, accurate, and customer-focused operations. Learn more in our whitepaper on AI and automation in lending.

As the commercial lending industry rapidly evolves, embracing digital transformation has become imperative for traditional banks and financial institutions. The shift towards automation and artificial intelligence (AI) promises significant improvements in operational efficiency. However, the true power lies in combining these technologies with human expertise. This approach optimizes lending operations and ensures they remain adaptable, accurate, and customer-focused.

Learn how effective loan servicing and strategic outsourcing can enhance efficiency and borrower experience, with insights on technology and GenAI’s transformative role in the financial industry.

Explore Asset Based Lending (ABL), a flexible financing solution for businesses, offering short-term capital for operations and aiding businesses in financial distress.

Explore the robust recovery of the cruise industry, driven by strong customer demand, record revenues, and strategic growth plans, set to continue into FY24.

Explore the challenges facing the US banking sector, including high inflation, regulatory measures, and geopolitical tensions, and understand how these factors impact profitability and asset quality.

Explore the impact of anticipated rate cuts by Fed on the US economy, including record highs in equities, surge in bond issuances, and changes in consumer loan interests.

In this testimonial, Lars Mitchell, Head of Research Publications at Peel Hunt discusses partnering with Evalueserve to come up with a unique solution for equity research distribution through our Insightsfirst platform.

Becoming sustainable is now vital for all sectors, driven by increasing customer, regulatory, and shareholder demands to reduce carbon emissions, reshaping how resources are procured, distributed, and utilized.

Explore the evolving Middle East payments landscape and discover strategies for banks to stay competitive in this dynamic digital era. Dive into key trends, opportunities, and successful partnerships in the region. Learn how intellectual property strategies can shape the future of banking. Read more in this insightful blog.

To explore how risk teams at financial institutions are managing generative AI, we gathered with a group of risk executives in New York City. Risk leaders and AI experts led the conversation around the how risk teams are using generative AI and managing the risks of GenAI.

Explore the world of fiduciaries in retirement plans, their responsibilities, and how Evalueserve’s domain experts empower firms with actionable insights and competitive intelligence.

Explore how the DOL’s new rule enables retirement plans to consider ESG factors, impacting stakeholders and paving the way for sustainable investment options.

Discover how the focus of Wealth Management has shifted from information availability back to the quality of advice with the advancement of data analytics in the industry.

Explore the H1’23 capital market landscape, highlighting trends in M&A, debt, and equity capital markets, as well as the impact on investment banks and advisory firms.

Explore the trends and factors impacting the global IPO market, including macroeconomic headwinds, investor sentiment, and regional performance in this comprehensive analysis.

The EU AI Act, passed by the European Union, aims to regulate Artificial Intelligence technology and strike a balance between safety and innovation. Evalueserve offers expertise in implementing the guidelines and supporting organizations with risk management frameworks.

Explore the rising trend of private equity partners acquiring and partnering with insurance companies to access permanent capital, transforming the industry landscape and creating value for investors.

During this year’s Risk Americas event, we had the honor of moderating a panel discussion featuring esteemed panelists from Blackrock, Mizuho, and Columbia University. The conversation centered around the new weaknesses in model governance and potential solutions.

Explore the power of forecasting stock prices using ARIMA and Reinforcement Learning models to construct high-performing portfolios.

SS 1/23, Model Risk Management Principles for Banks, is bringing sweeping change to Model Governance in the UK. Our blog dives deeper into the requirements, what it could mean for your firm, and how Evalueserve can help.

Discover the importance of identifying ideal M&A targets and overcoming common challenges in the target identification process for successful deal execution.

Employing generative AI in banking provides the unique opportunity to streamline lending services and enhance customer service. Explore 6 ways banks can use generative AI to revolutionize lending.

Utilizing generative AI in lending has the potential to transform the financial world. There are, however, limitations that banks need to consider if they want to maximize the benefits of this new technology.

We recently gathered with a group of top banking executives in NYC to discuss the business impact and high-potential use cases of generative AI. Here’s what we discussed.

Despite rising inflation and tightening credit measures, private credit is expected to remain strong. Discover 6 reasons why private credit is the future.

The failures of SVB and Signature Bank underline how crucial risk management in banking is. Discover the key lessons banks can learn from the 2023 banking crisis.

Use Generative AI in banking to accelerate Enhanced Due Diligence (EDD) research and gain deeper insights for better risk management.

FY 2022 was a challenging year for investment banks. However, hopes are higher for FY 2023. Here are 9 takeaways from our FY22 Investment Banking update.

Discover how the Sustainable Finance Disclosure Regulation (SFDR) affects asset managers. Learn how complying with this EU regulation can reduce risk exposure and improve financial performance.

Evalueserve recently conducted a survey of private equity professionals to understand the industry’s current state and gain insights into its direction in 2023. Here are 9 of the main takeaways from that survey.

The heightened level of risk in today’s world, combined with increasing regulations, necessitates that financial institutions employ RiskTech.

Financial institutions face a multitude of risks linked to operations, governance, and compliance. Because of the sector’s importance to global economies

One of the biggest challenges in ESG reporting according to investors is the lack of transparent and consistent data. It is important to understand and distinguish the challenges across the ESG data and insights value chain and then follow a piecemeal approach to address each of them. In this article, we will explore the three levels of the ESG data value chain and address these challenges and how to meet them.

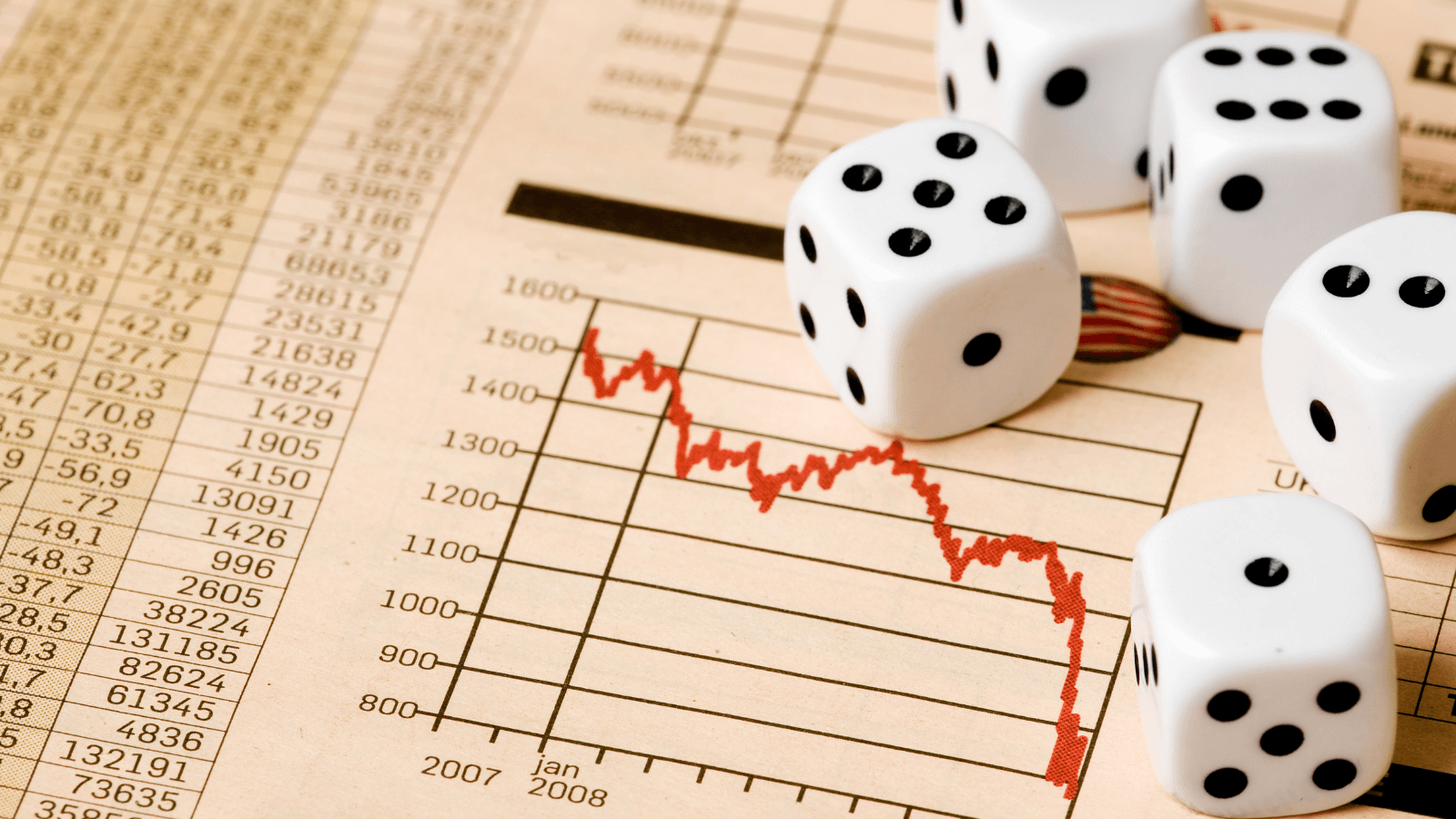

After the global financial crisis, the Basel Committee on Banking Supervision (BCBS) issued the Basel III reforms to its standards to

In our detailed Q3 review of the global investment banking industry, we have discussed the M&A, ECM, and DCM markets, along with the performance of bulge bracket investment banks and M&A advisory firms.

Deal activity across the global healthcare industry remained low, a stark contrast to the economic buoyancy witnessed during the same period last year. Investors continued to adopt a cautious approach amid the uncertainties related to global growth outlook…

Global O&G M&A activity slightly decreased in Q3 2022 amid indication of current global slowdown; however, North American M&A activity is up. Current geopolitical tensions and energy security is impacting the oil and gas sector majorly.

Despite low volumes, rising costs, supply chain interruptions, and lowered guidance in Q3 2022, the North American consumer and retail sector has continued to see modest growth, albeit at a considerably slower rate than in 2021…

In order to curb the growing influence of index providers on global asset market, the US SEC is tightening regulations on index players. Bhashkar Upadhyay in this research piece aims to examine the role of new regulations that would govern the producers of financial indices, challenges and concerns in implementing them, and their impact on the industry in general.

The global financial services market continued its frenetic pace of M&A and capital market activity at the start of 2022, keeping pace with a record-breaking 2021. However, it must be noted that the deal volume in 2021 did not yield an easy number that could be effortlessly replicated.

The year 2021 witnessed a renewed interest in liquid alternatives (alts.), and 2022 continues to see a strong inflow of funds. The primary reasons driving this inflow are volatile equity market returns, weakening policy support, higher interest rates and inflation, market volatility, and geopolitical turmoil, as they forced investors to critically think about portfolio construction and seek strategy changes.

The first half of 2022 saw ~USD 2.2 trillion of M&A deals being announced, ~21% lower than the same period last year and the slowest opening six months for M&A in two years. Technology, financials, and industrials accounted for almost half the total deal value in the first half of 2022.

The team at Evalueserve, a provider of banking and advisory support services, is back with another iteration of our M&A Recovery Report, covering 10 Major M&A markets, as we move through 2022. M&A recovery in 2022 took a drastic downward turn from the blockbuster start witnessed in the previous quarter on the back of growing concerns of a global economic slowdown.

The Middle East banking industry has been witnessing knock-on effects of the pandemic, volatile oil prices, and intensifying multi-dimensional disruptions. However, it has been able to withstand these pressures and bounce back strongly.

As market headwinds pick up speed in the post-Covid phase, bankers and analysts at boutique advisory firms are busy in keeping the ball rolling under high volume of M&A deals. With the increasing volume of deals, many bankers are spending a lot of time on unstructured data of private companies, one of them being franchise companies.

The biggest challenge for investment bankers is speeding up turnaround time while working on detailed and informative pitchbook presentations. Investment banking clients of Evalueserve can take use of a full range of presentation design services, including the templates and layouts creation, formatting support, and the pitchbook support using our in-house bankers’ productivity suite – Pitchready.

The use of machine learning (ML) models by financial institutions has grown steadily in recent years given their enhanced capabilities and widespread potential application. However, building, adopting, and regulating machine learning models remains a challenge.

With the help of an Early Warning Indicators (EWI) system, banks could effectively monitor their lending portfolios and could execute timely and appropriate actions to mitigate any upcoming risk.

We recently hosted an Investment Banking Executive Event in New York where senior leaders at top banks discussed Investment Banking trends such as the roles of AI, CRM, and Data Science in junior banker retention.

There are several model risk management tools available that automate manual processes to help MRM teams keep up with overwhelming demand.

The great recession of 2008 resulted in countless new financial regulations. Many of them are still top of mind for banks today as they continue to navigate implementation and reporting.

Model validation is key to assessing reliability and identifying errors and corrective actions, but high-quality validation is increasingly difficult to achieve.

In its recent meeting, the Fed signaled an end to its accommodative monetary policy in what could be the first hike in Federal fund rates since September 2018 after cutting it by 1.5 percentage points to 0.25% at the onset of the covid-19 pandemic in March 2020.

A sound model risk management framework is imperative to avoid the costly consequences of misused or flawed models. Strong model governance is the key to achieving effective model risk management.

While models are invaluable decision-making tools for financial firms, there is significant risk associated with the incorrect use of models or model malfunction. Decisions based on flawed or misused models can have dire consequences and be extremely costly.

Automation in model risk management has been gaining traction, however, despite the benefits automation offers, banks still resist adopting it.

“With great risks comes great reward,” especially in banking. Banks are in the business of taking on financial risk to generate profit. However, the stakes are high, and the downside potential is huge.

Introduction The purpose of this blog is to construct and analyze the performance of an in-house ESG index for the Chilean

Banking leaders face numerous challenges, from the ongoing global pandemic and an uncertain recovery to an accelerating digital transformation and a

Let’s discuss the challenges that come with adopting ESG indexes, are they more than a green initiative, how and what does it mean?

Lets talks about ESG enablers – Data, Rating & Index Services, Consulting & Auditing Services, Software, Reporting & Analytics

The recently issued interagency statement SR 21-8 is a non-binding guidance note with very useful and practical suggestions on how banks can juggle resources between SR 11-7 and AML/BSA compliance.

Let’s look into an alternative to funding President Bidens new tax plan.

RiskMinds event key takeaways – managing uncertainty, credit risk and systems, second generation risk models

and ESG stress testing.

Five key takeaways from Risk Americas 10th Annual Virtual Event.

Advanced Model Risk 2021 event offers eye-opening view of how MRM models enhanced through improved technology and practices.

Bhashkar Upadhyay, Evalueserve’s, Financial Services lead analyst weighs in on President Joe Biden’s infrastructure plan.

Competition in the private equity game has continued to heat-up over the past few years as more capital has flowed in, leading to higher prices for fewer deals.

The MRM infrastructure implemented by banks in the past few years has finally been put to test. The plane has met air, and risk teams need to adjust to any turbulence mid-air.

In our conversations with industry leaders, fulfilling the following parameters will help ensure a successful partnership.

Amit Inamder shares highlights from RiskMinds International 2020 conference

Through our proposed solution, we see the addition of shame to financial institutions’ vocabulary as an essential tool to empathetically and respectfully reach those who have been greatly affected by the pandemic.

The Investment Management industry has witnessed secular changes in structure, pricing, and asset flows.

Perpetual (always fresh) Know Your Customer (PKYC) is the ongoing process by which financial organizations continuously aggregate and update customer information with the aim to use it for risk management.

In this blog, we set out to test our hypothesis by tracking the returns of companies that facilitate remote working.

RPA for Model Risk Management has become a rising topic in the risk and compliance space, as Model Risk Management (MRM) teams have started to look at the use of robotic process automation (RPA) to help ensure that their models are meeting regulatory requirements and the bank’s financial standards.

As of May 2020, four European monetary zones (the Eurozone, Denmark, Sweden, and Switzerland) along with Japan are firmly in negative interest rate territory.

The performance of factors in the US and other developed markets have been widely studied.

KYC as risk management, rather than data management, remains elusive for financial services firms as well as for the high-value goods and other industries

Banks and financial institutions are facing an uphill task of efficiently managing their ever-growing bundles of financial data in multiple and complex formats.

Facebook surprised the market by announcing its intention to launch Libra, a new global currency powered by blockchain technology.

A month after April 2020, when oil futures traded negative for the first time in history, markets are still wary, although

COVID-19 has taken the world by storm, and for the first time since the Great Depression, both advanced and emerging economies are plunging into recession simultaneously.

The COVID-19 pandemic has emerged as a grave threat for both global health and the economy.

Public and regulatory attention to the impact of COVID-19 on banks has been rightly focused on credit quality.

The Global Lockdown May Accelerate Automation And New Ways Of Working With Lower Costs.

Imagine yourself in a Harry Potter movie, reading a newspaper with pictures that move and characters that smile and wave to you! How cool would that be?

As Covid-19 continues to spread, the burden of disease has been asymmetrically distributed, as countries find themselves at different stages of the pandemic.

The journey of SFTR had initially started in Jan 2016 and is now planned to become partially in force from July 2020.

In this post, we take a look at the key trends and themes in risk for 2020 – and some smart solutions too.

How often do you find yourself or your team members tied up in essential but repetitious tasks?

Microsoft Excel has dominated the financial services industry for the last 20 years as the go-to tool for calculations, data analysis, and reporting.

Asset managers rely on third-party composite scores for their investment decision-making. But how reliable and valid is this data, and does it truly meet their investment objectives? Let’s try and understand.

Increasingly, ‘alternative’ or non-market data holds the promise of smarter investments and superior returns. But how can you get to grips with the mass of information out there and use it to make better decisions?

What is the role of the shadow banking in China’s economy and how does it develop under the impact of crackdown and a raging trade war? Check out this blog article for more details.

The key pillars for a strong ESG data strategy are smart data interventions, backed up by input from subject matter experts (SMEs). Here are four areas where that approach can help you overcome ESG data issues.

The once revered LIBOR fell out of favor after banks manipulated it to boost profits. With the FCA deciding to phase it out completely by 2021, companies will need to change their systems within a short span of two years. Are you prepared?

See how asset management marketing can enable growth and profitability by modernizing its own operations. In this post, we discuss three automation strategies that can help industry CMOs and marketing stay relevant.

What are the opportunities in Latin America for investors seeking non-traditional assets? Here is a strategy that yields the same returns as the market, while reducing risks for investors.

Increasing importance of data lineage and advent of machine learning indicates that traditional and new risk models will co-exist, as the MRM life cycle is optimized. But what will help minimize teething pains associated with this growth phase? Find out more in this blog.

Developing, validating and monitoring multiple models is hard work. Regulators want high-quality, well-produced reports.

See why young investors looking to invest for a long term should consider dividend stocks.

Is it time for investors in LatAm to tread an investment path different from the one taken by traditional asset managers? Should they embrace the global trend of factor indices and take controlled risk with proven strategies?

MiFID II regulation provides transparency and investor protection, however, the European Union’s new approach creates conflict for US-based firms where bundling research is a common practice. So what is the need for the US to be compliant?

Saudi Arabia’s macro-economic indicators have put a big question mark on the sustainability of Saudi riyal (SAR) peg to the US dollar at 3.75. Devaluation appears to be the only potent weapon for the kingdom to rein in soaring fiscal deficit, without constraining economic growth.

The new legislative proposal is expected to have a global impact on the ecosystem of how buy-side consumes sell-side research. The changes will create fresh challenges for the industry, but they will also bring some attention-worthy opportunities.

The long-term impact of Brexit is not yet clear, although market sentiments seem largely negative. Companies need to choose between making a move right now or waiting for UK–EU negotiations to play out.

The asset management industry is already facing a number of challenges. How is the industry geared to meet technology-led disruption, including from FinTechs? Also, how are asset managers driving innovation across their value chain? Read to find out more.

While 2000–2009 saw disruption due to outsourcing and offshoring, years (2009–2015) following the global financial crisis, witnessed a stricter global regulatory environment.

RPA For Risk Model Management

Market Intelligence

Financial Spreading

Competitive Intelligence

Sector & Account Intelligence

MICI For Asset & Wealth Management

CI for Management Consulting Firms

Knowledge Management

ESG Intelligence for Asset Managers

Fund Marketing & Digital Marketing

Intellectual Property Strategy

Intellectual Property Management

MICI for Real Estate

Sector & Account Intelligence

MICI for Asset & Wealth Management

CI for Management Consulting Firms

ESG Intelligence for Asset Managers Fund Marketing & Digital Marketing Intellectual Property Management MICI for Real Estate

ESG Controversy Monitoring for Asset Managers

Patent Analysis

RPA For Risk Model Management

© 2025 Evalueserve. All rights reserved.